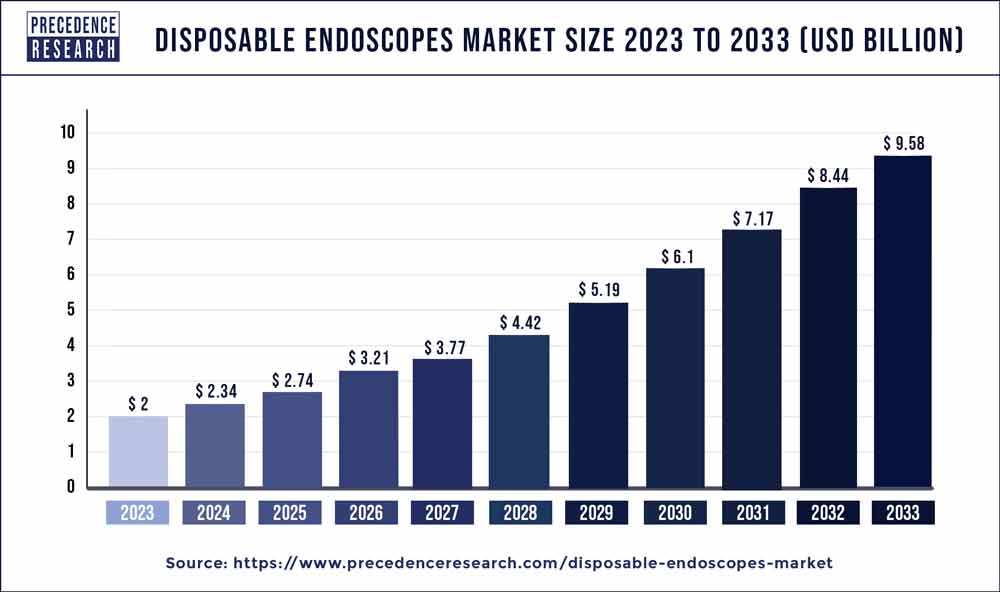

The global disposable endoscopes market size accounted for USD 2.37 billion in 2022 and is projected to hit around USD 10.4 billion by 2030, growing at a CAGR of 20.3% between 2022 and 2030.

The disposable endoscopes market growth is driven by the expanding cross-contamination problem with reusable endoscopes. According to Mr. Brian Dunkin, MD, CMO of Boston Scientific Endoscopy, one out of every twenty patients will have a pathogen contamination concern in 2020. Additionally, various time-consuming sterilization procedures to get rid of all kinds of bacteria from the reusable endoscopes are also anticipated to boost the use of disposable endoscopes.

Disposable Endoscopes Market Growth

A quick fix for the global problem of infections contracted during surgical procedures is disposable endoscopes. The global market would be driven by the accessibility of various medical devices, such as bronchoscopes, duodenoscopes, cystoscopes, hysteroscopes, esophagoscopes, proctoscopes, laryngoscopes, and ureteroscopes.

Other drivers propelling the global market include the preference for minimally invasive procedures over open operations and the rising incidence of many chronic conditions like cancer, inflammatory bowel disease, respiratory tract infections, and Crohn’s disease. Chronic disease prevalence and diagnostic rates are rising, and endoscopes are increasingly used in procedures like biopsy.

Regional Analysis

With a sales share of around 41.5% in 2021, North America dominated the global market. It is due to the widespread use of cutting-edge technologies, the presence of developed infrastructure, and rising public awareness of minimally invasive procedures. Over the anticipated years, Asia Pacific is anticipated to increase at the fastest rate. The two main variables expected to propel the market in this region are improving healthcare infrastructure and lax regulatory frameworks. Additionally, it is anticipated that the burden of chronic diseases in the area will increase, as will awareness of the benefits of minimally invasive surgery.

Report Scope of Disposable Endoscopes Market

| Report Coverage | Details |

| Market Size In 2022 | US$ 2.37 Billion |

| Market Size By 2030 | US$ 10.4 Billion |

| Growth Rate From 2022 to 2030 | CAGR of 20.3% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segments Covered | End User, Application, Region Type, and Regions |

Disposable Endoscopes Market Report Highlights

- Application Insights: By application, the market for disposable endoscopes is segmented into GI endoscopy, proctoscopy, bronchoscopy, urologic endoscopy, arthroscopy, and others. Additionally, it is predicted that the urologic endoscopy segment would rise over the projection period as a result of technical advancements. The expansion of vendors’ R&D efforts for the improvement of their product lines is also contributing to the segment’s growth.

- End-user Insight: The global market for disposable endoscopes is segmented into hospitals, diagnostic facilities, and clinics based on end-user. Hospitals are anticipated to have the highest revenue share of all of these in 2021, accounting for 48% of the market. Additionally, the segment is expected to rise as hospital-acquired diseases become more common due to contaminated equipment.

Also Read: Corporate Wellness Market US$ 96.15 Bn of Potential Opportunity Is Opening

Market Dynamics of Disposable Endoscopes Market

Drivers

Growing hospital investments in endoscopy facilities, rising endoscopic demand due to the incidence of target diseases, and technological improvements in endoscopy are the main factors driving the market for disposable endoscopes to continue growing. Demand for the product is increasing due to a variety of benefits offered by this type of endoscopes, including cheap maintenance, cleaning, and storage costs for the single-use endoscopes. Additionally, the growing concern of regulatory agencies for patient safety has aided in improving the quality of disposable endoscopes, reducing the number of infections. This situation has been beneficial for the expansion of the sector. Additionally, it is projected that rising target disease prevalence will fuel product demand.

Restraints

Over the past decade, disposable endoscopes have gained popularity in the global healthcare industry. The equipment seems to be an additional investment for healthcare facilities that currently use traditional endoscopes, which could hurt the market over the next ten years.

Endoscopes that are disposable and designed for one use add to the vast amounts of medical waste, particularly plastic trash. Around 85% of the total waste generated by healthcare operations is ordinary, non-hazardous waste, according to the World Health Organization (2018). Hazardous material, which includes the remaining 15% and may contain radioactive, poisonous, or infectious components.

Opportunities

The U.S. market is being driven by a number of factors, including an ageing population, an urgent demand for minimally invasive surgeries, and an increase in the prevalence of infectious diseases. A multisite research by the American Journal of Infection Control found that samples from 71% of endoscopes included microbial growth in 2018.

Contamination and residual fluid were caused by improper reprocessing and inadequate drying. The market will be supported by rising disposable endoscope demand in the United States, which is driven by the aforementioned factors.

Recent Development

- The U.S. Food and Drug Administration (FDA) granted Ambu Inc.’s fifth-generation sterile bronchoscopes, the Ambu aScope 5 Broncho, regulatory clearance in July 2022.

- New single-use bronchoscope from PENTAX Medical Europe, the PENTAX Medical ONE Pulmo, received the CE mark in May 2021. This innovative product provides the highest calibre pulmonary care. It is a disposable bronchoscope with increased suction capacity and better image quality.

Disposable Endoscopes Market Major Players:

- Olympus

- Ambu A/S

- Boston Scientific

- Covidien

- EndoChoice

- Fujifilm Holdings Corporation

- Richard Wolf Gmbh

- Karl Storz

- Pentax Medical Company

- Wohler

- Medela

- PFE medical

Market Segmentation

By Application

- GI Endoscopy

- Bronchoscopy

- Proctoscopy

- Urologic Endoscopy

- Arthroscopy

- Others

By End-user

- Diagnostic centers

- Hospitals

- Clinics

Regional Segmentation

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Southeast Asia and Rest of APAC)

- Latin America (Brazil and Rest of Latin America)

- Middle East and Africa (GCC, North Africa, South Africa, Rest of MEA)

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333

- Disposable Endoscopes Market Growing Demand and Insights 2030 - November 10, 2022

- Corporate Wellness Market US$ 96.15 Bn of Potential Opportunity Is Opening - November 10, 2022

- Active Pharmaceutical Ingredients Market Size Will Attain USD 356 Bn By 2030 - November 9, 2022