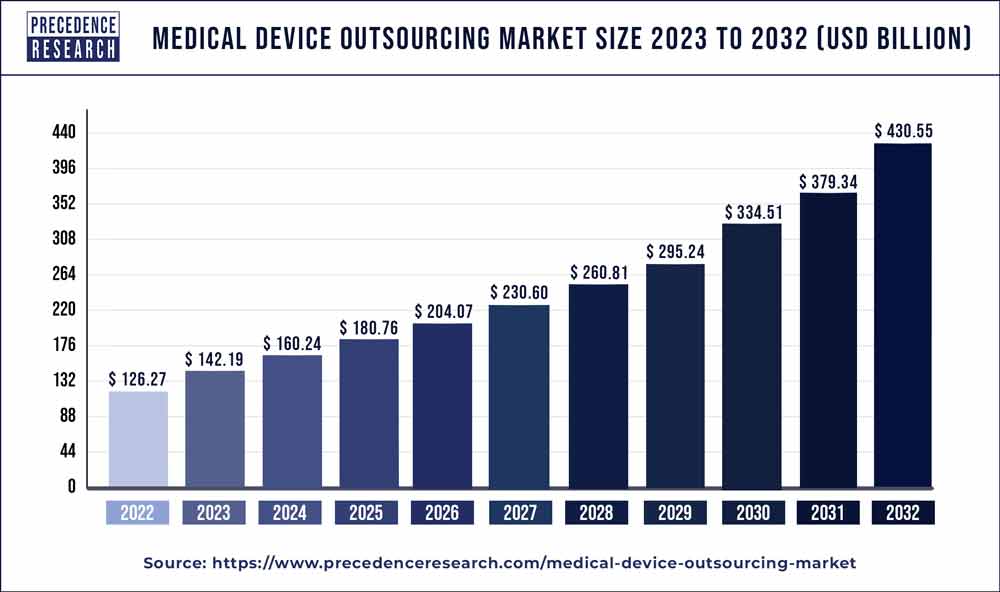

The medical device outsourcing market size is projected to hit around USD 231 billion by 2027 with a remarkable CAGR of 9.98% between 2022 and 2027.

The production of a medical device is known as medical device outsourcing. Medical device firms can use outsourcing to handle routine manufacturing and gain from cost savings, a streamlined supply chain, and logistical alignment. These features all assist them in delivering commercial goods to market while making sure all industry requirements are followed. During the forecast period, a growing need for medical devices, rising pricing competition, and the need to cut costs are anticipated to drive the market. The market’s future is also projected to be influenced by increasing challenges in product engineering and a rise in new competitors.

Medical Device Outsourcing Market Market Growth

Manufacturing processes are increasingly being outsourced, which is crucial since it balances rising operating costs while reducing direct costs and modernizing supply chains. Multiple factors are now driving expansion in the contract manufacturing sector. Different public organizations also provided funding for scaling up the production of these devices in response to the pandemic’s urgent need for COVID-19 test kits. In addition, regulatory bodies like the U.S. FDA and the European Union have granted the test kits Emergency Use Authorization (EUA), which has further fueled the market’s expansion.

Medical Device Outsourcing Market Report Scope

| Report Coverage | Details |

| Market Size By 2027 | USD 231 Billion |

| Growth Rate From 2022 to 2027 | CAGR of 9.98% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2021 |

| Forecast Period | 2022 to 2027 |

| Segments Covered | Service, Application, and Region |

Report Highlights

- Application Insight: Cardiology is predicted to experience the quickest increase among the various application categories in the upcoming years. This expansion is attributed to an increase in the prevalence of related illnesses and chronic diseases. It is also projected that the IVD division will expand significantly during the estimation period.

- Service Insight: Contract manufacturing accounted for the largest revenue share of the market in 2019 and is predicted to continue to dominate the medical device outsourcing market for the foreseeable future. While focusing on medical device cost reduction over time is enhancing segment growth. The quality assurance service segment, on the other hand, is anticipated to post the strongest CAGR over the coming years.

Regional Analysis

With a 41.52% sales share, the Asia Pacific region led the world market in 2021. Other enabling aspects that are projected to fuel this regional market include the existence of market participants and competitive pricing. Over the forecast period, North America is also expected to have significant growth. This is due to the long-established centers for producing sophisticated, reliable, and complex medical gadgets. Additionally, North America has a technologically superior electronic sector that gives it an advantage over other regions.

Medical Device Outsourcing Market Dynamics

Drivers

During the forecast period, a growing need for medical devices, rising pricing competition, and the need to cut costs are anticipated to drive the market. The market’s future is also projected to be influenced by increasing challenges in product engineering and a rise in new competitors. For testing, RT-PCR and COVID-19 antigen test kits were in high demand due to the COVID-19 pandemic. There is a good chance that the current pandemic will benefit the market. The need for medical equipment is rising due to the rising prevalence of chronic diseases.

Also Read: Enteral Feeding Devices: Valuable Niche in Medical Devices

Restraints

Large medical device producers are buying up smaller firms to strengthen their internal capabilities. Given that large corporations will have the resources to handle production in-house, this may be limited to CMOs. For instance, in December 2018, Linden purchased Avalign Technologies Medical, greatly enhancing its capabilities and opening up doors for future expansion.

Opportunities

The adoption of embedded software has been fueled by the expanding number of intelligent devices and smart systems in the healthcare industry. The practice of outsourcing software design and testing tasks to businesses with in-depth domain expertise has grown in popularity as a result. The development of such systems is attracting the attention of IT behemoths in the medical devices outsourcing sector. By considerably enhancing the end-user experience, their offerings have enhanced the caliber of healthcare services delivered.

Challenges

During the current COVID-19 epidemic, regulatory restrictions in several nations have forced many small manufacturers and some major firms to outsource a sizeable portion of their manufacturing processes to effective contract manufacturing companies (CMOs). After the pandemic phase, CMOs may find it challenging to maintain the proper operation of medical device assembly.

Recent Development

- The FDA granted SGS SA permission to take part in and offer services for third-party 510(k) premarket filings for medical devices in January 2021. To expand their service portfolio, market participants are also implementing the acquisition strategy.

- In order to broaden its product portfolio and add testing services for the pharmaceutical, medical device, and other industries, the life sciences business Labcorp purchased a CRO, Toxikon Inc., in December 2021.

Medical Device Outsourcing Market Key Players:

- Intertek Group PLC

- TüvSüd AG

- Wuxi Apptec

- SGS SA

- Toxikon, INC.

- Eurofins Scientific

- American Preclinical Services

- Sterigenics International LLC

- Pace Analytical Services LLC.

- North American Science Associates, Inc.

- Charles River Laboratories International, Inc.

Market Segmentation

By Service

- Product Upgrade Services

- Regulatory Affairs Services

- Legal representation

- Clinical trials applications

- Regulatory writing and publishing

- Quality Assurance

- Product Maintenance Services

- Product Testing & Sterilization Services

- Product Design and Development Services

- Molding

- Designing & engineering

- Machining

- Packaging

- Product Implementation Services

- Contract Manufacturing

- Accessories manufacturing

- Component manufacturing

- Device manufacturing

- Assembly manufacturing

By Application

- Drug delivery

- Dental

- Diabetes care

- Cardiology

- Endoscopy

- IVD

- Ophthalmic

- Diagnostic imaging

- Orthopedic

- General and plastic surgery

- Others

Regional Segmentation

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Southeast Asia and Rest of APAC)

- Latin America (Brazil and Rest of Latin America)

- Middle East and Africa (GCC, North Africa, South Africa, Rest of MEA)

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333

- Medical Devices Market Size To Touch USD 850 Billion By 2030 - November 21, 2022

- Medical Billing Outsourcing Market Size USD 35.7 Bn By 2030 - November 21, 2022

- Medical Device Outsourcing Market Size, Report 2027 - November 18, 2022