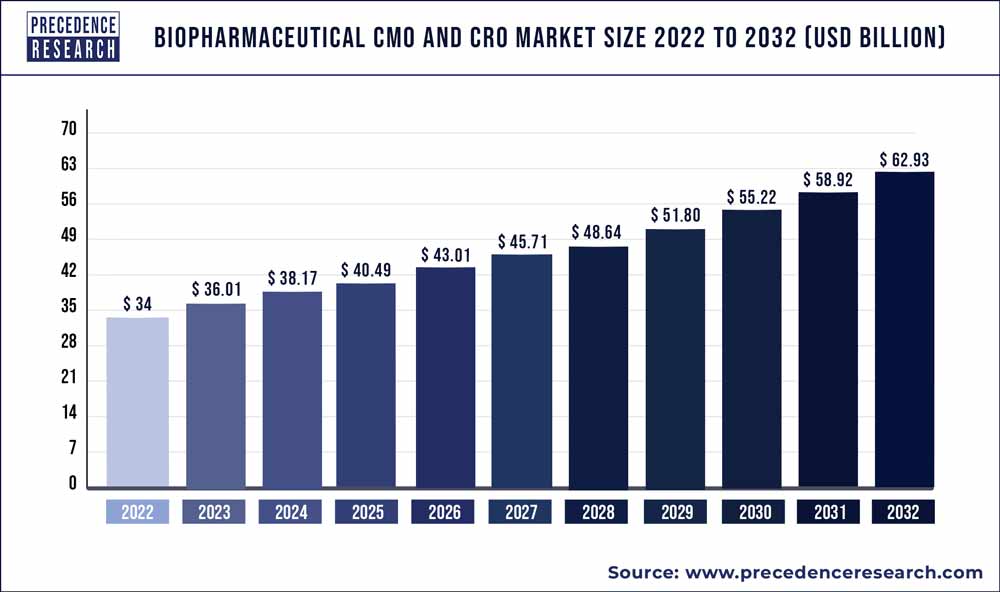

The global biopharmaceutical CMO and CRO market reached USD 34 billion in 2022 and is projected to hit USD 62.93 billion by 2032, growing at a CAGR of 6.4% from 2023 to 2032.

Key Takeaways

- North America led the global market with the highest market share of 34% in 2022.

- Asia-Pacific is expected to expand at the largest CAGR between 2023 and 2032.

- By Service, the contract manufacturing segment has held the highest market share of 58% in 2022.

- By Service, the contract research segment is anticipated to grow at the fastest CAGR from 2023 to 2032.

- By Source, the mammalian segment had a major market share of 54% in 2022.

- By Source, the non-mammalian segment is projected to expand at the fastest CAGR over the projected period.

- By Product Type, the biologics segment generated more than 81.5% of revenue share in 2022.

- By End-use, the biosimilars segment is estimated to grow at the fastest CAGR over the projected period.

The biopharmaceutical CMO and CRO is an integral part of the biopharmaceutical industry. The CMO and CRO are directly linked and influenced by the biopharmaceutical industry. CMO stands for contract manufacturing organizations that sets up manufacturing plants and produces biopharmaceutical products on large scale on contract basis. These organizations are manufacturing specialists that saves cost and time of the contractor and provides efficient output. The CRO refers to the contract research organizations that undertake the task of various research and developmental activities assigned by the contractors and helps in the development of new and innovative drugs. The rising demand for the biopharmaceutical drugs among the consumers has contributed to the rapid growth of the biopharmaceutical industry. Biopharmaceutical is rapidly growing globally and it alone accounts for over 20% of the total pharmaceutical industry. Growing investments and manufacturing contracts by the small and medium sized pharma industry players is propelling the growth of the CMO and CRO in the market significantly.

Get the Sample Pages of Report for More Understanding@ https://www.precedenceresearch.com/sample/1289

Crucial factors accountable for market growth are:

- Rapidly growing biopharmaceutical industry

- Rising demand for the biopharmaceutical products

- Increased participation of medium and small-sized enterprises in biologics

- Growing government expenditure on building sophisticated healthcare infrastructure

- Increasing adoption of biopharma drugs and therapeutics

- Rising burden of diseases amongst the population

- Presence of numerous CMOs and CROs in the market

Regional Snapshots

North America is the leading biopharmaceutical CMO and CRO market. The US accounts for around 33.33% of the global biopharmaceutical CMO market and is also the leader in biopharmaceutical CRO market. As per the Pharmaceutical Research and Manufacturers Association, US has the property rights on majority of the new medicines. North America is characterized by supportive setting for the commercialization and development of medicines, rewards to the developers in the form of intellectual property rights, and supportive regulatory framework for the biopharmaceuticals. This helps in attracting capital investments in North America region for the development of biopharmaceutical companies. This is a significant growth factor that boosts the growth and development of the biopharmaceutical CMO and CRO market in the region.

Asia Pacific is estimated to be the fastest-growing region, owing to enhanced regulatory framework regarding the biopharmaceuticals, greater supply of capital, and support from the government. In South Korea, the Samsung Biologics witnessed a spike in its sales by 56% in 2017. Further, the Celltrion Group of South Korea acquired European Medicines Agency approval for it biosimilar product called Herzuma, in 2018. Further, in India, Biocon received FDA approval for its biosimilar product called Ogivri in 2017. China, the second largest market for the biopharmaceuticals is attracting FDIs for setting up manufacturing units that exponentially propels the biopharmaceutical CMO and CRO market growth in Asia Pacific region.

Report Highlights

- By service, the contract manufacturing segment led the global biopharmaceutical CMO and CRO market with remarkable revenue share in 2020. This is attributed to the growing participation of the small and medium conventional pharmaceutical developers in the biopharmaceutical industry owing to its market attractiveness.

- By source, the mammalian segment led the global biopharmaceutical CMO and CRO market with remarkable revenue share in 2020. This is attributed to the growing importance of biotherapies namely, monoclonal antibodies, vaccines, and blood factors are developed using mammalian cell culture. Moreover, the antibody products are the dominant commercial products that foster the segment growth.

- By product type, the biologics segment led the global biopharmaceutical CMO and CRO market with remarkable revenue share in 2020. Biologics gained traction when it opened up the opportunities for the treatment of cancer. Moreover, higher approval rate of biologic medicines is fostering its adoption at a rapid pace among the consumers.

Biopharmaceutical CMO and CRO Market Scope

| Report Highlights | Details |

| Market Size in 2023 | USD 36.01 Billion |

| Market Size by 2032 | USD 62.93 Billion |

| Growth Rate From 2023 to 2032 | CAGR of 6.4% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Product, Source, Service |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

Drivers

The global biopharmaceutical CMO and CRO market is primarily driven by the increasing popularity and increasing investments by the key players in the biopharmaceutical industry for the development of cost-effective and innovative drugs.

Restraints

The lack of proper healthcare infrastructure in the underdeveloped economies, lack of awareness regarding technologically advance biopharma products, and high costs involved are the major factors that may hamper the market growth.

Opportunities

The growing research and development activities carried on by the key market players to develop effective drugs and medicines for various serious illnesses and disease like cancer may open up new opportunities in the upcoming future.

Challenges

Lack of adequate capital in the hands of the small pharmaceutical developers who have interests in shifting towards the biopharmaceuticals is a major challenge that may slow down the growth of the global biopharmaceutical CMO and CRO market.

Read Also: Preterm Birth and PROM Testing Market Size to Surpass US$ 2.1 Bn by 2030

Biopharmaceutical CMO and CRO Market Players

- Lonza

- JRS Pharma

- Samsung Biologics

- CMC Biologics

- TOYOBO Co. Ltd.

- RentschlerBiotechnologie

- FUJIFILM Diosynth Biotechnologies

- WuXi Biologics

- Patheon

- BoehringerIngelheim

- PRA Health Sciences

- LabCorp

Segments Covered in the Report

By Service

- Contract Manufacturing

- Process Development

- Upstream

- Downstream

- Fill & Finish Operations

- Analytical & QC studies

- Packaging

- Process Development

- Contract Research

- Inflammation & Immunology

- Cardiology

- Oncology

- Neuroscience

- Others

By Source

- Mammalian

- Non-Mammalian

By Product

- Biologics

- Vaccines

- Monoclonal antibodies (MABs)

- Recombinant Proteins

- Antisense, RNAi, & Molecular Therapy

- Others

- Biosimilars

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

- Esoteric Testing Market Size to Hit USD 75.54 Bn by 2032 - July 17, 2024

- mRNA Therapeutics Market Size to Surpass USD 39.99 Bn By 2033 - July 17, 2024

- Acne Treatment Market Size to Hit USD 15.86 Bn by 2033 - July 17, 2024