Synthetic Small Molecule API Market Key Takeaways

-

In 2024, North America held the largest revenue share of 38%.

-

The Asia Pacific region is projected to grow at a CAGR of 6.72% between 2025 and 2034.

-

By manufacturer type, the in-house segment dominated the market with a 60% revenue share in 2024.

-

The outsourced segment is expected to grow at a CAGR of 5.84% over the forecast period.

-

In terms of application, the cardiovascular diseases segment held the highest revenue share of 22% in 2024.

-

The oncology segment is anticipated to expand at the fastest CAGR of 7.51% during the forecast period.

What Is a Synthetic Small Molecule API and Why Is It Important in Pharmaceuticals?

A Synthetic Small Molecule Active Pharmaceutical Ingredient (API) is a chemically manufactured compound that forms the active ingredient in many pharmaceutical drugs. These molecules typically have low molecular weight and are designed to interact with specific biological targets, such as proteins or enzymes, to treat or prevent diseases. Synthetic small molecules are widely used because they can be precisely engineered, are generally stable, and can be administered orally in forms like tablets or capsules.

How Are Synthetic Small Molecule APIs Made and Where Are They Used?

These APIs are produced through complex chemical synthesis involving multiple steps of reaction, purification, and formulation under tightly regulated conditions. They are essential in treating a wide range of conditions, including cancer, cardiovascular diseases, infections, and neurological disorders. Due to their scalability and cost-effectiveness, synthetic small molecule APIs dominate the global pharmaceutical market and continue to be a foundation for both generic and branded medications. As new diseases emerge and personalized medicine grows, the demand for innovative small molecule therapies remains strong.

How is AI Transforming the Synthetic Small Molecule API Market?

AI is revolutionizing the synthetic small molecule API (Active Pharmaceutical Ingredient) market by accelerating drug discovery and development. Machine learning algorithms analyze vast chemical databases to predict molecular interactions, optimize lead compounds, and identify potential drug candidates more efficiently than traditional methods. This significantly shortens the R&D cycle and reduces costs for pharmaceutical companies.

In manufacturing, AI enhances process optimization and quality control. Advanced analytics and real-time monitoring systems use AI to predict equipment issues, minimize downtime, and ensure consistent API purity and yield. These innovations not only boost production efficiency but also support compliance with strict regulatory standards, making AI a critical driver in modernizing the synthetic small molecule API industry.

Synthetic Small Molecule API Market Growth Factors

Another significant trend is the growth of outsourcing and CDMO (Contract Development and Manufacturing Organization) partnerships. As pharmaceutical companies look to reduce costs and accelerate time-to-market, in-house manufacturing remains dominant, but outsourced production is expanding at the fastest rate. This is particularly evident in regions like Asia-Pacific, where low-cost manufacturing, regulatory support, and healthcare infrastructure development are driving robust market expansion. North America and Europe maintain strong market shares due to advanced pharma infrastructure and significant R&D investments.

Market Scope

| Report Coverage | Details |

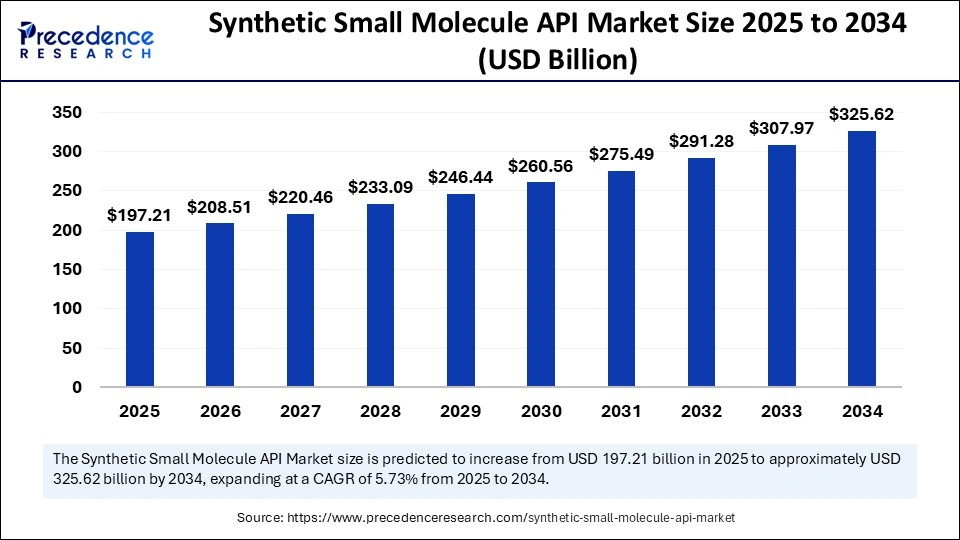

| Market Size by 2034 | USD 325.62 Billion |

| Market Size in 2025 | USD 197.21 Billion |

| Market Size in 2024 | USD 186.52 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.73% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Manufacturer, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

The synthetic small molecule API (active pharmaceutical ingredient) market is primarily driven by the continued dominance of small molecule drugs in the pharmaceutical sector due to their cost-effectiveness, well-established manufacturing processes, and broad therapeutic applicability. These APIs are integral to a wide range of therapeutic areas including oncology, cardiovascular diseases, infectious diseases, and central nervous system disorders. The rising prevalence of chronic conditions and the growing global aging population are significantly contributing to increased demand for small molecule-based therapeutics.

Additionally, the increasing number of generic drug approvals, supported by patent expiries of blockbuster drugs, is fostering growth in the synthetic API segment. Pharmaceutical companies are also outsourcing production to specialized contract development and manufacturing organizations (CDMOs), further boosting market expansion due to improved cost-efficiency and faster time-to-market.

Market Opportunities

The market presents multiple growth opportunities, particularly in the realm of high-potency APIs (HPAPIs), which are gaining traction due to their efficacy at lower dosages and targeted therapeutic action, especially in oncology. As more personalized and targeted therapies emerge, the need for complex synthetic APIs with high purity and quality standards is rising. Moreover, the expanding biopharmaceutical footprint in emerging economies presents substantial opportunities for manufacturers to establish or expand operations in cost-effective regions with supportive regulatory frameworks.

Technological advancements in continuous manufacturing, green chemistry, and process optimization also offer a pathway to enhanced efficiency, sustainability, and reduced production costs. Another opportunity lies in the growing focus on orphan drugs and rare disease treatments, where synthetic small molecules play a critical role due to their ability to penetrate cell membranes and interact with intracellular targets.

Market Challenges

Despite its robust growth potential, the synthetic small molecule API market faces several challenges. One of the major hurdles is the increasing regulatory scrutiny and stringent quality compliance requirements imposed by health authorities such as the FDA, EMA, and WHO. This necessitates significant investment in quality assurance, analytical testing, and documentation, which can be burdensome for small and mid-sized manufacturers.

Additionally, supply chain disruptions, particularly evident during the COVID-19 pandemic, highlighted the vulnerabilities of heavy dependence on a limited number of manufacturing hubs, especially in countries like China and India. Fluctuations in raw material prices and availability also impact production stability and margins. Moreover, the high level of competition and pressure on pricing, especially in the generics market, can limit profitability unless balanced by innovation and operational efficiency.

Regional Outlook

Regionally, North America dominates the synthetic small molecule API market, driven by a strong pharmaceutical infrastructure, extensive R&D investment, and a high rate of chronic disease incidence. The presence of major pharmaceutical companies and strict regulatory standards has led to high demand for high-quality APIs, particularly in the U.S. Europe follows closely, supported by well-established pharmaceutical manufacturing capabilities, strong government support for healthcare innovation, and increasing production of both branded and generic drugs.

The Asia-Pacific region is expected to witness the fastest growth, led by countries such as India and China. These nations are key global suppliers of APIs due to their large-scale production capacities, low-cost manufacturing, and expanding domestic pharmaceutical markets. Governments in these regions are also investing in infrastructure and policy reforms to boost local API production and reduce import dependencies.

Latin America and the Middle East & Africa (MEA) are emerging regions with growing demand for affordable medications, though challenges related to regulatory environments and infrastructure still need to be addressed to fully realize their market potential.

Synthetic Small Molecule API Market Companies

- AbbVie, Inc

- Merck & Co., Inc.

- Bristol-Myers Squibb Company

- Cipla, Inc.

- Albemarle Corporation

- Boehringer Ingelheim International GmbH

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy’s Laboratories Ltd.

- Aurobindo Pharma

- Teva Pharmaceutical Industries Ltd

Segment Covered in the Report

By Manufacturer

- In-house

- Outsourced

By Application

- Cardiovascular Diseases

- Oncology

- CNS and Neurology

- Orthopedic

- Endocrinology

- Pulmonology

- Gastroenterology

- Nephrology

- Ophthalmology

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Also Read: Water for Injection Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6195

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344

- Arteriovenous Implants Market Enhance dialysis outcomes with advanced grafts, endovascular access, and AI-assisted precision - September 16, 2025

- Smart Retinal Implants Market Restore vision with wireless bioelectronic prosthetics and AI-powered retinal technologies - September 16, 2025

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025