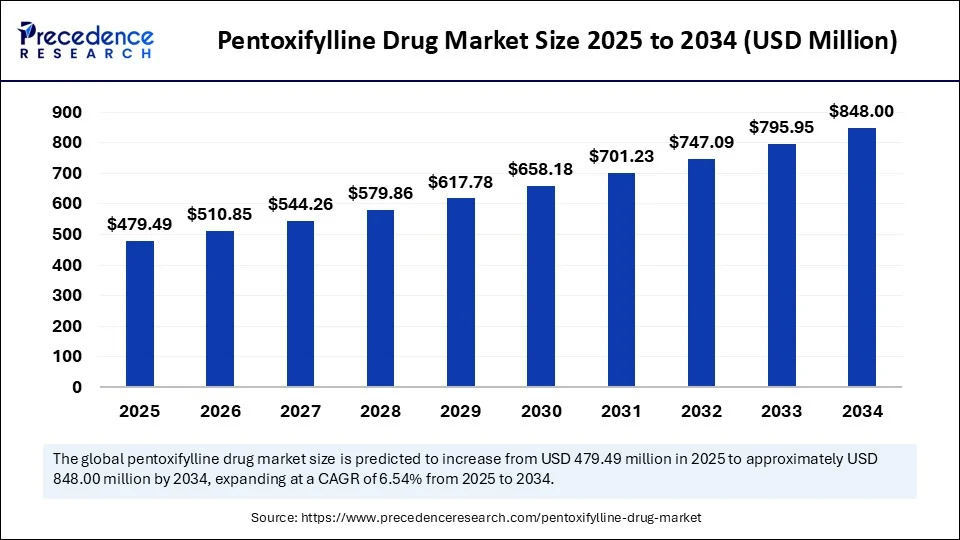

The global pentoxifylline drug market size was valued at USD 450.06 million in 2024 and is projected to increase from USD 479.49 million in 2025 to around USD 848.00 million by 2034, expanding at a CAGR of 6.54% during the forecast period. This growth is largely driven by the rising prevalence of peripheral artery disease (PAD), chronic blood circulation disorders, and the increasing adoption of pentoxifylline in the management of diabetic neuropathy and other microcirculatory complications.

Pentoxifylline Drug Market Key Takeaways

-

Market size reached USD 450.06 million in 2024.

-

Projected to hit USD 848.00 million by 2034, growing at a CAGR of 6.54%.

-

North America dominated with a 35% share in 2024.

-

Asia Pacific expected to register the fastest growth rate during 2025–2034.

-

Tablet segment accounted for 60% share in 2024.

-

Injection segment is anticipated to expand at the fastest CAGR.

-

Oral route of administration captured 70% share in 2024.

-

Peripheral vascular disease (PVD) was the leading application with 40% share in 2024.

-

Hospital pharmacies held the largest distribution share of 45% in 2024, while online pharmacies are set to grow rapidly.

Read Also: Electrolyte Tablet Market

Market Overview

Pentoxifylline, a xanthine derivative, is primarily prescribed for improving blood flow in patients with peripheral vascular diseases, chronic occlusive arterial disease, and intermittent claudication. The drug works by reducing blood viscosity, enhancing red blood cell flexibility, and preventing platelet aggregation.

Market growth is fueled by:

-

Rising cases of cardiovascular and peripheral vascular diseases.

-

A rapidly aging global population.

-

Growing usage in oral and injectable forms across hospitals and outpatient settings.

How AI is Transforming the Pentoxifylline Drug Market

Artificial Intelligence (AI) is playing a pivotal role in accelerating drug discovery and clinical trials. AI-driven algorithms can:

-

Predict efficacy, toxicity, and pharmacokinetic properties.

-

Analyze genomic and proteomic data to identify new therapeutic targets.

-

Support personalized medicine approaches and optimize treatment outcomes.

This technological integration is expected to open new opportunities for better formulations and broader applications of pentoxifylline.

U.S. Pentoxifylline Drug Market

The U.S. market was valued at USD 110.26 million in 2024 and is forecasted to reach USD 212.23 million by 2034, growing at a CAGR of 6.77%.

Key drivers include:

-

High prevalence of peripheral artery disease and intermittent claudication.

-

FDA’s regulatory oversight ensuring safety and efficacy.

-

Presence of major pharmaceutical players such as Teva and Johnson & Johnson.

Regional Insights

North America

North America held the largest market share in 2024, supported by:

-

Strong healthcare infrastructure.

-

Ongoing clinical trials exploring new indications.

-

Presence of leading manufacturers like ANI Pharmaceuticals.

Asia Pacific

Asia Pacific is anticipated to be the fastest-growing region due to:

-

Large aging population.

-

Rising incidence of diabetic complications and PAD.

-

Expansion of API manufacturing hubs in India and South Korea.

Canada

Canada’s market is shaped by Health Canada’s regulations and the availability of generics through companies like AA Pharma Inc. Government-funded research exploring new indications adds further momentum.

Market Dynamics

Drivers

-

Rising prevalence of peripheral arterial disease (PAD).

-

Increasing elderly population.

-

Expanding applications in diabetic nephropathy and kidney diseases.

Restraints

-

Growing competition from generic drugs.

-

Emergence of alternative therapies.

-

Side-effect profile limiting adoption in certain patient groups.

Opportunities

-

Expanding use in diabetic kidney disease (DKD) and nonalcoholic steatohepatitis (NASH).

-

Development of sustained-release formulations to enhance compliance.

Market Segmentation

-

By Dosage Form: Tablet, Capsule, Injection, Others

-

By Route of Administration: Oral, Intravenous/Injectable, Others

-

By Application/Indication: Peripheral Vascular Disease, Cerebrovascular Disorders, Diabetic Neuropathy, Chronic Venous Insufficiency, Others

-

By Distribution Channel: Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Others

-

By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Key Players in the Pentoxifylline Drug Market

Some of the major companies include:

Sanofi, Teva Pharmaceuticals, Mylan (Viatris), Cipla, Sun Pharma, Glenmark, Lupin, Aurobindo, Zydus Cadila, Dr. Reddy’s Laboratories, Sandoz, Torrent Pharmaceuticals, Hikma Pharmaceuticals, F. Hoffmann-La Roche Ltd, Intas Pharmaceuticals, among others.

Recent Developments

-

January 2024 – ANI Pharmaceuticals launched Pentoxifylline Extended-Release Tablets, a generic version of Trental®, targeting the U.S. market.

-

May 2023 – Soligenix, Inc. signed an option agreement with Silk Road Therapeutics to develop a topical pentoxifylline formulation for Behçet’s Disease.

-

August 2025 – The RECLAIM trial in Canada began exploring interventions, including pentoxifylline, for managing Long COVID symptoms.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Autonomous Vehicle Market Size to Reach USD 4450.34 Billion by 2034 - September 19, 2025

- Sterilization Equipment Market Size to Reach USD 36.16 Bn by 2034 - September 19, 2025

- Wearable Cardiac Devices Market Size to Hit USD 32.16 Bn by 2034 - September 19, 2025