Key Points

- North America market accounted highest revenue share of 41% in 2022.

- By product, laboratory information management systems (LIMS) segment has generated revenue share of 45.5% in 2022.

- The enterprise content management (ECM) product segment is growing at a CAGR of 3.3% over the forecast period.

- By delivery mode, the cloud-based segment has accounted for 41% revenue share in 2022.

- By component, services segment was highest revenue holder in 2022 and garnered 55.6% revenue share in 2022.

- By end-use, life science companies segment has garnered 26% revenue share in 2022.

In the coming years, a growth in laboratory automation demand is likely to drive adoption and acceptance globally. Due to technological developments in molecular genomics and genetic testing techniques, the amount of information created by laboratories has expanded considerably in recent years. Furthermore, the shift in preference towards cancer genomics investigations, personalized medicine, and increased patient interaction needs are projected to drive higher demand for lab automation systems.

Get the Sample Pages of the Report for More Understanding@ https://www.precedenceresearch.com/sample/1536

The laboratory informatics market is expected to rise due to reasons such as contract research organizations’ greater use of cloud-based platforms, their demand for personalized medication, more regulatory approvals, new rising markets, and expanded research and development in medicine. In addition, artificial intelligence, augmented reality, and virtual reality technologies are predicted to contribute significantly to laboratory informatics market expansion while reacting to the COVID-19 pandemic and addressing continually increasing issues.

In addition, a growing regulatory burden for the deployment of lab automation systems is likely to provide attractive growth prospects for this industry. Robotics and process automation are becoming more common in healthcare, making operations more reproducible and repeatable. Highly elevated systems are becoming more widely used, allowing for more efficient evaluation of experimental results, which improves laboratory operations overall during the forecast period.

Report Highlights:

- Based on the product, the laboratory information management systems (LIMS)segment dominated the global laboratory informatics market in 2020 with highest market share. The surge in demand for fully integrated services in the research and life science sectors to eliminate data management mistakes and enhance qualitative analysis of research data is expected to fuel segment expansion in the coming years.

- Based on the delivery mode, the cloud-based segment dominated the global laboratory informatics market in 2020 with highest market share. Cloud-based technology enables for the remote storage of large amounts of data, freeing up space on devices and allowing data retrieval based on client needs.

- Based on the component, the services segment dominated the global laboratory informatics market in 2020 with highest market share. An increase in the outsourcing of LIMS solutions is contributing to the segment’s growth.As they lack the resources and expertise required for analytics adoption, many pharmaceutical research labs outsource these services.

- Based on the end use, the life science companies segment dominated the global laboratory informatics market in 2020 with highest market share. The life sciences industry is increasing its demand for laboratory informatics in order to create innovative products and improve product quality and operational efficiency.

- North America is the largest segment for laboratory informatics market in terms of region. This is due to the availability of infrastructure and legislation that encourages the use of laboratory information systems.

- Asia-Pacific region is the fastest growing region in the laboratory informatics market. This is due to an increase in the number of CROs in the region that offer LIMS solutions. The key market players outsource LIMS to firms in the Asia-Pacific region to decline the cost of LIMS support systems and boost operational efficiency and effectiveness.

Scope of the Laboratory Informatics Market

| Report Coverage | Details |

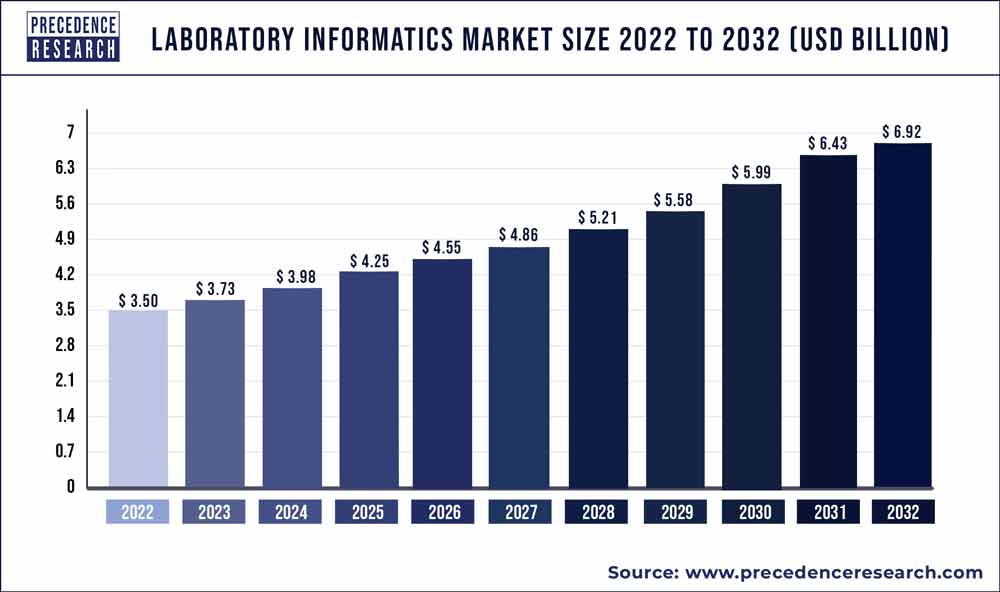

| Market Size | US$ 6.92 Billion by 2032 |

| Growth Rate | CAGR of 7.10% from 2023 to 2032 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Product, Delivery Mode, Component, End Use, Region |

Future of Laboratory Informatics Market

Laboratory automation is gaining traction as a viable solution to the difficulties of a labor scarcity and strategies for reducing manual intervention in lab procedures. The use of dedicated workstations and software to program instruments to automate common lab activities improves lab productivity and allows individual researchers to concentrate on more critical tasks. The inclusion of monitoring standards, in combination with strict regulatory criteria for accurate outputs, aids in the establishment of standardized systems with repeatable results. Laboratory informatics solutions are good fit for this demand since they help to simplify, increase, and enhance productivity and effectiveness of laboratory procedures. Thus, laboratory automation is creating growth prospects for the laboratory informatics market for the future.

COVID-19 Impact Analysis:

- With unexpected global demand for COVID-19 testing, clinical labs have ramped up their operations and faced new problems, including the development, validation, and standardization of new methods for testing and administering large volumes of patient samples and test data, as well as quick and efficient reporting of test results.

- A LIMS plays a critical role in accelerating the increasing demand for COVID-19 tests in clinical labs, which led to the product’s acceptance.

Read Also: Dental Implants Market Size to Reach USD 6.31 Billion by 2030

Key Developments in the Marketplace:

- In July 2020, LabVantage 8.5 was published, which is an enhanced version of the LabVantage platform that includes a fully integrated SDMS.

- In June 2020, LabWare published LabWare 8, the most recent version of its LIMS. The LabWare 8 solution is the company’s enterprise laboratory platform, which combines LIMS and ELN features into a single system.

Some of the prominent players in the global laboratory informatics market include:

- Thermo Fisher Scientific Inc.

- LabVantage Solutions Inc.

- Core Informatics

- ID Business Solutions Ltd.

- McKesson Corporation

- Abbott Informatics

- PerkinElmer Inc.

- Agilent Technologies

- Waters Corporation

- LabLynx Inc.

Segments Covered in the Report

By Product

- LIMS

- ELN

- SDMS

- LES

- EDC & CDMS

- CDS

- ECM

By Delivery Mode

- On-premise

- Web-hosted

- Cloud-based

By Component

- Software

- Services

By End Use

- Life Sciences Companies

- CROs

- Chemical Industry

- F&B and Agriculture

- Environmental Testing Labs

- Petrochemical Refineries & Oil and Gas Industry

- Other Industries

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

- Orthopedic Implants Market Size, Share, Share, Report 2032 - April 25, 2024

- Advanced Drug Delivery Market Size, Trends, Report By 2032 - April 25, 2024

- Artificial Intelligence (AI) In Drug Discovery Market Size Report by 2032 - April 25, 2024