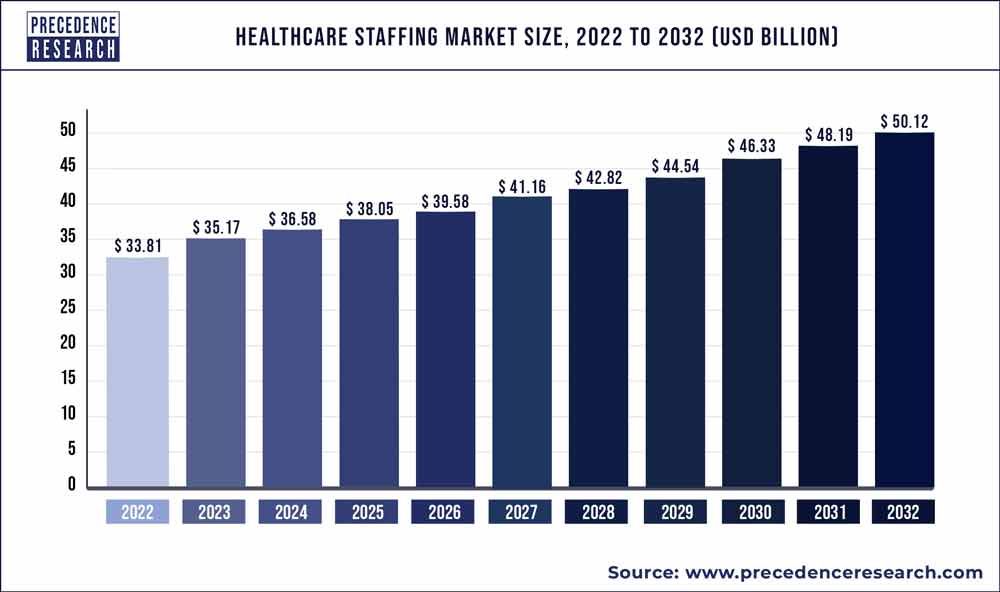

The healthcare staffing market size is poised to grow by $ 50.12 billion by 2032 from $ 33.81 billion in 2022, exhibiting a CAGR of 4.02% during the forecast period 2023 to 2032.

Key Takeaway

- Based on service type, the travel nurse segment accounted market share of over 34.5% in 2022.

- The locum tenens service segment is growing at a CAGR from 2023 to 2032.

- North America accounted highest revenue share of over 59% in 2022.

- The Asia Pacific market is growing faster over the forecast period

- The U.S. healthcare staffing market was valued at USD 24.5 billion in 2022 and is expected to surpass around USD 35.1 billion by 2032 with a CAGR of 5.6% from 2023 to 2032.

Healthcare staffing is referred to as a firm, services person, partnerships, corporations, and other business entities that is engaged in offering nursing personnel to healthcare agencies or to an individual in order to render temporary nursing services. Healthcare providers are pursuing responses to deal the regulatory upheaval, rising physician shortage, constricted nurse staffing levels and several technology challenges. Healthcare is one of the most regulated sectors, thus, staffing organizations require flawless management and organization to deal several credentialing and compliance necessities required for operating in this industry. Factors such as travel opportunities, flexible schedules, and clinical experience across several locations are influencing locum tenens and travel nurses to opt for a career in the healthcare staffing field. In 2013, World Health Organization (WHO) reported that, there was a shortage of around 7.2 million healthcare staff globally, and is estimated to touch 12.9 million by the end of 2035. These factors are expected to open new avenues for industry growth.

Get the Sample Pages of Report for More Understanding@ https://www.precedenceresearch.com/sample/1013

Growth Factors

Growing geriatric population has increased several concerns such as shortage of nurses and other working staff in hospitals and also an increase in demand for healthcare facilities. Thus, temporary healthcare staffing is gaining traction across several hospitals globally due to its cost-effective attribute, thereby expected to witness a positive impact on market growth over the forecast period. Healthcare firms are coming across the diverse challenges such as meeting high revenue rates and increasing patient contentment rates. Approach for searching proficient staff is emerging to address the requirements of a new generation of nurses.

The advent of new technologies is playing a vital role to increase healthcare employment which is anticipated to fuel the healthcare staffing market growth during the projected period. Technological advancement has led to innovations in services including telehealth and informatics which have driven the need for skilled working staff in order hand both technical as well as non-technical operations.

Healthcare Staffing Market Scope

| Report Highlights | Details |

| Market Size in 2023 | USD 35.17 Billion |

| Market Size by 2032 | USD 50.12 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.02% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Service, End User, Region |

Report Highlights

- Locum tenens segment is projected to expand with fastest CAGR over the forecast period due to cost reduction offered by temporary employees hiring and growing physicians’ preference for working as locum tenens.

- In 2019, allied healthcare segment held the largest market share in terms of revenue. It comprises physical therapists, occupational therapists, pharmacists, respiratory therapists, phlebotomists, and medical technologists.

- The major players are adopting several marketing strategies such as collaborations, mergers, and acquisitions to gain maximum market share and expand their geographical presence.

- Hospital leaders are also taking several important initiatives to overcome frontline staff shortage in current pandemic situations which is expected to propel the market growth.

- In 2019, HNI Healthcare, Inc. announced acquisition of Martin Healthcare Group which is private company operated across the Midwest and Florida in order to spread its business across U.S. Midwest region.

- Some of the prominent players operating in this market are AMN Healthcare; Adecco Group; Envision Healthcare Corporation; CHG Management, Inc.; inVentiv Health; Cross Country Healthcare, Inc.; TeamHealth; Almost Family; and Maxim Healthcare Services, Inc.

Regional Snapshots

North America dominated the global healthcare staffing market and accounted for the largest market share, in 2019. Lack of skilled staff as compared to the need, growing geriatric population, and the existence of key market players are major factors responsible for regional market growth. In this region, key players are adopting some strategic initiatives like mergers, acquisitions, and collaborations to expand their geographical reach and services portfolio. Therefore, growing market penetration is expected to surge the regional market growth during the forecast period.

Asia Pacific is expected to grow with the fastest CAGR from 2020 to 2027. This growth is attributed to rising demand for contract staffing, and growing investments by market players along with promising economic outlook. Several benefits of contract staffing such as no liabilities that are generally occurred by permanent staffing have led to an increase in demand for contract staffing in this region.

Key Players & Strategies

The healthcare staffing market is highly competitive in nature owing to the presence of a large number of market players. Therefore, market players are focusing on adopting several strategies such as mergers & acquisitions, and collaborations in order to sustain in a competitive market. For example, TeamHealth acquired Emergency Medicine Consultants (EMC), an emergency medical staff provider, in 2018. This initiative will help the TeamHealth to add EMC’s 330 physicians and 80 advanced practice clinicians

Read Also: Medical Devices Market Size To Touch USD 850 Billion By 2030

Some of the prominent players in the healthcare staffing market include:

- CHG Management, Inc.

- AMN Healthcare

- Almost Family

- Envision Healthcare Corporation

- inVentiv Health

- TeamHealth

- Maxim Healthcare Services, Inc.

- Cross Country Healthcare, Inc.

Segments Covered in the Report

This research report estimates revenue growth at global, regional, and country levels and offers an analysis of present industry trends in every sub-segment from 2023 to 2032. This research study analyzes market thoroughly by classifying global healthcare staffing market report on the basis of different parameters including service type and region as follows:

By Service Type

- Travel Nurse Staffing

- Per Diem Nurse Staffing

- Locum Tenens Staffing

- Allied Healthcare Staffing

By End User

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Home Care Settings

- Private Sector

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Table of Content

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Healthcare Staffing Market, By Service

7.1. Healthcare Staffing Market, by Service Type, 2023-2032

7.1.1. Travel Nurse Staffing

7.1.1.1. Market Revenue and Forecast (2020-2032)

7.1.2. Per Diem Nurse Staffing

7.1.2.1. Market Revenue and Forecast (2020-2032)

7.1.3. Locum Tenens Staffing

7.1.3.1. Market Revenue and Forecast (2020-2032)

7.1.4. Allied Healthcare Staffing

7.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 8. Global Healthcare Staffing Market, Regional Estimates and Trend Forecast

8.1. North America

8.1.1. Market Revenue and Forecast, by Service (2020-2032)

8.1.2. U.S.

8.1.3. Rest of North America

8.1.3.1. Market Revenue and Forecast, by Service (2020-2032)

8.2. Europe

8.2.1. Market Revenue and Forecast, by Service (2020-2032)

8.2.2. UK

8.2.2.1. Market Revenue and Forecast, by Service (2020-2032)

8.2.3. France

8.2.3.1. Market Revenue and Forecast, by Service (2020-2032)

8.2.4. Rest of Europe

8.2.4.1. Market Revenue and Forecast, by Service (2020-2032)

8.3. APAC

8.3.1. Market Revenue and Forecast, by Service (2020-2032)

8.3.2. India

8.3.2.1. Market Revenue and Forecast, by Service (2020-2032)

8.3.3. China

8.3.3.1. Market Revenue and Forecast, by Service (2020-2032)

8.3.4. Japan

8.3.4.1. Market Revenue and Forecast, by Service (2020-2032)

8.3.5. Rest of APAC

8.3.5.1. Market Revenue and Forecast, by Service (2020-2032)

8.4. MEA

8.4.1. Market Revenue and Forecast, by Service (2020-2032)

8.4.2. GCC

8.4.2.1. Market Revenue and Forecast, by Service (2020-2032)

8.4.3. North Africa

8.4.3.1. Market Revenue and Forecast, by Service (2020-2032)

8.4.4. South Africa

8.4.4.1. Market Revenue and Forecast, by Service (2020-2032)

8.4.5. Rest of MEA

8.4.5.1. Market Revenue and Forecast, by Service (2020-2032)

8.5. Latin America

8.5.1. Market Revenue and Forecast, by Service (2020-2032)

8.5.2. Brazil

8.5.2.1. Market Revenue and Forecast, by Service (2020-2032)

8.5.3. Rest of LATAM

8.5.3.1. Market Revenue and Forecast, by Service (2020-2032)

Chapter 9. Company Profiles

9.1. CHG Management, Inc.

9.1.1. Company Overview

9.1.2. Product Offerings

9.1.3. Financial Performance

9.1.4. Recent Initiatives

9.2. AMN Healthcare

9.2.1. Company Overview

9.2.2. Product Offerings

9.2.3. Financial Performance

9.2.4. Recent Initiatives

9.3. Almost Family

9.3.1. Company Overview

9.3.2. Product Offerings

9.3.3. Financial Performance

9.3.4. Recent Initiatives

9.4. Envision Healthcare Corporation

9.4.1. Company Overview

9.4.2. Product Offerings

9.4.3. Financial Performance

9.4.4. Recent Initiatives

9.5. inVentiv Health

9.5.1. Company Overview

9.5.2. Product Offerings

9.5.3. Financial Performance

9.5.4. Recent Initiatives

9.6. TeamHealth

9.6.1. Company Overview

9.6.2. Product Offerings

9.6.3. Financial Performance

9.6.4. Recent Initiatives

9.7. Maxim Healthcare Services, Inc.

9.7.1. Company Overview

9.7.2. Product Offerings

9.7.3. Financial Performance

9.7.4. Recent Initiatives

9.8. Cross Country Healthcare, Inc.

9.8.1. Company Overview

9.8.2. Product Offerings

9.8.3. Financial Performance

9.8.4. Recent Initiatives

Chapter 10. Research Methodology

10.1. Primary Research

10.2. Secondary Research

10.3. Assumptions

Chapter 11. Appendix

11.1. About Us

11.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/