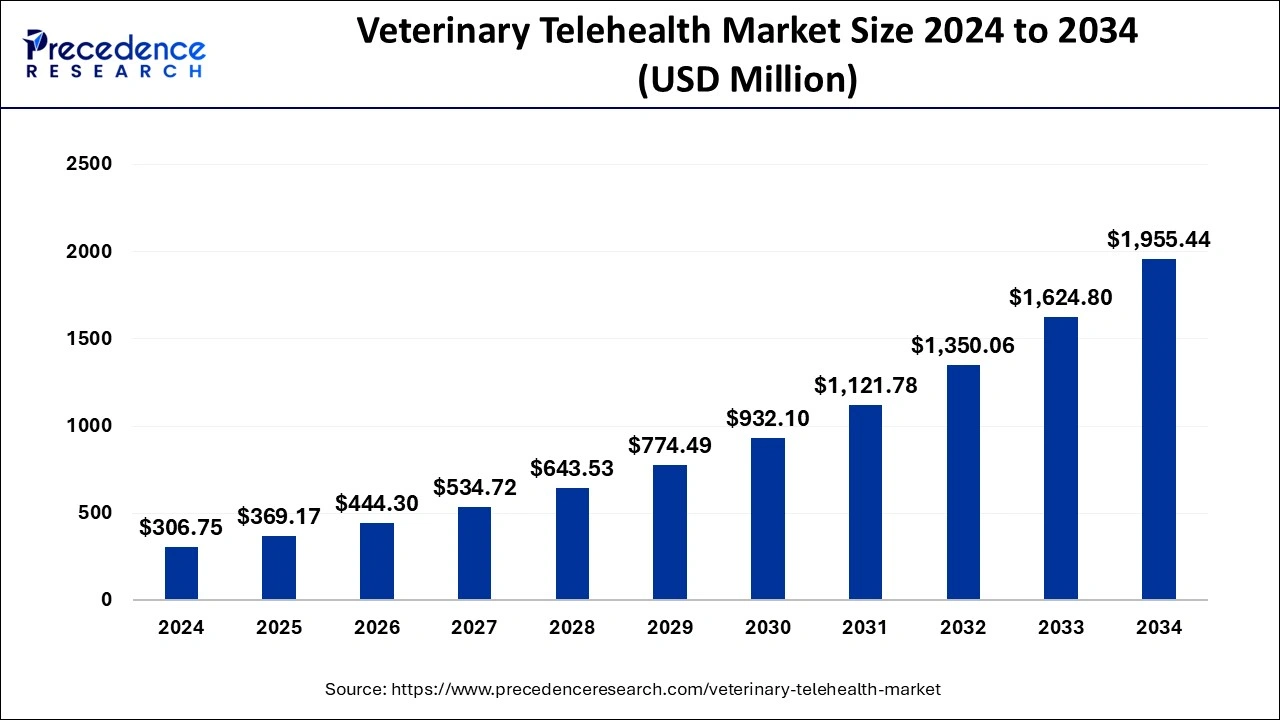

The global veterinary telehealth market size was calculated at USD 306.75 million in 2024 and is predicted to reach around USD 1,955.44 million by 2034, expanding at a CAGR of 20.35% from 2025 to 2034. The veterinary telehealth market is driven by the increasing demand for convenient and accessible pet care services.

Market Overview

The veterinary telehealth market is rapidly expanding as digital healthcare solutions reshape animal care. Pet owners, especially in rural or underserved areas, benefit from easier access to veterinary services without requiring in-person clinic visits.

Telehealth supports chronic disease management for pets suffering from diabetes, arthritis, and other long-term conditions, offering continuous monitoring and better outcomes. Wearable devices and IoT-powered tools are now integrated with veterinary telemedicine, providing real-time data for diagnosis and treatment.

The adoption of pet telehealth surged after the COVID-19 pandemic, driven by rising pet ownership and growing awareness of advanced veterinary care options.

How AI is Enhancing Veterinary Telehealth

Artificial intelligence (AI) is playing a transformative role in veterinary telehealth:

-

Error Reduction: AI recommends treatments and detects overlooked patterns in pet health records.

-

Data-driven Insights: It analyzes patient history, breed information, and global veterinary research for evidence-based advice.

-

Image Recognition: AI tools scan pet images to detect injuries, infections, or dental issues.

-

Faster Virtual Care: AI-powered systems help veterinarians match symptoms with possible diagnoses during online consultations.

This integration makes veterinary telehealth more efficient, accurate, and scalable.

U.S. Veterinary Telehealth Market Outlook

The U.S. veterinary telehealth market was valued at USD 92.33 million in 2024 and is projected to reach USD 599.68 million by 2034, growing at a CAGR of 20.58%.

North America leads the market due to advanced technological infrastructure, widespread smartphone use, high-speed internet penetration, and growing reliance on telemedicine platforms. The veterinary workforce shortage further boosts the need for digital healthcare solutions.

Regional Insights

-

North America: Largest market in 2024 with strong technological infrastructure and rising demand for digital healthcare.

-

Asia-Pacific: Expected to grow at the fastest CAGR, fueled by rising awareness among pet owners and livestock farmers, especially in rural areas where veterinary access is limited.

-

Europe: Growing adoption of pet telehealth platforms, supported by regulatory developments.

-

Latin America & the Middle East & Africa: Emerging markets with growing opportunities for online veterinary consultations and tele-pharmacy services.

Market Dynamics

Drivers

-

Increasing adoption of telehealth technologies such as mobile apps, video consultations, and high-speed internet.

-

Rising global pet ownership and growing perception of pets as family members.

-

Convenience and cost savings for pet owners seeking timely veterinary advice.

Restraints

-

Regulatory barriers and state licensing requirements for veterinarians limit cross-border telehealth services.

-

Reimbursement challenges in veterinary telemedicine reduce adoption in certain regions.

Opportunities

-

Rising use of AI and IoT for real-time pet monitoring and predictive diagnostics.

-

Growing demand for virtual veterinary consultations in emerging economies.

Segment Insights

By Type

-

Teleconsulting (Largest in 2024): Provides remote consultations via video, phone, or chat.

-

Teleradiology (Fastest Growing): Increasing demand for advanced imaging services such as X-rays, CT scans, and MRIs.

By Animal Type

-

Canine (Largest in 2024): Dogs face chronic health conditions like diabetes, obesity, and arthritis.

-

Feline (Fastest Growing): Telehealth reduces stress for cats, enabling early diagnosis of subtle symptoms.

By Delivery Mode

-

Cloud/App-Based (Largest): Affordable subscription-based platforms dominate the market.

-

On-Premises: Limited but still used by large veterinary hospitals.

By End-Use

-

Patients (Largest in 2024): Pet owners increasingly rely on remote consultations.

-

Providers (Fastest Growth): Veterinary professionals are adopting digital platforms to expand their service reach.

Veterinary Telehealth Market Growth Factors

-

Increasing pet ownership and demand for convenient healthcare access.

-

Cost-effective virtual consultations for minor illnesses and chronic care.

-

Expansion of pet insurance coverage supporting telehealth adoption.

-

Strong R&D in telemedicine software and AI-powered veterinary platforms.

Competitive Landscape

Key players in the veterinary telehealth market include:

-

AirVet

-

PetCoach

-

WhiskerDocs LLC

-

Vetster

-

TeleVet

-

FirstVet

-

Petriage

-

VetCT

-

VetRad

-

Pets at Home Group Plc

-

Activ4Pets

-

VitusVet

-

BabelBark

-

Chewy Inc.

-

Vetlive

-

GuardianVets

Recent Developments

-

May 2024: Walmart+ announced a partnership with Pawp to provide telehealth services to pet-owning members.

-

Nov 2024: Walmart expanded its pet services centers in Georgia and Arizona, offering veterinary telehealth and medication delivery.

Market Scope

| Report Coverage | Details |

|---|---|

| Market Size (2024) | USD 306.75 Million |

| Market Size (2025) | USD 369.17 Million |

| Market Size (2034) | USD 1,955.44 Million |

| CAGR (2025–2034) | 20.35% |

| Leading Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025–2034 |

| Segments Covered | Type, Animal Type, Delivery Mode, End-use, Region |

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Veterinary Telehealth Market Size to Hit USD 1,955.44 Mn by 2034 - September 1, 2025

- Oral Vaccine Market Size to Hit USD 9.62 Billion by 2034 - September 1, 2025

- Rifaximin Market Size to Hit USD 5.09 Billion by 2034 - August 29, 2025