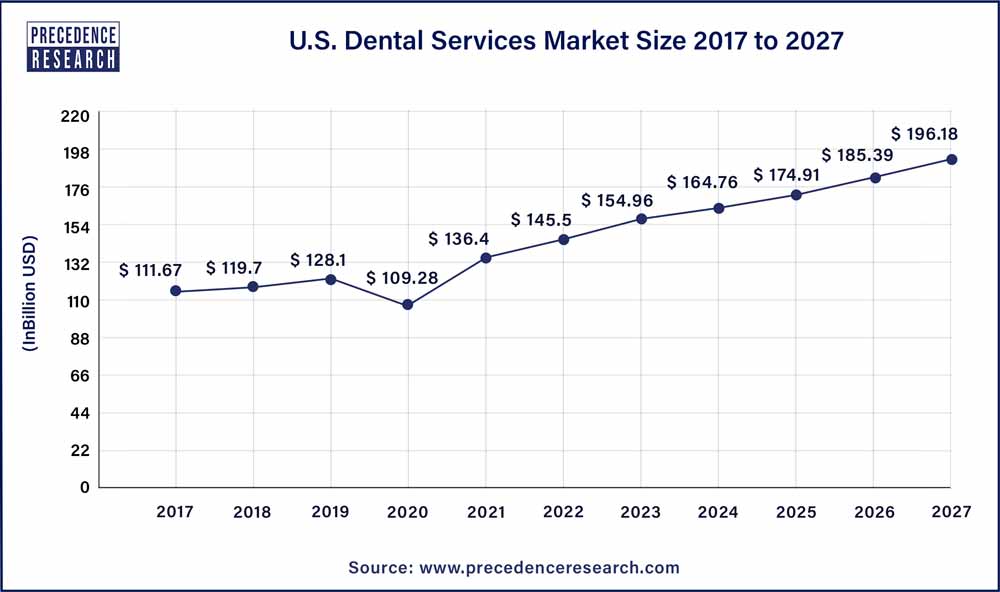

The US dental services market size is expected to reach over USD 196.18 billion by 2027, growing at a CAGR of 6.24% between 2021 and 2027.

COVID-19 impact

The pandemic of COVID-19 has had a significant influence on the healthcare system, especially the dental business. Many dental practices shuttered except for emergencies in March and April when the epidemic first spread across the United States. Changes were obvious even after they reopened. According to an American Dental Association survey of dentists conducted the week of Aug. 10, 98.9% were open, but only 47.6% reported “business as normal,” while 51.3% were open but had “lower patient volume than typical.”

Get report sample copy for more understanding@ https://www.precedenceresearch.com/sample/1425

When compared to the same months the year before, dental services were used 75% less in March 2020 and 79% less in April 2020, demonstrating the impact of the COVID-19 pandemic. Many states adopted COVID-19-related limitations on elective dental operations during these months. Dental care consumption decreased by 27% in May 2020, when many jurisdictions reversed these bans, compared to May 2019. In June 2020, compared to June 2019, there was a 1% rise in use.

In March and April 2020, all states had a drop in dental care utilization when compared to the same months in 2019. The Northeast and Midwest had the five biggest drops. In March, the West experienced the smallest declines, followed by the West and South in April. Vermont (82.5%), Iowa (81.2%), Wisconsin (81%), Minnesota (80.7%), and Maine (80.7%) had the five highest declines in March (80%). Idaho (64%), Utah (65.1%), Montana (66.1%), Wyoming (66.4%), and Arizona (64%) saw the smallest drops (67.7%).

Many states saw an increase in dental care consumption in June 2020 compared to the previous June, while others saw a drop. Massachusetts (23.9%), South Dakota (19%), Vermont (18.9%), Wisconsin (17.9%), and Maine (17.9%) saw the highest drops in the Northeast and Midwest (13.5%). Alaska (28.3%), Utah (26.6%), Hawaii (25.3%), Kentucky (22.7%), and Montana (22.7%) saw the highest increases (20.7%).

Some dental operations declined in the rankings of common procedures from March and April 2019 to March and April 2020, while others gained. A full oral evaluation for a new or established patient, for example, has dropped from eighth or ninth position to tenth or twelfth place among the most common dental operations. A problem-focused, limited oral examination, which can be used as an emergency examination, climbed from 11th place in March and April 2019 to fifth place in March and fourth place in April 2020. As a result, a higher percentage of patients than usual were visiting the dentist for specific urgent or emergent difficulties rather than cleanings and regular or routine appointments.

The amount of a rebound in dental procedures in June 2020 compared to June 2019 varied. All age groups improved above their June 2019 levels for a problem-focused, limited oral evaluation. No age group recovered to the previous year’s utilization level for a thorough oral evaluation for a new or established patient.

During the pandemic, the 10 most prevalent dental-related diagnoses seen in urgent care centers and emergency rooms in the US did not vary significantly, but there were some shifts. In particular, from January to April 2020, dental caries (tooth decay or cavities) increased from fifth to fourth position among the dental-related diagnoses seen in urgent care centers and emergency rooms.

Hospital spending growth reverses while hospital prices accelerate

In recent years, hospital spending has grown in lockstep with overall healthcare spending patterns. For example, between 2016 and 2019, hospital spending increased at a rate of 4.8% each year, slightly higher than the overall NHE growth rate of 4.6%. However, in 2019, these rates diverged, with hospital spending increasing by 6.2% year over year, owing to increased use and intensity as well as higher pricing. In recent years, commercial costs, for instance, have gotten further away from Medicare.

In March and April 2020, hospital spending plummeted by 35.8%, owing to the reduction of non-essential services like elective procedures. The financial impact has been enormous because these treatments are among the most profitable in hospitals. Reduced admissions for acute medical problems, such as heart attacks and strokes, have also been seen, most likely due to changes in patient behavior. This is unlikely to be due to congestion, as significant reductions in non-COVID-19 admissions were observed even at hospitals with few COVID-19 patients.

Although admissions are still around 5% below normal as of early November, and emergency department volume is considerably lower than baseline, hospital spending began to increase in May when discretionary care resumed. Given accumulating evidence that patient behavior has changed and that alternatives to admissions (such as home-based care with remote monitoring) may be acceptable for some patients, a new and lower baseline for hospitalizations may emerge in the future.

After 2016, the hospital price increase has outpaced total healthcare price growth, but the difference has grown since the epidemic began. Over the last six months, the average year-over-year hospital price rise has been 3.4%; if this pattern continues, annual price growth for 2020 will be 3.1%, up from 2.0% in 2019. Consolidation has been a major driver of hospital pricing growth in recent years, and financial instability caused by COVID-19 may hasten the pace of mergers.

Hospitals may also be under more pressure to raise prices to compensate for lower volume. There are major opposing influences, though. Over the last decade, increased pricing transparency has prompted calls for a public option at the state and federal levels, as well as government action requiring more price disclosure, attempts at federal legislation to address surprise billing, and a more strengthened employer movement.

Report Scope of the U.S. Dental Services Market

| Report Coverage | Details |

| Market Size in 2022 | USD 145.5 Billion |

| Market Size by 2027 | USD 196.18 Billion |

| Growth Rate from 2021 to 2027 | CAGR of 6.24% |

| Base Year | 2021 |

| Forecast Period | 2021 to 2027 |

| Segments Covered | Services, Application |

Service Type

As of 2020, the endodontic procedures segment accounted for the largest chunk of the US dental service market share. There have been considerable advancements in technology, materials, and endodontic treatment processes over the last two decades. Microscopy, rotating Ni-Ti files, ultrasonic, increased irrigation solutions and technologies, digital radiography, CBCT three-dimensional imaging, bioceramics, and other technologies are among them. On teeth with sophisticated anatomy and morphology, these alterations have generated a gap in the quality of care provided by specialist vs a regular dentist. The deteriorating dental health among Americans is expected to drive the growth of this segment.

Application Type

Preventive dental service segment accounted for the largest share of the US dental service industry. The demand for preventive dental services such as teeth cleaning and fluoride treatments was substantially high due to consumer awareness. However, COVID-19 has resulted in the closure of dental practices and a reduction in their hours of operation, except emergency and urgent treatments, limiting routine care and preventive. Nonetheless, the pandemic presents a chance for the dentistry profession to transition away from surgical procedures and toward nonaerosolizing, prevention-focused methods to care. If regulatory barriers to oral health care access were removed during the pandemic, it could have a positive impact in the future.

Read Also: Home Diagnostics Market Size to Hit USD 9.87 Billion by 2032

Competitive landscape

Heartland Dental, Aspen Dental, Pacific Dental Services, and Smile Brands are the leading playersin the US dental services market as of 2020. These companies have been focusing on expansions and partnerships over the past few years.

Competitive Landscape Analysis

- Smile Brands Inc.

- Aspen Dental

- InterDent (Gentle Dental)

- Coast Dental

- Pacific Dental Services

- Heartland Dental

- Affordable Care

- Great Expressions Dental Centers

- Western Dental

- Dental Care Alliance

Market Segmentation

By Services

- Cosmetic Dentistry

- Endodontic Procedures

- Periodontal Dentistry

- Orthodontic and Periodontic Services

- Diagnostic and Preventive Services

- Oral and Maxillofacial Surgery

By Application

- Preventive

- Corrective

- Therapeutic

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Orthopedic Implants Market Size, Share, Share, Report 2032 - April 25, 2024

- Advanced Drug Delivery Market Size, Trends, Report By 2032 - April 25, 2024

- Artificial Intelligence (AI) In Drug Discovery Market Size Report by 2032 - April 25, 2024