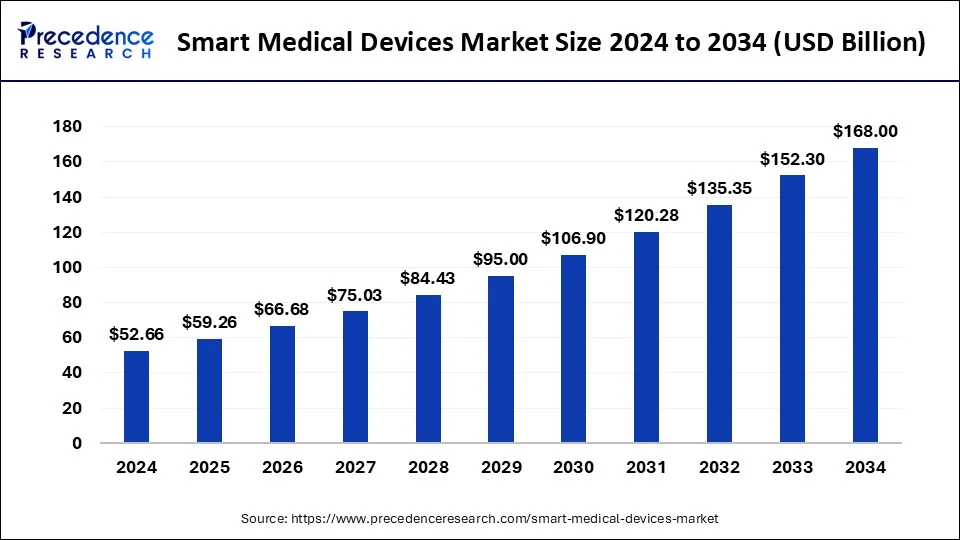

The global smart medical devices market size was valued at USD 52.66 billion in 2024 and is projected to increase from USD 59.26 billion in 2025 to approximately USD 168 billion by 2034, expanding at a CAGR of 12.30% during the forecast period. The rapid integration of advanced technologies, including artificial intelligence (AI), Internet of Things (IoT), and machine learning (ML), is driving the expansion of the market.

Market Overview

Smart medical devices are advanced tools equipped with AI, IoT, and data analytics capabilities that enable real-time monitoring, diagnosis, and treatment of patients. These devices fall into two primary categories:

-

Automated Health Management Devices: Provide real-time health insights to physicians.

-

Informational Devices: Collect and display patient data for informed healthcare decisions.

The rising prevalence of chronic diseases, increasing demand for remote monitoring, and surging healthcare expenditures are accelerating the adoption of smart medical devices globally.

Read Also: Orthodontics Market

Smart Medical Devices Market Key Takeaways

-

The global smart medical devices market was valued at USD 52.66 billion in 2024.

-

It is expected to reach USD 168 billion by 2034.

-

The market is projected to grow at a CAGR of 12.30% from 2025 to 2034.

-

North America dominated the market with a 41.6% share in 2024.

-

Asia Pacific is expected to record the fastest growth during the forecast period.

-

By product, the diagnostics and monitoring segment held the largest share (87% in 2024).

-

By end-use, the home care settings segment recorded the highest growth in 2024.

U.S. Smart Medical Devices Market Size and Growth 2025 to 2034

The U.S. smart medical devices market size was valued at USD 17.53 billion in 2024 and is anticipated to surpass USD 56.33 billion by 2034, growing at a CAGR of 12.38% between 2025 and 2034.

North America maintained the leading position in 2024, primarily driven by

-

Early adoption of advanced medical technologies.

-

High healthcare investments in the U.S. and Canada.

-

Presence of leading manufacturers and investors in smart medical devices.

-

Increasing demand due to the growing geriatric population and prevalence of chronic diseases.

Smart Medical Devices Market Share, By Region, 2024 (%)

-

North America: Largest share (41.6%) with sustainable long-term growth.

-

Asia Pacific: Fastest-growing region, supported by rising chronic disease cases, aging population, and healthcare technology adoption.

-

Europe: Strong growth fueled by IoT-enabled medical devices, wearable technologies, and stringent regulatory standards.

-

Latin America & MEA: Emerging opportunities due to healthcare infrastructure development and rising awareness of digital health solutions.

Smart Medical Devices Market Growth Factors

-

The growing prevalence of chronic diseases among the elderly, such as diabetes, cardiovascular disorders, and asthma, is driving demand.

-

Rising healthcare spending and awareness due to improving disposable incomes.

-

Real-time health monitoring and diagnosis capabilities enhance treatment efficiency.

-

Rapid technological advancements in IoT-enabled and AI-driven medical devices.

-

Government initiatives and policies supporting digital healthcare transformation.

Market Scope

| Report Coverage | Details |

|---|---|

| Global Market Size in 2024 | USD 52.66 Billion |

| Market Size in 2025 | USD 59.26 Billion |

| Market Size by 2034 | USD 168 Billion |

| CAGR (2025–2034) | 12.30% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025–2034 |

| Segments Covered | Product, Modality, End-User, Distribution Channel, Region |

Market Dynamics

Driver – Increasing Demand for Efficient Healthcare Operations

The need for real-time monitoring of chronic conditions has boosted the demand for smart medical devices, including wearable trackers, portable monitors, and IoT-enabled diagnostic tools. These devices enhance patient engagement, reduce hospital visits, and provide healthcare professionals with actionable insights.

Restraint – Lack of Proper Infrastructure

In underdeveloped regions, insufficient healthcare infrastructure, limited skilled professionals, and low adoption of advanced devices act as significant restraints.

Opportunity – Innovations in Medical Devices

Emerging technologies such as medical robots, AI-driven diagnostics, immersive healthcare solutions, and 5G-enabled IoT devices present new growth avenues. Increasing R&D investments and strategic collaborations are further unlocking opportunities for innovation.

Segmentation Insights

By Modality

-

Portable Devices: Largest segment, driven by demand for home-based monitoring.

-

Wearable Devices: Fastest-growing segment, supported by rising fitness awareness and personalized healthcare.

By Product

-

Diagnostics & Monitoring Devices: Largest market share in 2024, especially blood glucose monitors, fueled by rising global diabetes prevalence.

-

Therapeutic Devices: Includes insulin pumps, hearing aids, and portable ventilators.

By Distribution Channel

-

Pharmacies: Largest share, offering easy access to diagnostic and monitoring devices.

-

Online Platforms: Fastest-growing channel due to rising e-commerce penetration.

By End-User

-

Hospitals: Significant share due to regulated adoption of certified devices.

-

Homecare Settings: Fastest-growing, driven by geriatric care needs and telehealth adoption.

Smart Medical Devices Market Companies

- Abbott

- Apple, Inc

- Fitbit, Inc.

- Dexcom, Inc

- F. Hoffmann-La Roche Ltd

- Zephyr

- Sonova, NeuroMetrix, Inc.

- Medtronic

- Johnson & Johnson.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Smart Medical Devices Market Size to Sore USD 168 Bn by 2034 - September 17, 2025

- Orthodontics Market Size to Reach USD 65.13 Billion by 2034 - September 17, 2025

- Gynecological Devices Market Size to Hit USD 23.22 Billion by 2034 - September 17, 2025