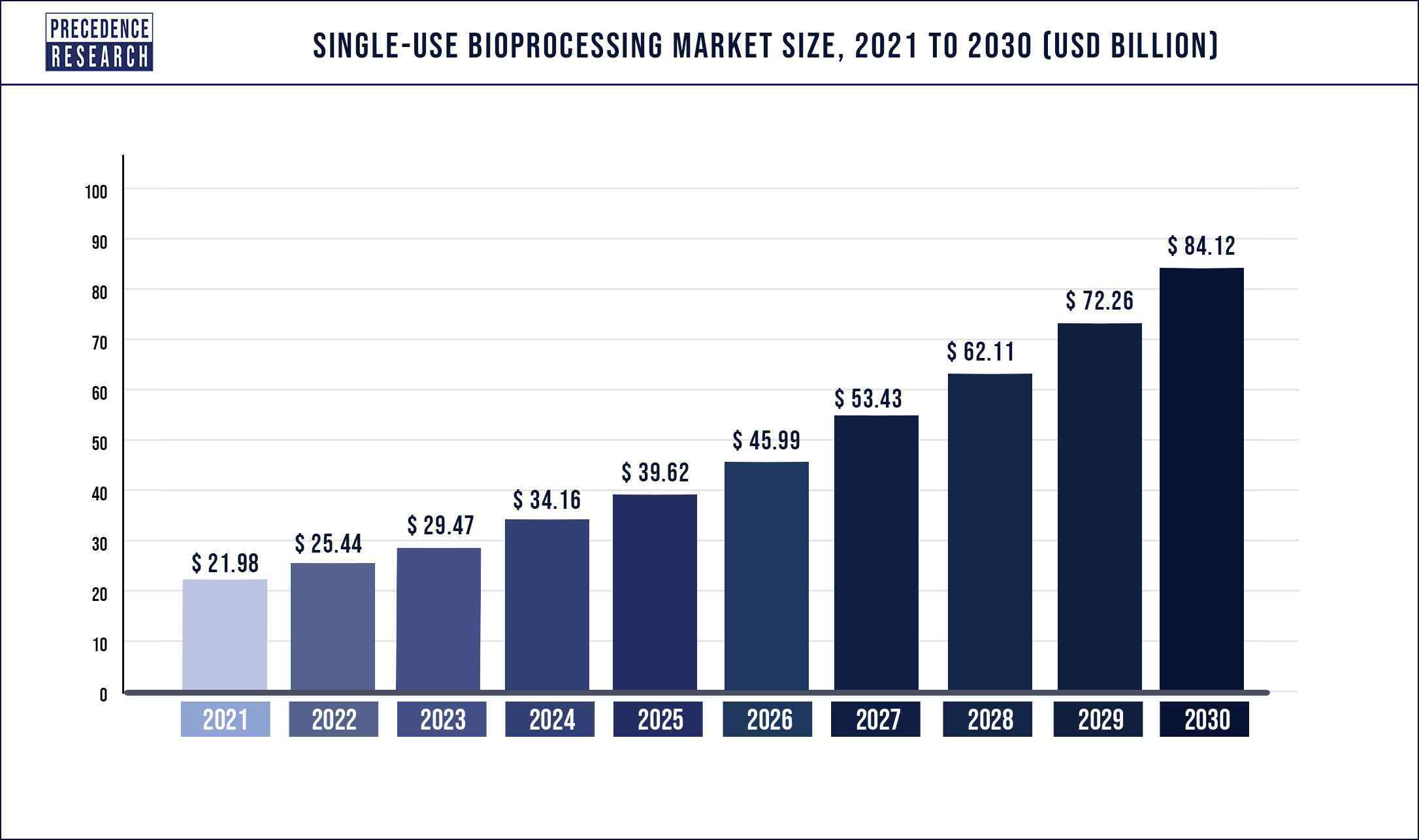

The global single-use bioprocessing market size was surpassed at USD 25.44 billion in 2022 and is projected to reach USD 84.12 billion by 2030 with a CAGR of 16.1% from 2023 to 2030.

Key Points

- North America has captured revenue share of 34.5% in 2022.

- Asia Pacific region is anticipated to grow at CAGR of 16.5% over the forecast period 2023 to 2030.

- By Product, the simple & peripheral elements segment has accounted 49.4% revenue share in 2022.

- By Workflow, the upstream bioprocessing segment recorded revenue share of 57.8% in 2022.

- By End-use, the biopharmaceutical manufacturers segment has held larghest revenue share of around 58.5% in 2022.

- Academic & clinical research institutes segfment are expected to reach at a 16.37% of CAGR from 2023-2030.

Single-use bioprocessing systems are known for developing pharmaceuticals such as medicines, vaccines, and monoclonal antibodies by using disposable or single-use technologies. The use of single-use bioprocessing technologies during the development phase of drugs has witnessed exponential growth in the past few years. The single-use bioprocessing technologies are being used increasingly by the contract manufacturers in biopharmaceutical industry for acquiring the benefits such as low investment, low environmental footprint, and reliability. This is one of the primary factors propelling the growth of the global single-use bioprocessing market.

Get Report Sample Copy of this Report@ https://www.precedenceresearch.com/sample/1308

The growing geriatric population is boosting the market growth significantly. The growing prevalence of chronic conditions and diseases amongst the old age population is boosting the demand for the biopharmaceutical medicines. According to the United Nations, the old age population of 65 years or above will reach up to 1.5 billion by 2050. This is estimated to foster the single-use bioprocessing market in the future. Moreover, increasing investments in the development of numerous vaccines, drugs, and diagnostic tests is positively impacting the market growth.

Crucial factors accountable for market growth are:

- Rapid growth of the biopharmaceutical industry

- Growing government investments in the development of vaccines and drugs

- Rapid technological developments by the key players

- Rising government expenditure on developing healthcare infrastructure

- Increasing activities of the contract development manufacturing organizations

- Growing popularity of disposables in the biopharmaceuticals

Regional Snapshots

North America is the leading single-use bioprocessing market owing to the increased spending on healthcare, technological development in bioprocessing, and growing importance of life science research. Growing adoption of disposable systems and increased energy efficiency coupled with the minimal risk of product cross-contamination are the beneficial factors associated with the use of single-use bioprocessing products. Further, the introduction of automation, big data technology, and artificial intelligence in the single-use system has been gaining rapid traction in North America. These latest technologies in the manufacturing units are expected to boost production and helps the manufacturers to achieve cost-efficiency and reduce wastages.The presence of a large number of big and small contract manufacturing organizations in the region are increasingly using the single-use bioprocessing technology due to its low cost and improved output. The increased economic activity of these contract manufacturers will significantly drive the growth of the single-use bioprocessing market in North America.

Asia Pacific is characterized by growing production of biosimilars, cell therapy, vaccines, and various other types of biopharmaceutical products. Moreover, China is the second largest biopharmaceutical market just after the US. China’s economic policies to attract FDIs for setting up manufacturing plants for biopharmaceutical products is exponentially fostering the demand for single-use bioprocessing technology. Moreover, nations like India, Japan, and South Korea have been a leading player in the Asia Pacific region. Biocon of India and Samsung Biologics of South Korea have earned FDA and European Medicines Agency approval respectively, for their new biosimilar products in 2017. Therefore, the single-use bioprocessing market has huge growth potential in the Asia Pacific region.

Report Highlights

- By product, the media bags and containers segment led the global single-use bioprocessing market with remarkable revenue share in 2020. This is due to the benefits associated with the media bags and containers such as low capital requirement, saving of cost in sterilization and cleaning, operating scale flexibility, quick batch changeover and quick deployment, and cleaning validation elimination.

- By application, the filtration segment led the global single-use bioprocessing market with remarkable revenue share in 2020. This is attributed to the increasing adoption of single-use bioprocessing system in filtration owing to its flexibility. It is applicable in a wide variety of biopharmaceutical applications depending on the type of solutions used and is very much effective in eliminating viruses and other such cultures.

- By End User, the biopharmaceutical manufacturer segment led the market in 2020 as rapid growth of biopharmaceuticals industry. Biopharmaceutical industry alone represents over 20% of the total pharmaceutical industry and is rapidly growing across the markets like North America and Europe.

Report Scope of the Single Use Bioprocessing Market

| Report Coverage | Details |

| Market Size | USD 84.12 Billion by 2030 |

| Growth Rate | CAGR of 16.1% From 2023 to 2030 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2030 |

| Segments Covered | Product, End User, Application, Workflow, Region |

Market Dynamics

Drivers – The single-use bioprocessing market is significantly driven by the growing demand from the biopharmaceutical industry. Majority of the biopharmaceutical companies are increasingly adopting the single-use bioprocessing technology because the single-use bioprocessing systems increases the efficiency in the process and reduces the costs associated with sterilization, cleaning, and maintenance of steel bioreactors. This drives the higher adoption of disposable bioprocessing systems in the biopharmaceutical industry.

Restraints – The Bio-Process System Alliance has published a set of tests to be performed regarding the extractable and leachable contamination. The leachable and extractable are the unwanted products produced by the single-use bioprocessing system. The disposable bioprocessing system are made of plastic and often faces contamination issues. This may hamper the single-use bioprocessing market growth.

Opportunities – The emerging markets such as China and India have a high growth potential. The growing investments by the major players, growing geriatric population, and rapidly growing biotechnology in the industry is providing lucrative growth opportunities to the single-use bioprocessing market players.

Challenges – The plastic wastes generated by the disposable bioprocessing system is a major challenge faced by the market players due to the growing environmental concerns and government regulation regarding plastic wastes.

Read Also: Scar Treatment Market Size To Attain USD 64.26 Bn By 2032

Recent Developments

- In December 2020, Thermo Fisher Scientific launched a single-use bioreactor for manufacturing cell culture.

- In March 2020, GE Healthcare’s Biopharma business was acquired by Danaher Corporation and now Biopharma is renamed as Cytiva.

Some of the prominent players in the single-use bioprocessing market include:

- Thermo Fisher Scientific, Inc.

- Sartorius AG

- Merck KGaA

- Pall Corporation

- Corning Incorporated

- Eppendorf AG

- General Electric Company (GE Healthcare)

- Lonza

- Rentschler Biopharma SE

- JM BioConnect

- Meissner Filtration Products, Inc.

- Infors AG

- BoehringerIngelheim GmbH

- Entegris, Inc.

- PBS Biotech, Inc.

Segments Covered in the Report

By Product

- Filtration Assemblies

- Disposable Bioreactors

- Disposable Mixers

- Media Bags & Containers

- Others

By Application

- Filtration

- Purification

- Cell Culture

- Others

By End User

- Biopharmaceutical Manufacturers

- Clinical & Academic Research Institutes

- Others

By Workflow

- Upstream

- Fermentation

- Downstream

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

- Orthopedic Implants Market Size, Share, Share, Report 2032 - April 25, 2024

- Advanced Drug Delivery Market Size, Trends, Report By 2032 - April 25, 2024

- Artificial Intelligence (AI) In Drug Discovery Market Size Report by 2032 - April 25, 2024