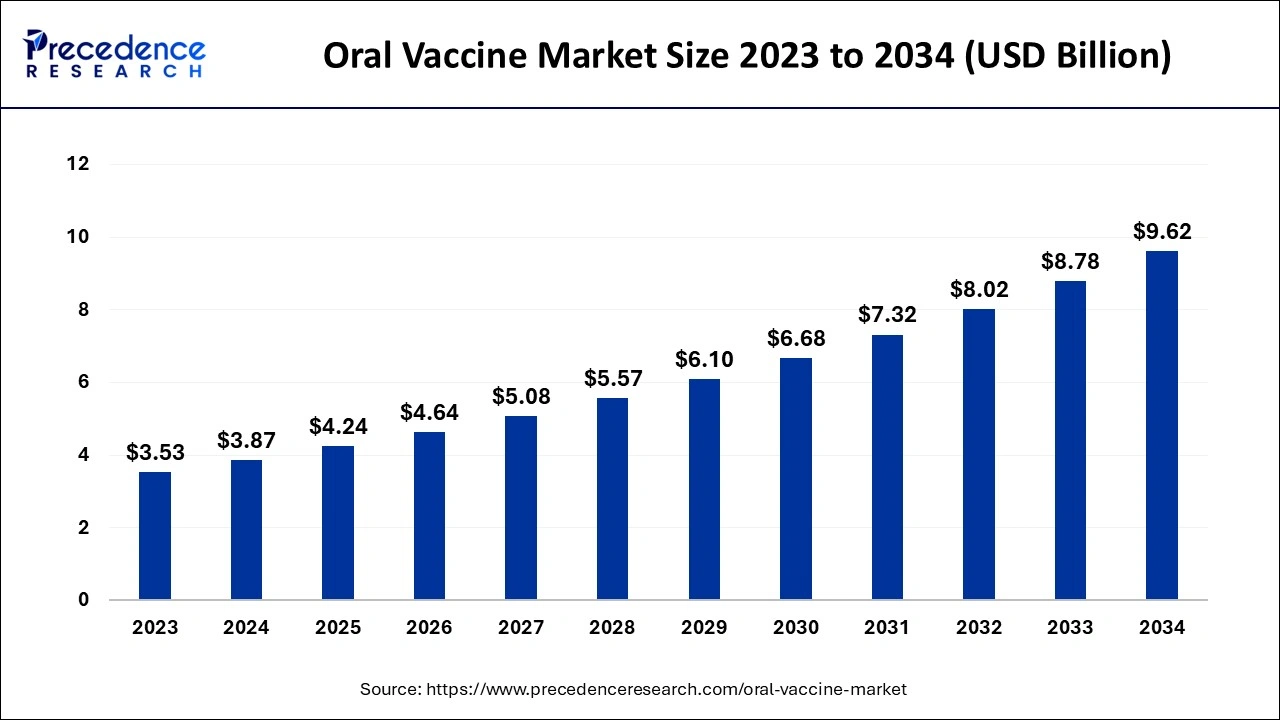

The global oral vaccine market size was valued at USD 3.87 billion in 2024 and is projected to surpass USD 9.62 billion by 2034, growing at a CAGR of 9.53% from 2025 to 2034. The market growth is fueled by the rising demand for safer, more affordable, and easier-to-administer vaccines compared to injectable vaccines.

Oral Vaccine Market Key Takeaways

-

Valued at USD 3.87 billion in 2024, projected to reach USD 9.62 billion by 2034

-

Expected CAGR of 9.53% from 2025 to 2034

-

North America led the market in 2024

-

Europe anticipated to record the fastest growth through 2034

-

Live attenuated vaccines segment dominated in 2024

-

Inactivated vaccines expected to grow at a significant CAGR

-

By application, infectious diseases held the largest share in 2024

-

Cancer vaccines projected to expand at the highest CAGR

-

Hospitals accounted for the highest distribution share in 2024

-

Clinics expected to grow significantly during the forecast period

-

Pediatric end-user segment dominated in 2024

-

Adult segment anticipated to grow at the fastest CAGR

Market Overview

Oral vaccines are increasingly preferred as they are non-invasive, safe, cost-effective, and easy to administer. Unlike injectable vaccines, oral formulations do not require medical personnel, making them highly suitable for mass immunization programs, especially in developing regions.

-

Polio (Polio Sabin)

-

Cholera (Dukoral, Vaxchora)

-

Rotavirus (RotaTeq, Rotarix)

-

Typhoid fever (Vivotif)

In 2024, a major campaign in Guinea vaccinated over 3.2 million children with oral vaccines, showcasing their scalability in large immunization drives.

How Artificial Intelligence (AI) is Transforming the Oral Vaccine Market

Artifical intelligence is reshaping vaccine development and distribution. During the COVID-19 pandemic, AI-based tools accelerated vaccine design and trials, enabling the creation of mRNA vaccines within a year. Techniques such as deep learning algorithms (e.g., Linear Design) are now being used to design next-generation oral vaccines, enhancing precision and speed.

Market Growth Factors

-

Bacillus subtilis spores: Clinical studies show significant antibody elevation with oral doses.

-

Nanoparticle-based delivery systems: Liposomes, lipid nanoparticles, and dendrimers are boosting oral vaccine stability and efficacy.

-

No adverse effects: Reduced infection risk and better safety for people with weakened immune systems.

-

User-friendly administration: Needle-free methods reduce blood-borne disease transmission and simplify vaccination logistics.

Market Dynamics

Driver – Routine Immunization

Routine immunization programs for children, adolescents, and adults are driving steady market growth. Governments and health organizations are prioritizing universal vaccination to combat infectious diseases.

Restraint – Tolerance Issues

Oral vaccines must withstand harsh gastrointestinal conditions such as acidic environments and enzymes, which limit their effectiveness. A lack of effective mucosal adjuvants is a key challenge.

Opportunity – Government and Industry Initiatives

Governments and international organizations are investing heavily in new vaccine technologies, R&D, and manufacturing hubs. Collaborative programs with WHO, UNICEF, and GAVI are strengthening global vaccine coverage.

Vaccine Type Insights

-

Live Attenuated Vaccines – Dominated the market in 2024 due to strong immune response and long-lasting protection.

-

Inactivated Vaccines – Expected to grow significantly, with higher safety and lower reactogenicity but requiring multiple doses.

Application Insights

-

Infectious Diseases – Largest market share in 2024 due to high demand for preventive vaccination.

-

Cancer – Projected to grow at the fastest CAGR, with oral cancer vaccines emerging as innovative treatment methods.

Distribution Insights

-

Hospitals – Accounted for the largest market share in 2024 due to structured immunization programs.

-

Clinics – Expected to expand rapidly as they ensure vaccine availability and patient monitoring.

End-User Insights

-

Pediatrics – Largest share in 2024, supported by mandatory vaccination programs for children.

-

Adults – Fastest-growing segment, as booster vaccines and preventive care gain traction.

Regional Insights

-

North America – Largest market in 2024, supported by FDA approvals, strong healthcare infrastructure, and high R&D investments.

-

Europe – Forecast to be the fastest-growing market due to strong vaccination awareness campaigns and government initiatives.

-

Asia-Pacific, Latin America, Middle East & Africa – Emerging as promising markets driven by expanding immunization programs and government support.

Key Players in the Oral Vaccine Market

-

Takeda Pharmaceuticals

-

Soligenix

-

Liquidia Technologies

-

Oravax Medical

-

Bharat Biotech

-

Matinas Biopharma

-

ACM Biolabs

-

Prokarium Ltd

Recent Developments

-

Aug 2024 – Bharat Biotech launched Hillchol (BBV131), a new oral cholera vaccine.

-

Dec 2024 – WHO, UNICEF, and GAVI launched a mass oral cholera vaccination campaign covering 3.8 million people.

-

Dec 2024 – Sanofi announced progress in developing a combined flu and COVID-19 vaccine.

-

Nov 2024 – GSK reaffirmed commitment to innovative meningococcal vaccines in Europe.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Veterinary Telehealth Market Size to Hit USD 1,955.44 Mn by 2034 - September 1, 2025

- Oral Vaccine Market Size to Hit USD 9.62 Billion by 2034 - September 1, 2025

- Rifaximin Market Size to Hit USD 5.09 Billion by 2034 - August 29, 2025