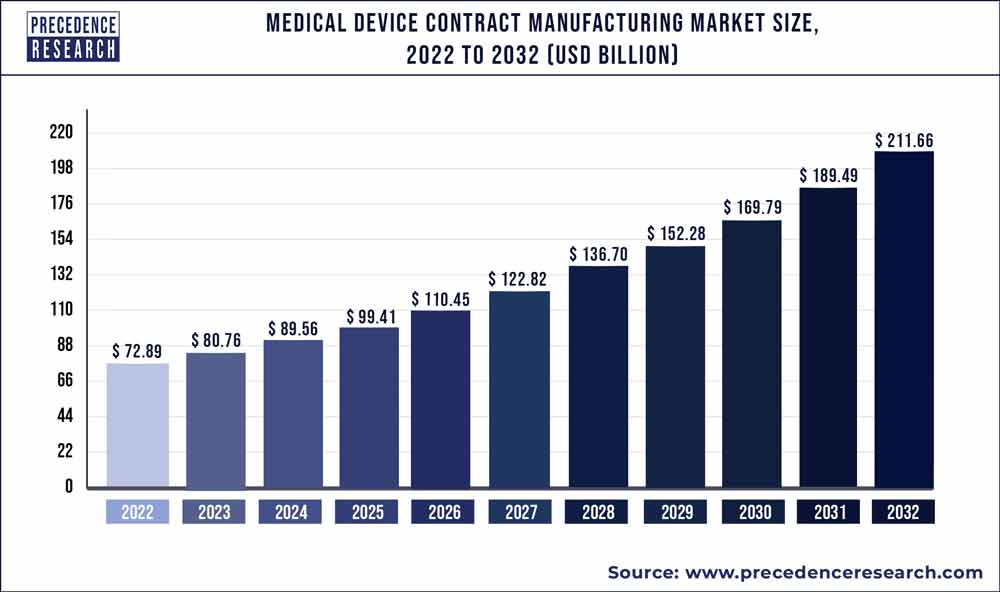

The global medical device contract manufacturing market size reached USD 72.89 billion in 2022 and is projected to hit USD 211.66 billion by 2032, with a CAGR of 11.3% from 2023 to 2032.

Key Points

- North America leads the market share in 2022.

- By Device Type, the IVD devices segment has held the largest market share in 2022.

- By Service, the device development and manufacturing services segment generated over 54% of revenue share in 2022.

- By Application, the orthopedic segment had the largest market share in 2022.

- By Application, the orthopedic segment is expected to expand at a CAGR of 12.9% over the projected period.

The global medical device contract manufacturing market is driven by advancements in healthcare, medical, and biomedical technology, as well as the increasing expansion and development of skilled and technologically superior healthcare infrastructure and medical facilities.

The increased global demand for efficient and technologically advanced medical equipment, as well as rising demand for complex and affordable medical devices is some of the key factors driving the growth of the global medical device contract manufacturing market. The rising prevalence of chronic disorders and the growing elderly population are propelling the market for medical device contract manufacturing forward.

Get the sample copy of report@ https://www.precedenceresearch.com/sample/1051

About Market

Contract manufacturing allows an organization to exploit a specialist in one or more fields of design and production without needing significant capital investments. Design, engineering, component production, assembly or even full-service capabilities are among the choices that OEMs will find in the contract manufacturing partner. This helps the organization to stay focused on core competencies and strategic planning.

As medical devices OEMs are more likely to follow these standards, specialized companies familiar with the tight regulatory environment will continue to grow. Price, time on the market, project experience and cost controls are just a few of the many reasons OEMs choose a service partner.

Regional Snapshot

Asia-Pacific is the fastest growing region for global medical device contract manufacturing market in terms of region. The increased demand for innovative and effective medical equipment, as well as rising healthcare spending, rising medical needs of the ageing population, and a steady increase in the number of surgical cases, are driving the medical device contract manufacturing market in the U.S.

North America region accounted largest revenue share in the 2020. This could be attributable to an increase in the number of elderly people in Asia-Pacific countries. Due to high levels of unhealthy eating and drinking habits, the U.S. is a significant consumer of medical equipment and so has the greatest market share by consumption.

Ask here for customization study@ https://www.precedenceresearch.com/customization/1051

Key Players

Some of the major players noticed and covered in the medical device contract manufacturing market report are Flex, Ltd., Integer Holdings Corporation, Gerresheimer AG, Sanmina Corporation, Nipro Corporation, Celestica International Lp., Plexus Corp., Benchmark Electronics Inc., and West Pharmaceutical Services, Inc.

Medical Device Contract Manufacturing Market Scope

| Report Highlights | Details |

| Market Size by 2032 | USD 211.66 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 11.3% |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Device Type, Service Type, Application Type, Region Type |

Market Dynamics

Drivers

Rising prevalence of chronic disorders

Several disorders, such as genetic, cardiovascular, and neurological ailments, are becoming more common. The cardiovascular diseases are the leading cause of the death worldwide, according to the World Health Organization (WHO), with an estimated 17.9 million deaths each year. This has resulted in a greater public awareness of early diagnosis and an increase in routine diagnosis, both of which support the medical device contract manufacturing market’s overall growth. Furthermore, the medical device contract manufacturing market’s strong growth is being aided by the launch of novel advanced in-vitro diagnostics (IVD) products. As a result, the rising prevalence of chronic disorders is driving the growth of the global medical device contract manufacturing market.

Restraints

High cost of medical devices

The medical devices have seen considerable advancements and innovations in the last decade, including the adoption of new products and design changes, among other things. However, the high cost of medical devices, as well as the high cost of equipment maintenance, limits the medical device contract manufacturing market expansion to a greater extent. Additionally, the operation of medical devices necessitates the use of trained personnel. As a result, the medical device’s maintenance costs will rise, stifling the medical device contract manufacturing market’s overall growth during the forecast period.

Opportunities

Growth in Industry 4.0 technologies

The advanced automation is enabled by Industry 4.0 technologies, such as machine-to-machine connectivity and cloud computing, which help to overcome the production issues of medical devices. These technologies’ data gathering capabilities and improved connectivity is enabling the smooth manufacturing processes of medical services. Several governments are encouraging key market players to include 4.0 into their manufacturing processes in order to accelerate the development of technologically superior medical products. Thus, the growth in Industry 4.0 technologies is creating lucrative opportunities for the growth of the medical device contract manufacturing market.

Challenges

Budgetary constraints of hospitals

Several healthcare providers have aligned themselves with integrated health networks, group buying organizations, and integrated delivery networks in response to increased government pressure to reduce healthcare costs. These groups pool their members’ purchasing power and negotiate with medical equipment suppliers and manufacturers for a low price. For mass purchasing of medical devices, integrated health networks, group buying organizations, and integrated delivery networks engage in extensive negotiations. As a result, the budgetary constraints of hospitals are a huge challenge for the growth of the medical device contract manufacturing market during the forecast period.

Read Also: Point-of-Care Diagnostics Market Size To Hit USD 74.5 Bn by 2033

Report Highlights

- Based on device type, the IVD segment is expected to grow at a rapid pace during the forecast period, and it currently holds the greatest market share. This is attributed to improved awareness among women and quick technological improvements in IVD testing devices, which have now been made simple to use and increasingly available to the general public.

- Based on service, the device development and manufacturing is the largest segment, and it is predicted to increase at a faster rate than the other segments. This rapid expansion can be attributed to increased incentive-based systems implemented by governments around the world, which have resulted in an increase in expenditure on healthcare infrastructure.

COVID -19 Impacts:-

Manufacturing outsourcing has drastically changed in recent years, with a surge of consolidation between OEMs and contract manufacturing organizations (CMOs) a shift that is particularly important now that companies are struggling to meet the urgent demand for life-saving ventilators required to support coronavirus victims.

Some of the noteworthy players in the global medical device contract manufacturing market include:

- Flex, Ltd.

- Nortech Systems, Inc.

- Sanmina Corporation

- Nipro Corporation

- Jabil Inc.

- Nemera Development S.A.

- TE Connectivity Ltd.

- Kimball Electronics, Inc.

- Viant Medical

- Celestica International Lp.

- Plexus Corp.

- SMC Ltd.

- Phillips-Medisize Corporation

- Benchmark Electronics Inc.

- Integer Holdings Corporation

- Gerresheimer AG

- Consort Medical PLC

- Tessy Plastics Corp

- Tecomet, Inc.

Segments Covered in the Report

This research report includes complete assessment of the market with the help of extensive qualitative and quantitative insights, and projections regarding the market. This report offers breakdown of market into prospective and niche sectors. Further, this research study calculates market revenue and its growth trend at global, regional, and country from 2023 to 2032. This report includes market segmentation and its revenue estimation by classifying it depending on device, service, application and region as follows:

By Device Type

- IVD Devices

- Drug Delivery Devices

- Diagnostic Imaging Devices

- Patient Monitoring Devices

- Therapeutic Patient Assistive Devices

- Minimally Access Surgical Instruments

- Others

By Service

- Device Development and Manufacturing Services

- Quality Management Services

- Final Goods Assembly Services

By Application

- Laparoscopy

- Pulmonary

- Urology & Gynecology

- Cardiovascular

- Orthopedic

- Oncology

- Neurovascular

- Radiology

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Esoteric Testing Market Size to Hit USD 75.54 Bn by 2032 - July 17, 2024

- mRNA Therapeutics Market Size to Surpass USD 39.99 Bn By 2033 - July 17, 2024

- Acne Treatment Market Size to Hit USD 15.86 Bn by 2033 - July 17, 2024