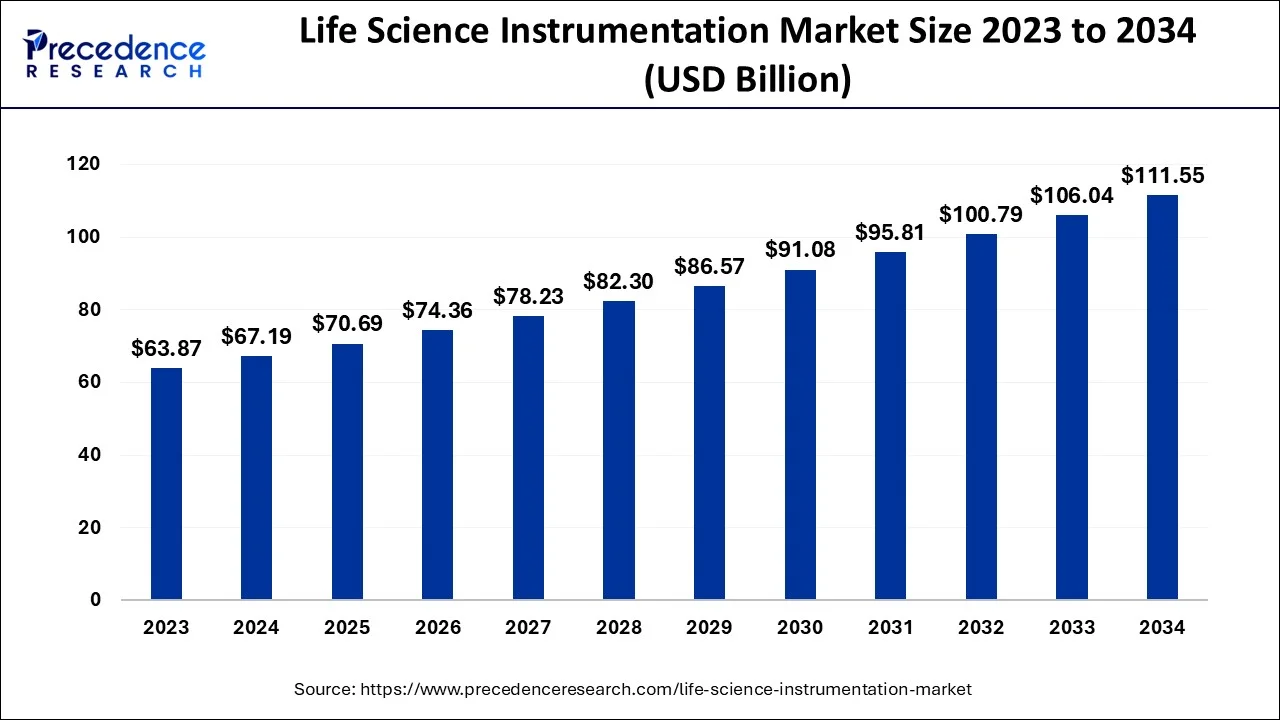

The global life science instrumentation market is witnessing steady growth, driven by increasing demand for analytical technologies in research, diagnostics, drug discovery, and clinical applications. The market size accounted for USD 67.19 billion in 2024 and is projected to reach USD 111.55 billion by 2034, growing at a CAGR of 5.20% over the forecast period.

Read Also: Biopharmaceutical Third Party Logistics Market

Market Overview

Life science instrumentation encompasses a wide range of tools and technologies used in:

-

Drug discovery and development

-

Clinical and diagnostic applications

-

Research in genomics, proteomics, and metabolomics

-

Environmental, agricultural, and food testing

These instruments are increasingly integrated with AI and machine learning to enhance accuracy, productivity, and efficiency. AI-powered tools enable:

-

Rapid analysis of large biological datasets

-

Prediction of molecule behavior and therapeutic targets

-

Repetitive task automation in imaging and sequencing

-

Improved personalized medicine through patient-specific predictions

Such innovations reduce time-to-market for new products and enhance research productivity.

Market Size and Regional Insights

-

Global Market (2024): USD 67.19 billion

-

Forecast (2034): USD 111.55 billion

-

Revenue Projection (2032): USD 100.79 billion

-

CAGR (2024–2034): 5.20%

Regional Highlights

-

North America: Dominates the market due to a mature life science ecosystem, strong pharmaceutical and biotech presence, and extensive R&D investments.

-

Asia-Pacific: Fastest-growing region, fueled by expanding pharmaceutical industries in China and India, strategic market expansions, and rising adoption of advanced instruments.

-

Europe, Latin America, MEA: Moderate growth driven by technological advancements and increased government and private-sector investments in life science research.

Market Drivers

-

Rising R&D Activities: Growth in biotechnology, pharmaceuticals, and diagnostics fuels the demand for analytical instruments.

-

Next-Generation Sequencing (NGS): Increased focus on genomics and personalized medicine drives adoption of high-throughput sequencing technologies.

-

Chronic Disease Prevalence: Rising cases of cancer, infectious diseases, and genetic disorders accelerate the need for advanced diagnostic and analytical tools.

-

Public and Private Investments: Funding for life sciences research and technological innovations supports market growth.

-

Product Innovation: Frequent launches of advanced instruments enhance accuracy and efficiency in research and diagnostics.

Market Restraints

-

High Costs of Instruments: Maintenance and operational expenses may limit adoption in smaller labs or emerging regions.

-

Skill Shortages: Limited availability of trained professionals, particularly in forensic and advanced molecular analysis, may slow adoption.

Technology Insights

-

Spectroscopy: Led the market in 2024 due to its crucial role in molecular analysis across clinical, diagnostic, and research applications.

-

Next-Generation Sequencing (NGS): Fastest-growing segment, enabling high-throughput DNA sequencing for genomics, personalized medicine, and drug discovery.

-

Other Technologies: Flow cytometry, microscopy, electrophoresis, lab automation, and liquid handling systems continue to support broad life science applications.

Application Insights

-

Clinical and Diagnostic Applications: Dominant segment driven by rising chronic diseases, personalized medicine adoption, and demand for faster, more accurate diagnostics.

-

Drug Discovery and Development: Fastest-growing segment due to AI, machine learning, and high-throughput technologies accelerating drug R&D.

-

Research Applications: Include genomics, proteomics, metabolomics, and cell biology, which benefit from advancements in instrumentation and analytics.

End-User Insights

-

Pharmaceutical & Biotechnology Companies: Lead the market due to extensive R&D investment and diverse applications of instruments.

-

Contract Research Organizations (CROs): Fastest-growing segment due to outsourcing of complex trials and growing demand for specialized expertise.

-

Clinical Labs, Hospitals, and Academic Institutions: Increasingly adopting advanced instrumentation for research and diagnostics.

-

Food & Beverage, Environmental, and Agricultural Labs: Expanding applications further drive market growth.

Key Market Players

-

Thermo Fisher Scientific

-

Illumina

-

Bruker Corporation

-

Eppendorf AG

-

Hitachi High Technologies Corporation

-

Becton Dickinson and Company

-

Bio-Rad Laboratories Inc.

-

Waters Corporation

-

Agilent Technologies

-

Shimadzu Corporation

-

Qiagen N.V.

Recent Developments

-

March 2025: Beckman Coulter Life Sciences launched CytoFLEX mosaic Spectral Detection Module, the first modular spectral flow cytometry solution.

-

March 2025: Diasorin introduced Simplexa™ C. auris Direct kit, enhancing rapid detection of Candida auris in CE mark countries.

Market Segmentation

By Technology / Instrument Type:

-

Spectroscopy (UV-Vis, MS, NMR, IR/NIR, Fluorescence, Raman)

-

Chromatography (LC, HPLC, UHPLC, GC, Ion, TLC)

-

PCR & NGS (Whole genome, targeted, RNA sequencing)

-

Flow Cytometry & Microscopy (Optical, Electron, Confocal, AFM)

-

Electrophoresis, Centrifuges, Lab Automation, Thermal Cyclers

By Application:

-

Clinical & Diagnostic Applications

-

Research Applications (Genomics, Proteomics, Metabolomics)

-

Drug Discovery & Development

-

Quality Control & Manufacturing

-

Forensic, Environmental, and Food & Agricultural Testing

By End-User:

-

Pharma & Biotech Companies

-

Clinical Labs & Hospitals

-

Academic & Research Institutions

-

CROs

-

Food & Beverage, Environmental, and Industrial Labs

By Geography:

-

North America (U.S., Canada)

-

Europe (U.K., Germany, France)

-

Asia-Pacific (China, India, Japan, South Korea)

-

Middle East & Africa

-

Latin America

Conclusion

The life science instrumentation market is projected to grow steadily through 2034, driven by rising demand for advanced diagnostics, drug discovery, and research applications. Innovations such as NGS, AI-driven analytics, and automated lab solutions are reshaping the landscape, while growing chronic disease prevalence and increased public-private investments further support market expansion. Despite high costs, ongoing technological breakthroughs and rising R&D activities ensure the market remains highly promising for global players and emerging companies alike.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Life Science Instrumentation Market Size to Reach USD 111.55 Bn by 2034 - October 7, 2025

- Biopharmaceutical Third Party Logistics Market Size Surpass USD 271.76 Billion by 2034 - October 7, 2025

- Cleanroom Technology Market Size to Reach USD 7.85 Bn By 2034 - October 6, 2025