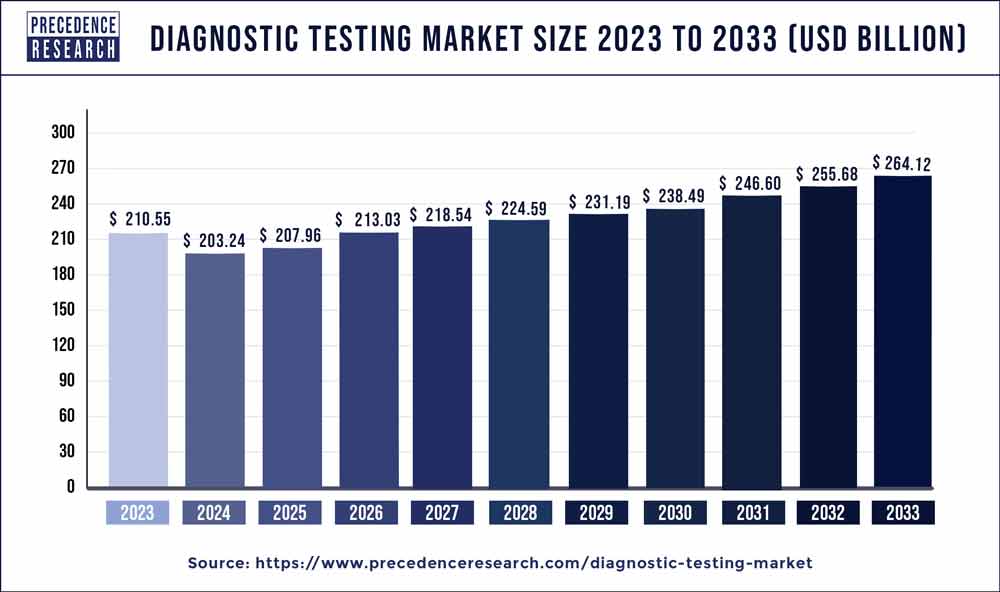

The global diagnostic testing market size reached USD 210.55 billion in 2023 and is projected to hit around USD 264.12 billion by 2033, registering a CAGR of 3% from 2024 to 2033.

In the realm of biomedical research, diagnostic tests are regarded as a useful tool for the early diagnosis of disease. Additionally, they aid in distinguishing between cancer in adults and cancer in children. In order to increase the rate of early detection and diagnosis of the disease that is preventable at an early stage among chronic and non-chronic disease as well, diagnostic tests are used in basic cancer research and drug development. This leads to the adoption of new therapies, patient specific therapies, and personalised medicine.

Get the Free Sample Copy of Report@ https://www.precedenceresearch.com/sample/1984

Increased prevalence of chronic disease, an increase in IVD tests worldwide, adequate reimbursement policies, an improvement in diagnosis seeking rates worldwide, and an expansion of molecular diagnostics are all contributing to the growth of the diagnostic tests market. However, factors such as high kit costs, a lack of relevant and appropriate kits, and a shortage of skilled laboratory personnel may restrain the market’s expansion during the period of forecasting.

Due to rising public awareness and actions taken by the government and other authorities in this area, the diagnostic testing market has seen extraordinary penetration in developed economies in North America.

Regional Snapshots

In 2021, North America had the highest revenue share (more than 40%). This can be ascribed to the population’s rising health consciousness on the advantages of these tests and the region’s thriving healthcare business. Due to the fast-rising COVID-19 cases and the existence of important players in the U.S. and Canada, the area will continue its leading position throughout the projection years. For instance, bioLytical Laboratories Inc., a Canadian company, gained CE certification for the iStatis COVID-19 Antigen Home Test in March 2022. The business will be able to reach the European market thanks to this.

From 2024 to 2033, the Asia Pacific market is anticipated to develop at the quickest rate among all regions. A growing number of regional producers of diagnostic kits and reagents are anticipated to propel the point-of-care market in the Asia Pacific, providing a variety of testing options for the detection of coronavirus infection. In order to increase COVID-19 testing, the nations are continually expanding their capabilities. For example, the Malaysian Ministry of Health approved the use of antigen quick testing kits shipped from South Korea in April 2020 to expand the nation’s COVID-19 testing to a daily capacity of 16,500 tests.

Report highlights

- The advent of several illnesses and infections is expected to cause the size of the worldwide market to increase to USD 339,893 million by 2033. The market for diagnostic tests is expanding at an accelerated rate due to an increase in investment.

- Hematology is predicted to lead the market on the basis of testing type because the majority of diagnoses tests use blood to find and identify disorders.

- Due to the fact that most diagnostic tests are carried out on elderly patients, the geriatric sector is predicted to dominate the market. As they are more susceptible to infectious, chronic, and non-chronic illnesses, elderly patients need frequent monitoring and diagnosis. North America now dominates the diagnostic test market as a result of the region’s growing geriatric population base.

Diagnostic Testing Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 210.55 Billion |

| Market Size by 2033 | USD 264.12 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 3% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Application, Approach, Solution, Technology, Mode of Testing, Sample Type, Testing Type, Age, Distribution Channel, End User, Geography |

Diagnostic Testing Market Dynamics

Drivers

Growing prevalence of chronic diseases, significant R&D spending, and advancements in diagnostics systems boosting market growth for diagnostics. According to the Non-communicable Illnesses Key Facts report released by the World Health Organization (WHO) in April 2021, chronic diseases are responsible for around 41 million deaths year, or 71% of all fatalities globally. The need for healthcare systems is growing as a result of the rise in chronic illnesses. Thus, clinical diagnostics have demonstrated value in the management of chronic disease conditions as well as in the prevention, identification, and detection of disease.

Growth is partly attributable to the expanding use of clinical diagnostics, which is a result of the boost in testing brought on by the epidemic. Over the course of the study period, the market growth is anticipated to be boosted by the development of automated clinical diagnostics systems for laboratories and hospitals to give quick, accurate, and error-free diagnosis. The market is expanding due to the increasing number of clinical diagnostics products being introduced by major companies. Clinical diagnostic tools with molecular diagnostic capability produce reliable findings.

Due to the rising prevalence of infectious and chronic illnesses as well as the rising use of automated platforms, the market is predicted to expand. Government financing and the increasing number of tests due to the steady increase in patients are the two factors that are anticipated to increase demand for COVID-19 test kits and propel the market’s overall expansion significantly.

The growth of the market has been significantly influenced by the rising demand for point-of-care clinical diagnostics devices and the growing use of these devices. This is further supported by key businesses investing more money in research and development to create new products and examine novel uses for clinical diagnostics methods.

Restraints

In the last ten years, there have been considerable improvements and innovations in clinical diagnostic products, including the adoption of new products and further design changes. However, the high price of clinical diagnostics equipment and the high cost of instrument upkeep have in some ways limited the market’s expansion. Furthermore, trained people are needed to operate clinical diagnostics equipment. As a result, the maintenance cost of the gadget rises, which eventually slows market expansion.

Opportunities

Furthermore, the market participants would have lucrative prospects due to the expansion of healthcare decentralisation from 2024 to 2033. The market will also grow as a result of an increase in investments and funds for product development.

Challenges

On the other side, it is anticipated that pricing pressure brought on by reimbursement reductions, budgetary restraints, and strict regulatory rules would hinder market expansion. Additionally, insufficient adoption of Point of Care devices in professional settings and a lack of agreement with clear central lab methodologies are anticipated to provide challenges to the diagnostic tests market during the forecast period of 2024–2033.

Read Also: Image-guided Therapy Systems Market Size to Hit USD 9.53 Bn by 2032

Key Market Developments

- In January 2021, Roche introduced its Cobas Pulse System in a few nations that accepted the CE Mark. The item is a networked point-of-care solution from Roche Diagnostics’ most recent generation. The most recent release provides expert blood glucose management.

- In September 2021, Ortho Clinical Diagnostics announced that Immediate Spin Crossmatch (ISXM), a tool for identifying recipient and donor incompatibility in blood transfusions, will be made available on the company’s Ortho Vision and Ortho Vision Max Analyzers.

Diagnostic Testing Market Players

- F-Hoffman La-Rcohe Ltd. (Switzerland)

- Danaher (US)

- BD (US)

- Thermo Fisher Scientific Inc. (US)

- ACON Laboratories Inc. (US)

- Hemosure, Inc. (US)

- MicroGen Diagnostics (US)

- Grifols, S.A (Spain)

- BODITECH MED INC. (South Korea)

- Chembio Diagnostic Systems, Inc. (US)

- Nanoentek (South Korea)

- DiaSorin S.p.A. (Italy)

- Bio-Rad Laboratories, Inc. (US)

- BIOMEDOMICS INC (US)

- EKF Diagnostics Holdings plc (UK)

- Siemens Healthcare GmbH (Germany)

- PerkinElmer Inc. (US)

- bioMérieux SA (France)

- ARKRAY USA, Inc. (US)

- Biohit Oyj (Finland)

- Quidel Corporation (US)

- Illumina, Inc. (US)

- Lamdagen Corporation (US)

- LifeSign LLC. (US)

- Medixbiochemica (Finaland)

- Nova Biomedical (US)

- Ortho Clinical Diagnostics (US)

- Sannuo Biosensing Co., Ltd. (US)

- STRECK (US)

- Sysmex Corporation (Japan)

Segments covered in the report

By Type

- Clinical Diagnostic

- Home Diagnostic

By Application

- Cardiology

- Oncology

- Neurology

- Orthopedics

- Gastroenterology

- Gynecology

- Odontology

- Others

By Approach

- Molecular Diagnostic Instrument

- In-Vitro Diagnostic Instrument

- Point Of Care Testing Instrument

By Solution

- Services

- Products

By Technology

- Immunoassay-Based

- PCR-Based

- Next-generation Sequencing

- Spectroscopy-Based

- Chromatography-Based

- Microfluidics

- Substrate Technology

- Others

By Mode of Testing

- Prescription Based Testing

- OTC Testing

By Sample Type

- Urine

- Saliva

- Blood

- Hair

- Sweat

- Others

By Testing Type

- Biochemistry

- Hematology

- Microbiology

- Histopathology

- Others

By Age

- Pediatric

- Adult & Geriatric

By Distribution Channel

- Direct Tenders

- Retail Sales

- Online Sales

By End User

- Hospitals, Diagnostic Center

- Research Labs and Institutes

- Research Institute

- Homecare

- Blood Banks

- Specialty Clinics

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Esoteric Testing Market Size to Hit USD 75.54 Bn by 2032 - July 17, 2024

- mRNA Therapeutics Market Size to Surpass USD 39.99 Bn By 2033 - July 17, 2024

- Acne Treatment Market Size to Hit USD 15.86 Bn by 2033 - July 17, 2024