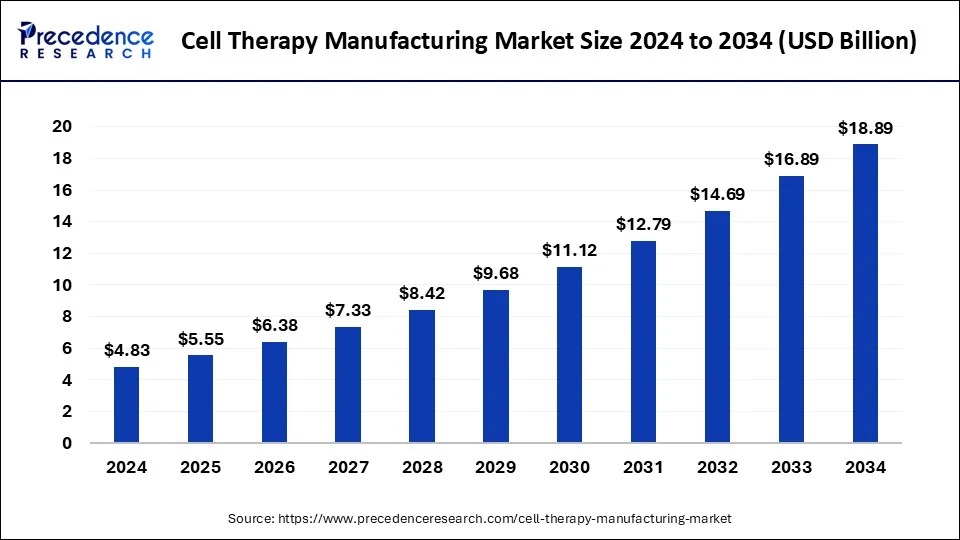

The global cell therapy manufacturing market size is expected to grow from USD 5.55 billion in 2025 to USD 18.89 billion by 2034, expanding at a CAGR of 14.61%. Explore growth drivers, trends, AI integration, and regional insights.

Market Overview

The global cell therapy manufacturing market was valued at USD 4.83 billion in 2024 and is projected to reach USD 18.89 billion by 2034, growing at a CAGR of 14.61% during 2025–2034.

Rising incidence of cancer, autoimmune disorders, and degenerative diseases, coupled with technological advancements in biotechnology and gene editing, are driving market expansion. Cell therapies such as CAR-T, stem cell therapy, and regenerative treatments are transforming healthcare by offering curative potential where conventional treatments often fail.

Key Takeaways

-

Market size in 2024: USD 4.83 billion

-

Market size by 2034: USD 18.89 billion

-

CAGR: 14.61% (2025–2034)

-

North America held the largest share (44%) in 2024.

-

Asia-Pacific is set to be the fastest-growing region.

-

By therapy type, Autologous therapies led with a 59% share in 2024, while allogeneic therapies are projected to grow fastest.

-

By technology, Somatic cell technology dominated, while 3D technology is expected to witness the highest growth.

-

By application, Oncology contributed a 35% share, while neurology is forecasted to expand at the fastest rate.

Growth Drivers

-

Expanding Clinical Success: Increasing approvals and late-stage trials of CAR-T and other therapies validate the potential of cell-based treatments.

-

Technological Advancements: Automation, closed-system production, and AI-powered monitoring reduce errors and enable large-scale manufacturing.

-

R&D Investments: Public and private funding, alongside clinical collaborations, are boosting global adoption.

-

Regulatory Support: Agencies like the FDA and EMA are offering fast-track approvals and clear regulatory pathways for cell therapies.

Market Restraints

-

Complex Manufacturing Processes: Cell therapies demand high precision, making scalability challenging.

-

High Costs & Compliance Burden: Regulatory requirements vary across regions, increasing production delays and costs.

-

Skilled Workforce Shortage: The need for highly specialized expertise slows down capacity expansion.

Market Opportunities

-

Allogeneic Therapies: “Off-the-shelf” treatments using donor cells can dramatically reduce costs and expand accessibility.

-

AI & Digital Twins: Predictive analytics, automation, and simulation models improve efficiency, reduce batch failures, and speed up commercialization.

-

Emerging Markets in Asia-Pacific: Governments and private players in India, China, Japan, and South Korea are heavily investing in manufacturing infrastructure.

Role of AI in Cell Therapy Manufacturing

Artificial intelligence is revolutionizing the market by:

-

Monitoring and predicting cell culture growth conditions.

-

Reducing batch failures with real-time quality control.

-

Supporting automation to minimize human error.

-

Forecasting raw material and supply chain needs.

-

Accelerating research-to-commercialization timelines.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 14.61% |

| Market Size in 2024 | USD 4.83 Billion |

| Market Size in 2025 | USD 5.55 Billion |

| Market Size by 2034 | USD 18.89 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Therapy Type, Technology Type, Source, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Regional Insights

North America

-

Largest market share (44% in 2024).

-

The U.S. market was worth USD 1.49 billion in 2024 and is projected to reach USD 5.87 billion by 2034.

-

Growth driven by the presence of leading biotech firms, contract manufacturers, and advanced R&D facilities.

Asia-Pacific

-

Fastest-growing region.

-

Driven by government initiatives, clinical trial expansion, and CAR-T therapy developments.

-

Example: In April 2024, India launched its first indigenous CAR-T therapy, marking a milestone in cancer treatment.

Europe

-

Strong emphasis on regenerative medicine and collaborations with academic institutions.

-

A supportive regulatory landscape is enabling clinical trial acceleration.

Segment Insights

-

By Therapy Type: Autologous therapies dominate, while allogeneic therapies offer the biggest future potential.

-

By Technology: Somatic cell technology leads, but 3D technologies (biomaterial scaffolds, growth factor delivery systems) are set to revolutionize regenerative applications.

-

By Source: iPSCs lead the market, followed by bone marrow-derived therapies.

-

By Application: Oncology dominates; neurology is emerging as the fastest-growing application area.

-

By End User: Pharma & biotech firms dominate today, while academic & research institutes are expected to grow fastest.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Epinephrine Market Size to Reach USD 6.87 Billion by 2034 - September 26, 2025

- Healthcare ERP Market Size to Reach USD 12.71 Billion by 2034 - September 26, 2025

- Cell Therapy Manufacturing Market Size to Reach USD 18.89 Billion by 2034 - September 25, 2025