Get the Sample Pages of Report@ https://www.precedenceresearch.com/sample/1646

The rising adoption of the biosimulation services and software among the biosimilar companies, pharmaceutical companies, and regulatory authorities has significantly fueled the growth of the global biosimulation market. There are very high chances of failure of the new developed drugs during the each phase of drug development and clinical trials. The adoption of the biosimulation can help to reduce the risks of failure and hence significantly reduce the costs of drug discovery and development. The rising investments towards the adoption of the digital technologies in the pharmaceutical sector are expected to be one of the most important drivers of the global biosimulation market.

Report Highlights

- Based on the product, the software segment dominated the market, constituting a revenue share of over 66% in 2021. The increased adoption of the biosimulation software among the pharmaceutical companies, contract research organizations, and regulatory authorities has significantly augmented the growth of the software segment across the globe. The rising investments towards the drug discovery and development by the pharmaceutical companies are expected to further fuel the demand for the software in the global biosimulation market.

- On the basis of application, the drug discovery is anticipated to be the most opportunistic segment during the forecast period. The growing demand for the biosimulation software and services in the pharmacogenomics and pharmacogenetics is projected to propel the growth of the drug discovery segment in the upcoming future.

- Based on the end user, the pharmaceutical & biotechnology segment accounted for more than 51% of the market share and led the global biosimulation market in 2021. The increased prevalence of various chronic diseases and genetic diseases has fostered the demand for the new drugs. The biopharmaceutical manufacturers are constantly engaged in the research and development process for the discovery of innovative drugs, which has fostered the adoption of the biosimulation in the pharmaceutical industry.

Regional Snapshot

North America led the global biosimulation market and constituted a revenue share of over 45% in 2020. The favorable government policies in US and the increased healthcare expenditure owing to the increased prevalence of chronic diseases are the prominent factors that has encouraged the drug discover, drug development, and research activities in the region. The majority of property rights for the newly developed drugs belongs to US. The presence of several top pharmaceutical companies has significantly fostered the demand for the biosimulation in North America.

Asia Pacific is anticipated to register a significant growth rate during the forecast period. Asia Pacific is the home several top and well-known research organizations. The presence of few top pharmaceutical companies in South Korea, China, and India are expected to present a lucrative growth opportunity for the key players operating in the biosimulation market. The favorable government policies and availability of cheap factors of production is attracting huge FDIs from the top biopharmaceutical players across the globe. The increasing investments in the research, drug discovery, and clinical trials in Asia Pacific region is expect6ed to drive the demand for the biosimulation in the forthcoming years.

Report Scope of the Biosimulation Market

| Report Coverage | Details |

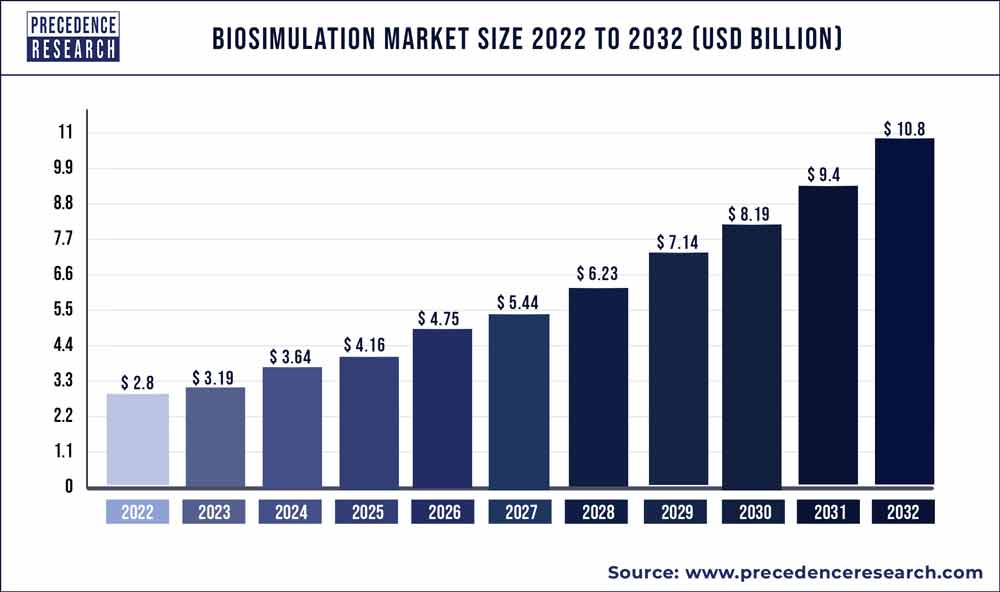

| Market Size by 2032 | USD 10.80 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 14.4% |

| Packaging Segment Market Share in 2022 | 46% |

| Software Segment Makret Share in 2022 | 66% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Product, Application, End User, Delivery Model, Geography |

Biosimulation Market Dynamics

Driver

Rapid growth in the biopharmaceutical industry

The biopharmaceutical industry accounts for about 20% of the pharmaceutical industry. The rising popularity of the biosimilar and biologic drugs among the consumers across the globe is fueling the investments in the research and development of new drugs. The regulatory authorities like FDA and EMA are contributing towards the growth of the biopharmaceutical industry. The rising focus towards the development of new drugs by the biopharmaceutical companies is expected to augment the demand for the biosimulation software and services significantly.

Restraint

Lack of standardization is a major restraint

There is a lack of standardization regarding the use of biosimulation technology in the drug discovery and drug development. Biosimulation uses different type of models and tools for registering and processing various biological processes in the drug discovery. The higher complexities associated with the use of biosimulation results in a difficulty for the researchers to manage, edit, and share data and models. Therefore, the need for standardization is high for the efficient and consistent results. The lack of standardization by the regulatory authorities is a major restraining factor for the growth of the biosimulation market.

Opportunity

Growing applications of biosimulation

The biosimulation is finding its place in various end use applications such as industrial bio-processing, agriculture, defense, and nutraceuticals, which is expected to present huge growth opportunities to the market players in the foreseeable future. For instance, in April 2017, Certara entered into a partnership with the Australian Department of Defense to conduct an audit the research and development capability of the Australia’s MCM products.

Challenge

Lack of biosimulation modelling experts

Biosimulation uses complex mathematic operations and equations in order to represent human body processes. Therefore, skilled and expert professionals are needed for the management and monitoring of the biosimulation software. The lack of such experienced and skilled professionals in the market is a major challenge that restricts the adoption of the biosimulation.

Read Also: Biologics Market Size to Hit US$ 620.31 Bn by 2032

Key Market Developments

The biosimulation market is moderately fragmented owing to the presence of several top market players. These market players are constantly involved in the various developmental strategies such as partnerships, mergers, acquisitions, collaborations, new product launches, and various others to strengthen their position and increase their market share.

- In November 2020, Certara, a prominent player in the biosimulation market, opened its office in Shanghai to boost its ties with its partners in the China biopharmaceutical industry.

- In September 2020, Advanced Chemistry Development, introduced new updates in its Spectrus and Percepta platforms. This new update aimed at improving the portfolio of the company by advancing new features like MS and NMR functionality in the chromatography line up.

- In June 2020, Certara introduced an update in its Phoenix Biosimulation software that enhanced the quality, improved time saving, and enhanced efficiency in the toxicokinetic and pharmacokinetic/pharmacodynamic modeling.

- In August 2020, Certara started developing the Quantitative Systems Pharmacology biosimulation software for the COVID-19 vaccines.

- In June 2017, Simulations Plus completed the acquisition of DILIsym Services, Inc., to expand its portfolio in consulting service and biosimulation software.

Biosimulation Market Companies

- Biovia

- Certara

- Compugen Inc.

- Genedata

- In Silico Biosciences, Inc.

- Leadscope Inc.

- Pharmaceutical Product Development, LLC.

- Schrödinger, LLC.

- Simulations Plus, Inc.

- DassaultSystemes

- Advanced Chemistry Development

Segments Covered in the Report

By Product

- Software

- Services

- Contract Services

- In-House Services

By Application

- Drug Discovery

- Lead Identification

- Lead Optimization

- Target Identification

- Target Validation

- Drug Development

- Preclinical Testing and Clinical Trials

- In Patient Validation

- Others

By End User

- Regulatory Authorities

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Academic Research Institutes

By Delivery Model

- Subscription Models

- Ownership Models

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Esoteric Testing Market Size to Hit USD 75.54 Bn by 2032 - July 17, 2024

- mRNA Therapeutics Market Size to Surpass USD 39.99 Bn By 2033 - July 17, 2024

- Acne Treatment Market Size to Hit USD 15.86 Bn by 2033 - July 17, 2024