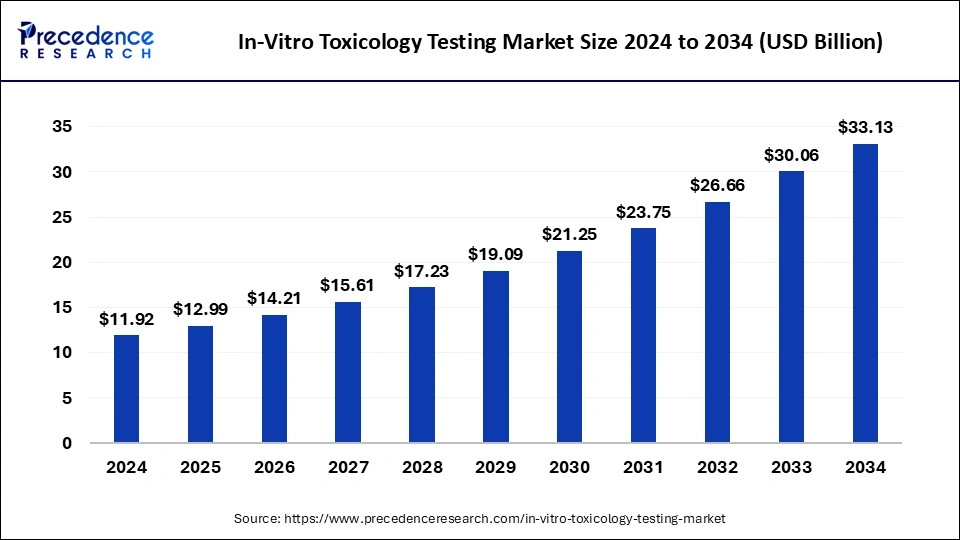

The global in-vitro toxicology testing market size was valued at USD 11.92 billion in 2024 and is projected to increase from USD 12.99 billion in 2025 to nearly USD 33.13 billion by 2034, expanding at a CAGR of 10.97% during the forecast period from 2025 to 2034.

Key Takeaways

-

North America accounted for 47.03% share in 2024, leading the global market.

-

By technology, the cell culture technology segment held 43.16% share in 2024.

-

By method, the cellular assay segment contributed 39.04% share in 2024.

-

By application, the genotoxicity segment captured 20.90% share in 2024.

Read Also: Ultra Low Temperature Freezer Market

Market Overview

In-vitro toxicology testing refers to experiments conducted outside a living organism using isolated cells, tissues, or organs. These models provide reliable toxicity data while reducing reliance on animal studies.

Key advantages

-

Cost-effective and time-efficient.

-

Higher scientific relevance to human biology.

-

Reduces attrition rates in drug discovery pipelines.

Role of Artificial Intelligence in the Market

Artificial Intelligence (AI) is reshaping in-vitro toxicology testing by

-

Enhancing predictive capabilities and efficiency.

-

Reducing false-positive rates compared to traditional models.

-

Processing massive data sets for mapping toxicological responses.

-

Supporting simulation of biological outcomes with minimal or no animal testing.

AI-driven approaches are becoming integral to faster, reliable, and ethically compliant toxicology screening.

Market Scope

| Report Coverage | Details |

|---|---|

| Market Size in 2025 | USD 12.99 Billion |

| Market Size in 2034 | USD 33.13 Billion |

| CAGR 2025–2034 | 10.97% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Years | 2025–2034 |

| Segments | Technology, Application, Method, End-user |

| Regions | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Regional Insights

North America

-

Holds the largest market share, supported by FDA & EPA regulations, major industry players, and investments in 3D cell models and toxicogenomics.

-

Strong government initiatives to reduce animal testing are propelling demand.

Europe

-

Driven by strict regulations such as REACH and Cosmetics Regulation (EC 1223/2009) banning animal testing.

-

Countries like Germany, France, and the UK lead with strong R&D investments.

-

Ethical concerns and public awareness accelerate market adoption.

Asia Pacific

-

Expected to record the fastest growth due to:

-

Expanding pharmaceutical & biotech industries.

-

Cost-effective clinical trials.

-

Rising government incentives for non-animal testing.

-

Investments in cruelty-free cosmetics and drug discovery.

-

Growth Drivers

-

Ethical Shift – Rising global awareness against animal testing.

-

Regulatory Support – OECD, FDA, and ECHA endorse in-vitro models.

-

Technological Advancements – Growth in 3D cell cultures, organ-on-chip, HTS, and omics technologies.

-

R&D Investments – Pharmaceutical sector using in-vitro testing for early-stage screening.

-

Consumer Demand – Strong demand for safer, cruelty-free products.

Product Insights

-

Consumables (reagents, cell culture media, assay plates) dominate due to frequent usage.

-

Assays are the fastest-growing product segment, supported by demand for high-content and multi-endpoint analysis.

Technology Insights

-

Cell Culture Technology leads with the largest share, enabling predictive and cost-effective testing.

-

High-throughput screening and omics technologies are expected to grow rapidly with advancements in automation and molecular testing.

Method Insights

-

Cellular assays dominate the market due to affordability, speed, and automation.

-

In-silico methods are projected to grow significantly, providing advanced computational toxicology models.

Application Insights

-

Genotoxicity remains the leading application segment due to stringent global regulatory requirements for testing genetic damage.

-

Other growing areas include cytotoxicity, carcinogenicity, neurotoxicity, and endocrine disruption testing.

In-Vitro Toxicology Testing Market Companies

-

- Charles River Laboratories International, Inc.

- SGS S.A.

- Merck KGaA

- Eurofins Scientific

- Abbott Laboratories

- Laboratory Corporation of America Holdings

- Evotec S.E.

- Thermo Fisher Scientific, Inc.

- Quest Diagnostics Incorporated

- Agilent Technolgies, Inc.

- Catalent, Inc.

- Danaher Corporation

- Bio-Rad Laboratories, Inc.

Segments Covered in the Report

By Technology

- Cell Culture Technology

- High Throughput Technology

- Cellular Imaging

- OMICS Technology

By Application

- Genotoxicity

- Cytotoxicity

- Phototoxicity

- Carcinogenicity

- Neurotoxicity

- Dermal Toxicity

- Endocrine Disruption

- Ocular Toxicity

- Others

By Method

- Cellular Assay

- Live Cells

- High Throughput / High Content Screening

- Molecular Imaging

- Others

- Fixed Cells

- Live Cells

- Biochemical Assay

- In-silico

- Ex-vivo

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Pharma 4.0 Market Size to Hit USD 81.20 Billion by 2034 - September 19, 2025

- In-Vitro Toxicology Testing Market Size to Reach USD 33.13 Billion by 2034 - September 19, 2025

- Ultra Low Temperature Freezer Market Size to Reach USD 1,721.56 Mn by 2034 - September 18, 2025