U.S. Clinical Trial Management System Market Key Insights

-

The enterprise segment emerged as the leading type in 2024, commanding the largest market share.

-

The site-based segment is projected to record the fastest growth rate over the forecast period.

-

Among delivery modes, web-based CTMS solutions dominated the market in 2024.

-

In terms of components, software held the top position in 2024.

-

The services segment is expected to witness the highest CAGR during the forecast timeline.

-

Pharmaceutical companies represented the largest end-user group in 2024.

-

Clinical research organizations (CROs) are anticipated to grow at a significant pace through 2034.

Why CTMS Is Now Essential in U.S. Clinical Research

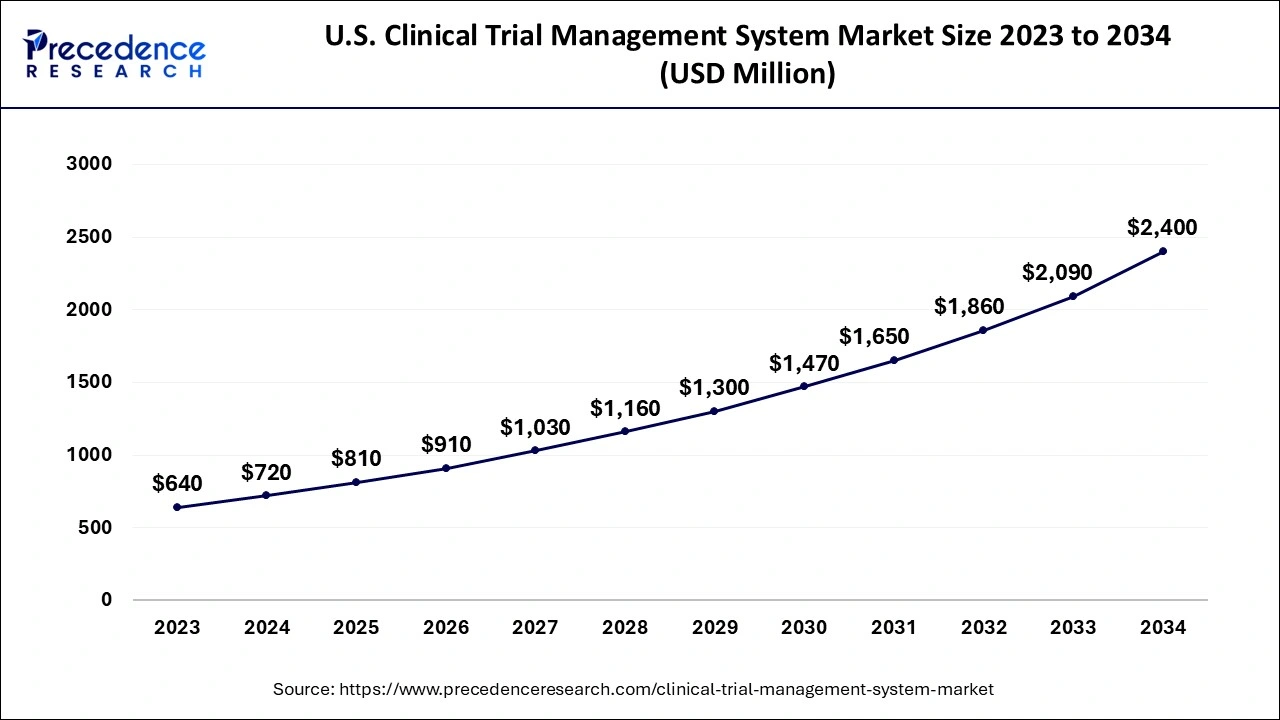

The clinical research landscape in the United States is undergoing a digital revolution, driven by increasing R&D investments, the complexity of multi-site trials, and the need for faster, data-driven decision-making. At the heart of this transformation lies the Clinical Trial Management System (CTMS)—an integrated platform that streamlines trial planning, monitoring, regulatory compliance, and stakeholder collaboration. In 2024, the U.S. CTMS market was valued at USD 720 million, and it’s projected to surge to USD 2,400 million by 2034, expanding at a CAGR of 12.79% between 2025 and 2034.

The market is gaining momentum as pharmaceutical companies, contract research organizations (CROs), and academic medical centers seek efficient, AI-powered, and cloud-based CTMS platforms to manage increasing trial complexity, address chronic disease burdens, and navigate evolving regulatory frameworks. The shift to decentralized clinical trials (DCTs) and the growing use of real-time data analytics further underscore the critical role of CTMS in modern drug development.

U.S. Clinical Trial Management System Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2,400 Million |

| Market Size in 2025 | USD 810 Million |

| Market Size in 2024 | USD 720 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.79% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Delivery Mode, Component, and End-User |

What is Driving the Growth of CTMS Adoption in the U.S.?

Several key factors are fueling the rapid adoption of CTMS platforms in the U.S. First, the digitization of clinical trials—from patient recruitment to endpoint monitoring—has created a demand for centralized systems that ensure continuity, traceability, and operational visibility. Cloud and web-based CTMS platforms provide just that, with scalable architectures that support both centralized and decentralized models.

Second, there’s an increasing need for real-time analytics to track trial milestones, safety signals, and site performance. Modern CTMS platforms offer dashboards and predictive analytics tools that enable sponsors and CROs to intervene early and optimize trial outcomes.

Third, regulatory agencies like the FDA are placing growing emphasis on data integrity and compliance, encouraging the industry to adopt validated systems that meet stringent requirements (e.g., 21 CFR Part 11). The CTMS also helps stakeholders manage patient-centric protocols, site activation timelines, and investigator compliance—all while reducing manual errors and documentation burden.

How is Artificial Intelligence Reshaping CTMS Capabilities?

Artificial Intelligence (AI) is ushering in a new era of intelligent CTMS platforms capable of driving trial success with increased precision and efficiency. For example, the Pfizer–Tempus AI collaboration leverages genomic data and predictive analytics to accelerate oncology trial enrollment, while Deep 6 AI’s deployment at Mayo Clinic demonstrates how AI can automate patient matching across real-world data sources.

-

Patient recruitment optimization, using EHR mining and predictive modeling

-

Compliance monitoring, through intelligent alert systems for protocol deviations

-

Resource planning, via AI-driven forecasting of trial timelines and costs

-

Adverse event prediction, leveraging ML on historical trial data

The FDA’s 2024 draft guidelines on AI use in clinical trials are accelerating industry confidence and adoption. These guidelines outline standards for transparency, explainability, and validation of AI tools, further embedding AI in CTMS strategy across the U.S.

Which Delivery Mode is Leading the Market and Why?

In 2024, web-based CTMS dominated the U.S. market due to its accessibility, ease of deployment, and integration with other trial systems. These platforms are ideal for managing multi-site studies, offering users secure access from anywhere, including mobile interfaces for real-time updates.

However, cloud-based CTMS is emerging rapidly as the delivery model of choice, particularly for sponsors and CROs seeking scalable, flexible, and cost-effective solutions. Cloud platforms reduce IT infrastructure costs, enable remote collaboration, and offer advanced integrations with tools for electronic data capture (EDC), eConsent, and ePRO (electronic patient-reported outcomes). The flexibility of the cloud also aligns well with decentralized trial models, where data is collected from various digital sources.

What are the Main Components and Who Uses Them Most?

In 2024, software solutions accounted for the largest revenue share in the U.S. CTMS market. Enterprise CTMS platforms offer modules for budgeting, site monitoring, protocol tracking, and regulatory submissions. The demand for highly configurable, interoperable systems that support both small-scale academic studies and large global trials continues to grow.

The services segment, while smaller, is expanding rapidly. Services such as system implementation, validation, user training, and customization are increasingly sought after, especially by smaller biotech firms and new entrants adopting CTMS for the first time.

-

Pharmaceutical companies are the leading adopters, driven by their need to manage extensive clinical pipelines and adhere to stringent regulatory requirements.

-

Contract Research Organizations (CROs) represent the fastest-growing segment, as they manage trials on behalf of multiple clients and require agile, multi-project platforms.

Which Type of CTMS is Most Preferred and Why?

The enterprise CTMS segment leads the market due to its robust capabilities in handling complex, multi-site, and global trials. These systems offer centralized management, audit readiness, and end-to-end process automation, which is critical for pharmaceutical companies and large CROs.

However, the site-based CTMS segment is gaining significant traction, particularly as decentralized and investigator-initiated trials become more common. Site-level CTMS solutions are tailored to individual hospitals, academic centers, and independent investigators, offering streamlined site workflows, subject tracking, and regulatory compliance—all within a user-friendly, cost-effective interface.

What Challenges Restrain the U.S. CTMS Market?

Despite strong growth, the CTMS market in the U.S. faces several barriers. Chief among them are high implementation and customization costs, especially for enterprise solutions that require system integration with existing EHRs, safety systems, and financial software.

Regulatory compliance burdens also pose a challenge. Adhering to HIPAA, 21 CFR Part 11, and evolving global privacy laws (e.g., GDPR for multinational trials) requires significant investment in validation, audit readiness, and user training.

Additionally, data interoperability issues and resistance to digital adoption—especially in smaller clinical settings—can slow CTMS rollout. Concerns around data privacy and security, particularly in the cloud environment, further complicate adoption.

How Are Decentralized Trials Opening New Avenues for CTMS Providers?

The rise of decentralized clinical trials (DCTs) is reshaping the CTMS ecosystem in the U.S., creating new demand for platforms that support remote data capture, patient engagement, and hybrid site models. As the number of DCTs continues to climb, CTMS providers are integrating with tools like wearable sensors, telehealth platforms, and eConsent technologies to manage participant data across various digital endpoints.

-

Medidata’s CTMS-DCT integration, allowing centralized oversight with decentralized data streams

-

Oracle and ObvioHealth’s collaboration, merging cloud CTMS with mobile trial apps and virtual site management

These trends point to a future where CTMS platforms are not just tools for project oversight but centralized digital hubs for decentralized trial orchestration.

U.S. Clinical Trial Management System Market Key Players

-

Medidata (Dassault Systèmes): Offers an industry-leading unified platform, with continuous enhancements in DCT integration and AI tools.

-

Oracle Health Sciences: Collaborates with digital health providers for end-to-end trial management and virtual site support.

-

Veeva Systems: Introduced its Vault CTMS with real-time visibility, and continues expanding AI integration for workflow optimization.

-

RealTime Software Solutions: Known for affordable and flexible site-based CTMS options, now expanding into mid-size sponsors.

-

IQVIA Technologies: Leverages its real-world data network to offer CTMS embedded with predictive trial insights.

-

IBM Watson Health (Merative): Focuses on analytics-driven CTMS with NLP and cognitive computing capabilities.

-

Cloudester Software: Launched new compliance-ready CTMS modules in 2024 targeting CROs and SMEs.

These companies are investing in AI, cloud infrastructure, decentralized integrations, and regulatory adaptability to stay competitive in a fast-evolving market.

A Digitally Powered Future for U.S. Clinical Trials

The U.S. Clinical Trial Management System (CTMS) market is entering a golden era of digital transformation. With a projected rise from USD 810 million in 2025 to USD 2,400 million by 2034, the market reflects the growing urgency for agile, intelligent, and compliant trial management solutions. Key drivers like decentralized trials, AI-powered recruitment, cloud-based deployments, and increased regulatory oversight will continue to push the industry forward.

As CTMS platforms evolve into centralized control hubs that support real-time collaboration, patient-centric design, and data-driven trial optimization, U.S.-based sponsors and CROs are poised to lead the global charge toward faster, safer, and smarter clinical development.

Read Also: Human Biospecimens Market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.co |+1 804 441 9344

- Pill Timer Market Size to Hit $2.94 Bn by 2034 | 9.02% CAGR Growth Forecast - August 12, 2025

- Blood Glucose Monitoring Market Size to Worth USD 25.53 Billion by 2034 - August 11, 2025

- Diabetes Care Devices Market Set to Surge to USD 118.34 Billion by 2034, Driven by Innovation and Rising Prevalence - August 8, 2025