Thermal Cycler Market to Accelerate from USD 1.06 Billion in 2024 to USD 2.39 Billion by 2034

Forecast CAGR of 8.47% (2025–2034) driven by escalating biotech R&D, clinical diagnostics demand, and advanced PCR automation

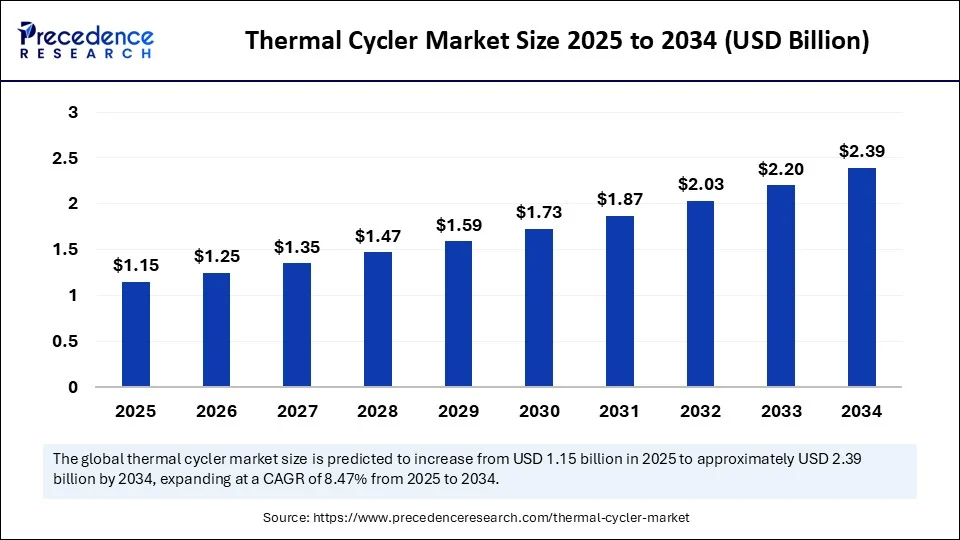

In 2024, the global thermal cycler market was valued at USD 1.06 billion, and is expected to surpass USD 2.39 billion by 2034, growing at a healthy CAGR of 8.47% from 2025 onward. Growth is propelled by expanding applications in genomics, clinical research, agricultural biotech, and diagnostics, as laboratories increasingly seek high-throughput systems like real‑time and gradient cyclers.

Thermal Cycler Market Quick Insights

-

In 2024, the global thermal cycler market was valued at USD 1.06 billion, and it is forecast to reach USD 1.15 billion by 2025. Looking ahead, the market is projected to grow to USD 2.39 billion by 2034, registering a CAGR of 8.47% during the 2025–2034 forecast period.

-

North America led the global market in 2024, while Asia Pacific is expected to emerge as the fastest-growing region throughout the forecast period.

-

Among product types, real-time PCR (qPCR) systems were the top performers in 2024, with digital PCR (dPCR) poised for the fastest growth due to its precision in detecting low-abundance nucleic acids.

-

By technology, gradient PCR systems accounted for the largest market share in 2024, whereas reverse transcription PCR (RT-PCR) is expected to be the fastest-growing segment driven by demand for RNA-based testing.

-

In terms of application, clinical diagnostics dominated usage in 2024, while agricultural biotechnology is projected to grow significantly, fueled by advancements in GMO detection and crop testing.

-

Academic and research institutions were the dominant end-users in 2024, with biotech and pharmaceutical companies expected to lead growth as they ramp up genomic R&D.

-

Regarding distribution, direct sales represented the primary channel in 2024, though online sales are gaining rapid traction due to procurement convenience and remote support services.

Artificial intelligence is increasingly integrated into thermal cycler platforms to optimize PCR protocols, predict maintenance needs, and detect operational errors in real time. AI‑enabled systems help reduce downtime and enhance throughput, critical for high-demand diagnostic and research settings.

Moreover, AI analytics streamline workflow by offering smart protocol recommendations and quality control diagnostics, improving consistency across real‑time and gradient PCR workflows. This convergence of AI and hardware is driving next-gen cyclers toward more autonomous, data‑driven performance.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.39 Billion |

| Market Size in 2025 | USD 1.15 Billion |

| Market Size in 2024 | USD 1.06 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.47% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Technology, Application, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Where Are the Emerging Opportunities and Trends?

-

Will digital PCR (dPCR) systems overtake qPCR as the gold standard in precision diagnostics?

-

Can gradient PCR technologies empower ultra‑fast primer optimization for multi‑site testing?

Key trends include the shift toward digital PCR adoption, the expansion of RT‑PCR for RNA viruses and biomarker research, and growing interest in automation for high-throughput and point-of-care genomic workflows.

Read Also: Bovine Blood Plasma Derivatives Market to Reach USD 3.00 Billion by 2034

Thermal Cycler Market Regional Analysis

North America Leads, Asia Pacific Rises Fast

North America held the largest share of the thermal cycler market in 2024, fueled by strong biotech R&D infrastructure and widespread institutional adoption of qPCR systems. However, Asia Pacific is projected to be the fastest-growing region from 2025 to 2034, driven by increased investments in molecular diagnostics, genomic medicine, and agricultural biotechnology across emerging economies.

Thermal Cycler Market Segmentation Analysis

Product Type: Real-Time PCR Dominates, dPCR Gaining Ground

In terms of product, real-time PCR (qPCR) systems led the market in 2024 due to their high sensitivity and widespread clinical use. However, digital PCR (dPCR) is expected to grow rapidly in the coming years, particularly for applications requiring precise quantification of low-abundance nucleic acids.

Technology: Gradient PCR Commands Share, RT-PCR to Expand

Gradient PCR technology accounted for the largest market share in 2024, offering flexibility for temperature optimization across samples. Meanwhile, RT-PCR (reverse transcription PCR) is poised for fast growth, especially due to increasing demand for RNA virus detection and gene expression profiling.

Application: Diagnostics Dominate, Agriculture Expanding

Clinical diagnostics remain the leading application for thermal cyclers, owing to their role in disease detection and personalized medicine. Simultaneously, agricultural biotechnology is an emerging application area, driven by growing needs in GMO testing, plant pathogen detection, and food safety analysis.

End‑User: Research Institutes Lead, Biotech Firms to Surge

Academic and research institutions led end-user adoption in 2024, reflecting their significant role in molecular biology research. Going forward, biotech and pharmaceutical companies are expected to show the fastest growth, propelled by increased genomic research and drug development initiatives.

Distribution Channel: Direct Sales Prevail, Online Gains Momentum

Direct sales channels dominated the market in 2024, particularly for large institutions with custom procurement needs. However, online sales are gaining popularity due to their convenience, real-time support capabilities, and suitability for smaller labs and emerging biotech firms.

Latest Breakthroughs from Leading Providers

Key global players such as Thermo Fisher Scientific, Bio‑Rad Laboratories, Abbott, F. Hoffmann‑La Roche, Eppendorf, QIAGEN, and Agilent continue innovating. Recent product rollouts include high‑throughput digital PCR platforms, integrated thermal cyclers with cloud‑based analytics, and compact qPCR systems for decentralized diagnostics.

Challenges & Cost Pressures

-

High R&D and precision manufacturing costs for new digital and gradient systems

-

Regulatory compliance burden, particularly in clinical diagnostic applications

-

Competition from alternative genomics technologies like next‑generation sequencing

-

Supplier constraints on high‑precision thermal blocks and robotics integration

Case Study

A leading research university deployed a next-gen AI‑enhanced digital PCR system across its molecular diagnostics lab. The result: 30% faster throughput, 40% lower reagent usage, and uninterrupted testing during peak demand periods, setting a new benchmark for academic‑industry collaboration in PCR automation.

Ready for In‑Depth Insights?

Get access to full sample report and schedule a meeting to explore:

-

Detailed segment and regional forecasts

-

Competitive benchmarking and strategic positioning

-

Innovation roadmap for product types, technologies, and applications

➡️ Download Sample Report / Schedule a Meeting https://www.precedenceresearch.com/sample/6462

About Precedence Research

Precedence Research delivers authoritative market intelligence and forecasting across healthcare, biotech, and emerging tech domains. Our reports provide actionable data, strategic insights, and scenario-based analysis for decision-makers.

Contact Us

Precedence Research Pvt. Ltd.

Email: sales@precedenceresearch.com

Website: www.precedenceresearch.com

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025

- Pill Timer Market Size to Hit $2.94 Bn by 2034 | 9.02% CAGR Growth Forecast - August 12, 2025

- Blood Glucose Monitoring Market Size to Worth USD 25.53 Billion by 2034 - August 11, 2025