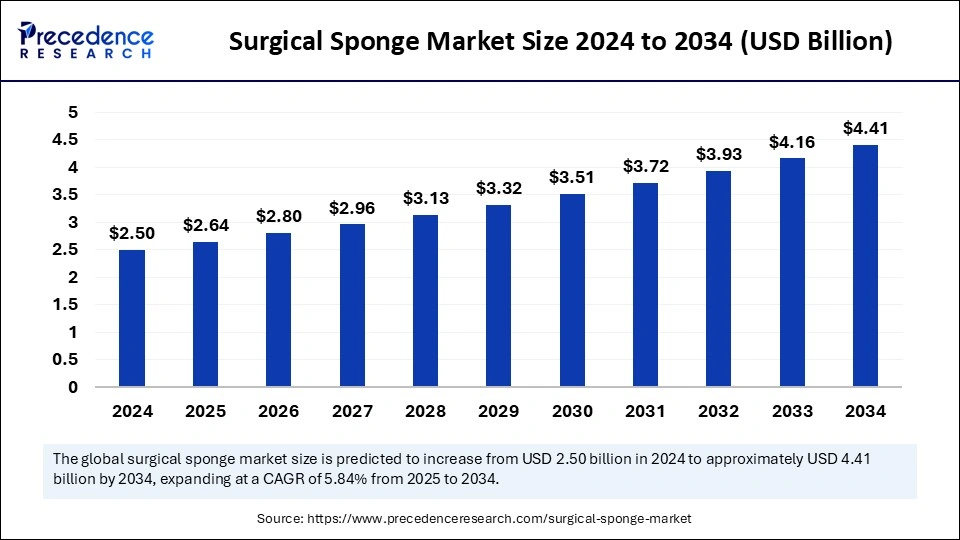

The global surgical sponge market size was valued at USD 2.50 billion in 2024 and is expected to attain around USD 4.41 billion by 2034, growing at a CAGR of 5.84% from 2025 to 2034.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5816

Surgical Sponge Market Key Takeaways

-

North America was the leading region in the surgical sponge market in 2024.

-

The Middle East and Africa are projected to register the most rapid growth rate.

-

Europe maintained a strong and significant market presence.

-

The cotton gauze sponges segment dominated by type in 2024.

-

Nonwoven sponges are poised for the fastest growth moving forward.

-

Hospitals captured the largest portion of the market in 2024.

-

Clinics are anticipated to grow swiftly over the coming years.

AI’s Role in Transforming Surgical Sponge Safety and Supply

Artificial Intelligence (AI) is playing a transformative role in the surgical sponge market by enhancing safety, efficiency, and accuracy in surgical environments. AI-powered tracking systems using RFID and barcode technologies help prevent retained surgical items by ensuring real-time counting and monitoring of sponges during operations. Additionally, AI-enhanced imaging tools assist in identifying sponges left inside the body through advanced image analysis, improving patient outcomes and reducing post-surgical complications.

Beyond the operating room, AI is also optimizing inventory management and quality control. Smart systems predict sponge usage trends, automate stock monitoring, and detect manufacturing defects, ensuring high product quality and reduced waste. Moreover, AI-driven data analytics support manufacturers and healthcare providers in making informed decisions by uncovering market trends and usage patterns, ultimately driving innovation and operational efficiency across the surgical sponge industry.

Surgical Sponge Market Growth Factors

-

Increasing Surgical Procedures:

The global rise in surgical interventions, including both elective and emergency surgeries, is a primary driver for the demand for surgical sponges. -

Advancements in Sponge Technology:

Innovations such as antimicrobial coatings, enhanced absorbency, and the integration of radiopaque materials have improved the safety and effectiveness of surgical sponges. -

Growing Awareness of Surgical Safety:

Heightened focus on patient safety and the prevention of retained surgical items (RSIs) have led to increased adoption of surgical sponges equipped with tracking technologies like RFID and barcode systems. -

Expansion of Healthcare Infrastructure:

Developing regions are investing in healthcare infrastructure, leading to more surgical procedures and, consequently, a higher demand for surgical sponges. -

Rising Prevalence of Chronic Diseases:

An increase in chronic conditions such as cancer and cardiovascular diseases necessitates more surgical interventions, thereby boosting the surgical sponge market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 4.41 Billion |

| Market Size in 2025 | USD 2.64 Billion |

| Market Size in 2024 | USD 2.50 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.84% |

| Dominated Region | North America |

| Fastest Growing Market | Middle East and Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

Several factors are driving the growth of the surgical sponge market. Most notably, the increasing volume of surgeries worldwide due to an aging population and the rising prevalence of chronic diseases such as cancer and cardiovascular conditions. Technological advancements, including the development of antimicrobial and radiopaque sponges, have improved product effectiveness and safety, encouraging wider adoption.

Furthermore, heightened awareness of surgical safety protocols, including the need to prevent retained surgical items, has led to the integration of RFID and barcode tracking systems into surgical sponge use, further boosting market demand.

Market Opportunities

The market presents significant opportunities, particularly in emerging economies where healthcare infrastructure is expanding rapidly. As more hospitals and surgical centers are established in these regions, the demand for surgical supplies, including sponges, is expected to grow. Additionally, the increasing focus on disposable and sterilized products to prevent infections opens up new product innovation avenues.

The integration of AI and smart technology into surgical sponge tracking also represents a growing field for investment and development, potentially transforming surgical procedures and patient safety protocols.

Market Challenges

Despite its promising outlook, the surgical sponge market faces certain challenges. One of the major concerns is the risk of sponge retention post-surgery, which can lead to serious medical complications and legal issues. While technology helps mitigate this risk, implementation costs can be high, especially for smaller facilities.

Moreover, the market is highly regulated, and stringent approval processes for new sponge materials or designs can delay product launches. Price competition and the availability of low-cost alternatives in developing countries may also impact profit margins for leading manufacturers.

Regional Insights

In terms of regional performance, North America dominated the surgical sponge market in 2024, driven by advanced healthcare systems, high surgical volumes, and early adoption of smart sponge technologies. Europe holds a significant market share due to strong regulatory frameworks and widespread healthcare coverage.

However, the most rapid growth is projected in the Middle East and Africa, fueled by increasing healthcare investments and expanding surgical infrastructure. Asia-Pacific is also a notable region with rising demand due to improving medical facilities and growing awareness of surgical safety standards across countries like China and India.

Surgical Sponge Market Companies

- Ethicon Inc

- Boston Scientific Corporation

- Medical Devices Business Services

- Betatech Medical

- LifeCell International Pvt Ltd

- Molnlycke Health Care

- W.L. Gore and Associates. Inc

- Medtronic

- TEPHA Inc

- B. Braun Melsungen AG

Latest Announcement

- In December 2024, Medline Industries, a leading manufacturer and distributor of medical supplies, announced that it had confidentially filed for an initial public offering (IPO) in the U.S. This move positions Medline for a significant public listing, potentially valuing the company at up to USD 50 billion. The chief executive officer of Medline, Jim Boyle, stated that “this strategic step aims to accelerate our growth trajectory and expand our capacity to serve healthcare providers worldwide.”

Recent Developments - In March 2025, MedTech Innovations launched a new AI-driven surgical sponge tracking system, SafeCount, designed to enhance patient safety in operating rooms. The system integrates RFID and computer vision technology to prevent retained surgical sponges, a leading cause of post-operative complications.

Segments Covered in the Report

By Type

- Cotton Gauze Sponges

- Nonwoven Sponges

- X-Ray Detectable Sponges

By End User

- Hospital

- Clinic

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Also Read: Medical Supplies and Labware Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/

- Arteriovenous Implants Market Enhance dialysis outcomes with advanced grafts, endovascular access, and AI-assisted precision - September 16, 2025

- Smart Retinal Implants Market Restore vision with wireless bioelectronic prosthetics and AI-powered retinal technologies - September 16, 2025

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025