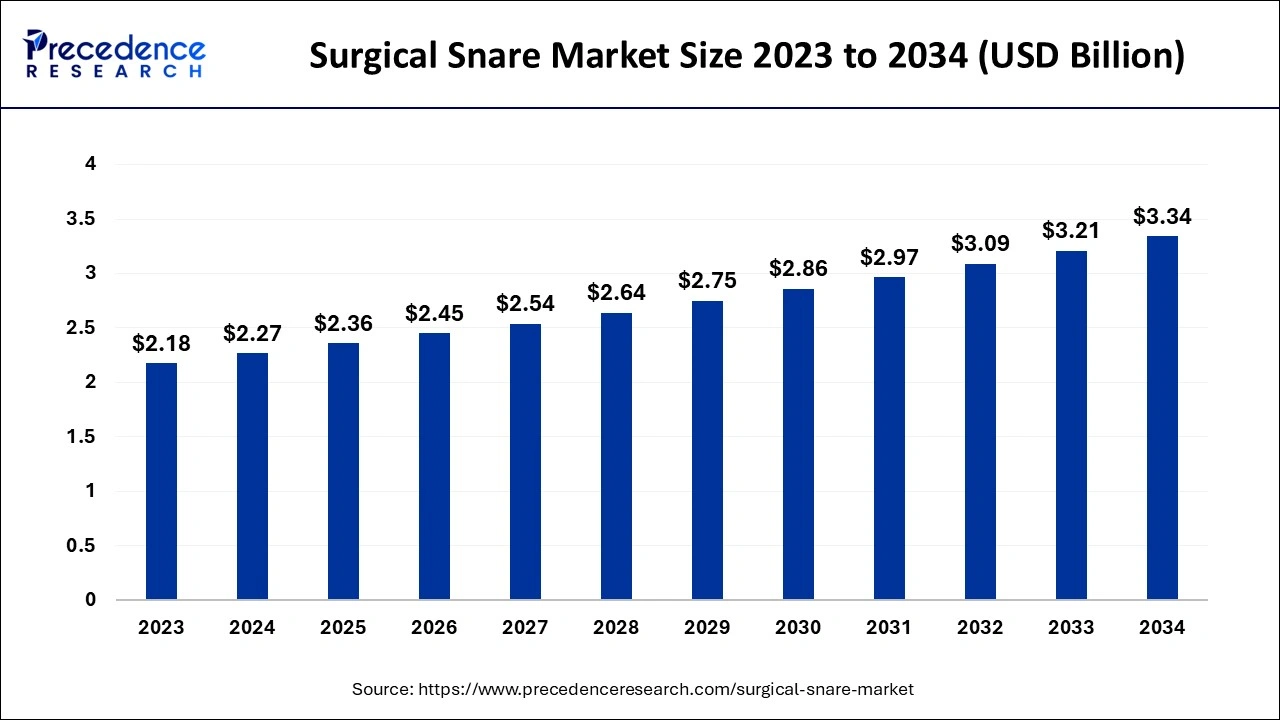

The global surgical snare market is set to witness steady growth over the next decade. Valued at USD 2.27 billion in 2024, the market is projected to reach USD 3.34 billion by 2034, growing at a CAGR of 3.94% from 2025 to 2034. This growth is driven by the increasing demand for minimally invasive surgeries, particularly for conditions like colorectal cancer, polyps, and other gastrointestinal (GI) disorders.

Key Takeaways

-

Market Value (2024): USD 2.27 Billion

-

Forecast Value (2034): USD 3.34 Billion

-

CAGR (2025–2034): 3.94%

-

Largest Region (2024): North America – 45% share

-

Fastest-Growing Region: Asia Pacific

-

Top Application: GI Endoscopy – 32% market share

-

Top End-User: Hospitals – 78% market share

Regional Insights

North America: Market Leader

North America accounted for the largest share of the surgical snare market in 2024. The region benefits from advanced healthcare infrastructure, high healthcare spending, and strong presence of leading players such as Medtronic and Boston Scientific.

U.S. Market Stats:

-

2024 Value: USD 710 million

-

2034 Projection: USD 1.08 billion

-

CAGR (2025–2034): 4.28%

Asia Pacific: Fastest Growing

Driven by a rising cancer burden and growing adoption of minimally invasive techniques, countries like India and China are fueling APAC’s growth. The demand for endoscopic procedures and oncology treatments is rising rapidly, creating new opportunities for surgical snare manufacturers.

How AI is Enhancing Surgical Snare Technology

Artificial Intelligence (AI) is transforming the surgical snare landscape:

-

Real-time lesion detection during endoscopy

-

Precision snaring with adaptive algorithms

-

Post-procedure validation of complete tissue removal

-

Reduced complications like bleeding or perforation

One major development was the GI Genius module by Medtronic, launched in August 2022, which leverages deep learning for AI-powered polyp detection.

Market Drivers

1. Growing Prevalence of GI and Chronic Diseases

The increasing incidence of gastrointestinal disorders, cancer, and obesity is a major market driver. Surgical snares are frequently used for tumor excision, polyp removal, and biopsy procedures.

2. Technological Advancements

Modern snares come with:

-

Improved safety features

-

Compatibility with robotic-assisted surgeries

-

Electrosurgical capabilities

These innovations are increasing procedure success rates and adoption across facilities.

Market Challenges

1. High Costs

Advanced snares (especially single-use) can be expensive, affecting adoption in resource-limited settings. Reusable snares reduce long-term costs but require sterilization infrastructure.

2. Limited Infrastructure in Developing Nations

Lack of modern surgical facilities, equipment, and trained personnel hampers the growth of endoscopic and minimally invasive procedures in some regions.

Market Opportunities

1. Rise in Cancer Cases

With cancer incidence increasing worldwide, the use of snares in oncology surgeries (e.g., colonoscopies, biopsies) is rising. Early polyp removal prevents cancer progression.

2. Patient Awareness and Demand for Minimally Invasive Surgery

Patients are actively seeking faster recovery times, less pain, and outpatient procedures, all of which surgical snares help facilitate.

Segmentation Analysis

By Usability

-

Single-Use (2024): 62% market share – preferred for infection control

-

Reusable: Fastest growing segment – cost-effective over the long term

By Application

-

Top Segment: GI Endoscope

-

Fastest-Growing Segment: Arthroscopy – driven by rising orthopedic issues and sports injuries

By End-Use

-

Hospitals (2024): 78% market share – high surgical volume

-

Ambulatory Surgical Centers: Growing rapidly – demand for outpatient procedures

Notable Market Developments

-

Feb 2024: Boston Scientific launches Versavue single-use cystoscope in the U.S.

-

March 2023: NVIDIA and Medtronic collaborate to integrate AI in colonoscopy tools

-

May 2024: Medtronic expands trials for its Hugo robotic-assisted surgery system

-

Nov 2024: Optiscan Imaging & Monash University enhance Edge-AI endomicroscopy for GI cancer detection

Leading Companies in the Surgical Snare Market

-

Boston Scientific

-

Merit Medical Systems

-

Avalign Technologies

-

CONMED Corporation

-

Hill-Rom Holdings

-

Sklar Surgical Instruments

-

Steris

-

Medline Industries

-

Cook Medical

Go through it: Veterinary Telehealth Market

For bulk orders, licensing, or report customization, contact us at:

📩 sales@precedenceresearch.com