The global smart retinal implants market is poised for robust expansion from 2025 to 2034, driven by increasing prevalence of vision-impairing diseases, rapid technological advancements in retinal prosthetics, and wider adoption of AI-enabled vision restoration systems. Valued at growing billions today, the market offers new hope for patients suffering from degenerative retinal conditions like age-related macular degeneration and retinitis pigmentosa, promising transformative improvements in quality of life through cutting-edge implant technology.

What are the Quick Insights on the Smart Retinal Implants Market?

-

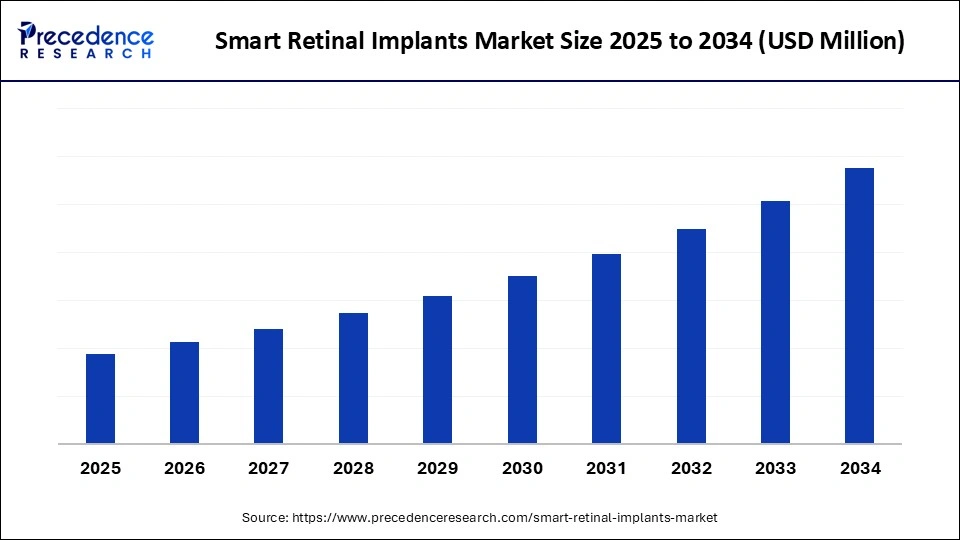

The market is forecasted to grow at a CAGR of approximately 12.8% over the next decade.

-

North America leads the market, backed by strong healthcare infrastructure and active clinical trials.

-

Asia Pacific is the fastest-growing region due to rising diabetic populations and healthcare investments.

-

Subretinal implants dominated in 2024, providing superior vision quality.

-

Microelectrode arrays hold the largest technology share given their safety and clinical dependability.

-

Biocompatible metals and polymers are preferred materials for implant manufacturing.

-

Hospitals and specialty clinics constitute the primary end-users because of their advanced surgical capabilities.

-

Key players innovating in this market include Second Sight Medical Products, Pixium Vision, and NIDEK Co Ltd.

How is the Market Growing? Introduction and Key Drivers

The smart retinal implants market is expanding due to a significant global rise in retinal disorders like diabetic retinopathy, age-related macular degeneration (AMD), and retinitis pigmentosa, conditions that impair vision and require advanced therapeutic interventions. The aging population worldwide and increasing awareness of vision restoration solutions further augment this growth. Moreover, governments and medical device companies are expanding funding and supportive regulatory pathways aimed at accelerating clinical trials and product approvals for ophthalmic devices.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6776

Smart Retinal Implants Market Segmentation

| Segment | Leading Category |

|---|---|

| Implant Type | Subretinal implants |

| Technology | Microelectrode arrays |

| Material | Biocompatible metals/polymers |

| End-User | Hospitals and specialty clinics |

| Dominant Region | North America |

| Fastest-Growing Region | Asia Pacific |

Artificial intelligence is revolutionizing smart retinal implant technology by enabling dynamic, real-time vision processing and adaptive stimulation. AI algorithms optimize implant performance by continuously adjusting electrode stimulation patterns based on environmental inputs and neural responses, thereby improving the quality and naturalness of restored vision. This AI integration allows devices to mimic human visual perception more closely, providing patients with enhanced autonomy and better functional vision.

Furthermore, AI-driven models enhance research and development by simulating visual outcomes and optimizing device parameters such as electrode configurations, which increases both efficacy and energy efficiency. As AI continues to evolve, it is expected to be a critical differentiator in the competitive landscape, powering next-generation retinal implants with personalized and predictive capabilities.

What Factors Are Driving Smart Retinal Implants Market Growth?

-

Rising prevalence of degenerative retinal diseases globally, including over 500 million people at risk for diabetic retinopathy.

-

Strong government initiatives and increased funding facilitating faster clinical trials and regulatory approvals.

-

Advancements in implant materials and miniaturization techniques improving patient comfort and implant longevity.

-

Growing collaboration between technology developers, clinicians, and patient advocacy groups to enhance treatment adoption.

-

Development of scalable manufacturing techniques and 3D printing to reduce device costs and improve accessibility.

What Opportunities and Trends Are Shaping the Market?

Why are subretinal implants dominating the market?

Subretinal implants occupy a leading position because they directly stimulate residual photoreceptors beneath the retina, offering higher resolution and more natural vision compared to other methods. Their robustness, proven clinical efficacy, and regulatory approvals position them as the standard in retinal prosthetics.

What makes optogenetic-based implants a fast-growing segment?

Optogenetic implants combine gene therapy with light-sensitive proteins, offering a less hardware-dependent solution. They reduce surgical risks, allow non-invasive upgrades, and open new treatment avenues for patients with advanced retinal degeneration, supported by increasing research funding.

How are hospitals and specialty clinics pivotal for market growth?

These facilities offer the advanced surgical infrastructure, skilled professionals, and rehabilitation programs essential for complex retinal implant procedures. They also serve as hubs for clinical trials and post-operative care, which fosters ongoing market expansion.

What Does Precedence Research Principal Consultant Say?

“Smart retinal implants are transforming the landscape of vision restoration by combining breakthrough biomedical engineering with AI-powered adaptability. As implant technologies become more accessible and refined, the potential to restore meaningful vision to millions suffering retinal degeneration is nearer than ever. We anticipate accelerated adoption in Asia Pacific given the region’s growing diabetic population and improving healthcare infrastructure,” notes Dr. Arjun Malhotra, Principal Consultant at Precedence Research.

How Is the Market Segmented Regionally and Technologically?

North America dominates due to its strong developer presence, sophisticated healthcare systems, and supportive regulatory climate. Asia Pacific is the fastest-growing region, fueled by demographic trends and government investments in healthcare modernization. Europe, Latin America, and Middle East & Africa also present growing opportunities, particularly through government health initiatives and rising patient awareness.

Technologically, microelectrode arrays maintain dominance due to their demonstrated clinical safety and efficacy, while AI-integrated implants are the fastest-growing segment for their ability to personalize vision restoration. Material innovations focus on biocompatible metals and polymers for durability, with nanomaterials emerging for their enhanced electrical properties and miniaturization potential.

What Are the Latest Breakthroughs and Key Players?

-

Second Sight Medical Products remains a leader with its Argus II system, pioneering implantable prosthetics.

-

Pixium Vision is gaining traction with its Prima system focusing on subretinal and optogenetic implants.

-

NIDEK Co Ltd is innovating in microelectrode arrays and implant material technology.

-

AI integration into implants is attracting collaborations across tech and healthcare sectors, pushing functional vision boundaries.

Smart Retinal Implants Market Companies

- Second Sight Medical Products, Inc.

- Retina Implant AG

- Pixium Vision SA

- Bionic Vision Technologies

- Nano Retina, Inc.

- Intelligent Implants GmbH

- iBionics

- Optobionics Corporation

- VisionCare Ophthalmic Technologies

- Ocumetics Technology Corporation

- Nidek Co., Ltd.

- Boston Scientific Corporation

- Medtronic plc

- Alcon (Novartis)

- Johnson & Johnson Vision Care, Inc.

- Zeiss Group

- Ophthorobotics AG

- Gensight Biologics

- LambdaVision, Inc.

- Neurotech Pharmaceuticals, Inc.

What Challenges and Cost Pressures Does the Market Face?

Complex surgical procedures require highly skilled surgeons and advanced facilities, limiting widespread adoption. High device costs restrict accessibility, especially in developing regions. Regulatory barriers and lengthy approval processes increase commercialization timelines and expenses. Additionally, improving visual resolution beyond basic light perception remains a critical technical challenge.

Case Study Highlight: Reducing Costs with 3D Printing

A leading implant manufacturer recently integrated 3D printing techniques to produce customized implant components at scale, reducing fabrication costs by 30% and enabling faster deployment to emerging markets. This innovation underscores the role of manufacturing advances in overcoming cost barriers and expanding accessibility.

Read Also: Blood Glucose Monitoring Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Arteriovenous Implants Market Enhance dialysis outcomes with advanced grafts, endovascular access, and AI-assisted precision - September 16, 2025

- Smart Retinal Implants Market Restore vision with wireless bioelectronic prosthetics and AI-powered retinal technologies - September 16, 2025

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025