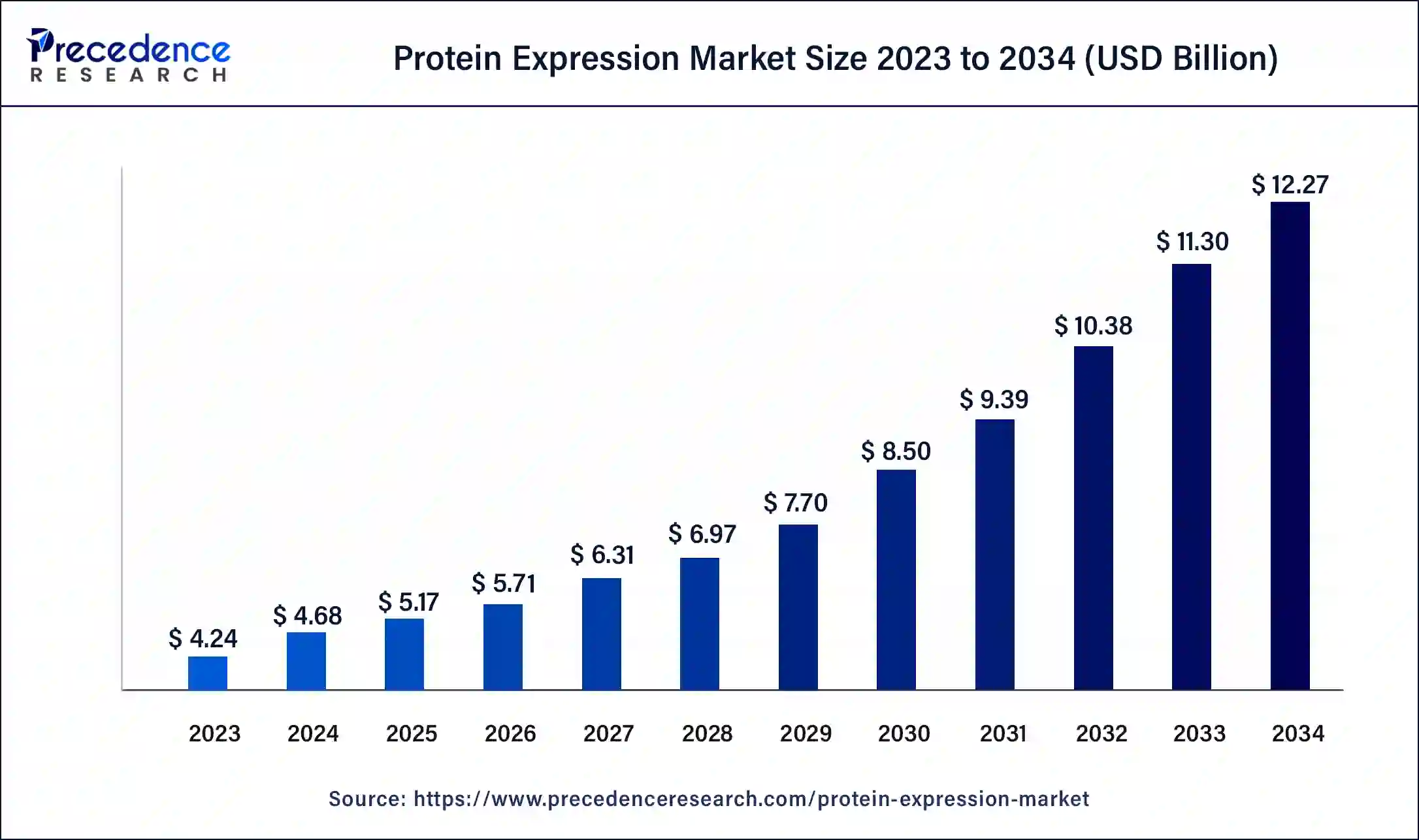

The global protein expression market has experienced strong growth, driven by the increasing demand for biologics, advanced therapeutics, and R&D innovations. Valued at USD 4.68 billion in 2024, the market is projected to reach USD 12.27 billion by 2034, growing at a robust CAGR of 10.45% from 2025 to 2034. North America currently leads the market, with the U.S. protein expression market estimated at USD 1.37 billion in 2023.

Read Also: Clinical Trials Market

Key Takeaways

-

Prokaryotic expression systems held 43.70% market share in 2024.

-

Eukaryotic expression systems expected to grow at CAGR of 9.10%, driven by demand for cell-based therapies.

-

Reagents dominate the product type segment with a 48.50% share.

-

Services segment projected to grow at a CAGR of 9.40%, fueled by outsourcing trends.

-

Therapeutic development application accounted for 41.60% share and is expected to grow at CAGR of 8.90%.

-

Pharmaceutical & biotechnology companies are the largest end-users with 45.20% share.

-

Stable expression method led with 33.50% share, while cell-free protein synthesis is fastest-growing at CAGR of 10.10%.

-

North America captured more than 41% revenue share in 2023, followed by Europe and Asia Pacific.

Market Overview

Protein expression is the process through which a cell synthesizes proteins based on genetic instructions. It involves:

-

Transcription – DNA is transcribed into messenger RNA (mRNA).

-

Translation – mRNA is translated into a specific protein sequence.

Applications of protein expression include:

-

Recombinant protein production

-

Drug discovery and development

-

Therapeutics and vaccines

-

Research in proteomics and genomics

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 12.27 Billion |

| Market Size in 2025 | USD 5.17 Billion |

| Market Size in 2024 | USD 4.68 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 10.12% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Expression System, Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Growth Factors

-

Rising Demand for Protein-Based Therapeutics

-

Personalized medicine and biologics are driving growth.

-

Collaborations like Merck and Orna Therapeutics’ $150M investment in RNA technology boost market expansion.

-

-

Technological Advancements

-

Cell-free protein synthesis enables rapid prototyping and production of difficult-to-express proteins.

-

Microfluidics technology allows precise protein expression and screening.

-

-

Biopharmaceutical Investments

-

Companies invest heavily in recombinant protein production and cell-based systems.

-

Strategic collaborations between industry and academia accelerate innovation.

-

-

Automation and AI Integration

-

AI and automation streamline workflows, reduce errors, and accelerate research timelines.

-

Expression System Insights

-

Prokaryotic Systems: Most widely used due to simplicity and cost-effectiveness.

-

Eukaryotic Systems: Fastest-growing, supporting cell-based therapies, mammalian, yeast, insect, and plant systems.

Product Type Insights

-

Reagents: Essential for protein folding and conformation, dominating 48.50% of the market.

-

Services: Highest CAGR of 9.40%, including custom protein expression, cell line development, and CRAMS.

Application Insights

-

Therapeutic Development: Leading segment, offering specificity, low side effects, and effectiveness.

-

Monoclonal antibodies, vaccines, enzymes, and hormones drive protein expression applications across therapeutics and industrial use.

End-Use Insights

-

Pharmaceutical & Biotech Companies: Largest users, utilizing cultured cells for therapeutics.

-

CMOs and CDMOs: Fastest-growing, driven by biologics and biosimilar production.

Expression Method Insights

-

Stable Expression: Dominates with 33.50% market share.

-

Cell-Free Protein Synthesis: Fastest-growing at 10.10% CAGR, enabling targeted and precision therapeutics.

Market Drivers

-

Rising interest in biologics to treat cancer, autoimmune diseases, and chronic conditions.

-

Strategic collaborations and funding for protein therapeutics development.

-

Emerging technologies like microfluidics and cell-free systems.

Market Challenges

-

Post-translational modifications and purification complexities.

-

Structural intricacies of proteins can reduce yield and stability.

Opportunities

-

Microfluidics adoption enables precise control of protein synthesis.

-

Automation and AI improve efficiency in R&D and production.

-

Personalized medicine expands demand for targeted protein therapeutics.

Key Market Players

-

Agilent Technologies Inc.

-

Bio-Rad Technologies

-

Thermo Fisher Scientific Inc.

-

Merck KGaA

-

Takara Bio Inc.

-

New England Biolabs Inc.

-

Oxford Expression Technologies Ltd

-

Promega Corporation

-

Qiagen NV

-

Sigma-Aldrich Corporation

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Antibody Drug Conjugates Market Size to Hit USD 31.96 Bn by 2034 - October 8, 2025

- Protein Expression Market Size To Reach Around USD 12.27 Bn By 2034 - October 8, 2025

- Clinical Trials Market Size to Reach USD 149.58 Billion by 2034 - October 8, 2025