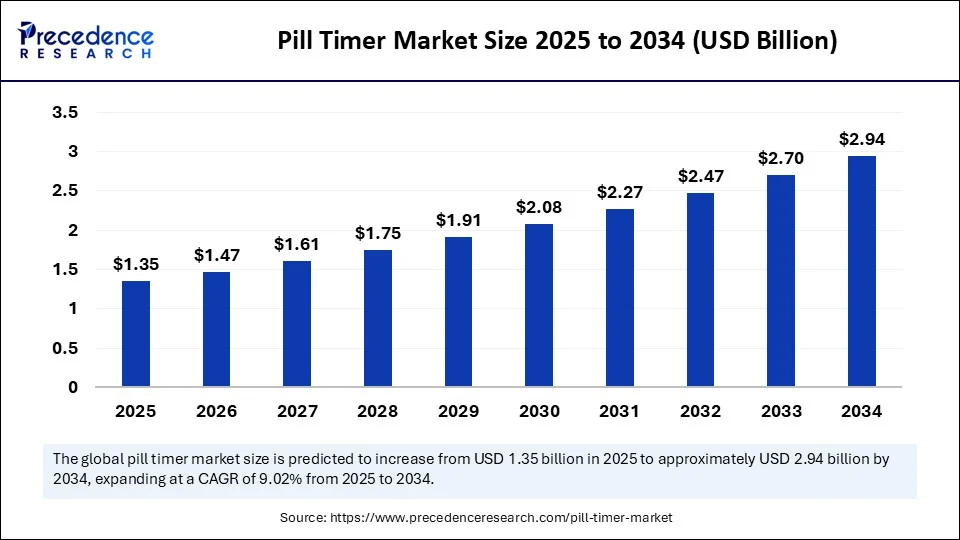

The global pill timer market is set to skyrocket from $1.35 billion in 2025 to an impressive $2.94 billion by 2034, maintaining a robust CAGR of 9.02%. This growth is propelled by rising awareness of medication adherence, mounting chronic diseases, an ageing global population, and a wave of technological innovations, particularly smart, AI-driven devices making an impact within consumer and clinical settings.

Pill Timer Market Quick Insights

-

In 2025, the pill timer market size is estimated at $1.35 billion.

-

North America continues to dominate, buoyed by the U.S.’s strong digital healthcare infrastructure and chronic illness rates.

-

Asia Pacific is the fastest-growing region, led by India’s digital health initiatives and a rapidly expanding elderly population.

-

Digital pill timers commanded the largest share in 2024, due to affordability and ease-of-use, especially for elderly users.

-

Smart, connected timers (IoT, app-synced) are the fastest-growing segment, offering real-time tracking, caregiver alerts, and remote monitoring.

-

Key players include: E-Pill, Accutab, GMS Med-e-lert, Ivation, HOSYO, MedReady, Active Forever, PIXNOR, MaxiAids, MedCenter, Xtech (HK) Limited, among others.

-

Online retail is now the leading distribution channel, thanks to convenience, wider availability, and consumer preference for digital shopping.

Download Sample: https://www.precedenceresearch.com/sample/6550

Pill Timer Market Revenue Table

| Year | Market Size (USD Billion) |

|---|---|

| 2024 | 1.24 |

| 2025 | 1.35 |

| 2034 | 2.94 |

The role of AI is fast evolving beyond simple reminder alerts. In January 2025 at CES, innovators unveiled AI-powered pillboxes capable of not just reminding but predicting and adapting to user behaviors, issuing smart alerts, and connecting patients to caregivers in real time. For example, Smart Pillbox’s HealthBuddy app uses machine learning to adjust timing, track missed doses, and escalate notifications to family members or health providers—significantly reducing non-adherence and enabling intervention before health events occur.

Similarly, India’s MIT-WPU launched an IoT-enabled dispenser that leverages AI not only for scheduling but also for analyzing regimen compliance trends. Such advances are moving smart pill timers from being passive tools to becoming proactive digital health companions.

What’s Powering Pill Timer Market Growth?

The worldwide drive to tackle medication non-adherence—which leads to poorer outcomes and billions in avoidable costs is fueling adoption across hospitals, home care, and among independent seniors. The spread of chronic illnesses (diabetes, hypertension), ageing populations, and discharge-to-home recovery models all require reliable, user-friendly medication reminders. These devices now stretch beyond simple buzzers: IoT-enabled, app-connected, and cloud-monitored, they provide data back to clinicians and make caregiving easier.

The home healthcare trend is another tailwind. More consumers are managing complex medication regimens outside hospitals, creating demand for portable, personalized, and tech-enhanced solutions.

Are Smart Pill Timers the Next Healthcare Essential?

Opportunity & Trend Watch

-

With healthcare shifting sharply toward remote monitoring and virtual care, pill timers are fast becoming cornerstones of connected home health.

-

Caregiver integration—timers that notify family, nurses, or providers—has arisen as a strong trend, offering reassurance to patients and care teams.

-

In developing markets like India and China, cost-effective, app-based dispensers are enabling wider access, while Europe and North America see uptake of premium, feature-rich options.

-

The digital pharmacy revolution is broadening access and providing new sales avenues for device manufacturers.

Market Expert View:

“Our research finds that smart pill timer adoption is no longer a niche behavior—it’s a critical aspect of modern healthcare. As AI and IoT features become commonplace, adherence solutions are evolving from reminders to active, personalized health partners. Investors and stakeholders should prepare for accelerating demand led by both ageing consumers and an increasingly digital health environment,”

— Dr. Priya Kaushal, Principal Consultant, Precedence Research

Regional & Segment Analysis

North America: Remains the leading regional market on the back of advanced digital healthcare infrastructure, high prevalence of chronic diseases, structured insurance, and growing awareness. The U.S. sets the pace, integrating timers into prescription programs and benefit plans.

Asia Pacific: Poised for fastest growth due to rising elderly populations, government-driven digital health missions, expanding middle-class adoption, and digital startups like India’s AI-powered pillboxes.

Europe: Sees steady growth with strong health system support, pharmaceutical use, and emphasis on patient safety and adherence.

| Region | 2024 Share | Trend |

|---|---|---|

| North America | Largest | Advanced, insurance-linked, tech-rich |

| Asia Pacific | Fastest-growing | Digital health focus, elderly boom |

| Europe | Stable | Patient compliance, pharma driven |

By Product

-

Digital Timers: Most popular, simple to use, and universally accessible.

-

Smart Timers (IoT): Rapidly gaining share for remote monitoring and caregiver integration.

By Age

-

Elderly/Geriatric segment dominates, reflecting chronic care needs and memory challenges.

By Function

-

Reminders Only: Remain standard due to low cost and reliability.

-

Reminders + Caregiver Notification: Fastest growth; supports remote and family care models.

By Distribution

-

Online Retail leads for accessibility, competitive pricing, and wide assortment.

What are the Latest Breakthroughs?

-

At CES 2025, Smart Pillbox released an AI-powered device with HealthBuddy app, enabling predictive reminders and caregiver escalation.

-

MIT-WPU introduced an AI, IoT-enabled dispenser, bringing AI-driven scheduling and advanced regimen compliance to Indian homes and care facilities.

Pill Timer Market Companies

-

E-Pill

-

Accutab

-

GMS Med-e-lert

-

Ivation

-

HOSYO

-

MedReady

-

Active Forever

-

PIXNOR

-

MaxiAids

-

MedCenter

-

Xtech (HK) Limited

What Hurdles and Headwinds Confront the Market?

Persistent challenges include:

-

High upfront cost for feature-rich devices.

-

Usability barriers among non-tech-savvy seniors or those with disabilities.

-

Data privacy and security concerns for internet-enabled pillboxes.

-

Patients’ reluctance to adopt digital health tools or resistance to behavioral change.

-

Reimbursement gaps in certain markets for consumer electronic health devices.

Case In Point:

After being discharged post-cardiac surgery, 76-year-old Mr. Sharma from Pune used a smart, AI-enabled pill timer. The device not only issued reminders, but sent weekly adherence reports to his doctor and alerts to his daughter for missed doses. Two months post-discharge, Mr. Sharma reported zero missed doses and received a personalized medication schedule update—the outcome: stabilized vitals and improved clinical confidence for his care team and family.

Read Also: Blood Glucose Monitoring Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Arteriovenous Implants Market Enhance dialysis outcomes with advanced grafts, endovascular access, and AI-assisted precision - September 16, 2025

- Smart Retinal Implants Market Restore vision with wireless bioelectronic prosthetics and AI-powered retinal technologies - September 16, 2025

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025