PEEK Interbody Devices Market Key Points

- North America dominated the PEEK interbody devices market in 2024.

- Asia Pacific is expected to witness the fastest growth during the forecast years.

- By product type, the interbody fusion devices segment held the largest market share in 2024.

- By product type, the posterolateral fusion devices segment is anticipated to show considerable growth in the market over the forecast period.

- By end-user, the hospitals segment held the biggest market share in 2024.

- By end user, the ambulatory surgical centers segment is expected to grow at the fastest CAGR in the upcoming period.

PEEK Interbody Devices Market Overview

The PEEK interbody devices market has emerged as a critical component in the field of spinal surgery, particularly in spinal fusion procedures. PEEK (polyether ether ketone) is a high-performance thermoplastic polymer known for its biocompatibility, radiolucency, strength, and elasticity that closely mimics human bone. These properties make PEEK ideal for interbody fusion cages that are implanted between vertebrae to maintain disc height, stabilize the spine, and promote bone growth during fusion. PEEK interbody devices are commonly used in treating conditions such as degenerative disc disease, spinal stenosis, spondylolisthesis, and trauma-related spinal injuries.

Over the past decade, the demand for minimally invasive and long-lasting spinal implants has significantly increased, and PEEK interbody devices have gained prominence due to their superior imaging compatibility (unlike metal implants, they don’t obstruct MRI or CT scans), reduced wear rates, and excellent mechanical properties. The market includes a variety of product types including anterior, posterior, lateral, and cervical interbody fusion cages. As the global burden of spinal disorders rises—especially among aging populations—the market for PEEK interbody devices is expected to grow steadily, supported by technological advancements and increasing surgical volumes.

PEEK Interbody Devices Market Growth Factors

One of the primary growth factors driving the PEEK interbody devices market is the growing prevalence of spinal disorders due to aging populations and sedentary lifestyles. As people age, the incidence of spinal conditions such as degenerative disc disease and herniated discs increases, fueling the demand for spinal fusion surgeries and, consequently, interbody fusion devices.

Another critical growth factor is the increasing adoption of minimally invasive spinal surgery (MISS). These procedures aim to reduce operative trauma, lower infection risk, and shorten hospital stays. PEEK interbody devices are particularly suited to MISS techniques due to their customizable shapes, lightweight design, and compatibility with advanced surgical tools.

Moreover, improved reimbursement frameworks in developed regions, coupled with the expansion of healthcare infrastructure in emerging economies, are increasing access to spinal care. This is enabling more patients to undergo elective spinal procedures, thus boosting market demand.

Technological advancements in material science and implant design are also fueling market growth. Innovations such as PEEK-OPTIMA™, carbon fiber-reinforced PEEK, and surface-modified PEEK with titanium coating or bioactive agents enhance osteointegration, reducing healing times and improving long-term surgical outcomes.

Impact of AI on the PEEK Interbody Devices Market

Artificial Intelligence (AI) is beginning to make a significant impact on the PEEK interbody devices market by improving surgical planning, precision, and postoperative outcomes. In spinal surgery, where millimeter-level accuracy is crucial, AI-powered tools such as robotic-assisted systems and AI-based navigation platforms are transforming how implants like PEEK cages are positioned.

AI algorithms integrated with imaging platforms can assist surgeons in preoperative planning by analyzing spinal anatomy, predicting optimal implant size and position, and simulating surgical outcomes. This reduces intraoperative guesswork, enhances efficiency, and lowers the risk of complications.

In postoperative care, AI-driven tools monitor patient recovery, fusion progress, and implant performance, alerting physicians to potential complications or the need for revision surgery. Predictive analytics based on historical surgical data and patient health records can also help identify patients who are most likely to benefit from PEEK interbody fusion versus alternative treatments.

Moreover, AI enhances the design and development of new PEEK implants by accelerating material testing, analyzing performance data, and optimizing device architecture for specific spinal conditions. These insights drive innovation and support the evolution of patient-specific and AI-customized spinal implants.

Market Scope

| Report Coverage | Details |

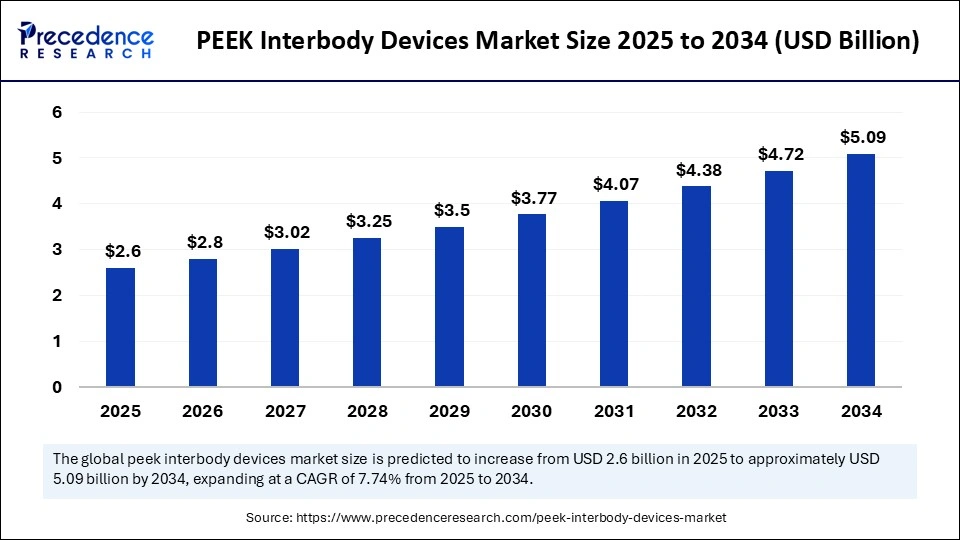

| Market Size by 2034 | USD 5.09 Billion |

| Market Size in 2025 | USD 2.6 Billion |

| Market Size in 2024 | USD 2.41 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.74% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Drivers

Key drivers of the PEEK interbody devices market include the rising number of spinal fusion procedures globally, particularly in orthopedic and neurosurgical practices. The shift towards early intervention in spinal degeneration and trauma cases has led to increased surgical volumes.

The clinical advantages of PEEK over traditional materials such as titanium are another major driver. PEEK’s radiolucency allows for better visualization of bone fusion during follow-ups, and its elastic modulus, similar to bone, reduces stress shielding—making it a preferred choice among surgeons.

Surge in outpatient spine surgeries and ambulatory surgical centers (ASCs) is further driving demand. These centers prefer implants that reduce surgical time and recovery periods—features that align well with PEEK devices.

Additionally, the growing interest in biomaterial innovations and bioactive PEEK composites that promote faster bone integration and healing is fostering demand from hospitals and surgeons seeking improved patient outcomes. The rise in health awareness and elective procedures, especially in developed countries, is contributing to the market’s expansion.

Opportunities

The PEEK interbody devices market holds vast potential across multiple dimensions. One promising opportunity lies in the development of personalized implants using 3D printing technologies and AI-driven customization. These implants can be designed to match the patient’s anatomy precisely, improving fit, stability, and fusion success.

Another opportunity exists in emerging economies, where improving healthcare infrastructure, expanding insurance coverage, and increasing awareness of spinal health are creating new demand channels. Countries in Asia-Pacific, Latin America, and the Middle East are expected to become important growth engines for global manufacturers.

The integration of bioactive coatings on PEEK implants—such as hydroxyapatite, titanium, or antimicrobial surfaces—offers the chance to enhance osteogenesis and reduce infection rates, leading to a new generation of next-level interbody fusion devices.

There is also significant potential for strategic partnerships between medtech companies and AI firms to develop intelligent surgical ecosystems, combining implants, robotics, and analytics into unified solutions. Such integrated offerings can improve surgical precision and deliver value-based care, aligning with the goals of modern healthcare systems.

Challenges

Despite its many advantages, the PEEK interbody devices market is not without challenges. A major concern is the high cost of PEEK implants relative to traditional materials like titanium or stainless steel, which may limit adoption in price-sensitive or underinsured markets.

Another challenge is the limited natural osteointegration of uncoated PEEK, which can slow fusion or lead to suboptimal clinical outcomes compared to bioactive materials. This has led to ongoing debates in the clinical community regarding the comparative effectiveness of PEEK versus titanium-coated or allograft options.

The market also faces regulatory hurdles and clinical validation requirements. Bringing a new PEEK device to market involves lengthy approval processes, clinical trials, and post-market surveillance, all of which demand significant investment and time.

Intense competition and price pressure, especially from regional and low-cost manufacturers, can impact profit margins for established brands. Moreover, surgeon preferences and hospital procurement policies can influence market penetration, particularly where decision-makers are hesitant to adopt newer biomaterials without long-term data.

PEEK Interbody Devices Market Regional Outlook

North America dominates the PEEK interbody devices market, driven by a high prevalence of spinal disorders, strong healthcare infrastructure, and early adoption of minimally invasive surgical technologies. The U.S. leads in terms of both procedure volume and innovation, supported by leading medtech companies and favorable reimbursement systems.

Europe holds a substantial share, with countries like Germany, the UK, and France at the forefront of spinal surgery advancements. Strict regulatory standards and emphasis on evidence-based medicine support the adoption of proven PEEK technologies. Aging populations and rising elective surgery rates further bolster demand.

Asia-Pacific is the fastest-growing regional market, fueled by increasing awareness, urbanization, and healthcare spending in countries like China, India, Japan, and South Korea. Government investments in public health and the growing presence of private hospitals are supporting advanced surgical practices, including spine care.

Latin America and the Middle East & Africa are emerging markets with growing interest in modern spinal implants, particularly in urban and affluent populations. While economic and regulatory barriers exist, the long-term outlook is positive as these regions invest in orthopedic infrastructure and surgical education.

PEEK Interbody Devices Market Companies

- Medtronic (Ireland)

- Stryker (U.S.)

- NuVasive, Inc. (U.S.)

- Zimmer Biomet (U.S.)

- Globus Medical (U.S.)

- DePuy Synthes (U.S.)

- Alphatec Spine (U.S.)

- B. Braun SE (Germany)

- Orthofix Medical Inc. (U.S.)

- LDR Holding Corporation (U.S.)

- SpineArt (Switzerland)

- Mazor Robotics (Israel)

- Invibio (UK)

- Raymedica (U.S.)

- K2M (U.S.)

- Finceramica (Italy)

- Biomet (U.S.)

- Exactech (U.S.)

- Japan Medical Materials (Japan)

- Curiteva (U.S.)

Segments Covered in the Report

By Product Type

- Posterolateral Fusion Devices

- Interbody Fusion Devices

- Anterior Lumbar Interbody Fusion Devices (ALIF)

- Extreme Lateral Interbody Fusion Devices (XLIF)

- Posterior Lumbar Interbody Fusion Devices (PLIF)

- Transforaminal Lumbar Interbody Fusion Devices (TLIF)

- Other Devices

By End User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

By Region

- North America

- Asia-Pacific

- Europe

- Latin America

- Middle East & Africa

Read Also: Oxycodone Hydrochloride Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6254

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344

- Arteriovenous Implants Market Enhance dialysis outcomes with advanced grafts, endovascular access, and AI-assisted precision - September 16, 2025

- Smart Retinal Implants Market Restore vision with wireless bioelectronic prosthetics and AI-powered retinal technologies - September 16, 2025

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025