Nucleic Acid Aptamers Market Key Takeaways

- In terms of revenue, the global nucleic acid aptamers market was valued at USD 257.93 million in 2024.

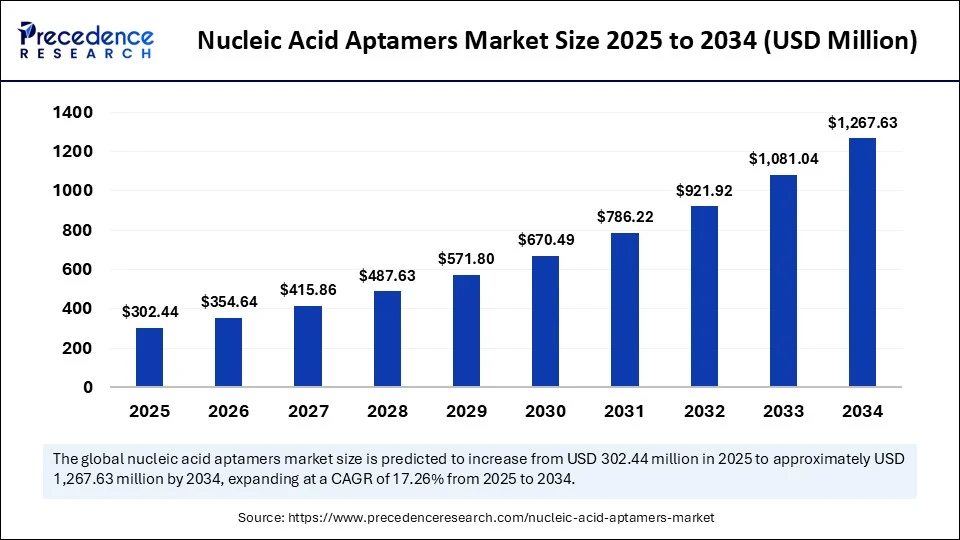

- It is projected to reach USD 1,267.63 million by 2034.

- The market is expected to grow at a CAGR of 17.26% from 2025 to 2034.

- North America dominated the nucleic acid aptamers market with the largest share of 39% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By type, the DNA aptamers segment held the highest market share of 45% in 2024.

- By type, the RNA aptamers segment will expand at a significant CAGR between 2025 and 2034.

- By application, the therapeutics segment contributed the biggest market share of 28% in 2024.

- By application, the diagnostics segment will expand at the highest CAGR between 2025 and 2034.

- By synthesis method, the SELEX (systematic evolution of ligands by exponential enrichment) segment led the market, under which the conventional SELEX segment held a significant share as a sub-segment in 2024.

- By synthesis method, the non-SELEX-based methods segment will grow at a significant CAGR between 2025 and 2034.

- By delivery method, the conjugated delivery segment captured the major market share of 41% in 2024.

- By delivery method, the carrier-mediated delivery segment will grow at the highest CAGR between 2025 and 2034.

- By end-user, the pharmaceutical & biotech companies segment generated the major market share of 36% in 2024.

- By end-user, the contract research organizations (CROs) segment will expand at a significant CAGR between 2025 and 2034.

Impact of AI on the Nucleic Acid Aptamers Market

Artificial Intelligence is reshaping the Nucleic Acid Aptamers Market by dramatically accelerating discovery and optimization processes. Traditional SELEX selection cycles, while effective, are time‑intensive and iterative. AI and machine‑learning platforms can analyze massive sequence‑binding datasets, predict aptamer folding and affinity, and propose novel candidates that minimize lab cycles.

Unsupervised learning models (such as Potts‑model based generators) are being used to design diverse aptamer sequences beyond empirical hits. These tools enhance affinity, stability, and target specificity while reducing development time and cost. AI also supports high‑throughput sequence modeling, off‑target prediction, and optimization of chemical modifications, enabling next‑generation nucleic acid aptamers with improved nuclease resistance and pharmacokinetic profiles.

Also read @ https://www.pharma-geek.com/nucleic-acid-aptamers-market/

Market Overview

Aptamers offer several advantages over monoclonal antibodies: synthetic production (no biological hosts), high batch consistency, low immunogenicity, tunable specificity, and stability under various storage conditions.

Core applications include diagnostics (biosensors, point‑of‑care platforms), therapeutics (targeted drug delivery, anti‑viral agents), and research tools (biomarker discovery, high‑affinity reagents). The market has seen increasing adoption in drug delivery systems, personalized medicine, pathogen detection, disease recognition, and biomarker identification.

Drivers

1. Rising demand for targeted therapeutics and personalized medicine: Chronic diseases such as cancer, diabetes, cardiovascular and age‑related disorders are growing globally, accelerating need for precise targeting agents. Nucleic acid aptamers can be engineered to bind specific biomarkers, offering efficacy with fewer side effects.

2. Advancements in aptamer development technologies: Innovations like SELEX improvements, cell‑SELEX, automated SELEX, high‑throughput sequencing, and particle display accelerate discovery. Integration of chemically modified or unnatural bases improves stability and affinity.

3. Increasing R&D investment and collaborations: Both public and private sectors are allocating greater funding toward therapeutic and diagnostic aptamer R&D. Partnerships between biotech firms and academic institutions are common, stimulating pipeline expansion.

4. Growing preference over antibodies: Compared to antibodies, aptamers are cheaper to produce, easier to modify, non‑immunogenic, and compatible with synthetic scalability. These advantages are gaining recognition across research and healthcare sectors.

Opportunities

-

Expansion in diagnostics and biosensor platforms: Aptamer‑based biosensors (especially electrochemical aptamer‑based or E‑AB sensors) are gaining traction for real‑time detection of small molecules and biomarkers. They offer fast, in‑vivo or point‑of‑care monitoring (e.g. ATP, serotonin, C‑reactive protein) with high specificity and rapid response.

-

Therapeutic application in niche disease spaces: Oncology, ophthalmology (e.g. aptamer targeting VEGF in age‑related macular degeneration), anti‑viral therapies, and rare diseases present high value opportunities for aptamer‑based drugs.

-

Integration with nanotechnology and drug delivery systems: Aptamers can be conjugated to nanoparticles or hydrogels for controlled release, site‑specific delivery, and tissue engineering.

-

AI‑driven next‑generation design: Machine learning enables the exploration of novel aptamer sequences with desired motifs, structural diversity, and improved binding, opening new functional possibilities.

-

Regulatory pathway advancement: As first aptamer‑based therapeutics progress in clinical pipelines, regulatory familiarity will improve, easing future approvals.

Challenges

-

Pharmacokinetic limitations: Aptamers are susceptible to rapid renal clearance and nuclease degradation, leading to short half‑lives unless chemically modified.

-

Limited awareness and market acceptance: Many healthcare professionals still favor antibodies due to greater commercial familiarity and validation.

-

Regulatory complexity: Approval processes for aptamer‑based diagnostics and therapeutics remain stringent; regulatory guidance is less mature than for antibodies.

-

High R&D and production costs: Although synthetic, the selection, modification, and scaling of aptamers involve significant investment.

-

Intellectual property issues: Patent landscapes are evolving; competition and disputes over core SELEX and novel modification methods can pose legal uncertainties.

-

Competitive pressure from antibody and alternative biomolecule markets: Established monoclonal antibodies, antibody fragments, peptides, and small molecules remain dominant in diagnostics and therapeutics.

Recent Developments

-

In March 2024, a prominent aptamer company formed a partnership with a major consumer goods company to leverage Optimer binder technology in life sciences innovation.

-

In May 2023, Life Edit Therapeutics and Novo Nordisk collaborated to develop gene editing and aptamer‑conjugated therapeutics for metabolic diseases.

-

In 2023, a leading aptamer group acquired another key pipeline player to expand its diagnostic and therapeutic offerings.

-

Multiple academic‑industrial collaborations in early 2024 focused on using unnatural base‑containing DNA aptamers (Xenoligo platform) to target infectious agents like viruses.

-

Expanded clinical trials: In ophthalmology, an aptamer therapeutic for geographic atrophy secondary to AMD entered Phase 3 trials under FDA Special Protocol Assessment.

-

Continued advances in SELEX variants (like FRELEX, particle display) and chemical modifications have improved stability, affinity, and scalability.

Also read @

-

Nucleic Acid Aptamers Market Companies

- SomaLogic Inc.

- Aptamer Group PLC

- NOXXON Pharma AG

- Base Pair Biotechnologies Inc.

- Aptamer Sciences Inc.

- AM Biotechnologies LLC

- NeoVentures Biotechnology Inc.

- TriLink BioTechnologies LLC

- Aptus Biotech S.L.

- Aptagen LLC

- Vivonics Inc.

- Aptamer Solutions Ltd.

- AuramerBio Ltd.

- Bio-Techne Corporation

- Novaptech

- IBA GmbH

- ATDBio Ltd.

- Raptamer Discovery Group

- LC Sciences LLC

- Integrated DNA Technologies (IDT)

Segment Covered in the Report

By Type

- DNA Aptamers

- RNA Aptamers

- XNA Aptamers (Synthetic analogs)

- Others (e.g., Spiegelmers)

By Application

- Therapeutics

- Cancer Therapy

- Ocular Diseases

- Cardiovascular Diseases

- Infectious Diseases

- Others

- Diagnostics

- Biomarker Discovery

- Pathogen Detection

- Point-of-Care Testing

- Imaging Agents

- Research & Development

- Target Validation

- Molecular Probes

- Biosensors / Analytical Devices

- Others (e.g., Food Testing, Environmental Monitoring)

By Synthesis Method

- SELEX (Systematic Evolution of Ligands by Exponential Enrichment)

- Conventional SELEX

- Cell-SELEX

- Capillary Electrophoresis-SELEX

- Microfluidic SELEX

- Non-SELEX-Based Methods

By Delivery Method (for therapeutic aptamers)

- Conjugated Delivery (e.g., PEGylated, Nanoparticle-conjugated)

- Unmodified Free Aptamers

- Carrier-mediated Delivery

- Others

By End User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Contract Research Organizations (CROs)

- Diagnostic Laboratories

- Others (Hospitals, Government Labs)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get Sample link @https://www.precedenceresearch.com/sample/6514

- Estrogen Replacement Therapy Market Size to Reach USD 19.46 Billion by 2034 - September 18, 2025

- Peptide Therapeutics CDMO Market Report Size, Share & Forecast 2034 - September 17, 2025

- Rare Musculoskeletal Disorder Treatments Market Size, Share & Future Trends 2034 - September 17, 2025