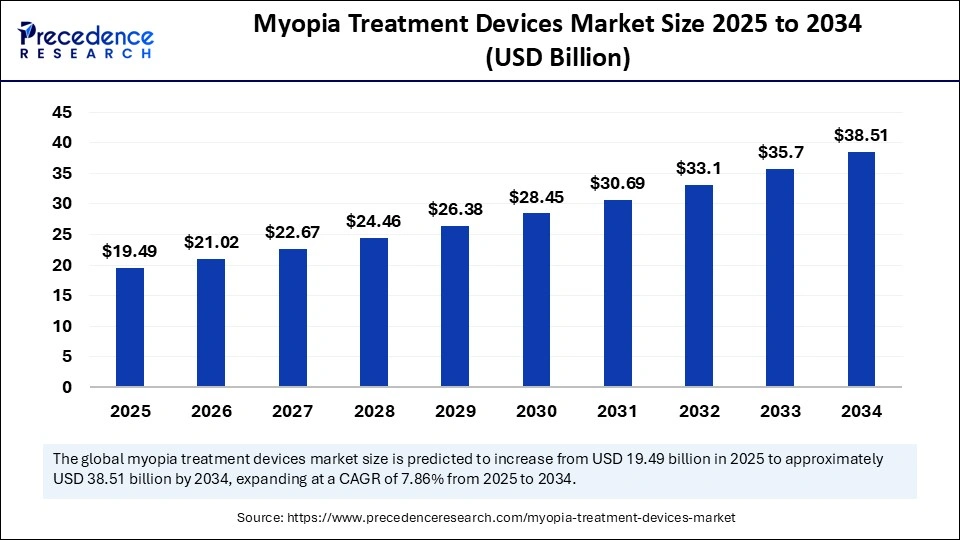

The global Myopia Treatment Devices Market is poised for substantial growth, driven by increasing prevalence of vision disorders in younger populations and the emergence of advanced corrective technologies. Forecasted to expand from USD 19.49 billion in 2025 to approximately USD 38.51 billion by 2034, the market exhibits a strong CAGR of 7.86%, reflecting rising awareness, early intervention strategies, and technological innovation in myopia management.

What’s Driving the Surge in Myopia Treatment Devices?

The growing burden of myopia, particularly among children and adolescents, coupled with lifestyle changes such as increased screen time and reduced outdoor activity, is propelling demand for effective treatment devices. Market growth is further fueled by technological advancements including smart contact lenses, orthokeratology lenses, and AI-powered diagnostic tools. Increasing investments in healthcare infrastructure, government initiatives, and expanding ophthalmic clinics are also pivotal contributors to this upward trajectory.

Myopia Treatment Devices Market Key Insights

-

The market size stood at USD 18.07 billion in 2024 and is anticipated to reach USD 19.49 billion in 2025.

-

Asia Pacific leads the market with a valuation of USD 7.80 billion in 2025 and is expected to double to around USD 15.60 billion by 2034.

-

North America is the fastest-growing regional market due to advanced corrective solutions and tele-optometry innovations.

-

Eyeglasses dominate the product type segment with a 40% market share, favored for their affordability and fashion appeal.

-

Ophthalmic clinics are the largest end-users, recognized for specialized care and innovative diagnostic technologies.

-

Adults represent the majority of patients, while children and adolescents are the fastest-growing age segments.

-

Optical retail chains hold the largest market share in distribution, whereas online platforms are rapidly growing due to convenience and digital penetration.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6651

Myopia Treatment Devices Market Revenue Snapshot and Market Breakdown

| Report Coverage | Details |

|---|---|

| Market Size by 2034 | USD 38.51 Billion |

| Market Size in 2025 | USD 19.49 Billion |

| Market Size in 2024 | USD 18.07 Billion |

| CAGR (2025 to 2034) | 7.86% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Segments Covered | Product, End Use, Age, Distribution, Region |

Artificial intelligence (AI) is a game-changer in the myopia treatment devices market. By enabling precise diagnosis, early detection, and patient-specific intervention, AI-driven analytics use large eye exam datasets to predict myopia progression accurately. This technological integration reduces human error through enhanced refractive evaluations and retinal imaging, ensuring more reliable patient assessments.

Moreover, AI facilitates the development of intelligent corrective devices such as smart contact lenses and adaptable orthokeratology lenses that monitor eye health continuously and adjust treatments accordingly. This not only improves treatment outcomes but also enhances clinical workflow efficiency, delivering significant value to patients and practitioners alike.

What Factors Are Fueling Market Growth?

Several factors are steering the market’s robust expansion:

-

Escalating global prevalence of myopia, particularly linked to urbanization, digital device usage, and sedentary lifestyles.

-

Rising government and healthcare institution initiatives focused on early screening and intervention programs.

-

Progressive innovations in device technology including minimally invasive surgical options, atropine delivery systems, and cloud-based orthokeratology design tools.

-

Growing acceptance and patient preference for non-invasive, effective myopia control solutions enhancing quality of life.

-

Expansion of tele-optometry services enabling broader accessibility and remote patient management.

What Emerging Opportunities and Trends Are Shaping the Market?

Could advancing technologies and unmet patient needs unlock new growth avenues in myopia treatment?

Emerging trends suggest a growing adoption of smart corrective lenses that integrate AI and IoT for real-time eye health monitoring. The increasing demand for non-surgical myopia control methods and enhanced customization of devices using cloud computing are opening unexplored opportunities. Additionally, expanding digital healthcare platforms and remote eye care services are creating promising channels for market expansion globally.

Myopia Treatment Devices Market Regional and Segment Highlights

Asia Pacific Leads the Market

Asia Pacific is the largest regional market for myopia treatment devices, projected to reach USD 7.80 billion in 2025 and expected to maintain a strong CAGR of 7.99% through 2034. The high prevalence of myopia in countries such as China, India, and Japan significantly drives demand. This region benefits from increased government initiatives focusing on eye health, including school-based myopia screening and treatment programs that aim to control the spread of myopia among children.

Additionally, urban lifestyle changes with more screen time and less outdoor activity contribute to rising myopia rates. The presence and expansion of ophthalmic clinics and hospitals offering specialized vision care services support market growth in this region.

North America as the Fastest Growing Market

North America is identified as the fastest-growing market for myopia treatment devices during the forecast period. Adoption of advanced corrective technologies such as Ortho-K lenses and innovative refractive surgery devices supports this growth.

The region’s well-established insurance frameworks facilitate patient access to myopia treatments, while increasing awareness about pediatric myopia control drives demand for specialized solutions. Furthermore, substantial investments in research and development by companies and healthcare organizations focus on improving pediatric myopia management, propelling market expansion.

Product Types: Eyeglasses and Orthokeratology Lenses

Eyeglasses hold the dominant share in the lens segment of the market, driven by their affordability, ease of use, availability in various styles, and fashion appeal. They remain the most common choice for myopia correction globally. However, orthokeratology (Ortho-K) lenses represent the fastest-growing segment within the lens category.

Ortho-K lenses are specialized rigid gas-permeable contact lenses worn overnight to temporarily reshape the cornea and correct myopia without surgery or daytime lens use. This non-invasive method is particularly favored for children and adolescents as a safe alternative to progressive myopia and is gaining rapid adoption.

End Users: Ophthalmic Clinics and Ambulatory Surgical Centers

Ophthalmic clinics constitute the largest end-user segment in the myopia treatment devices market. These clinics provide specialized diagnostic services and personalized treatment options such as corrective lenses and laser surgeries, making them preferred care centers for myopia patients.

Ambulatory surgical centers show the fastest growth rate due to their cost-efficiency and convenience for refractive surgeries and other ambulatory procedures. Their rising popularity enables easy access to myopia corrective surgeries without the need for hospital stays, supporting market growth.

Age Groups: Adult Dominance with Rapid Pediatric Adoption

Adults currently represent the largest age group utilizing myopia treatment devices, primarily due to sustained vision care needs induced by lifestyle factors, prolonged screen use, and aging-related eye changes.

Nonetheless, children and adolescents are the fastest-growing age group segment driven by increased early diagnosis and intervention strategies to counter myopia progression. Rising parental awareness and school eye health programs promote early treatment adoption among these younger populations.

Distribution Channels: Optical Retail Chains and Online Platforms

Optical retail chains lead as the primary distribution channel for myopia treatment devices, benefiting from their widespread physical presence, established customer relationships, and comprehensive eyewear collections.

These chains cater to the bulk of eyeglass and contact lens sales. Meanwhile, online platforms are experiencing rapid growth owing to their convenience, broader product selection, competitive pricing, and integrated digital eye tests or consultations. The surge in e-commerce for vision care products is expanding access and transforming traditional retail dynamics.

Myopia Treatment Devices Market Companies

- Carl Zeiss Meditec AG

- Johnson & Johnson Vision Care

- EssilorLuxottica

- Alcon Inc.

- Bausch + Lomb

- Hoya Corporation

- CooperVision Inc.

- Ziemer Ophthalmic Systems

- NIDEK Co., Ltd.

- Topcon Corporation

- STAAR Surgical Company

- SCHWIND eye-tech-solutions

- Oculus Optikgeräte GmbH

- Menicon Co., Ltd.

- Contamac Holdings Limited

- Visioneering Technologies, Inc.

- Medennium Inc.

- Haag-Streit Group

- Luneau Technology Group

- Canon Medical Systems Corporation

Challenges and Cost Pressures: What Barriers Lie Ahead?

Despite rapid advancements, the market faces challenges such as lengthy regulatory approvals that delay new device introductions, significant compliance costs especially for smaller firms, and intense competition diluting adoption rates across technologies. Furthermore, regional regulatory differences complicate expansion and limit timely patient access. Cost pressures arise from high marketing expenses and the need for continuous innovation to stay competitive.

Case Study Highlight: Cloud-Based Ortho-K Design Enhances Patient Outcomes

A growing trend is the adoption of cloud-powered orthokeratology lens design tools that reduce clinical chair time and improve lens customization accuracy. For instance, a multi-center pediatric myopia control program employing cloud-enabled diagnostics reported faster patient turnaround and higher satisfaction rates while controlling myopia progression more effectively. This case exemplifies how technology empowers practitioners and benefits patients simultaneously.

Read Also: Pharmaceutical Market

Take the Next Step: Access Our Sample Report or Schedule a Consultation

For detailed insights and customized market analysis on myopia treatment devices, download our comprehensive sample report or schedule a consultation with our expert analysts at Precedence Research. Unlock data-driven strategies and forecast models tailored for your business needs today.

Contact: sales@precedenceresearch.com

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025

- Pill Timer Market Size to Hit $2.94 Bn by 2034 | 9.02% CAGR Growth Forecast - August 12, 2025

- Blood Glucose Monitoring Market Size to Worth USD 25.53 Billion by 2034 - August 11, 2025