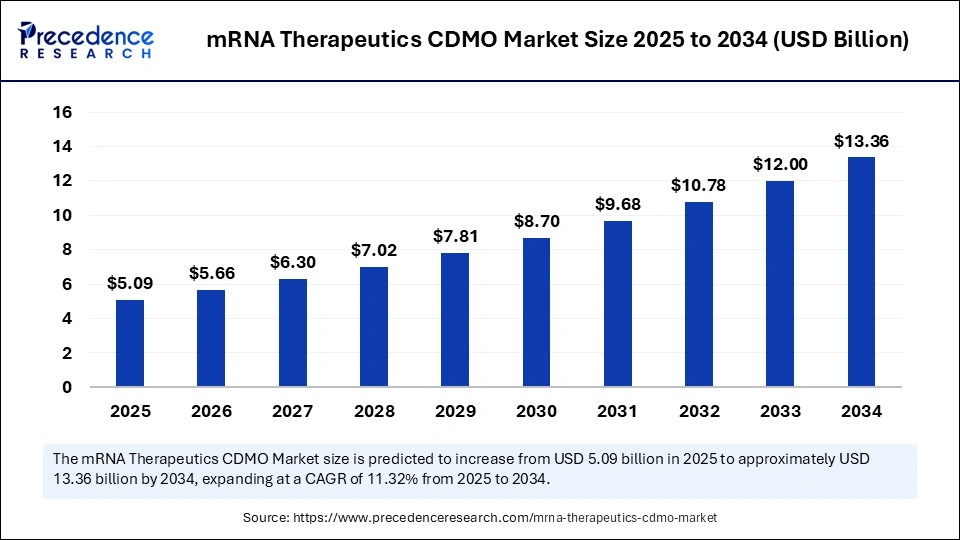

The global mRNA therapeutics CDMO market size is estimated to gain around USD 13.36 billion by 2034 from USD 4.57 billion in 2024, with a CAGR of 11.32%.

mRNA Therapeutics CDMO Market Key Insights

-

North America accounted for the largest revenue share of 38% in 2024.

-

The Asia Pacific region is projected to grow at a robust CAGR of 10.83% between 2025 and 2034.

-

By application, the viral vaccines segment held the highest revenue share in 2024.

-

The cancer immunotherapies segment is expected to register significant growth from 2025 to 2034.

-

Based on indication, the infectious diseases segment led the market with the largest revenue share in 2024.

-

The metabolic and genetic diseases segment is forecasted to grow at the fastest CAGR of 11.75% during the forecast period.

-

In terms of end use, biotech companies dominated the market with a 60% share in 2024.

-

The government and academic research institutes segment is anticipated to grow at the highest CAGR of 11.63% from 2025 to 2034.

What Are mRNA Therapeutics and What Role Do CDMOs Play?

mRNA therapeutics are a class of drugs that use messenger RNA (mRNA) to instruct cells to produce specific proteins to prevent or treat diseases. Unlike traditional therapies, mRNA treatments are not protein-based or cell-based but rather deliver the genetic blueprint for the body to make its own therapeutic proteins. This approach gained global attention with the success of mRNA-based COVID-19 vaccines and is now being explored for cancer immunotherapy, genetic disorders, and infectious diseases.

CDMOs (Contract Development and Manufacturing Organizations) are vital partners in the development and production of mRNA therapeutics. They offer specialized services like process development, mRNA synthesis, lipid nanoparticle formulation, aseptic fill-finish, and regulatory support. As mRNA products require highly complex manufacturing processes and facilities, CDMOs enable biotech and pharma companies to accelerate time to market without investing in costly infrastructure.

How is AI Accelerating the mRNA Therapeutics CDMO Market?

AI is playing a pivotal role in the mRNA therapeutics CDMO (Contract Development and Manufacturing Organization) market by enhancing the speed and precision of drug development. Machine learning models help identify optimal mRNA sequences, predict molecular stability, and streamline formulation processes. This allows CDMOs to develop more effective and targeted therapies while reducing time-to-market.

In manufacturing, AI-driven systems improve scalability and quality assurance. Real-time data analytics enable predictive maintenance, monitor critical process parameters, and ensure consistent batch quality. AI also aids in regulatory compliance by generating detailed reports and traceable data records. Overall, AI empowers CDMOs to deliver faster, safer, and more cost-effective mRNA-based treatments.

Growth Factors in the mRNA Therapeutics CDMO Market

The rising adoption and maturation of mRNA technologies—boosted by breakthrough lipid nanoparticle (LNP) delivery systems, improved stability, and the success of COVID‑19 vaccines—have dramatically increased demand for CDMO expertise in mRNA synthesis, formulation, purification, and scalable manufacturing. A robust and expanding pipeline of mRNA-based therapeutics targeting infectious diseases, oncology, and genetic disorders further fuels this demand. Additionally, heightened R&D investments by pharmaceutical and biotech firms—driven by proven efficacy and regulatory flexibility—are prompting them to partner with CDMOs to accelerate development timelines and mitigate investment risks.

Strategic collaboration and capacity expansion among CDMOs are another key driver. Partnerships between developers and contract organizations—such as Moderna with Thermo Fisher and AstraZeneca with CanSino—and investments like Vernal Biosciences’ funding rounds are expanding in scope and scale. Geographic diversification, with rapid growth in the Asia-Pacific region and a stronghold in North America and Europe, reflects both rising regional biotech capabilities and outsourcing trends. These dynamics enable CDMOs to offer tailored, flexible, and quality-compliant services—meeting regulatory standards and delivering faster, cost-effective solutions for emerging mRNA therapies.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 13.36 Billion |

| Market Size in 2025 | USD 5.09 Billion |

| Market Size in 2024 | USD 4.57 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.32% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Indication, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

The mRNA therapeutics CDMO (Contract Development and Manufacturing Organization) market is being driven by a surge in interest in mRNA technology following its success in COVID-19 vaccines. The adaptability, rapid development timeline, and strong immunogenic properties of mRNA have led to expanding research and commercial focus on its applications beyond infectious diseases, particularly in oncology, rare genetic disorders, and personalized medicine.

As biopharmaceutical companies seek to leverage this modality, they increasingly turn to CDMOs for the specialized expertise, infrastructure, and scalable manufacturing capabilities required for mRNA production. The complexity of mRNA therapeutics—encompassing synthesis, encapsulation in lipid nanoparticles (LNPs), and cold-chain logistics—has made outsourcing a strategic necessity. Moreover, public and private funding support for mRNA-based research and production infrastructure is fueling the demand for end-to-end CDMO solutions covering development, GMP manufacturing, and fill-finish services.

Market Opportunities

The mRNA therapeutics CDMO market offers robust growth opportunities as the pipeline for mRNA-based therapies expands rapidly. Beyond vaccines, mRNA is gaining traction in therapeutic areas like cancer immunotherapy, cardiovascular diseases, protein replacement therapies, and autoimmune conditions. Each of these indications requires customized mRNA sequences and delivery methods, opening doors for CDMOs to provide tailored development, analytical, and manufacturing services.

Technological advancements in lipid nanoparticle formulation and delivery systems are also creating demand for specialized partners with the capabilities to co-develop or optimize these platforms. Additionally, the rise of personalized medicine, especially cancer vaccines designed for individual patients, presents a high-value opportunity for flexible, small-batch, GMP-compliant manufacturing. The ongoing trend of biopharma companies reducing internal manufacturing investments in favor of partnering with CDMOs further strengthens the long-term potential of this market.

Market Challenges

Despite its promising outlook, the mRNA therapeutics CDMO market faces several challenges. One major barrier is the significant capital investment required to establish or upgrade facilities with the specialized equipment and cleanroom environments needed for mRNA synthesis and LNP formulation. The industry also suffers from a limited talent pool with experience in nucleic acid technologies, which can constrain growth and affect project timelines.

Intellectual property (IP) and technology transfer complexities are also key hurdles, especially as companies navigate proprietary lipid nanoparticle formulations or platform technologies. Regulatory uncertainty regarding the long-term safety and efficacy of mRNA therapeutics—especially outside of the vaccine space—adds an additional layer of risk, requiring CDMOs to maintain rigorous compliance standards and adapt to evolving guidelines. Furthermore, supply chain vulnerabilities, including limited availability of critical raw materials such as nucleotides and cationic lipids, can disrupt production and delay deliveries.

Regional Outlook

North America currently dominates the mRNA therapeutics CDMO market, supported by the strong presence of pioneering mRNA technology companies like Moderna and a mature CDMO landscape with robust regulatory oversight. The U.S. leads in clinical development pipelines, R&D investments, and biomanufacturing infrastructure, making it a hub for outsourcing opportunities.

Europe follows closely, particularly in countries like Germany, Switzerland, and Belgium, which have established capabilities in advanced biologics and a proactive regulatory environment. The region is also benefiting from EU-funded initiatives to boost vaccine self-sufficiency and pandemic preparedness. The Asia-Pacific region is emerging as a high-growth area, with countries like China, India, and South Korea investing heavily in biomanufacturing capacity and attracting global partnerships.

These countries offer cost advantages and growing expertise in biologics, though regulatory harmonization remains a work in progress. Latin America and the Middle East & Africa currently represent smaller markets but may see increased interest in local mRNA manufacturing capacity as part of global health equity and vaccine sovereignty efforts.

Roles of Key Companies in the mRNA Therapeutics CDMO Market

Danaher (Aldevron)

Aldevron, part of Danaher, is a leading contract manufacturer specializing in high-quality plasmid DNA, mRNA, and proteins. The company supports biotech and pharmaceutical clients with process development, large-scale GMP manufacturing, and critical raw materials for mRNA vaccines and therapeutics.

Biomay AG

Biomay AG offers comprehensive CDMO services, including process development, GMP manufacturing, and analytical testing for mRNA and DNA products. Biomay is known for its expertise in scaling up mRNA production for clinical and commercial applications, supporting vaccine and therapeutic developers.

Bio-Synthesis, Inc.

Bio-Synthesis, Inc. provides custom synthesis of mRNA, oligonucleotides, and related biomolecules. The company supports research and early-stage clinical development by offering tailored solutions for mRNA design, synthesis, and modification.

eTheRNA

eTheRNA is a biotechnology company with integrated CDMO capabilities, focusing on the development and manufacture of mRNA-based immunotherapies. The company provides end-to-end solutions, from mRNA design and optimization to GMP manufacturing, mainly targeting oncology and infectious diseases.

Kaneka Eurogentec S.A.

Kaneka Eurogentec S.A. delivers CDMO services for nucleic acids, including mRNA, with expertise in process development, large-scale GMP manufacturing, and quality control. The company serves pharmaceutical and biotech clients developing mRNA vaccines and therapeutics.

TriLink BioTechnologies

TriLink BioTechnologies is a leading provider of mRNA synthesis, capping technologies, and custom nucleic acid manufacturing. The company supports preclinical and clinical mRNA therapeutic programs, offering scalable production and proprietary technologies for enhanced mRNA stability and translation.

ApexBio Technology

ApexBio Technology offers synthesis and manufacturing services for oligonucleotides and mRNA, supporting research and early-stage therapeutic development. The company provides custom solutions for mRNA design, synthesis, and modification.

BioNTech SE

BioNTech SE is a pioneer in mRNA therapeutics, with extensive in-house and partnered CDMO capabilities. The company develops and manufactures mRNA-based vaccines and therapies and collaborates with CDMOs to scale up production for global distribution.

Biocina

Biocina is an emerging CDMO focused on mRNA and other biologics manufacturing. The company offers process development, GMP manufacturing, and analytical services to support clinical and commercial mRNA therapeutic programs.

Lonza

Lonza is one of the foremost CDMOs in the mRNA field, providing integrated development and manufacturing services for mRNA therapeutics and vaccines. Lonza’s expertise spans process optimization, large-scale GMP production, and regulatory support for global clients.

Recipharm AB

Recipharm AB offers CDMO services for mRNA therapeutics, including process development, formulation, and GMP manufacturing. The company supports clients from early-stage development through commercial production, with a focus on quality and scalability.

Novo Holdings (Catalent, Inc.)

Catalent, under Novo Holdings, is a major CDMO providing end-to-end solutions for mRNA therapeutics, including formulation, fill-finish, and large-scale GMP manufacturing. Catalent’s capabilities are critical for rapid scale-up and commercialization of mRNA vaccines and therapies.

Samsung Biologics

Samsung Biologics has expanded its CDMO offerings to include mRNA therapeutics, investing in advanced manufacturing infrastructure and technology. The company provides process development, GMP manufacturing, and analytical services to support global mRNA therapeutic development and commercialization..

Also Read: Synthetic Small Molecule API Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6195

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344

- Arteriovenous Implants Market Enhance dialysis outcomes with advanced grafts, endovascular access, and AI-assisted precision - September 16, 2025

- Smart Retinal Implants Market Restore vision with wireless bioelectronic prosthetics and AI-powered retinal technologies - September 16, 2025

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025