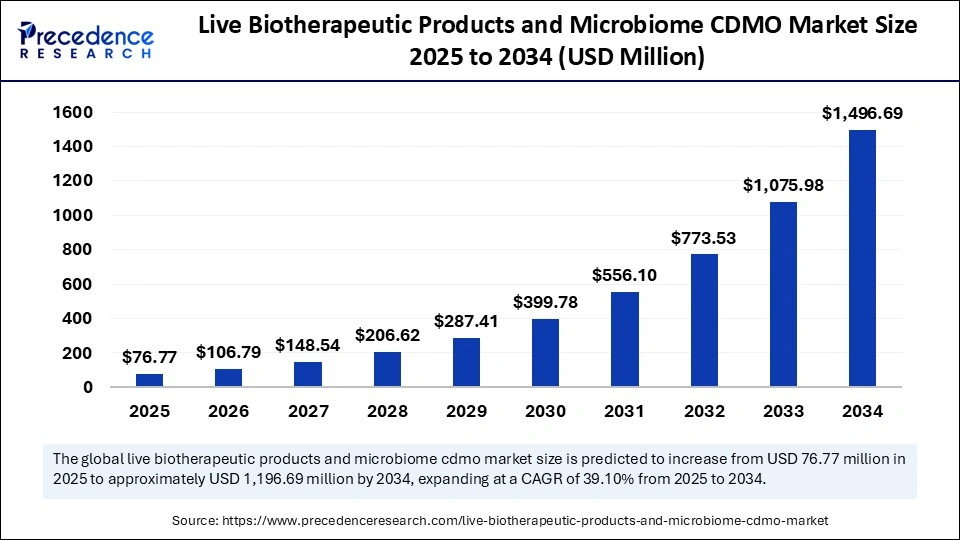

The global live biotherapeutic products and microbiome CDMO market size is estimated to attain around USD 1,496.69 million by 2034 from USD 55.19 million in 2024, at a CAGR of 39.10%.

Live Biotherapeutic Products and Microbiome CDMO Market Key Points

-

North America accounted for the majority of revenue in 2024, holding a substantial 72% share.

-

The Asia Pacific region is projected to grow at a strong double-digit CAGR of 44.95% between 2025 and 2034.

-

By application, the C. difficile segment dominated the market with an 87.11% revenue share in 2024.

-

The IBS (Irritable Bowel Syndrome) segment is expected to grow at a notable CAGR over the forecast period.

What Are Live Biotherapeutic Products and Why Are They Important?

Live Biotherapeutic Products (LBPs) are a class of biological drugs that contain live microorganisms—such as specific strains of bacteria—that provide therapeutic benefits to the host when administered in adequate amounts. Unlike probiotics, LBPs are developed under stringent pharmaceutical standards and are designed to treat, prevent, or cure specific diseases. They are particularly promising in areas like gut health, immune disorders, neurological conditions, metabolic diseases, and even cancer through modulation of the human microbiome.

LBPs act by interacting with the host’s microbiota, immune system, or metabolic pathways, offering a novel and highly targeted approach to disease management. As scientific understanding of the human microbiome deepens, LBPs are emerging as a transformative category in personalized and precision medicine.

What Role Do Microbiome CDMOs Play in Developing Live Biotherapeutics?

Microbiome CDMOs (Contract Development and Manufacturing Organizations) specialize in helping pharmaceutical and biotech companies develop, scale, and manufacture LBPs and other microbiome-based therapies. These CDMOs offer expertise in anaerobic fermentation, microbial strain isolation, downstream processing, lyophilization, encapsulation, and GMP-compliant production—all of which are critical for live microorganism stability and efficacy.

Given the highly sensitive and complex nature of microbiome therapeutics, CDMOs ensure strict environmental controls, microbial viability, and regulatory compliance. With increasing investments in microbiome research and a growing number of clinical trials involving LBPs, microbiome CDMOs are becoming essential partners in bringing next-generation biologics to market. The market is expected to grow significantly, driven by the surge in demand for innovative treatments for chronic and lifestyle-related diseases.

How is AI Advancing the Live Biotherapeutic Products and Microbiome CDMO Market?

AI is revolutionizing the live biotherapeutic products and microbiome CDMO market by accelerating microbiome-based drug discovery and development. Through advanced machine learning, AI can analyze complex microbial data sets to identify beneficial strains, predict their interactions within the human body, and model therapeutic outcomes. This reduces the need for lengthy experimental trials and enables faster, more targeted product development.

In the manufacturing domain, AI enhances process optimization, quality control, and regulatory compliance. It enables real-time monitoring of live cultures, ensuring the stability and viability of microbial formulations. AI also supports predictive maintenance and supply chain optimization, helping CDMOs scale production while maintaining high standards. As a result, AI is becoming integral to delivering safe, effective, and personalized microbiome-based therapies.

Growth Factors Driving the Live Biotherapeutic & Microbiome CDMO Market

Regulatory clarity, infrastructure investments, and global expansion further fuel market growth. North America leads the market, largely due to its R&D ecosystem and clinical trial activity, while Asia-Pacific—especially China, Japan, and India—exhibits the fastest CAGR, benefiting from rising healthcare investment and outsourcing trends. Collaborations, M&A activity, and significant private/public funding strengthen CDMO capabilities and geographic reach. With the global CDMO market forecasted to grow at 40–45% annually—projected to reach approximately USD 395 million by 2030—the sector is on track to support the next wave of microbiome-based therapeutics through robust, scalable, and compliant manufacturing solutions

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,496.69 Million |

| Market Size in 2025 | USD 76.77 Million |

| Market Size in 2024 | USD 55.19 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 39.10% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

The Live Biotherapeutic Products (LBPs) and microbiome CDMO market is gaining momentum as research increasingly supports the role of the human microbiome in health and disease. LBPs—defined by the FDA as biological products containing live microorganisms applicable for disease treatment—are at the forefront of next-generation therapies for conditions such as inflammatory bowel disease, Clostridioides difficile infection, neurological disorders, and metabolic diseases. This emerging class of therapeutics is pushing pharmaceutical and biotech companies to seek specialized CDMO partners capable of managing the unique complexities of cultivating live microbes, ensuring product viability, and maintaining GMP standards throughout development and production.

As clinical pipelines expand and more LBP therapies enter clinical trials, demand for microbiome-focused CDMO services—from strain selection and process development to encapsulation, lyophilization, and packaging—continues to rise. Regulatory support, increased funding for microbiome research, and the growing interest in personalized medicine are also significant market drivers.

Market Opportunities

There are considerable growth opportunities within the microbiome CDMO landscape. One of the most promising areas is in personalized live biotherapeutics, which aim to modulate an individual’s microbiome with targeted microbial consortia. The ability of CDMOs to offer tailored manufacturing solutions for such patient-specific products will become increasingly valuable as precision medicine gains traction. Additionally, the growing application of LBPs in oncology—particularly in enhancing immunotherapy responses—presents a high-growth opportunity. Another emerging segment is the use of microbiome-based therapeutics in mental health, where the gut-brain axis is being actively explored.

CDMOs that can deliver end-to-end solutions, including advanced analytics and regulatory support, are particularly well-positioned to capitalize on these developments. Furthermore, partnerships with academic institutions, digital health firms, and AI-driven microbiome analytics companies can open doors to novel strain development and characterization, providing a competitive edge in the market.

Market Challenges

Despite its strong growth potential, the market for microbiome and LBP CDMO services faces several challenges. Manufacturing live microorganisms at commercial scale poses significant hurdles related to strain stability, viability, and contamination risk. Maintaining strict anaerobic or microaerophilic conditions, controlling moisture content, and ensuring shelf stability throughout the supply chain require highly specialized infrastructure and expertise. Moreover, regulatory pathways for LBPs remain relatively new and are still evolving, creating uncertainty for both sponsors and manufacturers regarding clinical requirements, product classification, and labeling.

This can lead to delays in development and additional costs related to compliance. Intellectual property issues and strain ownership rights also complicate technology transfers and licensing agreements. Additionally, as the space becomes more competitive, CDMOs will need to continually invest in new capabilities—such as bioinformatics, rapid microbiome diagnostics, and biocontainment facilities—to differentiate themselves and meet client demands.

Regional Outlook

North America holds the largest share in the Live Biotherapeutic Products and microbiome CDMO market, largely driven by the presence of innovative biotech firms, academic research hubs, and supportive regulatory agencies like the FDA that have established draft guidelines for LBP development. The U.S. also benefits from a robust funding ecosystem that supports early-stage microbiome research and translation into clinical applications.

Europe represents the second-largest market, particularly in countries such as the UK, France, Germany, and the Netherlands, where investments in microbiome therapeutics are expanding, and regulatory bodies are progressively adapting to the emerging LBP space. Meanwhile, the Asia-Pacific region is experiencing accelerated growth as countries like Japan, South Korea, and China ramp up investments in advanced biologics infrastructure and promote gut microbiome research through public-private partnerships.

These regions are also offering competitive advantages in cost-effective production. Latin America and the Middle East & Africa remain nascent markets but show potential as international organizations promote global access to novel microbiome therapies, especially for infectious and gastrointestinal diseases prevalent in these regions

Live Biotherapeutic Products and Microbiome CDMO Market Companies

- Arrant Bio

- 4D Pharma

- Cerbios

- Biose Industrie

- Assembly Biosciences, Inc.

- Wacker Chemie AG

- Quay Pharmaceuticals

- NIZO

- Lonza

- Inpac Probiotics

Segments Covered in the Report

By Application

- C. Difficile

- Crohn’s Disease

- IBS

- Diabetes

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Also Read: mRNA Therapeutics CDMO Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6196

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344

- Arteriovenous Implants Market Enhance dialysis outcomes with advanced grafts, endovascular access, and AI-assisted precision - September 16, 2025

- Smart Retinal Implants Market Restore vision with wireless bioelectronic prosthetics and AI-powered retinal technologies - September 16, 2025

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025