Liposomal Supplements Market Key Takeaways

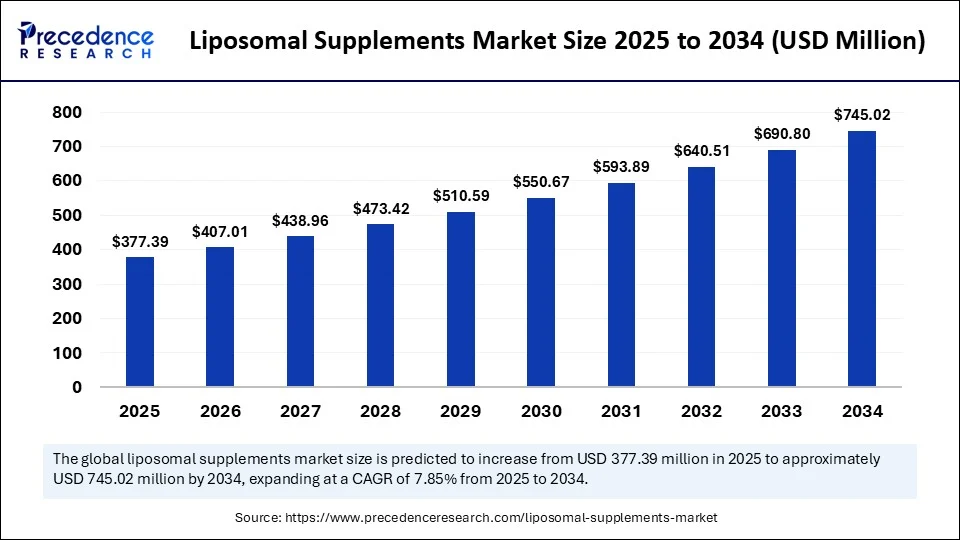

- In terms of revenue, the global liposomal supplements market was valued at USD 349.92 million in 2024.

- It is projected to reach USD 745.02 million by 2034.

- The market is expected to grow at a CAGR of 7.85% from 2025 to 2034.

- North America dominated the liposomal supplements market with the largest share of about 42.3% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By product type, the vitamins segment led the market, under which the vitamin C sub-segment held a 18.7% market share in 2024.

- By product type, the antioxidants segment is expected to grow at the fastest rate, under which the glutathione segment is likely to lead the charge between 2025 and 2034.

- By application, the immune health segment contributed the biggest market share of 24.2% in 2024.

- By application, the cognitive support and brain health segment is expanding at a significant CAGR between 2025 and 2034.

- By formulation type, the liquid segment contributed the highest market share of 41.5% in 2024.

- By formulation type, the capsules/softgels segment is expected to grow at a significant CAGR over the projected period.

- By distribution channel, the online retail (third party) segment held the largest market share of 36.9% in 2024.

- By distribution channel, the direct-to-consumer subscription segment is expected to grow at a notable CAGR from 2025 to 2034.

- By end user, the adults segment generated the major market share of 59.4% in 2024.

- By end user, the athletes/fitness enthusiasts segment is expected to grow at a notable CAGR from 2025 to 2034.

Impact of Artificial Intelligence on the Liposomal Supplements Market

Artificial intelligence (AI) is playing a growing role in the Liposomal Supplements Market, especially in product development, manufacturing optimization, quality control, and personalized nutrition. Companies deploy AI algorithms to analyze clinical, biochemical, and consumer data, enabling them to formulate liposomal supplements tailored to individual health needs—such as immune function, cognition, or nutritional gaps.

AI also improves manufacturing consistency and encapsulation efficiency by predicting optimal formulations and processing conditions, accelerating discovery of novel liposomal compositions and boosting accessibility of next‑generation products across the supplement space.

Market Overview

The Liposomal Supplements Market involves encapsulating vitamins, antioxidants, botanicals, amino acids, and other bioactives within phospholipid-based liposomes to protect active ingredients during digestion and improve cellular uptake. In 2024, the market size stood at approximately USD 349 million, with projection to nearly USD 745 million by 2034 at a CAGR of 7.85%.

Liposomes mimic human cell membranes and enable significantly higher absorption rates—for example, liposomal vitamin C can deliver nearly 90 percent absorption vs. ~20 percent for a standard tablet. As health-conscious consumers increasingly demand efficacy per dose—especially elder care, immune support, sports nutrition, and clinical supplementation segments—the liposomal format shifts emphasis from pill potency to delivery efficiency.

Drivers

Several key factors are fueling growth in the Liposomal Supplements Market:

-

Bioavailability demand: Awareness of conventional supplement limitations drives interest in liposomal formulations that deliver higher systemic absorption and improved nutrient utilization.

-

Aging population and chronic disease prevalence: Age-related nutrient deficiency and lifestyle‑related health conditions spur demand for effective supplementation, particularly among older adults seeking cognitive, immune, and anti-aging support.

-

Consumer preferences: Interest in clean-label, vegan-friendly, and plant-derived supplements supports liposomal formats that use plant phospholipids and avoid allergens or GMOs.

-

Online retail expansion: Growth in e‑commerce and D2C models improves access to niche, premium liposomal supplements.

-

Technological innovation: Advancements in encapsulation technologies like microfluidization, high-pressure homogenization, reverse-phase evaporation, PEGylation, and stealth liposomes enhance stability and shelf-life of products.

Opportunities

-

New formulations: Combining multiple actives—e.g. vitamin C + glutathione, curcumin + B‑complex, or CBD formulations—targeting specific conditions like immunity, oxidative stress, or cognitive wellness.

-

Emerging markets: Asia Pacific, Latin America, and the Middle East & Africa offer high growth potential due to rising income, awareness, and healthcare spending.

-

Customized nutrition: Personalized liposomal supplement bundles based on genetic, lifestyle, or health data empower targeted wellness solutions.

-

Packaging innovation: Convenient delivery formats—such as single‑serve sachets, emulsion pouches, or cold‑chain sachets—enhance consumer appeal for on‑the‑go or clinical use.

-

Scientific validation: Rigorous clinical trials demonstrating lipid encapsulation efficacy in key nutrients (vitamin C, glutathione, curcumin) can build trust and expand adoption, especially in healthcare or practitioner‑recommended channels.

Challenges

-

High production costs: Liposomal encapsulation demands specialized equipment and phospholipid input, making formulation costs 40–60 percent higher than traditional supplements, resulting in premium pricing that may deter price‑sensitive consumers.

-

Consumer awareness gap: Many consumers cannot accurately define liposome technology—surveys show 68 percent inability to explain liposomal format—which impedes adoption. Healthcare professionals also show limited recommendation rates due to insufficient familiarity.

-

Regulatory ambiguity: Dietary supplement regulations across regions vary; liposomal claims may lack required bioavailability proofs, and inconsistent standards undermine consumer confidence.

-

Quality inconsistency: Some products fail to deliver claimed encapsulation efficiency or stability; oxidation and sensory issues (rancid taste, liquid texture) reduce repeat usage.

-

Shelf‑life and supply chain constraints: Cold-chain needs, temperature sensitivity, and perishable packaging elevate logistics complexity.

-

Competitive alternatives: Traditional formulations, IV vitamin injections, or next-gen delivery systems like nanoemulsions pose competition.

Recent Developments

-

In June 2024, an Indian firm launched its “Lipoboost” range—13 liposomal ingredients (vitamin C, D3, B12, magnesium, curcumin, CoQ10, glutathione)—designed for enhanced absorption and efficacy.

-

Product innovation has brought forth new formulations in antioxidants (glutathione), botanical nanocarriers (curcumin, quercetin), CBD-based liposomal supplements, and combination blends targeting brain, immune, and metabolic health.

-

Packaging improvements include single-serve liquid sachets and emulsion-filled pouches aimed at convenience and maintaining payload integrity.

-

Clean-label trends push use of plant-derived phospholipids and vegan liposomal variants.

-

Asia Pacific expansion is underway, with growing distribution in emerging markets such as India, China, and Japan, supported by rising health awareness and disposable income.

Liposomal Supplements Market Companies

- Altrient (by LivOn)

- Amandean

- Aurora Nutrascience

- BioCeuticals

- Core Med Science

- Cymbiotika

- DaVinci Laboratories

- Designs for Health

- Dr. Mercola

- Elyptol

- Empirical Labs

- LipoLife

- LivOn Labs

- Nutrivene

- Pure Encapsulations

- Quicksilver Scientific

- Seeking Health

- SMP Nutra

- Thorne HealthTech

- Valimenta Labs

Segments Covered in the Report

By Product Type

- Vitamins

- Vitamin C (Ascorbic Acid)

- Vitamin D3

- Vitamin B12

- Multivitamins

- Others

- Minerals

- Magnesium

- Zinc

- Iron

- Others

- Antioxidants

- Glutathione

- Coenzyme Q10 (CoQ10)

- Alpha Lipoic Acid

- Others

- Herbal Extracts

- Curcumin

- Ashwagandha

- Ginseng

- Others

- Fatty Acids & Oils

- Omega-3 (DHA/EPA)

- Phosphatidylcholine

- Others

- Amino Acids & Peptides

- L-Carnitine

- L-Theanine

- Glutamine

- Others

- Cannabinoids

- Liposomal CBD

- Others

- Probiotics & Enzymes

- Others (e.g., Melatonin, NAD+, NMN, Resveratrol)

By Application

- General Health & Wellness

- Immune Health

- Anti-Aging & Skin Health

- Cognitive Support & Brain Health

- Cardiovascular Health

- Sports Nutrition & Recovery

- Stress & Sleep Management

- Digestive Health

- Others

By Formulation Type

- Liquid

- Gel

- Powder (Reconstitutable)

- Capsules / Softgels

- Sprays / Oral Pump Dispensers

- Others

By Distribution Channel

- Online Retail

- Brand-owned E-commerce

- Third-party E-commerce (Amazon, iHerb, etc.)

- Offline Retail

- Health & Wellness Stores

- Pharmacies / Drugstores

- Supermarkets / Hypermarkets

- Others

- Practitioner / Clinic-Based Sales

- Direct-to-Consumer (DTC) Subscriptions

By End User

- Adults

- Geriatric Population

- Pediatrics

- Athletes / Fitness Enthusiasts

- Pregnant & Lactating Women

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get sample link @ https://www.precedenceresearch.com/sample/6510

- Estrogen Replacement Therapy Market Size to Reach USD 19.46 Billion by 2034 - September 18, 2025

- Peptide Therapeutics CDMO Market Report Size, Share & Forecast 2034 - September 17, 2025

- Rare Musculoskeletal Disorder Treatments Market Size, Share & Future Trends 2034 - September 17, 2025