Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6395

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6395

Lipase Inhibitors Obesity Drugs Market Key Highlights

- North America held the largest market share of 39% in 2024, leading the global market.

-

The Asia Pacific region is projected to register the fastest growth rate throughout the forecast period.

-

Based on drug type, Orlistat dominated the market with an 81% share in 2024, while Cetilistat is forecasted to grow at a remarkable CAGR through 2034.

-

By formulation, capsules held the largest market share of 68% in 2024, whereas soft gels and oral films are expected to expand significantly during the forecast period.

-

In terms of route of administration, oral formulations contributed the vast majority of the market share at 98% in 2024. The transdermal route is expected to gain traction with a notable CAGR over the next decade.

-

When segmented by distribution channel, retail pharmacies generated the highest market share of 46% in 2024, while online pharmacies are poised for significant growth in the coming years.

-

Based on patient group, adults accounted for a dominant 89% share in 2024. The pediatric/adolescent segment is projected to grow at a notable CAGR through 2034.

Lipase Inhibitors Obesity Drugs Market Overview

Lipase inhibitors are pharmaceutical agents that block the activity of pancreatic lipase, an enzyme essential for fat digestion. By inhibiting fat absorption in the intestine, these drugs promote weight loss, making them effective in managing obesity. This therapy is especially appealing due to its non-invasive nature, allowing patients to avoid surgical procedures.

The end-users include overweight and obese individuals across a wide age range, particularly those with associated conditions like Type 2 diabetes and cardiovascular risk. As sedentary lifestyles, poor dietary patterns, and stress-related disorders become more common globally, demand for pharmacological obesity solutions is on the rise. The market is evolving to favor user-friendly, safer, and more effective formulations that align with consumers’ growing preference for long-term weight management strategies.

Market Scope

| Report Coverage | Details |

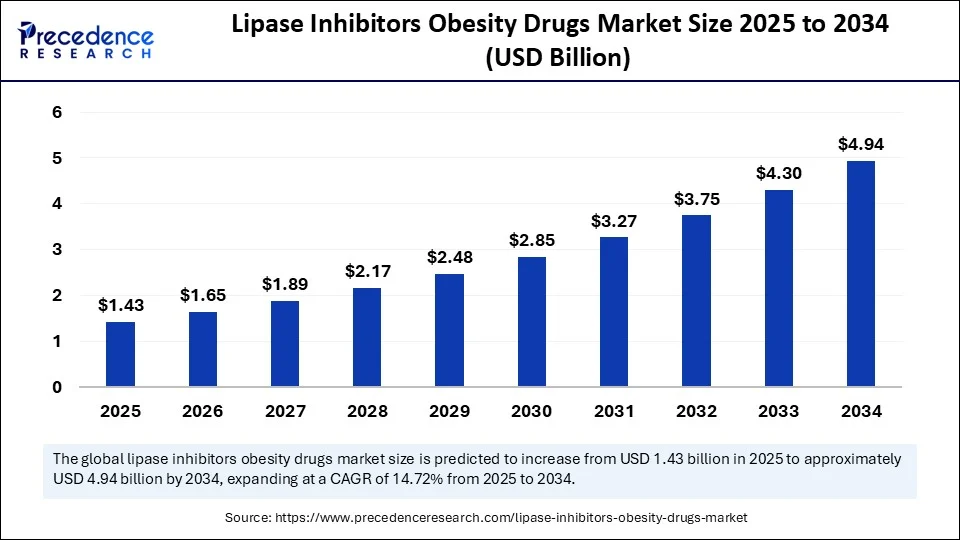

| Market Size by 2034 | USD 4.94 Billion |

| Market Size in 2025 | USD 1.43 Billion |

| Market Size in 2024 | USD 1.25 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.72% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Type, Formulation, Route of Administration, Distribution Channel, Patient Group, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Lipase Inhibitors Obesity Drugs Market Dynamics

Drivers

-

Global Surge in Obesity Rates: With more than 1 billion adults classified as obese, demand for obesity drugs, particularly lipase inhibitors, is escalating.

-

Preference for Non-Invasive Treatments: Patients are increasingly opting for pharmacological therapies over surgical interventions like bariatric surgery.

-

Government and Institutional Support: Public health initiatives and insurance reimbursements are helping boost accessibility to anti-obesity drugs.

-

Advances in Formulation and Delivery: Innovations in oral drug design, extended-release formats, and fewer gastrointestinal side effects are improving patient adherence.

Restraints

-

Adverse Effects and Low Long-Term Compliance: Common side effects such as diarrhea or gastrointestinal discomfort limit widespread adoption.

-

Regulatory Challenges: Strict safety and efficacy requirements for anti-obesity drugs can delay approval timelines.

-

Affordability in Emerging Markets: High costs and limited reimbursement may restrict access in low- and middle-income countries.

Opportunities

-

Growing Pediatric and Teen Obesity Segment: Formulations specifically designed for children and adolescents are in demand.

-

Rise of Telehealth and Online Pharmacies: Virtual consultations and e-prescriptions make drug access seamless.

-

AI-Powered Personalization: Tailored treatment regimens using AI and wearable integration improve outcomes and reduce adverse effects

Role of AI in the Lipase Inhibitors Obesity Drugs Market

Lipase Inhibitors Obesity Drugs Market Regional Insights

North America

-

Market Size (2024): Over USD 600 million

-

Growth Drivers: High obesity prevalence (42% in U.S. adults), presence of key pharmaceutical companies, and extensive clinical R&D

-

Policy Support: The FDA has approved multiple OTC and prescription lipase inhibitors; increasing insurance support for weight-loss treatments

Europe

-

Market Position: Stable growth with high regulatory scrutiny

-

Trends: Focus on natural and plant-based formulations; growing demand for combination therapies

-

Key Countries: Germany, UK, France – driven by government-supported anti-obesity programs

Asia Pacific

-

Fastest-Growing Market

-

Drivers: Urbanization, rise in disposable income, changing dietary patterns

-

Key Countries: China and India are major contributors due to their large populations and growing healthcare infrastructure

-

Barriers: Stigma around obesity treatment and fragmented regulatory policies

Lipase Inhibitors Obesity Drugs Market Segment Insights

By Drug/Device Type

-

Orlistat (Alli/Xenical) – The most commonly prescribed lipase inhibitor

-

Cetilistat – Newer class with fewer side effects in clinical trials

-

Natural Inhibitors – Gaining attention in wellness-conscious consumers

By Formulation/Technology

-

Capsules – Dominant form for ease of use

-

Soft Gels and Tablets – Preferred for patients with swallowing difficulties

-

Patches/Topical Solutions – Emerging non-oral delivery alternatives

By Route of Administration

-

Oral – Most widely adopted

-

Injectable – Used in combination therapies with GLP-1 analogs

-

Transdermal – Niche segment under development

By Distribution Channel

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies – Rapid growth fueled by convenience and telemedicine integration

By Patient Group

-

Adults (18–60 years) – Largest user base

-

Adolescents and Teens – Growing segment with rising youth obesity

-

High-Risk Individuals – Targeted for co-management of obesity with diabetes, hypertension, etc.

Recent Developments

-

Zydus Lifesciences launched clinical trials for a new herbal lipase inhibitor with reduced GI side effects.

-

Pfizer entered a partnership with a health-tech startup to integrate AI-driven obesity tracking with pharmacotherapy.

-

Roche reformulated its OTC Orlistat to enhance tolerability and packaging convenience.

-

Eli Lilly initiated development of combination therapies combining lipase inhibitors with GLP-1 analogs.

-

Novo Nordisk invested in a cloud-based obesity management ecosystem linking wearables with drug regimens

Key Companies

-

Roche Holding AG – Market leader with Xenical and Alli

-

GlaxoSmithKline plc – Strong presence in OTC obesity therapeutics

-

Zydus Lifesciences – Innovator in herbal lipase inhibitors

-

Pfizer Inc. – Active in digital obesity platforms and combination drug development

-

Novo Nordisk – Pioneering obesity and metabolic treatments

-

Eli Lilly and Company – Exploring GLP-1 and lipase inhibition synergies

-

Sun Pharmaceutical – Expanding generic Orlistat production

-

Takeda Pharmaceuticals – Active in GI-safe obesity drugs

-

Herbalife Nutrition – Focused on natural supplements with lipase-blocking effects

-

Amgen Inc.

-

Kowa Pharmaceuticals

-

Boehringer Ingelheim

-

Dr. Reddy’s Laboratories

-

Silence Therapeutics – Biotech player in RNA-based obesity therapies

-

Vivus Inc. – Known for combination weight-loss drug platforms

Future Outlook

The Lipase Inhibitors Obesity Drugs Market is positioned for a transformational decade, marked by increased acceptance of pharmacological obesity treatment, personalized and AI-integrated therapies, and greater regulatory support for early interventions. The future will see hybrid therapies combining lipase inhibitors with metabolic or behavioral treatments, as well as delivery innovations like oral thin films, subdermal implants, and sustained-release capsules.

Consumer demand is also shifting toward natural, side-effect-free solutions and digitally guided treatment paths, fostering partnerships between pharmaceutical firms, tech startups, and wellness platforms. This convergence of healthcare and technology will define the next era of obesity management.

Read Also: Peripheral Nerve Injury Market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 934

- Pill Timer Market Size to Hit $2.94 Bn by 2034 | 9.02% CAGR Growth Forecast - August 12, 2025

- Blood Glucose Monitoring Market Size to Worth USD 25.53 Billion by 2034 - August 11, 2025

- Diabetes Care Devices Market Set to Surge to USD 118.34 Billion by 2034, Driven by Innovation and Rising Prevalence - August 8, 2025