Implantable Insulin Pumps Market Key Takeaways

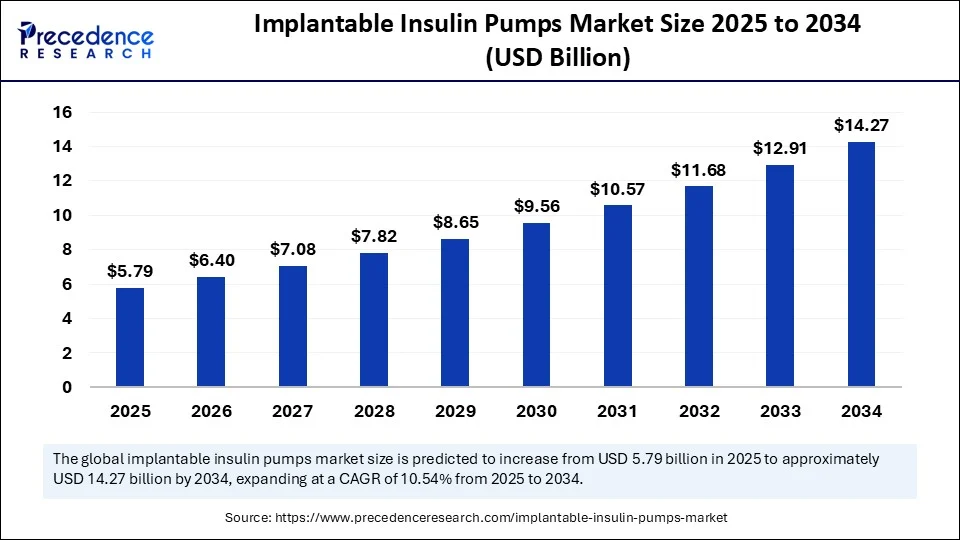

- In terms of revenue, the global implantable insulin pumps market was valued at USD 5.24 billion in 2024.

- It is projected to reach USD 14.27 billion by 2034.

- The market is expected to grow at a CAGR of 10.54% from 2025 to 2034.

- North America dominated the implantable insulin pumps market with the largest share of 44.7% in 2024.

- Asia Pacific is expected to grow at the highest CAGR from 2025 to 2034.

- By pump type, the programmable implantable pumps segment led the market with a 52.4% share in 2024 and is expected to sustain its position in the coming years.

- By reservoir size, the medium volume (10-20 ml) segment captured the biggest market share of 39.1% in 2024.

- By reservoir size, the large volume (>20 ml) segment is expected to grow at a significant CAGR over the projected period.

- By delivery mode, the combined basal-bolus delivery segment contributed the highest market share of 46.8% in 2024.

- By delivery mode, the continuous basal delivery segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By end user, the hospitals segment held the biggest market share of 41.3% in 2024.

- By end user, the homecare segment is expected to grow at the fastest CAGR from 2025 to 2034.

- By age group, the adults (18–64 years) segment generated the major market share of 54.2% in 2024.

- By age group, the pediatrics segment (≤17 years) is projected to grow at a significant CAGR between 2025 and 2034.

- By indication, the type 1 diabetes mellitus (T1DM) segment accounted for significant market share of 62.9% in 2024.

- By indication, the type 2 diabetes mellitus (T2DM) segment is expected to experience rapid growth during the forecast period.

- By distribution channel, the direct hospital procurement segment held a remarkeble market share of 47.5% in 2024.

- By distribution channel, the online pharmacy segment is expected to grow at a significant CAGR from 2025 to 2034.

How is AI Impacting the Implantable Insulin Pumps Market?

In the Implantable Insulin Pumps Market, AI is central to innovation in automated insulin delivery. Reinforcement learning algorithms and hybrid AI systems track glucose trends and daily variations to dynamically adjust basal–bolus dosing, improving time-in-range and reducing hypoglycemic events by up to 40–50%.

Closed-loop systems deploying ensemble deep‑reinforcement learning adapt rapidly to physiological changes and mealtime unpredictability. Remote patient monitoring platforms, underpinned by AI-driven telehealth frameworks, allow caregivers and clinicians to personalize pump settings, detect early warning patterns, and optimize therapy in real time, especially in lesser-resourced settings.

Drivers

The growth of the Implantable Insulin Pumps Market is supported by several critical drivers: rising global diabetes prevalence—over 537 million adults diagnosed in 2021, projected beyond 640 million by 2030—creating constant demand for precision insulin therapy; technological advancements including miniaturized, biocompatible designs, longer-lasting batteries, and smart algorithm integration that improve usability and outcomes; expanding adoption of CGM‑integrated closed-loop systems that mimic artificial pancreas behavior; and favorable reimbursement frameworks and growing provider familiarity in advanced healthcare markets.

Market Trends

Key trends shaping the Implantable Insulin Pumps Market include the rapid shift toward fully closed-loop artificial pancreas systems combining CGM data with adaptive AI-based dosing; the integration of wireless connectivity and mobile app support, enabling remote programming and reductions in follow-up visits; battery innovations such as rechargeable and wireless inductive recharging enabling multi-year device operation; emergence of pediatric-specific pump models under 30 mm diameter for children aged 6–16; and growing uptake of predictive AI dosing models validated in clinical simulations and early rollout programs.

Opportunities

High-impact opportunities for the Implantable Insulin Pumps Market include expansion into emerging regions—Asia‑Pacific, Latin America, and Africa—where diabetes prevalence is climbing and healthcare systems are modernizing; deeper integration of pump systems with digital health frameworks, telemedicine platforms, and personalized insulin dosing apps; development of dual-hormone implants (insulin + glucagon) and fully biodegradable refillable pump systems for extended wear; and strategic collaborations between diabetes device manufacturers, AI innovators, and healthcare institutions to accelerate clinical validation and broaden market access.

Challenges

The Implantable Insulin Pumps Market also faces notable challenges: high device and implantation costs—including surgical fees and type of device—limit accessibility, especially in low‑income regions; complexity in regulatory approval pathways across multiple countries slows global rollout; need for skilled medical personnel and infrastructure for implantation and maintenance, creating barriers in underserved geographies; risk of device malfunction, including occlusion, battery failure, or infection, which can undermine patient trust; and growing concerns about cybersecurity vulnerabilities and the safety of AI-controlled dosing systems.

Recent Developments

Recent highlights in the Implantable Insulin Pumps Market include the rollout of next-generation closed-loop systems featuring embedded AI analytics and long-lasting recharge capabilities demonstrating over 30% reduction in severe hypoglycemic events; pilot programs deploying pumps capable of updating insulin dosing every few minutes based on CGM trends, achieving up to 90–91% dosing accuracy in simulations; introduction of pediatric-specific miniaturized pumps with occlusion alert systems in trials in Asia and the EU; emerging inductive wireless recharging and Bluetooth-based remote configuration reducing the need for repeat surgeries; and early prototypes of biodegradable pump casings and year-long refillable reservoirs under development for extended wear cycles.

Also Read@ https://www.pharma-geek.com/laser-capture-microdissection-market/

Implantable Insulin Pumps Market Companies

- Medtronic plc

- Insulet Corporation

- Tandem Diabetes Care Inc.

- Roche Diabetes Care

- SOOIL Development Co., Ltd.

- Debiotech SA

- Beta Bionics

- Valeritas Inc.

- Ypsomed Holding AG

- CeQur SA

- Eli Lilly and Company (Automated Delivery Division)

- Bigfoot Biomedical

- Senseonics Holdings Inc.

- ViaCyte Inc.

- Dompe Farmaceutici SpA

- Terumo Corporation

- Delfu Medical

- ViCentra B.V.

- Eoflow Co., Ltd.

- Rani Therapeutics

Segments Covered in the Report

By Pump Type

- Programmable Implantable Pumps

- Closed-loop Pumps

- Open-loop Pumps

- Non-programmable Implantable Pumps

- Others (Hybrid Delivery Systems)

By Reservoir Size

- Small Volume (≤10 mL)

- Medium Volume (10–20 mL)

- Large Volume (>20 mL)

- Others

By Delivery Mode

- Continuous Basal Delivery

- Bolus Delivery

- Combined Basal-Bolus Delivery

- Others

By End User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Diabetes Clinics

- Homecare Settings

- Others (Military, Research)

By Age Group

- Pediatric (≤17 years)

- Adults (18–64 years)

- Geriatric (≥65 years)

By Indication

- Type 1 Diabetes Mellitus (T1DM)

- Type 2 Diabetes Mellitus (T2DM)

- Others (e.g., LADA, MODY)

By Distribution Channel

- Direct Hospital Procurement

- Retail Pharmacies

- Online Pharmacies

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get Sample Link@ https://www.precedenceresearch.com/sample/6521

- Estrogen Replacement Therapy Market Size to Reach USD 19.46 Billion by 2034 - September 18, 2025

- Peptide Therapeutics CDMO Market Report Size, Share & Forecast 2034 - September 17, 2025

- Rare Musculoskeletal Disorder Treatments Market Size, Share & Future Trends 2034 - September 17, 2025