Hyperpigmentation Disorder Treatment Market Key Takeaways

- In terms of revenue, the global hyperpigmentation disorder treatment market was valued at USD 5.78 billion in 2024.

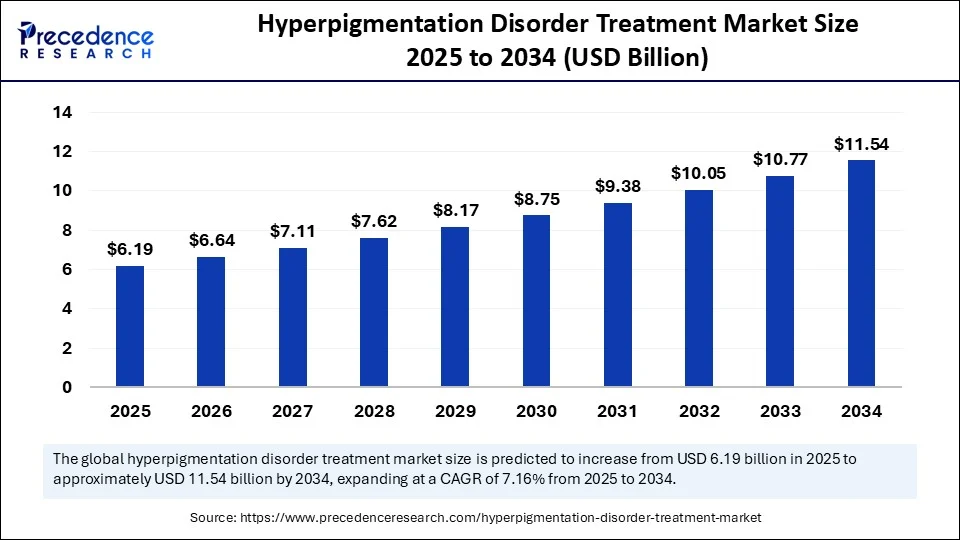

- It is projected to reach USD 11.54 billion by 2034.

- The market is expected to grow at a CAGR of 7.16% from 2025 to 2034.

- North America dominated the hyperpigmentation disorder treatment market with the largest market share of 34.9% share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By treatment type, the topical treatment segment held the biggest market share of 27.3% in 2024.

- By treatment type, the laser therapy segment is anticipated to grow at a significant CAGR between 2025 and 2034.

- By disorder type, the melasma segment captured the highest market share of 32.1% in 2024.

- By disorder type, the post-inflammatory hyperpigmentation segment is expected to expand at a notable CAGR over the projected period.

- By end user, the dermatology clinics segment generated the major market share of 38.7% in 2024.

- By end user, the home care settings segment is expected to expand at a notable CAGR over the projected period.

- By distribution channel, the prescription-based (Rx) segment accounted for significant market share of 41.5% in 2024.

- By distribution channel, the online retail segment is expected to expand at a notable CAGR over the projected period.

How is AI Reshaping the Hyperpigmentation Disorder Treatment Market?

In the Hyperpigmentation Disorder Treatment Market, artificial intelligence is transforming diagnostic precision and personalization. AI models such as DenseNet121 and InceptionResNetV2 have demonstrated accuracy rates near 86–87 percent in identifying facial pigmented lesions—often outperforming human dermatologists—a pivotal advancement in early detection and triaging. Some clinics (e.g. Kaya Clinic in 2024) launched AI platforms trained on thousands of skin images, generating individualized treatment plans based on real-time complexion analysis, particularly suited for darker skin tones.

While these innovations promise equitable skin health care and higher diagnostic throughput, bias remains a concern—accurate representation across skin types is essential to avoid disparities in performance.

Market Overview

The Hyperpigmentation Disorder Treatment Market includes cosmeceutical/topical agents, chemical peels, microdermabrasion, light and laser-based therapies, cryotherapy, and emerging home-care devices. In 2024 the market stood around USD 5.78 billion, projecting to USD 11.54 billion by 2034 at roughly 7.16 percent CAGR.

Topicals remain prominent due to accessibility and cost-effectiveness, while laser and device-based therapies are gaining preference for their precision. Melasma, solar lentigines, and post-inflammatory hyperpigmentation make up the majority of indications. Dermatology clinics and hospitals remain primary treatment settings, but home care and at-home devices are growing as patients seek convenience and autonomy. North America leads in adoption; Asia Pacific is rapidly expanding.

Drivers

Major forces driving growth in the Hyperpigmentation Disorder Treatment Market include:

-

Rising prevalence of melasma and age spots, especially in aging populations.

-

Expanded skincare awareness post-pandemic, nudged by social media and influencer-led beauty trends.

-

Technological advancement—including picosecond lasers, micro-needling, nanotechnology-enhanced topical formulations—which improve efficacy and safety.

-

Increasing acceptance of non-invasive aesthetic treatments such as IPL, chemical peels, and light therapies, particularly among middle-aged women in urban markets.

-

Expanding clinic infrastructure and access—many hospitals and dermatology centers now offer advanced pigmentation treatments.

Market Trends

Current Market Trends shaping the Hyperpigmentation Disorder Treatment Market include:

-

Surge in laser and light-based therapies—picosecond, fractional, IPL, nano-needling—due to faster recovery and minimal downtime.

-

Preference for botanical and mild cosmeceutical ingredients like kojic acid, azelaic acid, niacinamide, tranexamic acid.

-

Clean-beauty movement and natural ingredient formulations, appealing to younger, health-conscious demographics.

-

Digital marketing influence, as social media influencers, dermatologist testimonials, and before/after content drive consumer interest.

-

Home-care devices and OTC innovations leveraging microdermabrasion, LED masks, or at-home laser units.

Key Opportunities in the Hyperpigmentation Disorder Treatment Market include:

-

Expansion of AI-driven diagnostic platforms and teledermatology, especially for underserved regions and darker skin tones.

-

Development of nanotechnology-enhanced topical formulations for improved stability, penetration, and minimized side effects.

-

Strategic partnerships between skincare brands and dermatology clinics to co-develop and clinically validate new therapies.

-

Emerging demand in Asia Pacific, fueled by rising disposable income and growing skin aesthetic awareness in countries such as India, China, Japan, and Southeast Asia.

-

Customization and personalization—tailored regimens based on skin type, pigmentation disorder, and consumer lifestyle preferences.

Challenges

Challenges confronting the Hyperpigmentation Disorder Treatment Market include:

-

Safety and regulatory concerns around agents like hydroquinone due to risks of ochronosis and regulatory restrictions. Long-term safety data remain limited.

-

Bias and inclusivity gaps in AI models, which often perform worse on darker skin tones if training data lacks diversity.

-

High treatment costs for advanced devices, limiting adoption in less affluent markets, including parts of Asia and Africa.

-

Quality variability and counterfeit products, especially in OTC markets where unapproved ingredients may be used.

-

Social and cultural stigma—beauty standard-driven demand can fuel unsafe skin lightening practices, especially in regions with weak regulation.

Recent Developments

Recent developments shaping the Hyperpigmentation Disorder Treatment Market:

-

New product introductions in Asia Pacific in early 2025, such as serum launches in India targeting melasma and darker skin types.

-

Regulatory approvals in North America, including picosecond laser systems approved in Canada for benign pigmented lesions, offering expanded treatment scope.

-

Increased R&D focus on PATH-3 technology and ablative lasers for melasma and solar lentigines.

-

AI platforms launched in 2024, leveraging image datasets to recommend treatment plans for pigmented lesions tailored to Indian and diverse skin types.

-

Clinical partnerships and M&A activity, as skincare brands collaborate with clinics and biotech firms to co-develop validated therapies.

-

Rising awareness campaigns targeting risks of unregulated bleaching creams, catalyzed by recent reports of cancer and skin damage in Africa.

Hyperpigmentation Disorder Treatment Market Companies

- Galderma S.A.

- L’Oréal S.A.

- Allergan (AbbVie Inc.)

- Obagi Cosmeceuticals LLC

- Johnson & Johnson (Neutrogena)

- SkinCeuticals (L’Oréal)

- The Ordinary (DECIEM)

- Beiersdorf AG (Eucerin)

- La Roche-Posay (L’Oréal)

- Pierre Fabre Dermo-Cosmétique

- ISDIN

- PCA Skin

- Uriage Dermatological Laboratories

- Epionce

- Innoaesthetics

- Procter & Gamble Co. (Olay)

- Menarini Group

- Image Skincare

- Sesderma

- Bioderma (NAOS)

Segments Covered in the Report

By Treatment Type

- Topical Treatment

- Hydroquinone

- Retinoids (Tretinoin, Adapalene)

- Corticosteroids

- Azelaic Acid

- Kojic Acid

- Niacinamide

- Vitamin C (Ascorbic Acid)

- Tranexamic Acid

- Botanicals (Licorice Extract, Arbutin, etc.)

- Combination Formulations

- Others

- Laser Therapy

- Q-Switched Nd:YAG Laser

- Fractional CO2 Laser

- Intense Pulsed Light (IPL)

- Picosecond Laser

- Others

- Chemical Peels

- Glycolic Acid Peel

- Salicylic Acid Peel

- Lactic Acid Peel

- Trichloroacetic Acid (TCA) Peel

- Others

- Microdermabrasion

- Oral Treatment

- Tranexamic Acid (Oral)

- Polypodium Leucotomos

- Glutathione

- Others

- Others

- Cryotherapy

- Radiofrequency-based Treatments

By Disorder Type

- Melasma

- Post-Inflammatory Hyperpigmentation (PIH)

- Solar Lentigines (Age Spots)

- Freckles

- Drug-Induced Hyperpigmentation

- Others (e.g., Acanthosis Nigricans, Addison’s Disease-associated pigmentation)

By End User

- Dermatology Clinics

- Aesthetic Clinics

- Hospitals

- Home Care Settings (OTC Use)

- Others

By Distribution Channel

- Prescription-Based (Rx)

- Over-the-Counter (OTC)

- Online Retail

- Dermatology/Aesthetic Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get sample@ https://www.precedenceresearch.com/sample/6511

- Estrogen Replacement Therapy Market Size to Reach USD 19.46 Billion by 2034 - September 18, 2025

- Peptide Therapeutics CDMO Market Report Size, Share & Forecast 2034 - September 17, 2025

- Rare Musculoskeletal Disorder Treatments Market Size, Share & Future Trends 2034 - September 17, 2025