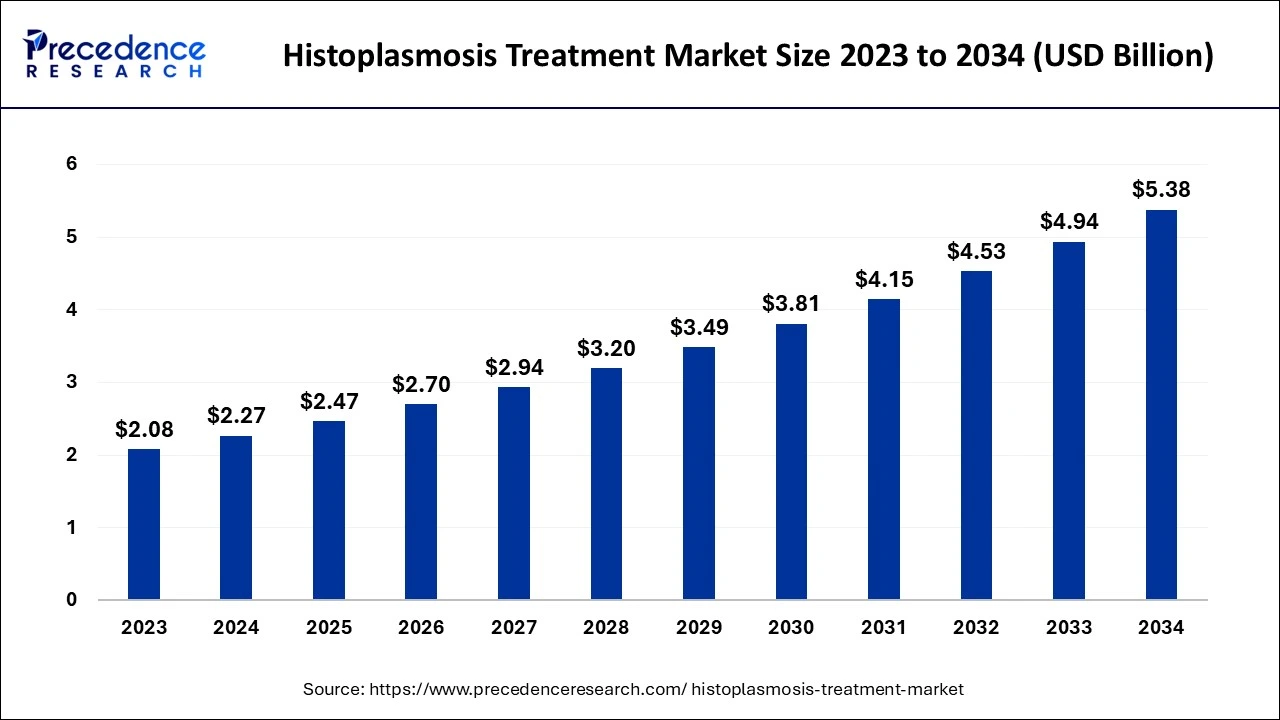

The histoplasmosis treatment market size is set to grow from USD 2.27 billion in 2024 to USD 5.38 billion by 2034 at a CAGR of 9.01%. Explore key drivers, trends, and regional insights shaping the future of histoplasmosis diagnostics and therapies.

Market Overview

The histoplasmosis treatment market is expanding rapidly, fueled by increasing cases among immunocompromised populations, technological advancements in diagnostics, and the development of new antifungal therapies. Valued at USD 2.27 billion in 2024, the market is projected to reach USD 5.38 billion by 2034, growing at a robust CAGR of 9.01% between 2025 and 2034.

North America currently leads the global market, driven by a robust healthcare infrastructure and widespread adoption of advanced diagnostics. Meanwhile, Asia-Pacific is expected to emerge as the fastest-growing region, driven by higher prevalence of immunocompromised patients, rapid urbanization, and government-led healthcare initiatives.

Read Also : Medical Waste Management Market

Histoplasmosis Treatment Market Key Takeaways

-

Market size valued at USD 2.27 billion in 2024.

-

Expected to reach USD 5.38 billion by 2034, at a CAGR of 9.01%.

-

North America dominated with 35% share in 2024.

-

Asia-Pacific is projected to record the fastest growth.

-

Acute type accounted for 60% of the market in 2024.

-

Chest CT scan dominated diagnosis segment; bronchoscopy growing fastest.

-

Amphotericin B remained the leading drug type.

-

Oral route of administration held the largest share in 2024.

Growth Drivers of the Histoplasmosis Treatment Market

Rising Prevalence of Histoplasmosis

Growing cases among immunocompromised populations—such as HIV/AIDS patients, cancer patients under chemotherapy, and organ transplant recipients—are driving demand for effective antifungal therapies.

Advances in Diagnostics

Improved technologies like AI-powered imaging, chest CT scans, and bronchoscopy are enabling early and accurate detection, reducing misdiagnosis with conditions like tuberculosis or lung cancer.

Drug Development and Innovation

Pharmaceutical companies are investing in novel antifungal drugs with higher efficacy and safety profiles. Amphotericin B continues to dominate, while enhanced versions of itraconazole and ketoconazole are gaining adoption.

Healthcare Access in Emerging Markets

Expanding healthcare infrastructure in Asia-Pacific and Latin America is boosting diagnosis and treatment uptake, supported by government programs targeting infectious diseases.

Role of AI in Histoplasmosis Treatment

Artificial intelligence is reshaping the diagnosis and treatment of histoplasmosis. AI-powered imaging improves detection accuracy, helping physicians distinguish histoplasmosis from other respiratory illnesses. In clinical trials, AI aids in patient selection, monitoring, and outcome analysis, accelerating the development of new antifungal therapies and ensuring better-targeted treatments.

Regional Insights

North America

-

Largest market share in 2024 (35%).

-

Strong healthcare infrastructure, advanced diagnostics, and specialized treatment programs.

-

U.S. market projected to grow from USD 556.15 million in 2024 to USD 1346.48 million by 2034, at a CAGR of 9.24%.

Asia-Pacific

-

Fastest-growing regional market.

-

Rising immunocompromised population due to HIV/AIDS and immunosuppressive therapies.

-

Increased urbanization raising fungal exposure risks in countries like India and China.

-

Government-led focus on infectious diseases fueling market growth.

Segmentation Analysis

By Type

-

Acute histoplasmosis dominated with 60% market share in 2024.

-

Chronic histoplasmosis projected to see strong growth due to aging populations and rising lung diseases such as COPD.

By Diagnosis

-

Chest CT scan remained the leading diagnostic method in 2024.

-

Bronchoscopy expected to grow fastest, driven by accuracy and insurance coverage expansion.

By Drug Type

-

Amphotericin B dominated due to its high potency in treating severe cases among immunocompromised patients.

-

Itraconazole expected to gain traction with bioavailable formulations.

By Route of Administration

-

Oral segment led in 2024 due to cost-effectiveness and ease of use.

-

Intravenous therapies remain essential for severe infections but are less adopted due to higher costs.

Market Challenges

-

Regulatory hurdles in drug approval prolong the introduction of new antifungal therapies.

-

Limited awareness in non-endemic regions restricts timely diagnosis and treatment.

-

High cost of advanced diagnostics and antifungal treatments poses accessibility issues in low-income countries.

Key Market Players

-

Novartis AG

-

Merck & Co., Inc.

-

Pfizer Inc.

-

Hindustan Antibiotics Limited

-

Siemens Healthcare GmbH

-

Sanofi-Aventis Groupe

Recent Developments:

-

August 2023: CVS Health launched Cordavis to co-produce biosimilar medicines in the U.S. market.

-

June 2022: Apex Laboratories introduced enhanced bioavailable itraconazole capsules (65 mg & 130 mg).

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Autonomous Vehicle Market Size to Reach USD 4450.34 Billion by 2034 - September 19, 2025

- Sterilization Equipment Market Size to Reach USD 36.16 Bn by 2034 - September 19, 2025

- Wearable Cardiac Devices Market Size to Hit USD 32.16 Bn by 2034 - September 19, 2025