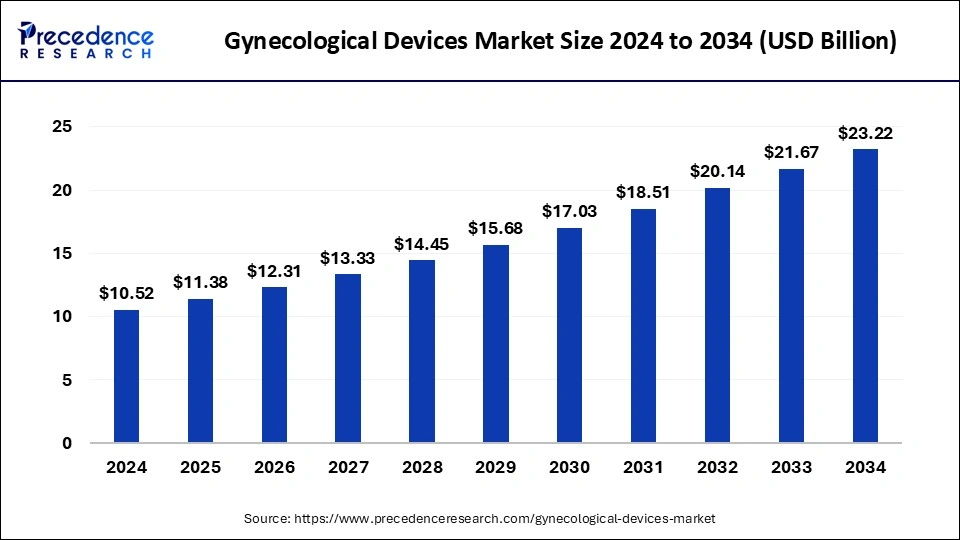

The global gynecological devices market size was valued at USD 10.52 billion in 2024 and is projected to grow from USD 11.38 billion in 2025 to around USD 23.22 billion by 2034, expanding at a CAGR of 8.25% from 2025 to 2034.

Gynecological Devices Market Key Takeaways

-

Market size reached USD 10.52 billion in 2024 and is forecasted to hit USD 23.22 billion by 2034.

-

The market is projected to expand at a CAGR of 8.25% between 2025 and 2034.

-

North America dominated with a 41.82% share in 2024, driven by strong healthcare infrastructure.

-

Asia Pacific is expected to record the fastest CAGR of 8.64% during 2025–2034.

-

By product, surgical devices accounted for over 53.20% revenue share in 2024.

-

Handheld instruments are anticipated to grow at a CAGR of 8.4% during the forecast period.

-

By end-use, hospitals & clinics represented a 65.26% share in 2024.

-

Ambulatory surgery centers (ASCs) are projected to grow at the fastest CAGR of 8.1% from 2025 to 2034.

Read Also: Cord Blood Banking Services Market

Role of Artificial Intelligence in the Gynecological Devices Market

Artificial Intelligence (AI) is reshaping the gynecological devices market by improving diagnostic accuracy, treatment precision, and patient outcomes.

-

AI-enabled imaging & diagnostics allow earlier and more precise detection of cervical cancer, endometriosis, and ovarian cysts.

-

Robotic-assisted surgeries reduce complications and shorten recovery times.

-

Personalized treatment plans are created using AI algorithms that analyze patient data.

-

Wearable AI-powered gynecological devices enable women to track fertility cycles, hormonal fluctuations, and reproductive health in real-time.

As healthcare increasingly shifts toward data-driven models, AI continues to foster innovation, improve decision-making, and enhance women’s reproductive healthcare technologies.

Market Dynamics

Drivers

-

Rising prevalence of gynecological disorders such as PCOS, uterine fibroids, and cervical cancer.

-

Growing awareness of women’s reproductive health.

-

Advancements in minimally invasive & robotic-assisted procedures.

-

The aging female population is increasing demand for pelvic organ prolapse and menopause-related treatments.

Opportunities

-

Government initiatives promoting women’s health programs and early diagnosis.

-

Rapid technological advancements in imaging, ablation, and minimally invasive surgical tools.

-

Increasing adoption of robotics and AI in gynecology.

Challenges

-

Concerns over pelvic organ prolapse device safety (such as vaginal mesh controversies).

-

Regulatory scrutiny and litigation risks are restraining adoption in some regions.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.25% |

| Market Size in 2025 | USD 11.38 Billion |

| Market Size by 2034 | USD 23.22 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segments Covered | Product and End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Product Insights

-

Surgical Devices – Dominated the market in 2024 with 53.2% share; widely used in hysterectomy, laparoscopy, and ablation procedures.

-

Handheld Instruments – Fastest-growing segment due to portability, affordability, and demand in community healthcare and rural clinics.

-

Diagnostic Imaging Systems – Expected to grow strongly due to rising unplanned pregnancies and demand for early diagnosis.

End-Use Insights

-

Hospitals & Clinics – Accounted for 65.16% of revenue in 2024, driven by complex surgical procedures and advanced infrastructure.

-

Ambulatory Surgery Centers (ASCs) – Expected to grow fastest at 8.1% CAGR due to demand for outpatient, minimally invasive, and same-day surgical procedures.

Gynecological Devices Market Companies

- Boston Scientific Corporation

- Ethicon Inc.

- Karl Storz Gmbh & Co. KG

- Cooper Surgical Inc.

- Hologic Inc.

- Medtronic plc

- Olympus Corporation

- Stryker Corporation

- Richard Wolf GmbH

- MedGyn Product Inc.

Segments Covered in the Report

By Product

- Surgical Devices

- Gynecological Imaging Devices

- Portable Tools

By End Use

- Hospital & Clinics

- Ambulatory Surgery Centers (ASCs)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Smart Medical Devices Market Size to Sore USD 168 Bn by 2034 - September 17, 2025

- Orthodontics Market Size to Reach USD 65.13 Billion by 2034 - September 17, 2025

- Gynecological Devices Market Size to Hit USD 23.22 Billion by 2034 - September 17, 2025