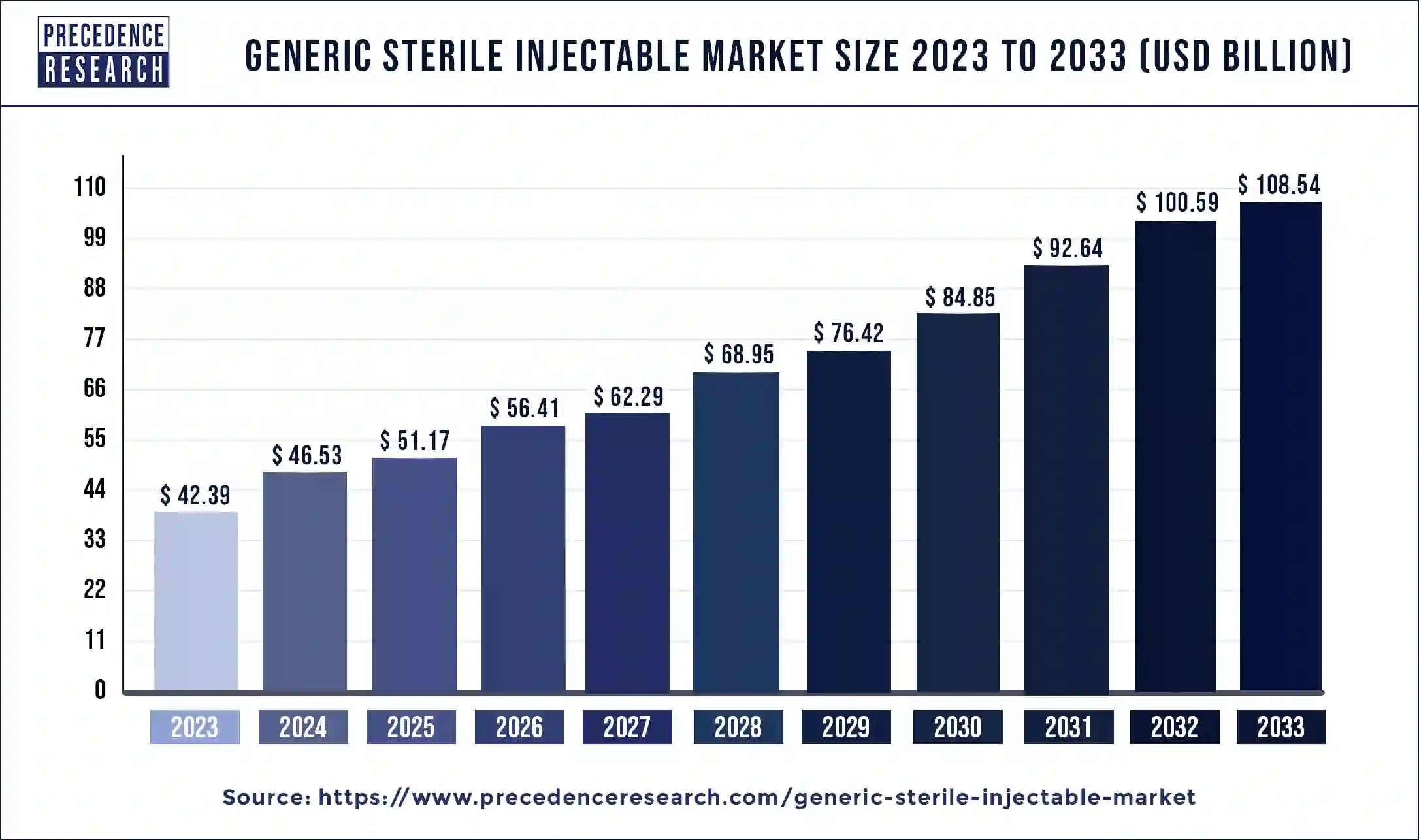

The global generic sterile injectable market, valued at USD 46.53 billion in 2024, is poised for significant expansion over the next decade, projected to reach USD 116.54 billion by 2034, reflecting a robust compound annual growth rate (CAGR) of 9.61% during the forecast period of 2025 to 2034.

Market Overview

Sterile injectables represent a critical drug delivery mechanism that allows therapeutic agents to bypass the gastrointestinal tract and deliver active compounds directly into the bloodstream. This ensures optimal bioavailability, rapid onset of action, and avoids degradation by digestive enzymes, a factor particularly relevant for biologics such as insulin or monoclonal antibodies. With the prevalence of chronic and metabolic disorders rising globally, including diabetes, cancer, cardiovascular diseases, and autoimmune diseases, the demand for generic sterile injectable formulations is growing exponentially.

Asia Pacific is anticipated to witness the fastest market growth during the forecast period, driven by a surge in chronic disease prevalence, rising healthcare expenditure, and expanding healthcare infrastructure. The region, along with Latin America and parts of Africa, is emerging as a lucrative market for generic sterile injectables, fueled by increasing accessibility to affordable healthcare solutions.

Read Also: Generic Drugs Market

Key Market Takeaways

-

Drug Type: Vaccines are projected to record the fastest growth in the generic sterile injectable market from 2025 to 2034. This is largely due to the rising demand for immunization programs, especially in developing nations, and an increased focus on preventive healthcare post-COVID-19 pandemic.

-

Therapeutic Application: Diabetes-related injectables are expected to witness the highest growth rate during the forecast period, supported by the growing diabetic population and rising adoption of GLP-1 receptor agonists and insulin analogs.

-

Distribution Channel: Retail pharmacies are emerging as a preferred channel, experiencing rapid growth due to increasing home-based care solutions and the availability of self-administered devices such as insulin pens and prefilled syringes.

-

Regional Insights: North America dominates the market, led by government initiatives, high chronic disease prevalence, and an aging population. Meanwhile, the Asia Pacific offers the fastest growth opportunity due to lifestyle-driven disease prevalence and expanding healthcare access.

The Role of Artificial Intelligence in Market Growth

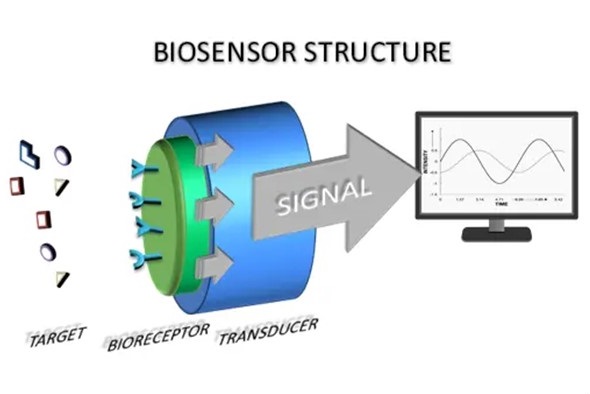

Artificial intelligence (AI) is rapidly transforming the generic sterile injectable sector by enhancing precision, operational efficiency, and regulatory compliance. AI-powered systems enable real-time monitoring of sterile manufacturing environments, anomaly detection, predictive maintenance, and batch consistency assurance. Machine learning models accelerate formulation development by optimizing drug stability and delivery systems, significantly reducing development timelines.

Moreover, AI enhances supply chain efficiency for cold chain-dependent injectables such as vaccines and biologics, predicting demand, managing inventory, and maintaining temperature integrity during transit. Generative AI tools are increasingly utilized for report generation, deviation tracking, and streamlined documentation, which allows manufacturers to produce high-quality injectables faster and at scale, ultimately expanding global access to critical therapies.

Market Dynamics

Drivers

-

Rising Prevalence of Chronic Diseases: The global increase in diabetes, cancer, cardiovascular disorders, and autoimmune conditions is creating sustained demand for injectable therapies. Generic sterile injectables provide cost-effective alternatives to branded biologics, ensuring long-term access to critical treatments.

-

Patent Expirations and Biosimilars: Expiring patents of blockbuster biologics, including monoclonal antibodies, open opportunities for generic and biosimilar manufacturers. Lower-cost alternatives enable broader access to treatments such as trastuzumab and rituximab.

Restraints

-

Complex Manufacturing Processes: Sterile injectables require stringent aseptic production techniques, including autoclaving, filtration, and rigorous quality control to ensure sterility, potency, and safety. The complexity and regulatory requirements of manufacturing remain a key barrier to entry.

Opportunities

-

Expiring GLP-1 Patents: Generic versions of high-demand drugs such as semaglutide present a substantial growth opportunity. Companies in India and Brazil are preparing launches as early as 2026, potentially reducing prices by up to 80% compared to branded counterparts.

-

Emerging Markets: Expansion in healthcare infrastructure across Asia Pacific, Latin America, and Africa, coupled with increasing public health spending and growing chronic disease prevalence, presents strong growth opportunities. Indian pharmaceutical manufacturers, leading globally in vaccine production, are well-positioned to scale distribution and penetration.

Segment Insights

Drug Type

-

Monoclonal antibodies, insulin, vaccines, and peptide hormones dominate the segment, with vaccines exhibiting the fastest projected growth due to global immunization demand.

-

Vaccine market expansion is supported by government initiatives, infectious disease control programs, and enhanced vaccine manufacturing infrastructure.

Therapeutic Applications

-

Diabetes-focused injectables are experiencing the highest growth due to the increasing diabetic population, rising healthcare costs, and the introduction of biosimilar alternatives.

-

Oncology and cardiovascular therapies continue to maintain strong market shares, driven by rising incidence rates and the expiration of branded biologics.

Distribution Channels

-

Retail Pharmacies: Growth is driven by self-administered devices and home-based care trends, enhancing patient convenience and adherence.

-

Hospital Pharmacies: Continue to dominate due to acute care and inpatient treatment requirements.

-

Online Pharmacies: Emerging as an alternative channel, particularly for chronic care patients requiring regular, home-delivered injectable medications.

Market Trends

-

The increasing prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders is driving demand for affordable injectable treatments.

-

The rise of biosimilars and generic sterile injectables is reshaping the market landscape as patents for blockbuster biologics expire.

-

Prefilled syringes, auto-injectors, and pen devices are boosting retail pharmacy sales and facilitating at-home care.

-

Outsourcing of sterile injectable production to CDMOs is accelerating adoption by smaller pharma companies while ensuring regulatory compliance.

-

Smart manufacturing using AI and robotics is improving batch consistency, real-time monitoring, and operational efficiency.

-

Strategic partnerships and acquisitions among key players are expanding product portfolios and market reach.

Competitive Landscape

-

Fresenius Kabi

-

Baxter

-

Civica

-

Pfizer

-

Mylan

-

Hikma

-

Sandoz

-

Teva

-

Nichi-Iko

-

3M

-

Merck & Co., Inc.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Anesthesia Devices Market Size to Surpass USD 39.97 Billion by 2034 - September 24, 2025

- Generic Sterile Injectable Market Size to Hit USD 116.49 Bn by 2034 - September 23, 2025

- Generic Drugs Market to Reach USD 728.64 Billion by 2034 - September 23, 2025