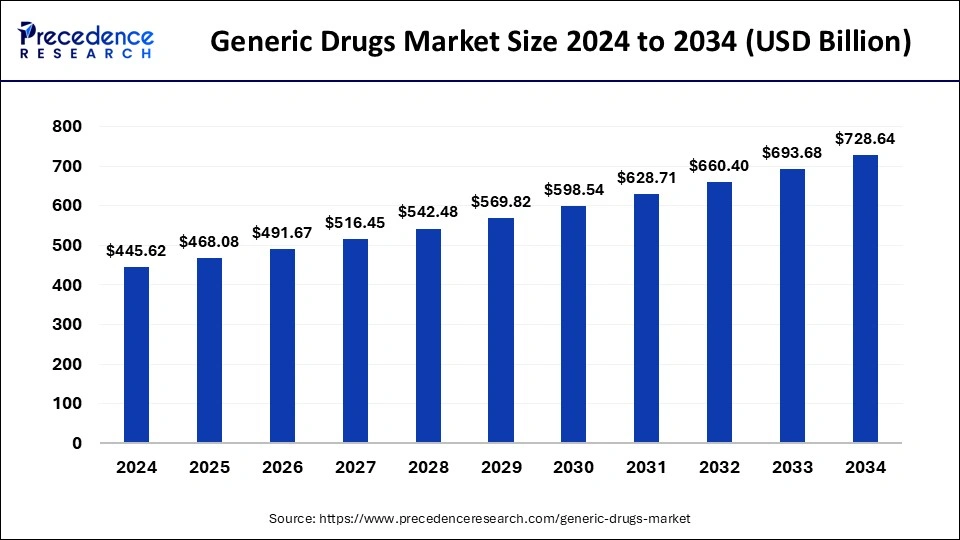

The global generic drugs market is poised for robust growth, with revenue projected to increase from USD 468.08 billion in 2025 to approximately USD 728.64 billion by 2034, reflecting a steady compound annual growth rate (CAGR) of 5.04% during the forecast period. The growth is largely fueled by rising demand for cost-effective medications, expanding healthcare infrastructure, and the adoption of advanced technologies like artificial intelligence (AI) to accelerate drug development and ensure quality.

Quick Insights

-

Market Size (2025): USD 468.08 billion

-

Forecast Size (2034): USD 728.64 billion

-

CAGR (2025–2034): 5.04%

-

Top Region: North America (39% market share in 2024)

-

Top Segment (Brand): Pure generics

-

Top Segment (Route of Administration): Oral generics

-

Fastest Growing Segment: Injectable generics (2025–2034)

-

Leading Distribution Channel: Retail pharmacy

-

Fastest Growing Distribution Channel: Hospital pharmacy

Read Also: Biofuels Market

What Opportunities Are Emerging in the Generic Drugs Market?

The sector is witnessing multiple growth drivers. Rising healthcare costs and increasing prevalence of chronic diseases are making affordable generic medicines a key solution. Additionally, AI integration in drug formulation and production is enhancing precision, reducing trial-and-error lab testing, and enabling manufacturers to scale up supply efficiently. Market players focusing on injectable generics and hospital pharmacy channels are likely to benefit from accelerated growth in the coming years.

Regional and Segmentation Analysis

North America

North America led the global market with a 39% share in 2024. The U.S. is a major contributor, with a market size of USD 139.03 billion in 2024, projected to reach USD 231.69 billion by 2034. Growth is supported by strong pharmaceutical infrastructure, government policies, and collaboration with global pharma markets. The increasing geriatric population and prevalence of chronic conditions are driving demand for affordable generics.

By Brand

The pure generics segment dominates due to its affordability and wide availability. These drugs provide an effective alternative to branded medications without compromising therapeutic outcomes.

By Route of Administration

-

Oral generics: Continue to dominate due to convenience and patient compliance.

-

Injectables: Expected to grow at the fastest rate as hospital-based treatments and specialty drugs gain traction.

By Distribution Channel

-

Retail pharmacies: Capture the largest share, benefiting from widespread access and consumer preference.

-

Hospital pharmacies: Set to grow fastest due to an increased in in-patient treatments and hospital procurement of injectable drugs.

Case Study: AI-Enhanced Generic Drug Production

A leading Indian generic manufacturer integrated AI-assisted formulation technology, achieving:

-

25% reduction in production time.

-

30% lower formulation errors.

-

Improved compliance with international quality standards.

This demonstrates how AI not only accelerates production but also ensures affordability and accessibility, benefiting both manufacturers and patients.

Generic Drugs Market Companies

- Mylan N.V.

- Abbott Laboratories

- ALLERGAN

- Teva Pharmaceutical Industries Ltd.

- Eli Lilly and Company

- STADA Arzneimittel AG

- GlaxoSmithKline Plc.

- Baxter International Inc.

- Pfizer Inc.

- Sandoz International GmbH

Segments Covered in the Report

By Drug Type

- Simple Generics

- Super Generics

By Brand

- Pure generic drugs

- Branded generic drugs

By Route of Drug Administration

- Oral

- Injection

- Cutaneous

- Others

By Therapeutic Application

- Central Nervous System (CNS)

- Cardiovascular

- Infectious Diseases

- Musculoskeletal Diseases

- Respiratory

- Oncology

- Others

By Distribution Channel

- Retail Pharmacy

- Hospital Pharmacy

- Online and Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Generic Sterile Injectable Market Size to Hit USD 116.49 Bn by 2034 - September 23, 2025

- Generic Drugs Market to Reach USD 728.64 Billion by 2034 - September 23, 2025

- Biofuels Market Size to Reach USD 257.61 Bn by 2034 - September 23, 2025