FFPE Tissue Samples for Genomics Study and Analysis Market Key Highlights

-

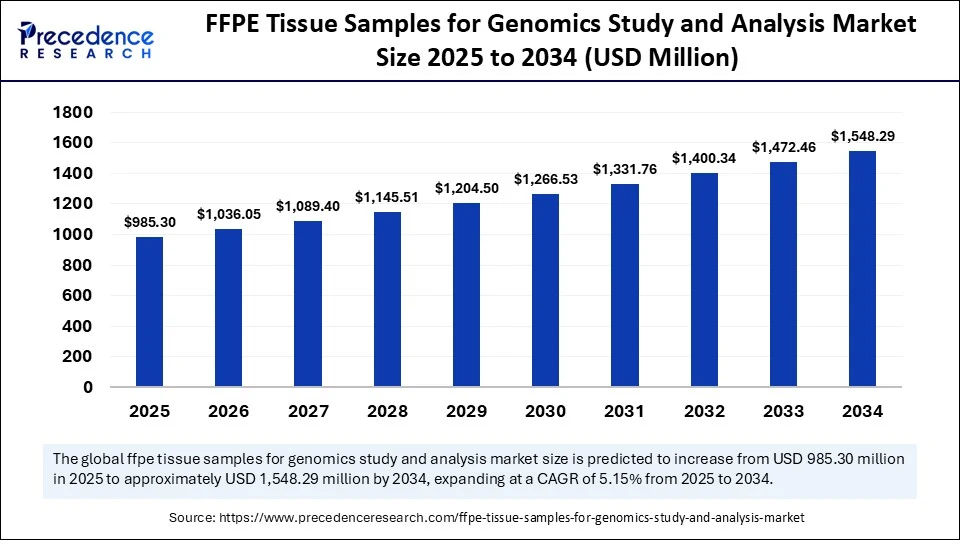

The global FFPE tissue samples for genomics study and analysis market was valued at USD 937.04 million in 2024 and is projected to reach USD 1,548.29 million by 2034, growing at a CAGR of 5.15% from 2025 to 2034.

-

North America led the market in 2024 with a 44% share, while the Asia Pacific region is forecasted to grow at the fastest CAGR during the forecast period.

-

By sample type, the blocks segment dominated with a 38% share in 2024, whereas the sections segment is expected to grow at a significant CAGR through 2034.

-

In terms of nucleic acid type, the DNA-based genomic analysis segment held the largest share at 62% in 2024, while the RNA-based genomic analysis segment is projected to grow at the highest CAGR.

-

Based on technology, next-generation sequencing (NGS) was the leading segment with a 55% share in 2024, and digital PCR (dPCR) is anticipated to grow substantially during the forecast period.

-

By application, cancer genomics dominated the market with a 48% share in 2024, while pharmacogenomics is projected to grow at a notable CAGR from 2025 to 2034.

-

Among end users, academic and research institutes accounted for the largest share at 33% in 2024, while the biopharmaceutical and biotechnology companies segment is expected to expand at the fastest pace over the forecast period.

FFPE Tissue Samples for Genomics Study and Analysis Market Overview

The formalin‑fixed, paraffin‑embedded (FFPE) tissue market has shifted from being a pathology laboratory staple to a strategic asset in precision medicine and biomarker discovery. Preserving morphological integrity while locking in DNA, RNA, and protein profiles, FFPE blocks underpin retrospective and longitudinal studies that are impossible with fresh‑frozen material. Demand is coming not only from academic biobanks but also from biopharma companies racing to populate multi‑omics data lakes, contract research organizations hunting for companion‑diagnostic signatures, and AI start‑ups that require diverse, well‑annotated cohorts to train predictive algorithms.

Growth Factors

Several long‑term drivers are fueling this expansion. First, the explosion of next‑generation sequencing (NGS) and spatial‑omics platforms has made it technically feasible—and increasingly routine—to extract high‑quality nucleic acids from decades‑old FFPE blocks, opening vast troves of legacy biospecimens for modern analysis. Second, oncology’s pivot toward tumor‑agnostic approvals and biomarker‑guided trials has created insatiable appetite for rare‑mutation panels, each demanding sizeable FFPE cohorts for validation. Third, global hospital digitization is bringing long‑neglected tissue archives into inventory systems, facilitating international sharing and commercialization. Finally, regulatory agencies now emphasize diversity in clinical evidence packages, prompting sponsors to mine multi‑ethnic FFPE libraries that reflect real‑world patient heterogeneity.

Role of AI in the FFPE Tissue Samples for Genomics Study and Analysis Market

Artificial intelligence is emerging as the connective tissue linking FFPE repositories to actionable genomic insights. Deep‑learning models correct fixation‑induced sequence artifacts, boosting variant‑calling accuracy from fragmented DNA. Image‑based AI overlays histopathology with spatial transcriptomics, enabling in‑silico microdissection that maximizes information from limited material. Large‑language models parse pathology reports to auto‑populate metadata fields, accelerating cohort curation and reducing annotation errors. At the enterprise level, machine‑learning engines match study protocols with optimal FFPE inventories in silico, shortening feasibility assessments and cutting weeks off trial timelines. Collectively, these AI tools elevate the quality, interpretability, and commercial utility of FFPE‑derived genomic datasets.

Market Drivers

On a practical level, three forces sustain daily demand. Precision‑oncology pipelines need ever larger, mutation‑verified FFPE cohorts to meet statistical power in basket trials. Regulatory push for real‑world evidence encourages the inclusion of archival tissues to confirm therapeutic benefit across broader populations. Cost efficiencies also play a role: FFPE blocks are cheaper to store and ship than fresh‑frozen biospecimens, making them attractive for multi‑center studies with tight budgets. Additionally, the growing prevalence of cancer screening programs is continually replenishing pathology archives, ensuring a durable supply of newly annotated tissues.

Opportunities

White‑space opportunities abound. LIMS‑enabled “digital biobank” services can monetize underutilized hospital archives through revenue‑sharing models. Molecular barcoding and single‑cell recovery kits tailored for FFPE now allow retrospective single‑cell analyses, a breakthrough for rare‑tumor research. Emerging markets are building national biorepositories; vendors that provide turnkey FFPE processing, data management, and QC workflows can secure long‑term supply contracts. There is also untapped potential in non‑oncology fields—such as neurodegeneration and autoimmune disease—where stored surgical biopsies remain underexploited for genomic discovery.

Challenges

Yet significant hurdles remain. Variable fixation times, suboptimal storage conditions, and decades‑old protocols create batch effects that can confound multi‑site studies. Ethical and legal barriers around consent and data sharing complicate cross‑border specimen transfer, particularly in jurisdictions with stringent privacy laws. Competition for high‑quality blocks bearing ultra‑rare mutations is intensifying, driving up acquisition costs. Finally, some clinicians still hesitate to part with valuable tissue samples, fearing future diagnostic needs, which can limit supply for research.

FFPE Tissue Samples for Genomics Study and Analysis Market Regional Outlook

North America currently commands the largest revenue share, thanks to its vast hospital networks, mature biobanking infrastructure, and aggressive adoption of NGS‑based diagnostics..

Europe follows, underpinned by coordinated biobank consortia and strong data‑protection frameworks that, paradoxically, slow but ultimately strengthen sample commercialization.

Asia‑Pacific is the fastest‑growing region: China and South Korea are investing heavily in precision‑medicine campuses, while Japan leverages decades of detailed pathology archives for aging‑related disease studies.

Latin America and the Middle East & Africa are still nascent markets, yet rising cancer incidence and international research partnerships are catalyzing initiatives to digitize and monetize regional FFPE collections, pointing to gradual but sustainable future growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,548.29 Million |

| Market Size in 2025 | USD 985.3 Million |

| Market Size in 2024 | USD 937.04 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.15% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Sample Type, Nucleic Acid Type, Technology, Application, End User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

FFPE Tissue Samples for Genomics Study and Analysis Market Companies

- Thermo Fisher Scientific

- Horizon Discovery (Revvity)

- QIAGEN

- Abcam plc

- BioChain Institute, Inc.

- OriGene Technologies, Inc.

- Indivumed GmbH

- ProteoGenex, Inc.

- USBiological Life Sciences

- Amsbio (AMS Biotechnology)

- BioIVT

- Tissue Solutions Ltd (a BioIVT company)

- Tristar Technology Group

- Asterand Bioscience (BioIVT brand)

- Genomic Testing Cooperative

- Aperiomics

- Genentech Tissue Repository

- iSpecimen Inc.

- Novogene Co., Ltd.

- Norgen Biotek Corp.

Segments Covered in the Report

By Sample Type

- Blocks

- Slides

- Scrolls

- Curls

- Sections

- Others (Cores, Punches)

By Nucleic Acid Type (Downstream Application)

- DNA-based Genomic Analysis

- Whole Genome Sequencing (WGS)

- Whole Exome Sequencing (WES)

- CNV/SNP Analysis

- qPCR-based Genotyping

- RNA-based Genomic Analysis

- Transcriptome Profiling

- mRNA Sequencing

- miRNA Sequencing

- Gene Fusion Studies

By Technology

- Next-Generation Sequencing (NGS)

- Microarrays

- PCR/qPCR

- Digital PCR (dPCR)

- Sanger Sequencing

- Nanostring and Other Platforms

By Application

- Cancer Genomics

- Infectious Diseases Genomics

- Neurological Disease Genomics

- Rare Disease Research

- Pharmacogenomics

- Biomarker Discovery and Validation

- Population Health Studies

By End User

- Academic & Research Institutes

- Contract Research Organizations (CROs)

- Biopharmaceutical & Biotechnology Companies

- Hospitals & Diagnostic Laboratories

- Biobanks & Tissue Repositories

Also Read: Adrenoleukodystrophy Drugs Market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344

- Arteriovenous Implants Market Enhance dialysis outcomes with advanced grafts, endovascular access, and AI-assisted precision - September 16, 2025

- Smart Retinal Implants Market Restore vision with wireless bioelectronic prosthetics and AI-powered retinal technologies - September 16, 2025

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025