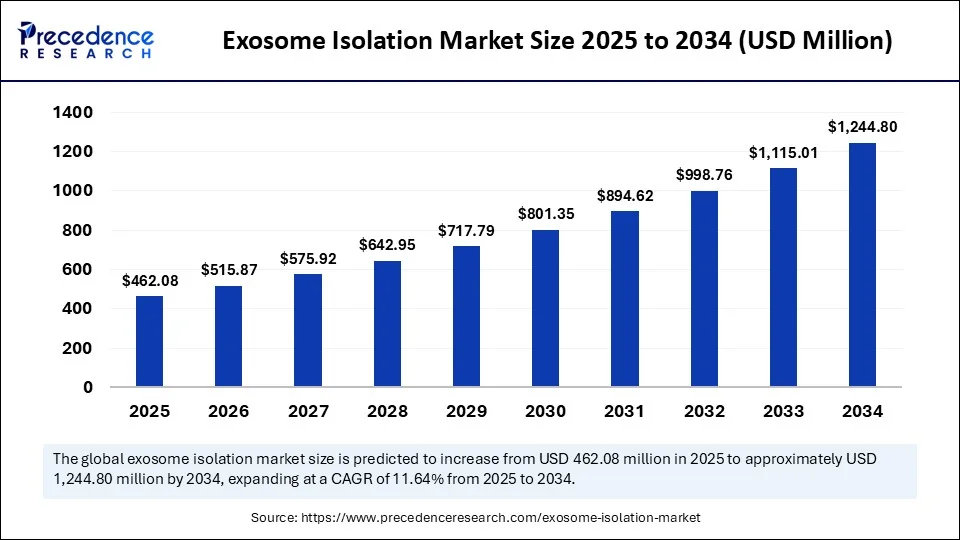

Exosome Isolation Market Size to Reach USD 1,244.80 Million by 2034, Driven by Precision Biomarkers & Advanced Isolation Technologies

Global market estimated at USD 462.08 Million in 2025; forecast CAGR 11.64% through 2034

The global exosome isolation market is poised for substantial growth, expanding from USD 462.08 million in 2025 to USD 1,244.80 million by 2034, at a compound annual growth rate of 11.64%. Rising demand for non‑invasive diagnostics, regenerative medicine, and drug delivery systems coupled with breakthroughs in isolation technologies is catalyzing this expansion.

Fueled by increased investment in advanced isolation technologies, the market is rapidly evolving to support next-generation therapeutic delivery, liquid biopsy development, and exosome-based therapeutics. Rising prevalence of chronic diseases, particularly cancer, and the growing adoption of personalized medicine are creating powerful tailwinds for market expansion.

Exosome Isolation Market Quick Insights

-

Market value in 2024: USD 413.91 million

-

Market value in 2025: USD 462.08 million

-

Forecast for 2034: USD 1,244.80 million

-

CAGR (2025–2034): 11.64%

-

Leading region (2024): North America

-

Fastest growth region (2025–2034): Asia Pacific

-

Top product segment (2024): Kits & reagents (47–58% share)

-

Fastest-growing product segment: Services & software (~40% CAGR)

-

Primary workflow stage (2024): Isolation methods (~55%)

-

Fastest-growing workflow stage: Downstream analysis (~39% CAGR)

-

Top application in 2024: Diagnostics / biomarker discovery

-

Fastest-growing application: Therapeutics / drug delivery / regenerative medicine

-

Leading indication (2024): Cancer

-

Fastest-growing indication: Neurodegenerative disorders

-

Top end-user (2024): Pharmaceutical & biotechnology companies

-

Fastest-growing end-user segment: Academic & research institutes

What’s Driving the Market’s Rapid Growth?

The market is thriving due to a surge in R&D focused on exosome-based diagnostics and therapeutics, particularly in oncology. Liquid biopsy innovations and targeted drug delivery platforms using exosomes are attracting substantial venture funding and academic interest. The advancement in ultracentrifugation-free isolation techniques is reducing complexity and increasing adoption across research and clinical labs.

Moreover, the growing interest in non-invasive diagnostic tools, especially those utilizing biofluids such as blood or urine, is opening new frontiers for exosome isolation kits and systems.

How Is AI Accelerating Innovation in Exosome Isolation?

Artificial Intelligence (AI) is revolutionizing the exosome isolation landscape by enabling the development of automated, high-throughput systems capable of distinguishing exosomes from other extracellular vesicles with unprecedented precision. Through the integration of AI-powered imaging and data analytics tools, researchers can now enhance the purity and yield of isolated exosomes while minimizing contamination.

Additionally, AI-driven predictive models are being used to identify disease-specific exosomal markers, especially for cancers and neurodegenerative disorders. These insights are empowering more accurate, early-stage diagnostics and significantly improving therapeutic targeting.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,244.80 Billion |

| Market Size in 2025 | USD 462.08 Billion |

| Market Size in 2024 | USD 413.91 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.64% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product & Service, Workflow Stage, Application / Use Case, Indication, EndUser, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

What Opportunities and Trends Are Shaping the Future?

Can exosome isolation unlock the future of personalized medicine?

Yes, and the trend is unmistakable. Exosomes are emerging as next-generation delivery vehicles for RNA therapeutics, CRISPR/Cas9 gene editing, and targeted drug delivery systems. The demand for customized kits for disease-specific exosome profiling is also creating significant commercial opportunities.

Is oncology still the top driver—or is regenerative medicine catching up?

While oncology remains the cornerstone, exosome-based applications in regenerative medicine, neurodegenerative diseases, and cardiovascular conditions are gaining traction, especially as FDA approvals increase for exosome-related therapies.

Expert Commentary

“The exosome isolation market is a powerhouse of biomedical innovation. As cancer research evolves, the demand for precision isolation techniques that preserve functional integrity will only intensify,”

says Dr. Aarav Mehta, Principal Consultant at Precedence Research.

“We are at a point where investment in AI-integrated isolation systems and disease-specific kits will determine who leads this next era of medical diagnostics and therapeutics.”

Exosome Isolation Market Regional Market Dynamics

North America led the market with the largest share in 2024, backed by strong research infrastructure, favorable funding for life sciences, and the presence of leading biotech firms. The U.S. is the epicenter of innovation with clinical trials and regulatory support for exosome-based therapies.

Asia Pacific is expected to witness the fastest growth rate during the forecast period, fueled by expanding biopharmaceutical industries in China, India, and South Korea. Government-backed precision medicine initiatives and the rise of academic research institutes are contributing to this boom.

Europe remains a critical player with ongoing EU-funded programs supporting translational exosome research, particularly in regenerative therapies and neurodegenerative diseases.

Exosome Isolation Market Segment Breakdown: Descriptive Analysis

By Product & Service:

-

Kits & reagents led in 2024 with ~47–58% revenue share, favored for simplicity and scalability.

-

Services & software expected to grow fastest (~40% CAGR) as labs outsource analysis and integrate analytics into workflows.

By Workflow Stage:

-

Isolation methods had ~55% share in 2024—highlighting dominance of established techniques like ultracentrifugation.

-

Downstream analysis is rapidly gaining (~39% CAGR), driven by demand for sequencing, proteomics, and functional assays.

By Application:

-

Diagnostics / biomarker discovery led in 2024.

-

Therapeutics / drug delivery / regenerative medicine is the fastest-growing application from 2025 onward.

By Indication:

-

Cancer remains the largest segment in 2024.

-

Neurodegenerative disorders are set for strong growth through 2034.

By End User:

-

Pharma & biotech companies held the largest share in 2024.

-

Academic & research institutes expected to grow fastest, reflecting increased R&D outsourcing and collaboration.

Exosome Isolation Market Recent Breakthroughs & Notable Companies

Leading industry players named in the report include:

Thermo Fisher Scientific, QIAGEN, Bio-Techne, Danaher (Beckman Coulter), Miltenyi Biotec, Abcam, Clara Biotech, Lonza, System Biosciences (SBI), NX Pharmagen, Exophar, RoosterBio, Creative Medical Technologies, Diagenode (Hologic), Izon Science, FUJIFILM, Everzom, Ciloa, Unchained Labs, Aethlon Medical.

In July 2025, CD Bioparticles announced availability of its high-quality purified exosomes to support research in drug delivery, regenerative medicine, and therapeutic R&D.

Exosome Isolation Market Challenges

Despite its strong growth trajectory, the exosome isolation market faces challenges:

-

High cost of advanced isolation systems limits access in emerging economies.

-

Lack of standardization across protocols and product validation hinders clinical translation.

-

Regulatory uncertainties regarding exosome-based therapeutics remain a bottleneck for commercialization.

Case in Point: Exosomes in Lung Cancer Liquid Biopsy

A leading academic institute in North America recently developed a non-invasive liquid biopsy platform using exosome-derived biomarkers to detect early-stage non-small cell lung cancer. The study demonstrated a 92% accuracy in detection—surpassing traditional methods and showcasing the game-changing potential of exosome isolation in oncology diagnostics.

Get the Full Report or Schedule a Meeting

Explore the full potential of the Exosome Isolation Market with our in-depth report.

📄 Download Sample Report: https://www.precedenceresearch.com/sample/6472

📅 Schedule a 1-on-1 Meeting with Our Research Analyst: sales@precedenceresearch.com

- Arteriovenous Implants Market Enhance dialysis outcomes with advanced grafts, endovascular access, and AI-assisted precision - September 16, 2025

- Smart Retinal Implants Market Restore vision with wireless bioelectronic prosthetics and AI-powered retinal technologies - September 16, 2025

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025