The esophageal cancer market is witnessing steady growth due to rising global cancer incidence, advances in medical imaging and oncology therapeutics, and increasing public health awareness. Esophageal cancer ranks among the top ten causes of cancer-related deaths worldwide, largely due to its late diagnosis and aggressive progression. The market encompasses a range of services and solutions, including diagnostics (biopsy, endoscopy, imaging), pharmacological therapies (chemotherapy, immunotherapy, targeted therapy), surgical procedures, and palliative care.

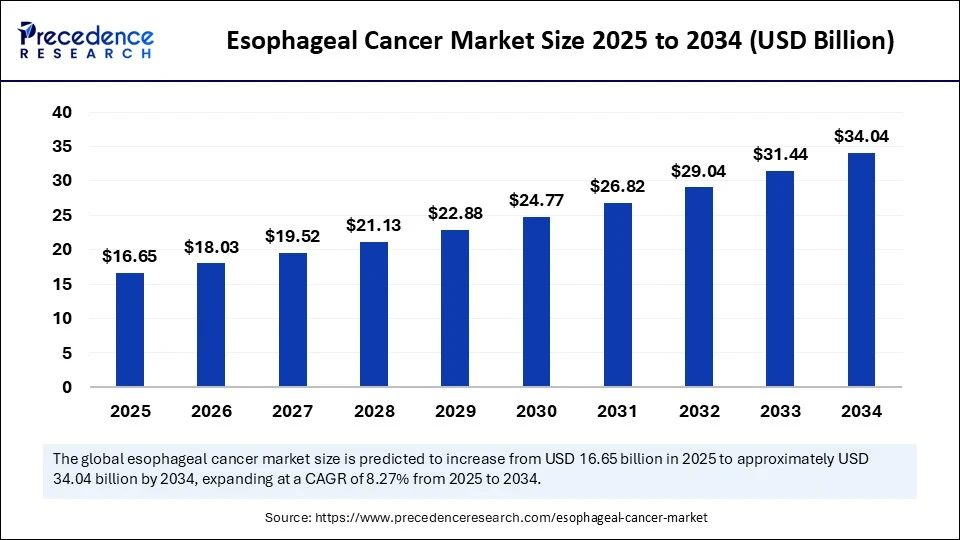

The global esophageal cancer market size is estimated to reach around USD 34.04 billion by 2034 increasing from USD 15.38 billion in 2024, with a CAGR of 8.27%.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6348

Esophageal Cancer Market Key Insights

-

North America dominated the esophageal cancer market in 2024, accounting for 40% of the total market share.

-

Asia Pacific is expected to record the fastest growth during the forecast period.

-

By cancer type:

-

Squamous cell carcinoma led the market with a substantial 80% share in 2024.

-

Adenocarcinoma is projected to register notable growth over the forecast years.

-

-

By diagnosis:

-

Endoscopy accounted for a significant 40% market share in 2024.

-

The imaging segment is expected to show considerable growth during the forecast period.

-

-

By treatment type:

-

Therapy-based treatments held the highest share of 60% in 2024.

-

-

By cancer stage:

-

Stage II esophageal cancer represented a noteworthy 35% share in 2024.

-

-

By route of administration:

-

Intravenous treatments dominated with an 85% share in 2024.

-

The oral administration route is anticipated to see significant growth over time.

-

-

By end user:

-

Hospitals were the primary market contributors with a 70% share in 2024.

-

Ambulatory surgical centers are expected to exhibit substantial growth in the coming years.

-

-

By distribution channel:

-

Hospital pharmacies led the market with a 60% share in 2024.

-

Online pharmacies are projected to grow rapidly during the forecast period.

-

Esophageal Cancer Market Growth Factors

Several factors contribute to the robust growth of the esophageal cancer market. One of the primary growth drivers is the increasing prevalence of risk factors such as gastroesophageal reflux disease (GERD), obesity, smoking, alcohol use, and dietary habits, all of which are strongly associated with the development of esophageal cancer. Furthermore, the aging global population contributes to the increased risk of cancer, including esophageal malignancies.

Advances in diagnostics, including endoscopic techniques, PET-CT imaging, and molecular biomarker testing, are improving early detection rates. Additionally, rising healthcare expenditure, government support for oncology research, and better access to specialty care in developing economies are helping expand treatment coverage and improve patient outcomes.

Regional Outlook

The regional outlook for the esophageal cancer market is shaped by differences in disease prevalence, healthcare infrastructure, and innovation adoption.

North America dominates the market due to high healthcare expenditure, advanced oncology infrastructure, and a high rate of targeted therapy usage. The presence of key pharmaceutical companies and active research initiatives further supports growth in the region.

Europe follows closely, with countries like Germany, the UK, and France leading in the integration of advanced diagnostic technologies and clinical trials for esophageal cancer.

Asia-Pacific is projected to be the fastest-growing region owing to a higher incidence of squamous cell carcinoma, especially in China, Japan, and parts of Southeast Asia. Rapid improvements in healthcare access, investment in cancer care, and local production of biologics contribute to regional momentum.

Latin America, the Middle East, and Africa are showing gradual progress, but these regions face infrastructure and affordability limitations. However, international partnerships and government-supported cancer programs may help bridge the gap over time.

Role of AI in the Esophageal Cancer Market

Artificial intelligence (AI) is beginning to play a transformative role in the esophageal cancer market, particularly in diagnostics and clinical decision-making. AI algorithms, particularly deep learning models, are being developed to assist in interpreting endoscopic images to detect early-stage lesions that may be missed by the human eye. These technologies enhance the accuracy and speed of diagnosis, allowing for earlier intervention and potentially improved survival rates.

AI-powered platforms are being used to integrate histopathological, genomic, and clinical data to help oncologists tailor personalized treatment plans for individual patients. In the field of drug development, machine learning tools are being applied to accelerate the discovery of novel therapeutic agents and predict response rates to targeted therapies. As these technologies mature, AI is expected to become a core component in managing esophageal cancer more efficiently and effectively.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 34.04 Billion |

| Market Size in 2025 | USD 16.65 Billion |

| Market Size in 2024 | USD 15.38 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.27% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Cancer Type, Diagnosis, Treatment, Stage, Route of Administration, End User, Distribution Channel and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Drivers

The esophageal cancer market is being driven by a combination of clinical needs and technological advancements. The growing burden of late-stage esophageal cancer, which requires intensive treatment, is propelling demand for innovative therapies and surgical interventions. The emergence of targeted therapies, including monoclonal antibodies against HER2 (e.g., trastuzumab) and immune checkpoint inhibitors (e.g., nivolumab, pembrolizumab), has opened new treatment pathways, especially for patients with advanced or metastatic disease.

Regulatory bodies are increasingly approving these drugs for broader indications, further boosting their adoption. Moreover, a better understanding of tumor biology and molecular subtypes is guiding more precise treatments. Additionally, the expansion of cancer screening programs in high-risk regions and the integration of esophageal cancer screening into general oncology care protocols are contributing to early detection and improving survival outcomes.

Opportunities

The esophageal cancer market offers numerous opportunities for growth and innovation. One major opportunity lies in the development of minimally invasive diagnostic and treatment solutions, such as robotic-assisted surgery and endoscopic therapies that reduce recovery times and hospital stays. The integration of telemedicine and digital health tools into oncology workflows also offers a scalable solution for follow-up care, remote diagnostics, and patient monitoring, especially in underserved regions.

The use of companion diagnostics to identify suitable candidates for targeted and immunotherapies is another promising area, enabling a shift toward more personalized oncology care. Moreover, pharmaceutical companies and biotech firms have the opportunity to expand clinical trials for novel therapeutics, especially in regions with rising incidence rates, such as Asia-Pacific. Collaborations between academia, private industry, and governments may also accelerate research and access to innovative therapies.

Challenges

Despite the advancements, the esophageal cancer market continues to face significant challenges. One of the most critical issues is the high mortality rate, with 5-year survival remaining under 20% in many regions due to late diagnosis and limited treatment response. In low- and middle-income countries, limited access to advanced diagnostic equipment and modern therapeutics hampers early intervention and long-term disease management. Cost is also a major barrier, as novel therapies like immunotherapy are expensive and may not be covered under public health systems or insurance plans.

Furthermore, side effects associated with chemoradiation and immunotherapies can reduce patient compliance and quality of life. Regulatory hurdles and lengthy clinical approval timelines can also slow the introduction of new treatments into the market. Lastly, the market suffers from disparities in care, with rural and economically disadvantaged populations having limited access to specialized oncology services.

Segmental Insights

By Cancer Type

Esophageal cancer is broadly divided into squamous cell carcinoma (SCC) and adenocarcinoma. SCC—linked to smoking, alcohol use, and low‑nutrition diets—remains dominant worldwide, accounting for roughly two‑thirds of total cases, yet its share is gradually declining in high‑income regions as smoking rates fall.

Adenocarcinoma, which is strongly associated with gastroesophageal reflux disease, Barrett’s esophagus, and obesity, is rising sharply in North America, Europe, and parts of Asia‑Pacific. From a market‑perspective, SCC drives procedure volumes for endoscopic screening in Asia, whereas adenocarcinoma commands higher average treatment costs per patient in Western markets because of more frequent use of targeted therapies and complex surgical–reconstruction techniques.

By Stage at Diagnosis

Stage III and IV disease still constitute well over half of new diagnoses globally, reflecting late presentation and limited screening outside specialty centers. Advanced stages translate into greater uptake of systemic therapies—chemotherapy, immunotherapy, and radiation—making them the single largest revenue generator for drug makers.

Early‑stage (Stage I/II) diagnoses, although fewer in number, are the fastest‑growing segment as endoscopic surveillance expands. Their management increasingly relies on minimally invasive procedures (endoscopic mucosal resection, radiofrequency ablation) and organ‑preserving chemoradiation, creating a niche for device manufacturers and outpatient surgery centers.

By Treatment Modalit

Chemotherapy and radiation remain the backbone of care, together contributing roughly 60 % of global therapeutic revenue, but they are growing at mid‑single‑digit rates. Immuno‑oncology (IO) and targeted therapies—including PD‑1/PD‑L1 inhibitors, HER2 antagonists, and antibody–drug conjugates—represent the highest‑growth slice, with a double‑digit CAGR through 2034.

Combination regimens that unite checkpoint blockade with chemotherapy are rapidly capturing first‑line treatment in metastatic disease, restructuring the revenue mix toward biologics. Surgical resection continues to dominate curative pathways in early and locally advanced cancer, but growth is modest and closely tracks improvements in minimally invasive thoracoscopic and robotic esophagectomy volumes.

By Diagnostic Techniqu

Endoscopy with biopsy accounts for the majority of diagnostic spending, but advanced imaging—narrow‑band imaging, confocal laser endomicroscopy, and PET‑CT—shows the steepest growth as physicians seek higher sensitivity for early lesions and accurate staging. Molecular diagnostics, including circulating tumor DNA assays and next‑generation sequencing panels, are a small yet rapidly expanding segment, driven by the need to match patients to IO and targeted therapies.

By End‑User

Multispecialty hospitals and academic medical centers treat over 70 % of esophageal cancer cases, reflecting their ability to coordinate surgery, radiotherapy, and systemic therapy. Dedicated oncology centers and ambulatory clinics, however, are the fastest‑growing venues, propelled by outpatient IO infusion programs and same‑day endoscopic procedures. Reference laboratories and pathology networks are emerging as influential stakeholders as precision‑medicine uptake rises.

Key Players and Their Roles

- Merck & Co. (Keytruda) – A pioneer in PD‑1 checkpoint inhibition, Merck has secured frontline and subsequent‑line approvals for Keytruda in esophageal SCC and adenocarcinoma. Ongoing trials exploring combination regimens with chemotherapy and novel agents reinforce its market‑leading position and support premium pricing.

- Bristol Myers Squibb (Opdivo) – Opdivo is entrenched in adjuvant and metastatic settings for both histologic subtypes. BMS focuses on expanding indications through synergy studies with CTLA‑4 inhibitor ipilimumab and next‑generation IO assets, solidifying its footprint in high‑value biologics.

- AstraZeneca (Imfinzi, Enhertu) – With the PD‑L1 inhibitor Imfinzi and the HER2‑directed antibody‑drug conjugate Enhertu, AstraZeneca targets both IO and HER2‑positive niches. Strategic co‑development partnerships with Daiichi Sankyo enable cross‑indication leverage, particularly in HER2‑mutant adenocarcinoma.

- Roche / Genentech (Tecentriq, Trastuzumab, Pertuzumab) – Roche positions itself in both immunotherapy and HER2 arenas. Combination strategies—such as Tecentriq plus chemotherapy for advanced disease and dual HER2 blockade for frontline adenocarcinoma—bolster its pipeline.

- BeiGene (Tislelizumab) – Emerging as a key Asian contender, BeiGene gained approvals for Tislelizumab in advanced esophageal cancer and is expanding into earlier lines of therapy, leveraging China’s large SCC patient base and price‑competitive positioning.

- Eli Lilly (Cyramza) – The VEGFR‑2 inhibitor Cyramza remains a cornerstone in second‑line settings. Lilly is pairing it with IO and exploring biomarkers to redefine its role in multi‑drug regimens, sustaining relevance amid IO dominance.

- Takeda (Nivolumab co‑marketing in Japan, targeted agents) – Takeda capitalizes on regional licensing deals and a robust gastrointestinal oncology franchise, supplying both IO and tyrosine‑kinase inhibitors tailored to Asian treatment protocols.

- Olympus, Boston Scientific, Pentax Medical – Diagnostic and endotherapy equipment leaders drive revenue via advanced endoscopes, EMR/ESD devices, and imaging technologies that detect dysplasia and early cancer, pivotal for shifting care toward earlier‑stage intervention.

- Exact Sciences, Guardant Health, Foundation Medicine – Liquid‑biopsy and sequencing innovators provide companion diagnostics and minimal residual disease monitoring, crucial for personalizing therapy, detecting recurrence early, and guiding clinical‑trial enrollment.

- Intuitive Surgical, Medtronic – Robotic and minimally invasive surgery pioneers facilitate thoracoscopic and laparoscopic esophagectomy adoption, reducing perioperative morbidity and enabling hospitals to market cutting‑edge surgical oncology programs.

Read Also: Benign Prostatic Hyperplasia Treatment Market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344

- Arteriovenous Implants Market Enhance dialysis outcomes with advanced grafts, endovascular access, and AI-assisted precision - September 16, 2025

- Smart Retinal Implants Market Restore vision with wireless bioelectronic prosthetics and AI-powered retinal technologies - September 16, 2025

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025