Endoscopy and Ambulatory Surgical Center Market Key Highlights

- In 2024, North America emerged as the dominant region, capturing the largest share of 37% in the global market. Meanwhile, the Asia Pacific region is projected to grow steadily at a CAGR of 3.70% over the forecast period.

- Based on surgical type, non-endoscopic procedures held a commanding share of 63% in 2024. However, the endoscopic segment is anticipated to witness the fastest growth rate during the forecast timeline.

- By end user, hospitals accounted for the largest share at 51% in 2024, while ambulatory surgical centers are expected to expand at the fastest pace in the coming years.

Endoscopy and Ambulatory Surgical Center Market Overview

The Endoscopy and Ambulatory Surgical Center (ASC) Market is witnessing robust expansion, driven by the global shift toward minimally invasive procedures and value-based outpatient care. Endoscopy, a medical procedure that enables internal visualization and diagnosis using flexible or rigid scopes, is increasingly performed in ambulatory surgical centers due to their efficiency, lower costs, and shorter recovery times compared to inpatient hospital settings. ASCs have become central to modern healthcare delivery, particularly for procedures such as colonoscopy, upper GI endoscopy, laparoscopy, bronchoscopy, and cystoscopy, among others.

The market’s growth is underpinned by a rising preference for outpatient surgeries, which offer significant cost benefits, lower infection risks, and reduced hospital stays for patients. Moreover, advancements in endoscopic technology—including high-definition imaging, capsule endoscopy, and robotic-assisted endoscopic surgery—are enhancing diagnostic precision and expanding the range of procedures that can be performed in ASCs. Increasing incidences of gastrointestinal disorders, colorectal cancer, obesity, and urological and gynecological conditions are further driving the demand for endoscopy services, while favorable reimbursement policies and healthcare reforms are accelerating the migration of procedures from hospitals to ambulatory centers.

Growth Factors

The growth of the endoscopy and ASC market is driven by a confluence of demographic, technological, and systemic healthcare factors. A key growth factor is the aging global population, which is more susceptible to chronic diseases such as colorectal cancer, gastrointestinal bleeding, and gallbladder conditions—all of which often require diagnostic or therapeutic endoscopy. As life expectancy increases, so too does the need for ongoing surveillance and minimally invasive intervention, making ASCs an efficient and patient-friendly option.

The rising burden of gastrointestinal and hepatobiliary diseases, exacerbated by changing dietary habits, sedentary lifestyles, and rising obesity rates, is also fueling demand for endoscopic diagnostics and interventions. Moreover, increasing awareness and participation in preventive health screening programs, especially for colorectal cancer, are significantly boosting the volume of procedures such as colonoscopy and sigmoidoscopy performed at ASCs.

Technological innovation is another major growth enabler. Breakthroughs in endoscopic visualization, flexible scope designs, electrosurgical tools, and real-time data integration are making endoscopic procedures safer, faster, and more accurate. Simultaneously, favorable regulatory environments and investments in ASC infrastructure—particularly in the United States, Europe, and parts of Asia—are supporting broader access to ambulatory endoscopy services.

Impact of AI on the Endoscopy and Ambulatory Surgical Center Market

Artificial Intelligence (AI) is having a transformative effect on the endoscopy and ASC market by enhancing clinical accuracy, operational efficiency, and patient outcomes. In diagnostic endoscopy, AI-powered tools are now being used for real-time polyp detection during colonoscopy, assisting gastroenterologists in identifying and classifying lesions with high sensitivity and specificity. This dramatically improves cancer detection rates and reduces inter-observer variability.

AI also supports automated image analysis and computer-aided diagnosis (CADx) in procedures like upper GI endoscopy and bronchoscopy, helping clinicians distinguish between benign and malignant lesions more reliably. Machine learning algorithms trained on thousands of annotated images are enabling more consistent interpretations, reducing false negatives, and expediting clinical decision-making.

In the context of ASCs, AI is streamlining operational workflows, such as scheduling optimization, inventory management, and patient triaging. Predictive analytics tools help centers forecast patient volumes, optimize staffing, and reduce procedure wait times. AI-integrated electronic health records (EHRs) can alert providers to patient risks based on prior histories, thereby improving safety and outcomes in outpatient settings.

Moreover, AI-driven robotic systems are increasingly being integrated with endoscopic equipment to assist in precision-guided interventions, especially in complex laparoscopic surgeries. These systems reduce human error and expand the potential for same-day discharge after procedures that previously required hospitalization.

Market Drivers

-

Increased demand for minimally invasive procedures, which offer quicker recovery and lower post-operative complications.

-

Shift toward outpatient care models, driven by rising healthcare costs and the need for more efficient service delivery.

-

Growing prevalence of digestive diseases, cancer, and obesity-related conditions requiring endoscopic interventions.

-

Technological advancements in endoscopes, imaging systems, and accessories, enabling safer and more diverse applications.

-

Expansion of ASC networks by both private healthcare providers and hospital systems looking to decentralize care.

Opportunities

-

Rising healthcare access in emerging economies, where expanding middle classes and healthcare infrastructure upgrades are increasing demand for outpatient services.

-

Integration of AI and digital health platforms into endoscopic diagnostics, offering new products and value-added services.

-

Development of specialized ASCs, focused solely on endoscopy, which can offer high-throughput, cost-effective care in urban and semi-urban areas.

-

Tele-endoscopy and remote diagnostics, especially for underserved or rural populations, where physical access to advanced facilities is limited.

-

Growth in preventive screening programs, supported by government health policies, leading to higher procedure volumes.

Challenges

-

High initial investment and maintenance costs of advanced endoscopic equipment and surgical infrastructure can deter smaller players.

-

Shortage of trained professionals, particularly endoscopists and perioperative nursing staff, may limit scalability.

-

Patient safety concerns and procedural risks, though minimal in endoscopy, can impact public perception and willingness to undergo elective procedures.

-

Regulatory and reimbursement complexities, especially in fragmented markets, can hinder procedural volume and profit margins.

-

Competition from hospitals and integrated health systems, which may offer bundled services, reducing footfall at independent ASCs.

Market Scope

| Report Coverage | Details |

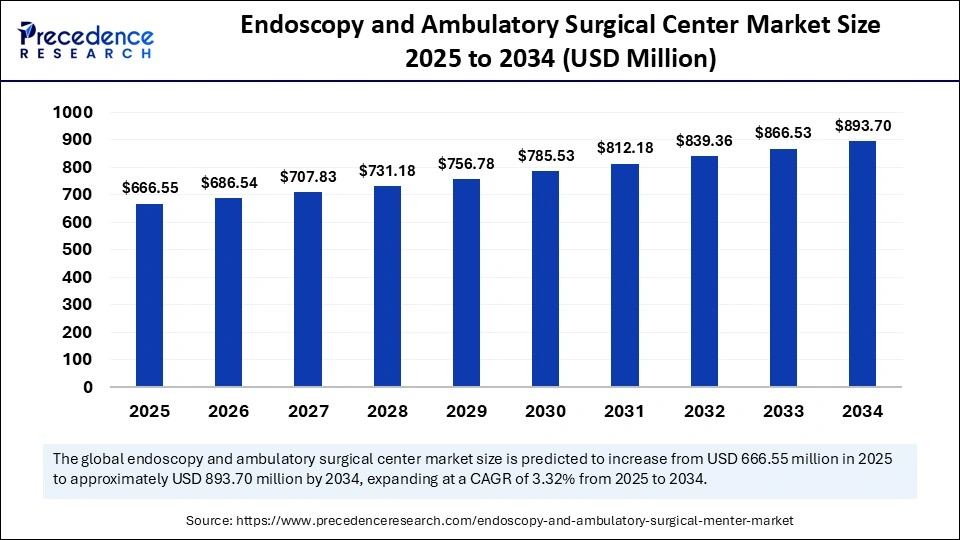

| Market Size by 2034 | USD 893.70 Billion |

| Market Size in 2025 | USD 666.55 Billion |

| Market Size in 2024 | USD 644.63 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.32% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Surgery Type, End User and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Outlook

North America dominates the global endoscopy and ASC market, with the United States being the largest contributor. The U.S. healthcare system is increasingly promoting outpatient care to control costs, and ASCs are central to this transition. The region’s mature regulatory framework, widespread insurance coverage for outpatient procedures, and high awareness of preventive screenings support sustained growth.

Europe follows closely, with countries like Germany, France, and the UK investing heavily in outpatient surgery infrastructure. The adoption of day-care surgery models, coupled with advanced imaging technologies and centralized electronic records, is facilitating procedural migration from hospitals to ASCs.

Asia-Pacific is the fastest-growing region, driven by rising disposable incomes, urbanization, and health awareness. Countries such as China, India, Japan, and South Korea are experiencing an increase in GI disease prevalence and cancer screening initiatives, which are fueling demand for endoscopic services and outpatient facilities.

Latin America and the Middle East & Africa are emerging markets with gradual improvements in healthcare infrastructure. While adoption is currently limited by access and affordability, foreign investments, public-private partnerships, and telemedicine expansion are expected to bridge these gaps over the next decade.

Endoscopy and Ambulatory Surgical Center Market Companies

- Olympus Corporation

- Boston Scientific Corporation

- PENTAX Medical (Hoya Corporation)

- FUJIFILM Holdings Corporation

- Karl Storz GmbH & Co., KG

- Stryker

- Medtronic

- Ambu A/S

- STERIS plc.

- CHSPSC, LLC.

- Edward-Elmhurst Health

- Eifelhöhen-Klinik AG

- Envision Healthcare Corporation

- Healthway Medical Group

- Nexus Day Surgery Centre

- Pediatrix Medical Group

- Prospect Medical Holdings, Inc.

- SurgCenter

- Surgery Partners

- TH Medical

- UNITEDHEALTH GROUP

Segments Covered in the Report

By Surgery Type

- Endoscopic

- Gastrointestinal Endoscopy

- Obstetrics Endoscopy

- Urology Endoscopy

- Laparoscopy

- Bronchoscopy

- Laryngoscopy

- Arthroscopy

- Others

- Non-endoscopic

- Ophthalmology

- Obstetrics/Gynaecology

- Orthopedic

- Cardiovascular

- Otolaryngology

By End User

- Ambulatory Surgical Centers

- Hospitals

- Others

By Region

- North America

- Europe

- Asia-Pacific,

- Latin America

- Middle East & Africa

Read Also: Neutralizing Antibody Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6084

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344

- Arteriovenous Implants Market Enhance dialysis outcomes with advanced grafts, endovascular access, and AI-assisted precision - September 16, 2025

- Smart Retinal Implants Market Restore vision with wireless bioelectronic prosthetics and AI-powered retinal technologies - September 16, 2025

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025