Diagnostic Dermatology Equipment Market Key Points

-

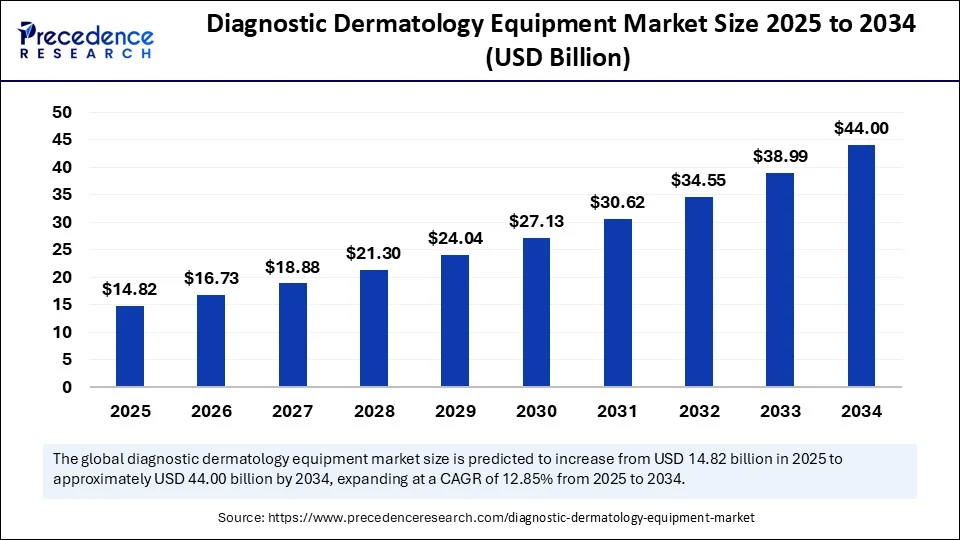

The global diagnostic dermatology equipment market was valued at USD 13.14 billion in 2024 and is projected to reach USD 44 billion by 2034, growing at a CAGR of 12.85% from 2025 to 2034.

-

North America led the market in 2024, while the Asia Pacific region is expected to register the fastest CAGR during the forecast period.

-

By device type, dermatoscopes accounted for the largest market share in 2024.

-

The microscopes & trichoscopes segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

-

In terms of application, dermatitis dominated the market in 2024.

-

The skin cancer segment is projected to expand at a notable CAGR throughout the forecast period.

-

Among end-users, dermatology clinics held the largest share in 2024.

-

The hospitals segment is expected to experience significant growth in the coming years.

Diagnostic Dermatology Equipment Market Growth Factors

Several structural and healthcare-related factors are propelling the growth of this market. An increasing incidence of skin diseases such as melanoma, acne, psoriasis, and eczema has led to rising demand for early and accurate diagnosis. The expansion of dermatology clinics, rising healthcare spending, and the growing popularity of cosmetic and aesthetic procedures further support market expansion. Additionally, greater patient awareness of skin health and the availability of innovative diagnostic tools are fueling market penetration even in emerging economies.

Role of AI in the Diagnostic Dermatology Equipment Market

Artificial Intelligence (AI) is playing an increasingly crucial role in the diagnostic dermatology equipment market. AI-powered imaging systems can now detect skin abnormalities with high precision, offering diagnostic support for conditions like skin cancer, rosacea, and dermatitis. Machine learning algorithms are being integrated into digital dermatoscopes and optical coherence tomography (OCT) devices to enhance diagnostic accuracy and reduce human error. AI also enables real-time image analysis, pattern recognition, and clinical decision support, making skin examinations more scalable, especially in teledermatology and rural health applications.

Key Market Drivers

-

Technological advancements in imaging equipment, such as high-resolution dermatoscopes, reflectance confocal microscopy, and optical coherence tomography, are improving diagnostic capabilities.

-

Increased demand for non-invasive and early detection methods is encouraging dermatology practices and hospitals to adopt advanced diagnostic tools.

-

Aesthetic consciousness among younger and older populations is prompting individuals to seek early dermatological consultations, thereby boosting demand.

-

Rise in skin cancer cases, especially melanoma, is generating the need for routine skin screening and advanced diagnostic devices.

Opportunities

-

Expansion into emerging markets, particularly in Asia-Pacific and Latin America, presents immense growth potential due to rising healthcare infrastructure and awareness of skin health.

-

Integration of telemedicine and mobile diagnostics offers new business models and service delivery options, especially in underserved areas.

-

Product innovation, including handheld, wireless, and AI-integrated diagnostic tools, will attract both clinics and home-care users.

-

Partnerships between tech companies and healthcare providers can accelerate the commercialization of smart diagnostic systems.

Challenges

-

High cost of advanced dermatology equipment limits access for small and mid-sized healthcare facilities.

-

Shortage of trained dermatologists in many regions restricts the adoption of advanced diagnostic tools.

-

Data privacy and regulatory concerns around AI-based diagnostic systems may slow down market penetration in some countries.

-

Lack of reimbursement for dermatological diagnostic procedures, particularly cosmetic-related ones, can impact market growth.

Regional Outlook

-

North America held the largest market share in 2024, supported by high healthcare expenditure, strong technological adoption, and an established network of dermatologists and clinics.

-

Europe follows closely due to a rising elderly population, high incidence of skin disorders, and favorable reimbursement policies.

-

Asia-Pacific is the fastest-growing region, fueled by improving healthcare infrastructure, a large population base, and rising awareness of dermatological health. Countries like China, India, and Japan are experiencing rapid adoption of diagnostic technologies.

-

Latin America and the Middle East & Africa are gradually expanding their presence in the market, driven by urbanization, medical tourism, and government healthcare initiatives.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6313

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 44 Billion |

| Market Size in 2025 | USD 14.82 Billion |

| Market Size in 2024 | USD 13.14 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.85% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Device Type, Application, End-User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

By Product:

-

Dermatoscopes accounted for a significant share in 2024, driven by their widespread use in diagnosing skin lesions and melanoma.

-

Imaging equipment, including digital and portable devices, is growing at a rapid pace due to increasing demand for non-invasive diagnostics.

-

Biopsy devices remain essential tools, particularly for confirming skin cancer diagnoses, although their invasive nature may limit usage compared to optical tools.

By End-User:

-

Hospitals dominate the market due to their broad access to capital-intensive equipment and availability of trained personnel.

-

Dermatology clinics are rapidly expanding their share with the rising number of private practices and specialized centers.

-

Homecare and teledermatology settings are emerging segments, boosted by AI-integrated handheld devices and growing preference for remote consultations.

Key Players in Diagnostic Dermatology Equipment Market

- Bausch Health

- Alma Lasers Ltd.

- Cutera, Inc.

- Lumenis Be Ltd.

- Cynosure Inc.

- Dino-Lite Europe

- IDCP B.V.

- Genentech, Inc.

- Michelson Diagnostics Ltd.

- Galderma S.A.

- Casio Computer Co., Ltd.

- Nikon Corporation

- Others

Recent Developments in Diagnostic Dermatology Equipment Market

- In March 2025, Damae Medical announced that its deepLive™ medical device received 510(k) clearance from the U.S. Food and Drug Administration (FDA). deepLive™ is a non-invasive imaging technology that delivers real-time, 3D visualization of the skin, enabling dermatologists to conduct highly precise clinical evaluations and assess tissue health with greater accuracy.

Read Also: Duchenne Muscular Dystrophy Drugs Market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344

- Arteriovenous Implants Market Enhance dialysis outcomes with advanced grafts, endovascular access, and AI-assisted precision - September 16, 2025

- Smart Retinal Implants Market Restore vision with wireless bioelectronic prosthetics and AI-powered retinal technologies - September 16, 2025

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025