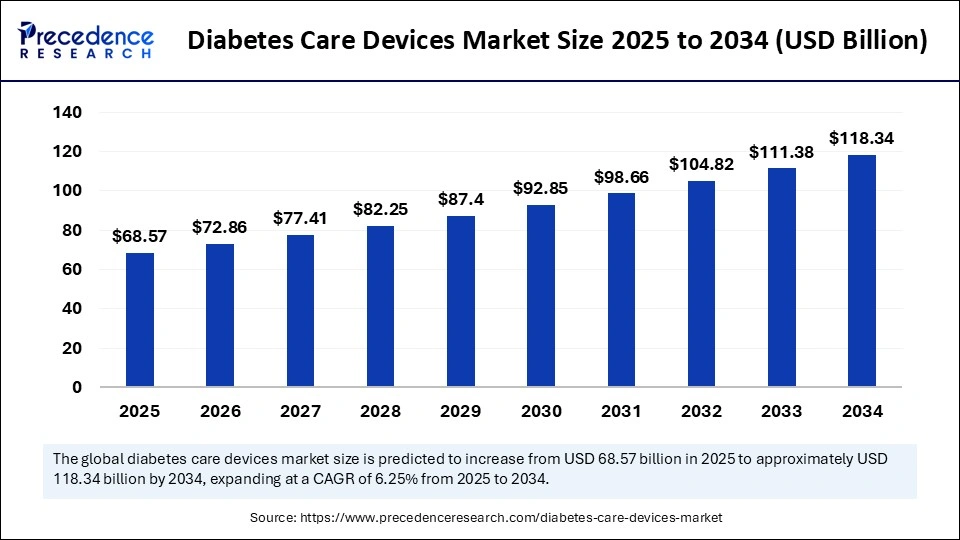

Market poised for a steady CAGR of 6.25% from 2025 to 2034, led by North America’s dominance and rapid technological advancements

The global diabetes care devices market is rapidly evolving, projected to reach a substantial valuation of USD 118.34 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.25% from 2025 onward. This growth is primarily fueled by the increasing prevalence of diabetes worldwide, heightened awareness of disease management, and continuous innovation in diabetes monitoring and insulin delivery devices.

The rising geriatric population, alongside shifting lifestyle patterns marked by unhealthy diets and reduced physical activity, has further accelerated demand. Advanced healthcare infrastructure and supportive government policies also play a significant role in driving market expansion.

Diabetes Care Devices Market Quick Insights

-

Global market valuation reached USD 64.54 billion in 2024

-

Projected market size of USD 118.34 billion by 2034 at a CAGR of 6.25%

-

North America led the market in 2024 with 39% revenue share

-

Key players include Medtronic, Abbott Laboratories, Dexcom, Roche, and Tandem Diabetes Care

-

Increasing adoption of continuous glucose monitors (CGMs) and insulin delivery devices

-

Emerging markets in Asia-Pacific presenting significant growth opportunities

How is the Diabetes Care Devices Market Shaping Regional Leadership and Growth Dynamics?

North America stands as the dominant region in the diabetes care devices market, attributed to advanced healthcare systems, high patient awareness, and strong presence of major industry players. The U.S. market, carrying a revenue of approximately USD 11.04 billion in 2024, is forecasted to nearly double by 2034.

Growing health consciousness, increased funding for diabetes research, and expanded reimbursement frameworks amplify growth. Meanwhile, Europe and Asia-Pacific are poised for rapid expansions due to improving healthcare infrastructures and rising diabetes incidence rates.

Asia-Pacific’s market growth is further catalyzed by urbanization, greater healthcare investments, and governmental encouragement in key countries such as China and India.

What Are the Latest Breakthroughs Driving Innovation in Diabetes Care Devices?

Leading companies are pushing the envelope with state-of-the-art continuous glucose monitoring systems, smart insulin pens, and personalized digital health platforms. For example, Dexcom’s collaboration with ŌURA integrates glucose monitoring with holistic health tracking via wearable technology. Abbott’s introduction of over-the-counter glucose sensors and Roche’s advanced CGM solutions exemplify how wearable technology and real-time data insights are revolutionizing diabetes management. Innovations focus on enhancing user convenience, accuracy, and seamless connectivity for better disease management.

Diabetes Care Devices Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 118.34 Billion |

| Market Size in 2025 | USD 68.57 Billion |

| Market Size in 2024 | USD 64.54 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.25% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, End User, Distribution Channel, Patient Type, Usage, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

What Opportunities and Trends Are Emerging in the Market?

-

Increasing integration of artificial intelligence and digital health technologies for personalized diabetes management

-

Shift towards home-based monitoring tools, reducing hospital dependency

-

Growing acceptance of non-invasive glucose monitoring devices

-

Expansion of telemedicine and mobile applications enhancing patient engagement and adherence

-

Emerging markets with unmet demand providing ample room for expansion

What Challenges and Cost Pressures Are Market Players Facing?

Despite promising growth, the diabetes care devices market grapples with high product costs, reimbursement challenges, and regulatory hurdles. The affordability of advanced devices remains a barrier in low- and middle-income countries. Additionally, the need for continuous innovation to stay competitive demands substantial R&D investments. Data privacy and cybersecurity concerns in digital diabetes management also present challenges.

How Do Market Segments Break Down?

The diabetes care devices market is broadly segmented into monitoring devices and insulin delivery devices. Glucometers remain the largest share holders among self-monitoring blood glucose devices, while continuous glucose monitoring segments are witnessing the fastest growth. On the insulin delivery side, disposable insulin pens hold a major share, with insulin pumps predicted to register the highest CAGR due to their efficiency and convenience.

Case Study Highlight

A leading U.S.-based healthcare provider implemented continuous glucose monitoring paired with AI-driven analytics for diabetic patients. This approach improved glycemic control by providing patients and clinicians with predictive insights, reducing hospital admissions and enhancing quality of life. Such implementations underscore the market’s potential to transform diabetes care beyond traditional methods.

Diabetes Care Devices Market Companies

- Abbott Laboratories

- Medtronic plc

- F. Hoffmann-La Roche Ltd

- Dexcom, Inc.

- Ascensia Diabetes Care (PHC Holdings)

- LifeScan, Inc.

- Insulet Corporation

- Tandem Diabetes Care, Inc.

- B. Braun Melsungen AG

- Ypsomed AG

- Terumo Corporation

- Novo Nordisk A/S

- Eli Lilly and Company

- Sanofi S.A.

- Glooko, Inc.

- Senseonics Holdings, Inc.

- ARKRAY, Inc.

- Nipro Corporation

- Embecta Corp

- AgaMatrix, Inc.

Segments Covered in the Report

By Product Type

- Blood Glucose Monitoring Devices

- Self-Monitoring Blood Glucose (SMBG) Devices

- Glucometers

- Test Strips

- Lancets

- Continuous Glucose Monitoring (CGM) Systems

- Sensors

- Transmitters & Receivers

- Integrated CGM Systems

- Flash Glucose Monitoring Systems

- Insulin Delivery Devices

- Insulin Pens

- Disposable Pens

- Reusable Pens

- Insulin Pumps

- Tethered Pumps

- Patch Pumps

- Insulin Syringes

- Jet Injectors

- Others

- Digital Diabetes Management Platforms

- Smart Wearables & Smart Insulin Patches

By End User

- Hospitals & Clinics

- Homecare Settings

- Ambulatory Surgical Centers (ASCs)

- Diabetes Specialty Centers

- Others

By Distribution Channel

- Institutional Sales

- Hospitals

- Clinics

- Pharmacies

- Retail Sales

- Online Pharmacies

- Offline Retail (Stores)

- Direct-to-Consumer

By Patient Type

- Type 1 Diabetes

- Type 2 Diabetes

- Gestational Diabetes

- Others (Pre-diabetic, monogenic diabetes, etc.)

By Usage

- Diagnostic Use

- Therapeutic Use

- Remote Patient Monitoring

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Read Also: Exosome Isolation Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344

- Arteriovenous Implants Market Enhance dialysis outcomes with advanced grafts, endovascular access, and AI-assisted precision - September 16, 2025

- Smart Retinal Implants Market Restore vision with wireless bioelectronic prosthetics and AI-powered retinal technologies - September 16, 2025

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025