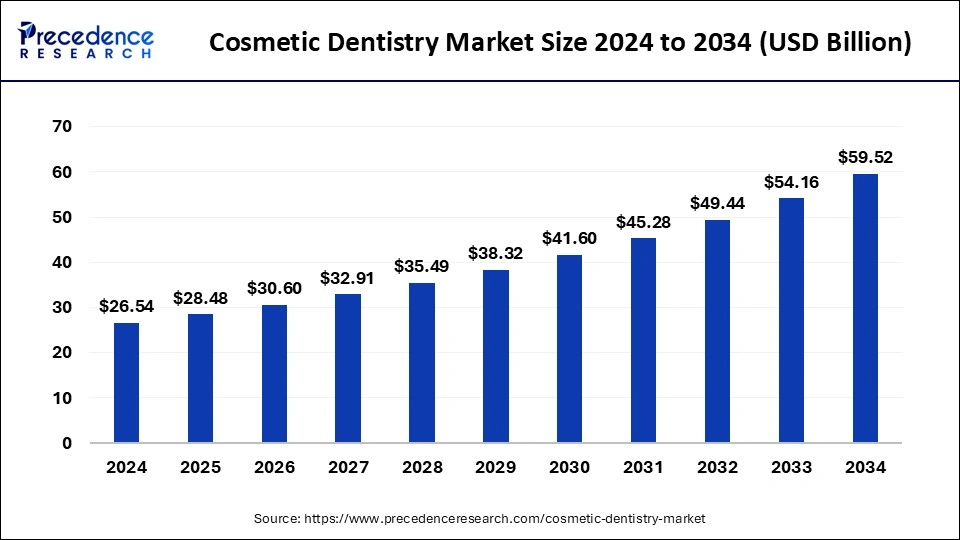

The global cosmetic dentistry market size was valued at USD 26.54 billion in 2024 and is projected to grow from USD 28.48 billion in 2025 to around USD 59.52 billion by 2034, expanding at a CAGR of 8.53% during the forecast period (2025–2034).

Cosmetic Dentistry Market Key Takeaways

-

By product: Dental systems & equipment held the largest share at 21.94% in 2024.

-

By end user: Dental hospitals & clinics accounted for 67.87% revenue share in 2024.

-

By geography, North America captured the majority share at 33.93% in 2024.

-

The orthodontic braces segment is forecast to grow at a CAGR of 9.5%.

-

Dental implants and dental laboratories are set to witness notable growth.

Read Also: Liquid Biopsy Market

How AI Integration is Transforming Cosmetic Dentistry

Artificial Intelligence (AI) is revolutionizing the cosmetic dentistry market with

-

AI-powered smile design: Aligns dental aesthetics with facial proportions.

-

Treatment planning tools: Optimizes braces, aligners, and implant positioning.

-

CAD/CAM and 3D printing synergy: Enables same-day production of crowns, veneers, and aligners that look and feel natural.

U.S. Cosmetic Dentistry Market Size and Growth 2025 to 2034

The U.S. cosmetic dentistry market was valued at USD 4.25 billion in 2024 and is expected to reach USD 8.88 billion by 2034, growing at a CAGR of 7.76%.

Key Growth Drivers in the U.S.

-

Increasing oral aesthetic awareness driven by social media influence.

-

Rising demand for teeth whitening, aligners, and smile makeovers.

-

Adoption of digital workflows (intraoral scanning, CAD/CAM, AI smile simulation).

-

Growing demand from aging populations seeking youthful appearance.

Market Scope

| Report Coverage | Details |

|---|---|

| Growth Rate (2025–2034) | CAGR of 8.53% |

| Market Size in 2025 | USD 28.48 Billion |

| Market Size by 2034 | USD 59.52 Billion |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segments Covered | Product, End User, Age Group |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Regional Insights

North America

-

Held the largest revenue share in 2024.

-

Growth supported by an aging population, technological advancements, and higher adoption of cosmetic procedures.

Asia Pacific

-

Expected to be the fastest-growing market.

-

Rising disposable incomes in China and India.

-

Expansion of dental tourism boosting market growth.

Country highlights:

-

China: USD 2.40B (2024) → USD 5.95B (2034), CAGR 9.6%.

-

Japan: USD 1.45B (2024) → USD 3.90B (2034), CAGR 10.5%.

-

India: USD 1.25B (2024) → USD 3.42B (2034), CAGR 10.7%.

Europe

-

Strong market presence with advanced dental systems in Germany, France, and the U.K.

-

Growing demand for whitening, implants, and clear aligners.

-

Increasing regulatory standards enhance quality and patient trust.

Market Growth Factors

-

Technological Advancements: CAD/CAM, robotics, dental lasers, and 3D printing.

-

Lifestyle Shifts: Higher demand for aesthetics-driven treatments.

-

Aging Population: Rising age-related dental issues are driving cosmetic demand.

Challenges

-

High costs of cosmetic dental procedures limiting accessibility.

-

Pricing competition between global and local players.

Opportunities

-

Development of innovative materials like zirconium and titanium implants.

-

Rising demand for minimally invasive treatments and laser dentistry.

-

Expanding adoption of adhesive dentistry for natural aesthetics.

Product Insights

-

Dental Implants: Fastest-growing segment due to natural look and durability.

-

Dental Veneers & Crowns: Increasing popularity for smile restoration.

-

Orthodontic Braces & Clear Aligners: Growing adoption, especially among youth.

End-User Insights

-

Dental Hospitals & Clinics: Largest market share.

-

Dental Laboratories: Rapidly expanding with the adoption of 3D printing and CAD/CAM workflows for custom restorations.

Recent Developments

-

Apr 2025: Align Technology launched Invisalign System with mandibular advancement in the U.S. and Canada.

-

Oct 2024: Align Technology updated its Invisalign Smile Architect software with multi-treatment planning.

-

Apr 2024: Straumann launched the iEXCEL premium implant system in North America and the AlliedStar intraoral scanner in China.

Cosmetic Dentistry Market Companies

- 3M Company

- J. Morita Corp.

- Brasseler USA

- IvoclarVivadent AG

- BIOLASE Inc.

- 3Shape A/S

- GC Corporation

- Runyes Medical Instrument

- DentalEZ Inc.

- Henry Schein

- Dentsply International Inc.

- VATECH

- Straumann Holdings AG

- Millennium Dental Technologies Inc.

- Yoshida Dental Mfg. Co. Ltd.

- Align Technology

- Kuraray Co. Ltd.

- Zimmer Biomet Holdings Inc.

- Planmeca Oy

- Sirona Dental Systems Inc.

Segments Covered in the Report

By Product

- Dental Systems & Equipment

- Instrument Delivery Systems

- Dental Chairs

- Dental Handpieces

- Light Curing Equipment

- Dental Scaling Units

- Dental CAM/CAD Systems

- Dental Lasers

- Dental Radiology Equipment

- Dental Implants

- Dental Crowns and Bridges

- Dental Veneer

- Orthodontic Braces

- Clear Aligners

- Others

- Bonding Agents

- Inlays and Onlays

- Whitening

By End User

- Dental Hospitals & Clinics

- Dental laboratories

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Aquaculture Healthcare Market Size to Surge USD 3.04 Bn by 2034 - September 18, 2025

- Cosmetic Dentistry Market Size to Hit USD 59.52 Billion by 2034 - September 18, 2025

- Liquid Biopsy Market Size to Reach USD 22.69 Billion by 2034 - September 18, 2025