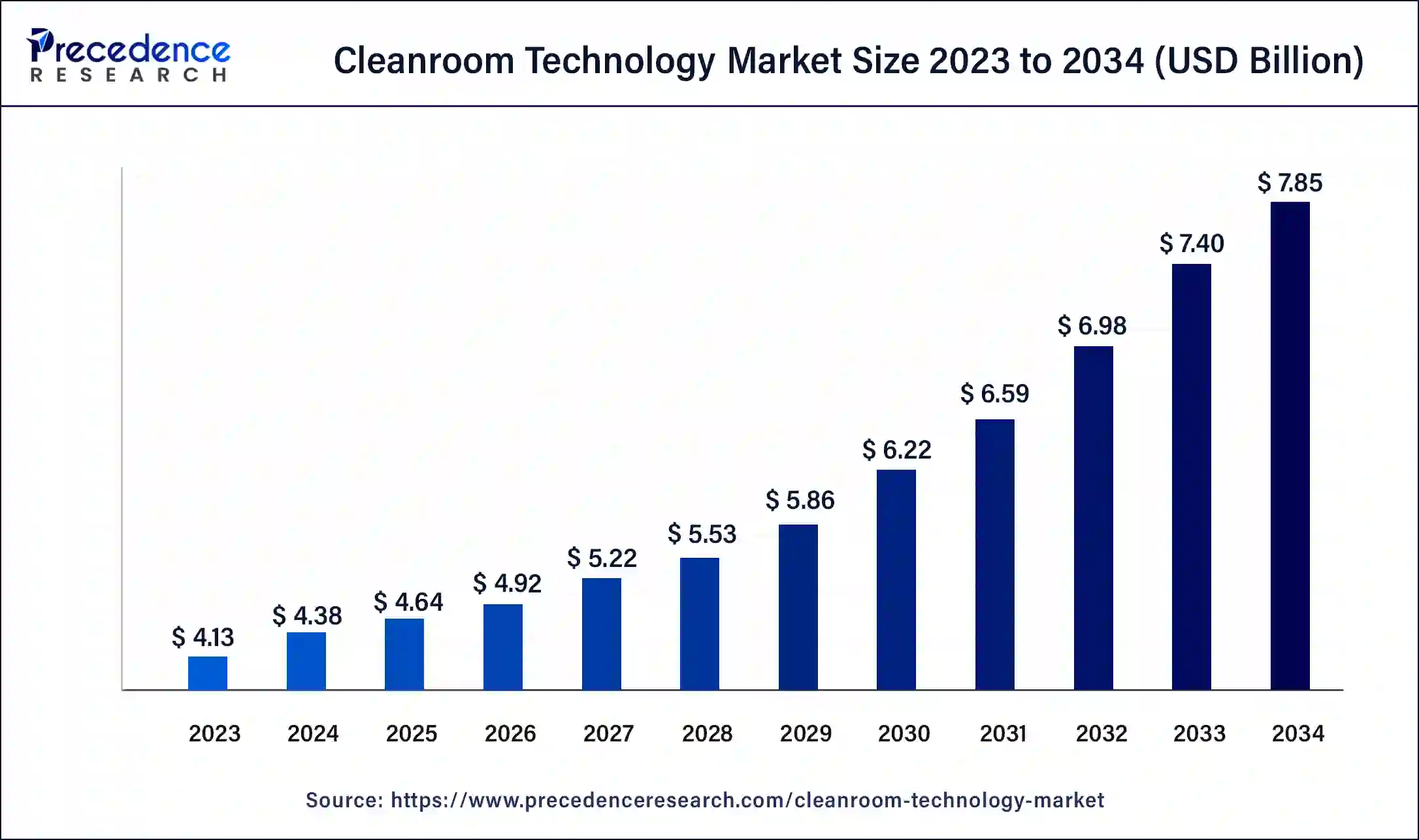

The global cleanroom technology market is valued at USD 4.38 billion in 2024 and is projected to reach USD 7.85 billion by 2034, growing at a CAGR of 6.01% between 2025 and 2034. Increasing demand from the pharmaceutical, biotechnology, and electronics sectors, coupled with strict regulatory frameworks and rising emphasis on contamination-free manufacturing, is driving sustained growth in this market.

Read Also: Epinephrine Market

Key Market Drivers

1. Stringent Regulatory Standards

Cleanroom technology adoption is heavily influenced by global Good Manufacturing Practices (GMP) and Good Distribution Practices (GDP) regulations.

-

Agencies like the FDA (U.S.) and EMA (Europe) require cleanroom compliance for pharmaceuticals and biotech manufacturing.

-

Non-compliance can lead to product recalls, fines, or reputational damage, compelling manufacturers to invest in advanced cleanroom systems.

-

The electronics and semiconductor sectors also follow strict ISO 14644 standards to prevent particle contamination during wafer fabrication and testing.

2. Expanding Pharmaceutical and Biotechnology Production

The pharmaceutical industry accounts for 31.9% of total cleanroom demand (2024), fueled by:

-

Rising biologics and biosimilar production.

-

A surge in cell and gene therapy manufacturing.

-

Strong R&D investments in sterile drug development.

These facilities depend on contamination-free environments to meet quality assurance and patient safety standards.

3. Technological Advancements in Cleanroom Design

Advancements in HVAC systems, HEPA/ULPA filtration, and airflow control technologies have led to higher efficiency and better particulate control.

The integration of AI and IoT is revolutionizing cleanroom operations by providing predictive maintenance and real-time environmental monitoring.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 4.38 Billion |

| Market Size in 2025 | USD 4.64 Billion |

| Market Size by 2034 | USD 7.85 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.01% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Opportunities

1. Growth of Advanced Manufacturing Processes

The shift toward high-precision manufacturing in sectors such as semiconductors, aerospace, and medical devices has created new demand for cleanroom infrastructure.

-

For instance, next-generation chip fabrication and biopharmaceutical production processes require ultra-clean environments (ISO Class 5–7).

2. Focus on Energy Efficiency and Sustainability

As industries move toward green operations, manufacturers are adopting energy-efficient air handling systems and eco-friendly construction materials.

-

Companies such as Contec (EcoShield initiative, May 2025) and QleanAir Scandinavia (QleanGuard Monitoring System) are pioneering sustainable cleanroom innovations.

-

Energy-efficient HVAC and filtration systems reduce both operational costs and environmental impact, aligning with corporate ESG goals.

3. Modular and Flexible Cleanroom Designs

The modular cleanroom segment is forecasted to grow at a CAGR of 8.80%, the fastest among all types.

-

Modular systems offer speedy installation, scalability, and cost-effectiveness.

-

These setups are increasingly preferred for pharma R&D, semiconductor, and biotech labs that require flexible upgrades.

Restraints and Challenges

-

High Initial Capital Investment:

Designing and constructing ISO-compliant cleanrooms involves substantial costs due to specialized filtration, HVAC, and validation systems, limiting adoption among SMEs. -

Complex Regulatory Compliance:

Constant validation, monitoring, and documentation requirements make compliance both time-consuming and resource-intensive.

Companies face penalties for deviations from FDA, ISO 14644, or EU GMP standards.

Industry Trends

-

Increasing automation and AI-driven monitoring systems for contamination control.

-

Adoption of IoT-enabled cleanrooms for real-time tracking.

-

Growth in non-porous composite panels and powder-coated steel materials to improve durability and hygiene.

-

Rise in energy recovery systems and eco-design cleanroom solutions to reduce operational costs.

Segment Covered in the Report

By Product Type

- Equipment

- HVAC Systems

- HEPA Filters / ULPA Filters

- Fan Filter Units (FFU)

- Laminar Airflow Units

- Air Diffusers & Showers

- Pass-Through Systems

- Cleanroom Furniture (Benches, Cabinets)

- Others (e.g., Biosafety Cabinets, Trolleys, Glove Boxes)

- Consumables

- Apparel

- Coveralls

- Gloves

- Shoe Covers

- Hoods and Masks

- Cleaning Products

- Mops & Wipes

- Disinfectants & Detergents

- Stationery and Tapes

- Swabs and Adhesive Mats

- Others

- Apparel

By Type of Cleanroom

- Standard Cleanroom

- Modular Cleanroom

- Softwall Cleanroom

- Hardwall Cleanroom

- Mobile Cleanroom

By Construction Type

- New Cleanroom Construction

- Restrooms and Renovations

By End User / Industry

- Pharmaceutical Industry

- API & Formulation Plants

- Biologics Manufacturing

- Biotechnology

- Medical Devices

- Hospitals & Diagnostic Centers

- Electronics & Semiconductor

- Food & Beverage Processing

- Aerospace & Defense

- Automotive

- Optics and Laser Industry

- Research Laboratories / Academic Institutes

By ISO Cleanroom Classification (Air Cleanliness Class)

- ISO 1–ISO 3 (Ultra-clean)

- ISO 4–ISO 5 (Very High Cleanliness)

- ISO 6–ISO 7 (Moderate Cleanliness)

- ISO 8–ISO 9 (General Cleanliness)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Life Science Instrumentation Market Size to Reach USD 111.55 Bn by 2034 - October 7, 2025

- Biopharmaceutical Third Party Logistics Market Size Surpass USD 271.76 Billion by 2034 - October 7, 2025

- Cleanroom Technology Market Size to Reach USD 7.85 Bn By 2034 - October 6, 2025