Blood Transfusion Diagnostics Market Key Takeaways

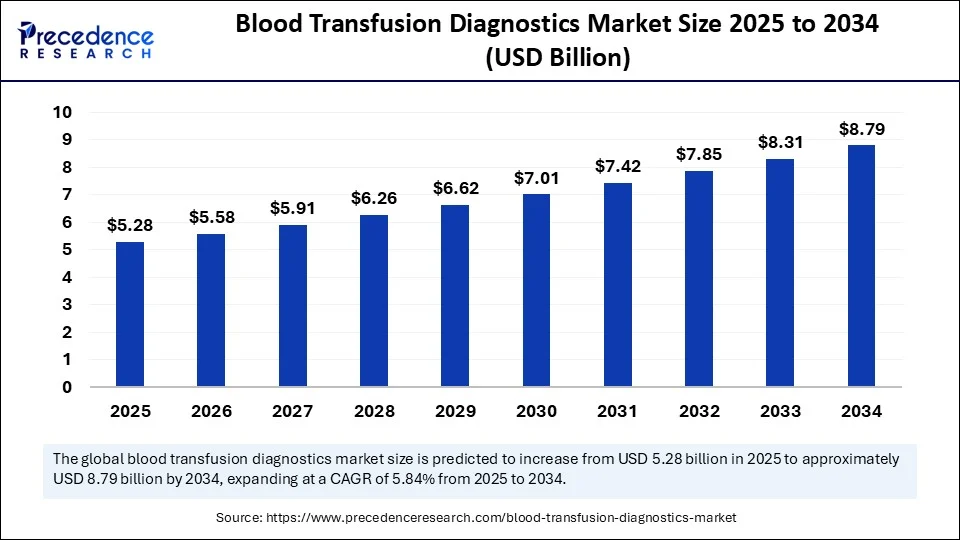

- In terms of revenue, the global blood transfusion diagnostics market was valued at USD 4.98 billion in 2024.

- It is projected to reach USD 8.79 billion by 2034.

- The market is expected to grow at a CAGR of 5.84% from 2025 to 2034.

- North America dominated the blood transfusion diagnostics market with the largest market share of 33.7% share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By product type, the reagents & kits segment held the biggest market share of 52.8% in 2024.

- By product type, the instruments segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By test type, the disease screening segment captured the biggest market share of 45.1% in 2024.

- By test type, the molecular testing segment is expected to expand at a notable CAGR over the projected period.

- By technology, the serology-based testing segment contributed the major market share of 48.6% in 2024.

- By technology, the molecular-based testing segment is expected to expand at the highest CAGR over the projected period.

- By end user, the hospitals segment generated the major market share of 42% in 2024.

- By end user, the plasma fractionation centers segment is expected to expand at a notable CAGR over the projected period.

How is AI Redefining Blood Transfusion Diagnostics

The application of artificial intelligence in the Blood Transfusion Diagnostics Market is accelerating, supporting more precise and efficient testing. AI-enabled systems can interpret multiplex NAT assays and chemiluminescent immunoassays rapidly, minimizing false positives and enhancing throughput. Deep-learning imaging solutions enable reagent-free leukocyte classification and compatibility prediction. Machine learning models are increasingly used in data-rich labs for predictive risk profiling, compatibility scoring, and optimizing donor-recipient matching workflows.

Drivers

Some of the most influential drivers for the Blood Transfusion Diagnostics Market include:

-

Increasing incidence of blood disorders and transfusion needs among aging and surgical patient populations.

-

Rising regulatory emphasis on nucleic acid testing and pathogen screening to reduce transfusion-transmitted infections.

-

Expansion of blood donation programs, hospitals, and diagnostic centers in fast-growing regions.

-

Demand for standardized, automated systems that reduce manual errors and optimize capacity.

-

Increased R&D in molecular and point-of-care diagnostics improving accessibility and speed.

Market Trends

Current trends reshaping the Blood Transfusion Diagnostics Market:

-

Growing uptake of automated blood group typing and centrifuge-incubator combined platforms.

-

Rising share of nucleic acid-based testing (PCR, digital PCR) for highly sensitive screening.

-

Continued dominance of reagents & kits, especially low-cost, high-volume consumables.

-

Emergence of portable, rapid point-of-care devices for on-site compatibility checks.

-

Enhanced connectivity between diagnostic instruments and laboratory information systems for streamlined operations.

Opportunities

Significant growth opportunities in the Blood Transfusion Diagnostics Market:

-

Rapid deployment in emerging markets with improved healthcare access and donor safety programs.

-

AI-based diagnostic algorithms that provide enhanced compatibility scoring and diagnostics efficiency.

-

Scaling microfluidics and lab-on-a-chip platforms for use in remote or low-resource settings.

-

Adoption of next-gen sequencing and universal pathogen inactivation tools to advance blood safety.

-

Strategic partnerships between diagnostic developers and transfusion services to validate next-gen platforms.

Also Read@ https://www.pharma-geek.com/laser-capture-microdissection-market/

Challenges

Key challenges in the Blood Transfusion Diagnostics Market include:

-

High cost barrier for advanced diagnostics, limiting penetration in lower-income regions.

-

Limited expert workforce for operating molecular and automated diagnostic instruments.

-

Complex global regulatory landscapes delaying product approvals and cross-border adoption.

-

Supply chain disruptions affecting reagent and kit availability and pricing.

-

Relatively slow acceptance of novel test formats without long-term clinical validation.

Recent Developments

Recent advances in the Blood Transfusion Diagnostics Market include:

-

In early 2025, a major lab-instrument company debuted a high-throughput automated transfusion diagnostics platform enhancing blood screening speed.

-

In 2024, several new assays launched, including advanced PCR-based multiplex tests and novel compatibility-screening reagents.

-

Automated immunohematology analyzers were upgraded in 2023 to offer faster throughput, stronger data integrity, and remote monitoring.

-

Quality control and data management platforms have been integrated across multiple companies to standardize diagnostics reporting.

-

Pilot deployments of AI-based reagent-free hematology imaging systems and point-of-care microfluidic diagnostics are underway in select regions.

Blood Transfusion Diagnostics Market Companies

- Grifols, S.A.

- Ortho Clinical Diagnostics

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche Ltd.

- Abbott Laboratories

- Siemens Healthineers AG

- Immucor, Inc.

- Thermo Fisher Scientific Inc.

- Quotient Limited

- Danaher Corporation (Beckman Coulter)

- Becton, Dickinson and Company (BD)

- HemoCue AB

- BioMérieux SA

- DiaSorin S.p.A.

- Sysmex Corporation

- Bag Health Care GmbH

- Fresenius Kabi AG

- Gen-Probe Incorporated (Hologic)

- Agena Bioscience, Inc.

- Tulip Diagnostics (P) Ltd.

Segments Covered in the Report

By Product Type

- Instruments

- Immunohematology Analyzers

- Nucleic Acid Amplification Systems (NAT)

- Microarray Platforms

- ELISA Readers

- PCR Systems

- Others

- Reagents & Kits

- ABO/Rh Typing Reagents

- Antibody Screening Reagents

- NAT Reagents

- HLA Typing Kits

- ELISA Kits

- Others

- Software & Services

- Blood Bank Management Software

- Laboratory Information Systems (LIS)

- Testing Services

- Others

By Test Type

- Blood Group Typing

- ABO Typing

- Rh Typing

- Antibody Screening

- Disease Screening

- HIV

- Hepatitis B & C

- Syphilis

- Malaria

- Other

- Molecular Testing

- NAT (Nucleic Acid Testing)

- Genotyping & HLA Typing

- Pathogen Inactivation Detection

- Crossmatching & Compatibility Testing

- Major Crossmatch

- Minor Crossmatch

By Technology

- Serology-based Testing

- Molecular-based Testing

- Microarray

- Next-generation Sequencing (NGS)

- Enzyme-linked Immunosorbent Assay (ELISA)

- Rapid Diagnostics

- Others

By End User

- Hospitals

- Blood Banks

- Diagnostic Laboratories

- Plasma Fractionation Centers

- Academic & Research Institutes

Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get Sample Link@ https://www.precedenceresearch.com/sample/6520

- Estrogen Replacement Therapy Market Size to Reach USD 19.46 Billion by 2034 - September 18, 2025

- Peptide Therapeutics CDMO Market Report Size, Share & Forecast 2034 - September 17, 2025

- Rare Musculoskeletal Disorder Treatments Market Size, Share & Future Trends 2034 - September 17, 2025