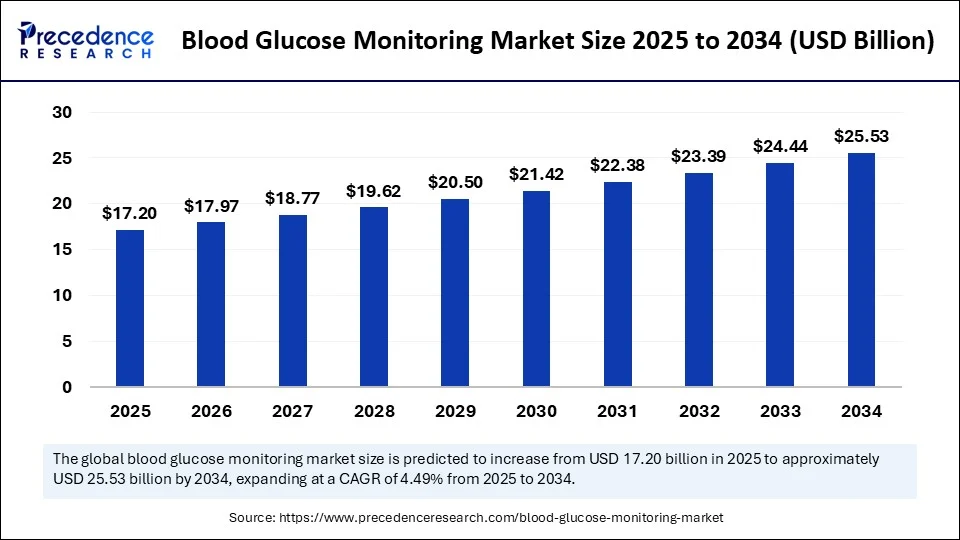

The global blood glucose monitoring market is experiencing robust growth driven by the escalating prevalence of diabetes and rapid technological advancements. Valued at USD 16.46 billion in 2024, the market is projected to reach approximately USD 25.53 billion by 2034, registering a compound annual growth rate (CAGR) of 4.49% from 2025 to 2034. This expansion is underpinned by increasing health awareness, innovative device integrations, and expanding healthcare infrastructure worldwide.

What Are the Key Drivers Powering This Market Growth?

The surge in diabetes cases worldwide remains the foremost catalyst for market expansion. Rising patient awareness and early diagnosis efforts have increased demand for reliable glucose monitoring solutions. Significant advancements in sensor technology, mobile connectivity, and software platforms have enhanced accuracy and user convenience, further driving adoption. Supportive government health programs and reimbursement policies also play a crucial role in facilitating this growth, alongside an increasing emphasis on preventive healthcare and remote patient monitoring.

Blood Glucose Monitoring Market Quick Insights

- The market size stood at USD 16.46 billion in 2024.

-

Expected to grow to USD 25.53 billion by 2034 at a CAGR of 4.49%.

-

North America dominates the market with the largest regional revenue share.

-

Asia Pacific represents the fastest-growing regional segment.

-

Top players include Abbott Laboratories, F. Hoffmann-La Roche Ltd., Dexcom, Inc., Johnson & Johnson, and Medtronic plc.

-

Continuous glucose monitoring (CGM) and self-monitoring blood glucose (SMBG) devices lead product innovation.

-

Advances in AI are enabling real-time monitoring and personalized diabetes management.

Revenue Breakdown by Region and Segment

| Region | Market Size 2024 (USD Billion) | Projected Market Size 2034 (USD Billion) | CAGR (2025-2034) |

|---|---|---|---|

| North America | 4.38 | 6.93 | 4.70% |

| Asia Pacific | – | – | Fastest Growing |

| Europe | Significant Market Share | Growth Expected | Moderate Growth |

| Latin America | Emerging Market | Growth Potential | Positive |

| Middle East & Africa | Emerging Market | Growth Potential | Positive |

Artificial intelligence (AI) is revolutionizing blood glucose monitoring by integrating advanced algorithms capable of analyzing continuous data streams from monitoring devices. AI-driven systems forecast glucose fluctuations by evaluating historical data and lifestyle factors, enabling proactive management of hypoglycemia and hyperglycemia. Integration with wearable devices and mobile applications delivers intelligent alerts and actionable insights, improving patient adherence and outcomes.

For healthcare providers, AI facilitates remote patient monitoring through trend visualization and predictive analytics, enhancing clinical decision-making for insulin dosing and medication adjustments. This intelligent automation reduces the clinical workload while elevating the quality of care, ushering in a new era of personalized diabetes management.

Blood Glucose Monitoring Market Growth Factors

A combination of rising global diabetes prevalence, technological breakthroughs in sensor accuracy, and growing healthcare expenditure fuels market growth. Increasing urbanization and sedentary lifestyles contribute to diabetes incidence globally, prompting greater reliance on glucose monitoring devices. In addition, government initiatives aimed at public health education, preventive care, and device reimbursement enhance market accessibility.

Additionally, the evolving preference for continuous glucose monitoring over traditional methods has accelerated industry innovation and adoption, particularly in developed regions with advanced healthcare infrastructure.

What Are the Emerging Opportunities and Trends?

Could Non-invasive and AI-Enhanced Monitoring Devices Reshape Diabetes Care?

The demand for less invasive glucose monitoring technologies presents a significant growth opportunity. Non-invasive continuous glucose monitoring (CGM) devices promise greater patient comfort and adherence, addressing pain and inconvenience associated with finger-prick methods. Simultaneously, the integration of AI and telemedicine expands healthcare access to remote and underserved populations, enabling personalized and timely interventions.

Innovations such as hybrid closed-loop systems and smartphone-compatible devices that offer seamless data tracking and management are gaining traction. Companies investing in these technologies are poised to capitalize on unmet patient needs and growing market segments.

How Does Regional and Segmentation Analysis Shape Market Dynamics?

North America remains the dominant market driven by reimbursement policies, high diabetes prevalence, and established health infrastructure. The U.S. market alone is projected to grow from USD 4.38 billion in 2024 to USD 6.93 billion by 2034 with a CAGR of 4.70%. Europe maintains consistent demand fueled by universal healthcare systems and patient awareness.

Asia Pacific is the fastest-growing region, attributed to rising diabetes incidence, expanding healthcare access, and increasing government initiatives in countries like China and India. Emerging economies in Latin America and the Middle East & Africa are also witnessing growth due to rising health awareness and screening programs.

Product segmentation reveals strong demand for continuous glucose monitoring systems due to their enhanced accuracy and convenience, alongside self-monitoring devices favored for affordability and widespread use.

Which Companies Are Leading with Innovations and Recent Breakthroughs?

Notable companies actively driving product development and market expansion include:

-

Abbott Laboratories

-

F. Hoffmann-La Roche Ltd.

-

Dexcom, Inc.

-

Johnson & Johnson

-

Medtronic plc

-

ARKRAY, Inc.

-

Bayer AG

-

Nipro Diagnostics, Inc.

-

Terumo Medical Corporation

These industry leaders are focusing on developing non-invasive glucose monitors, integrating AI capabilities, expanding wearable device compatibility, and enhancing data connectivity. Recent product launches include advanced hybrid closed-loop systems and AI-powered continuous glucose monitoring platforms that offer prolonged sensor wear and improved patient comfort.

What Challenges and Cost Pressures Impact the Market?

High costs associated with advanced CGM devices remain a barrier, particularly in developing countries where reimbursement policies are limited. Expense factors include device hardware, sensors, batteries, and recurring consumables. Patient adherence issues due to initial cost and device complexity also challenge widespread adoption.

Additionally, regulatory hurdles and data privacy concerns related to AI and connected devices require ongoing attention. Addressing affordability and improving reimbursement frameworks will be vital to unlocking growth in emerging markets.

Is There a Real-World Example Demonstrating Market Impact?

Consider a case study where AI-powered CGM systems were implemented in a diabetes management program. Patients using these devices experienced up to 30% fewer hypoglycemic episodes due to timely alerts and personalized insulin recommendations. Healthcare providers observed improved patient engagement and reduced hospitalization rates, demonstrating the tangible benefits of integrating AI with glucose monitoring technology.

Read Also: Diabetes Care Devices Market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344

- Arteriovenous Implants Market Enhance dialysis outcomes with advanced grafts, endovascular access, and AI-assisted precision - September 16, 2025

- Smart Retinal Implants Market Restore vision with wireless bioelectronic prosthetics and AI-powered retinal technologies - September 16, 2025

- Myopia Treatment Devices Market Size to Reach USD 38.51 Billion by 2034, Growing at a CAGR of 7.86% - September 1, 2025