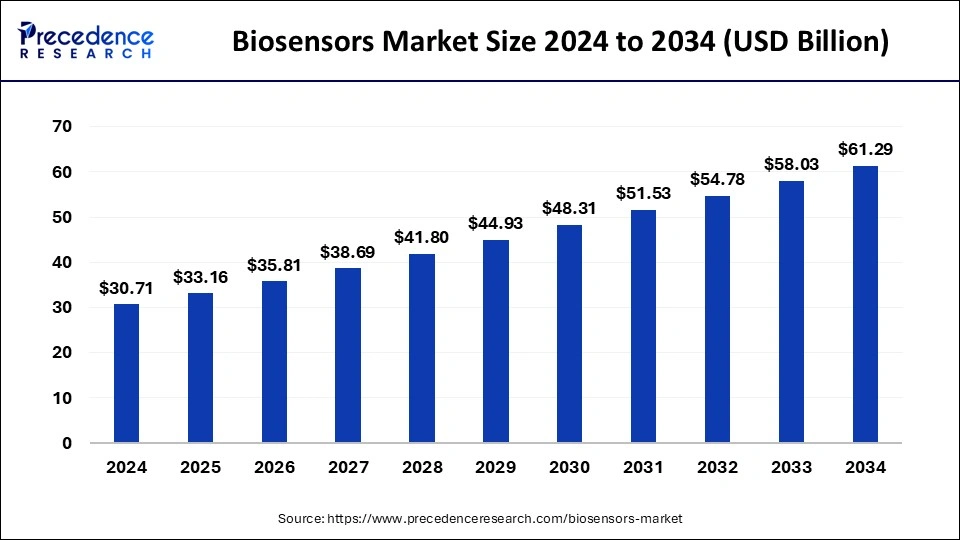

The global biosensors market is witnessing significant momentum, driven by advancements in healthcare technologies, growing prevalence of chronic diseases, and the rapid integration of artificial intelligence (AI) into diagnostic solutions. According to Precedence Research, the global biosensors market size was valued at USD 30.71 billion in 2024 and is projected to increase from USD 33.16 billion in 2025 to around USD 61.29 billion by 2034, registering a CAGR of 7.07% during the forecast period.

Biosensors Market Size 2025 to 2034

-

Market value in 2025: USD 33.16 billion

-

Market value by 2034: USD 61.29 billion

-

CAGR (2025–2034): 7.07%

-

North America dominated with 39.46% market share in 2024

-

Optical biosensors are projected as the fastest-growing technology segment

-

Agriculture expected to witness the highest growth by application

-

The food industry anticipated to grow with the highest CAGR among end users

Read Also: Autonomous Vehicle Market

Role of AI in the Biosensors Market

Artificial intelligence is transforming the biosensors industry by enabling:

-

Real-time analytics of complex biological data.

-

Predictive healthcare applications such as arrhythmia detection and early disease diagnosis.

-

Personalized monitoring where devices adapt to individual health baselines.

-

Faster diagnostics at point-of-care with improved accuracy.

-

Optimized manufacturing processes through AI-driven automation.

AI-enhanced biosensors are increasingly used in wearables, glucose monitoring, cardiovascular assessments, and remote patient monitoring systems, reinforcing their role in next-generation healthcare.

Regional Insights

North America

-

Market size (2024): USD 12.12 billion

-

Expected to reach: USD 23.64 billion by 2034

-

Dominated with 39.46% market share in 2024

-

Growth driven by rising chronic disorders, advanced healthcare infrastructure, high R&D investments, and favorable regulatory frameworks.

-

The U.S. leads biosensor innovation, supported by strong reimbursement policies and biotech manufacturing bases.

-

Canada is progressing with research-led portable diagnostics and strong academic collaborations.

Europe

-

Market size (2024): USD 7.31 billion

-

CAGR: 6.9% (2025–2034)

-

Rapid growth driven by the prevalence of diabetes, an ageing population, and regulatory support for non-invasive diagnostics.

-

The UK leads regional adoption, while Germany plays a key role in R&D and manufacturing.

Asia Pacific

-

Market size (2024): USD 6.24 billion

-

Expected to reach: USD 12.74 billion by 2034

-

Fastest-growing region, supported by expanding healthcare infrastructure, government programs, and increasing investments in biotechnology.

-

China and India lead in biosensor manufacturing and adoption of digital health technologies.

Latin America

-

Growth led by Brazil and Mexico with increasing adoption of electrochemical biosensors for healthcare and food safety.

-

Strong demand in point-of-care diagnostics and wearable solutions.

Middle East & Africa

-

Expanding healthcare infrastructure and increasing adoption of electrochemical biosensors.

-

Governments are integrating biosensor technologies into digital health strategies.

-

Growth driven by the rising prevalence of cardiovascular and metabolic disorders.

Growth Factors

-

Rising prevalence of chronic diseases such as diabetes and cardiovascular disorders.

-

Increasing demand for non-invasive, real-time diagnostic technologies.

-

Integration of AI, IoT, and nanotechnology in biosensor development.

-

Expanding applications beyond healthcare, including food safety, agriculture, and environmental monitoring.

Challenges:

-

Stringent government regulations and reimbursement policies.

-

Slower adoption rates in low- and middle-income countries.

Technology Insights

-

Electrochemical biosensors dominated in 2024 with over USD 21.5 billion revenue.

-

Optical biosensors are expected to grow at the fastest pace due to real-time, label-free detection capabilities.

-

Integration of optical biosensors with smartphones and wearables enhances point-of-care testing.

Application Insights

-

Medical applications remained the largest segment with USD 20.2 billion in 2024.

-

Agriculture is projected to grow at the fastest rate, driven by precision farming, pathogen detection, and food safety monitoring.

-

Biosensors are widely used for detecting contaminants, managing irrigation, and improving crop yields.

End User Insights

-

Point-of-care testing dominated in 2024 with USD 14.47 billion in revenue.

-

Food industry is expected to grow at the highest CAGR due to increasing demand for real-time safety and quality testing.

-

Integration of biosensors in smart packaging solutions is further driving adoption in the food sector.

Key Companies in the Biosensors Market

-

Abbott Laboratories

-

Bio-Rad Laboratories Inc.

-

Biosensors International Group Ltd.

-

DuPont Biosensor Materials

-

Johnson & Johnson

-

TDK Corporation

-

Zimmer & Peacock AS

-

Pinnacle Technologies Inc.

Recent Developments

-

October 2024: Bruker Corporation acquired Dynamic Biosensors GmbH to expand its single-cell interaction technologies portfolio.

-

April 2025: Researchers developed an advanced optical biosensor using nano-pillar photonic crystal structures for highly sensitive diagnostics.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

- Generic Drugs Market to Reach USD 728.64 Billion by 2034 - September 23, 2025

- Biofuels Market Size to Reach USD 257.61 Bn by 2034 - September 23, 2025

- Biosensors Market Size to Hit USD 61.29 Billion by 2034 - September 23, 2025