Market Overview

The Biomarker Discovery Outsourcing Services Market has emerged as a critical component in the global healthcare and pharmaceutical ecosystem. Biomarkers play an essential role in diagnosing diseases, predicting therapeutic responses, and monitoring disease progression. With the rise of personalized medicine and targeted therapies, the demand for reliable and efficient biomarker discovery has grown exponentially.

Outsourcing these services allows pharmaceutical and biotech companies to leverage specialized expertise, advanced technologies, and cost-efficient models. Outsourcing partners provide comprehensive services ranging from biomarker identification to validation, making the process faster and more scalable. As a result, the biomarker discovery outsourcing services market is experiencing robust growth, driven by both scientific advancements and strategic outsourcing trends.

AI and Innovation in Biomarker Discovery Outsourcing

Artificial intelligence (AI) and machine learning are revolutionizing the biomarker discovery outsourcing services market. By analyzing massive volumes of omics data—genomics, proteomics, metabolomics—AI tools can uncover novel biomarkers with unprecedented speed and accuracy. Outsourcing companies are integrating bioinformatics platforms and predictive analytics to enhance discovery pipelines.

Innovations such as next-generation sequencing (NGS), single-cell analysis, and high-throughput screening are also transforming how biomarkers are discovered and validated. Many service providers are now offering AI-powered platforms that identify biomarker candidates, prioritize them based on biological relevance, and accelerate preclinical validation. This integration of AI and big data analytics is reshaping the competitive landscape of the biomarker discovery outsourcing services market.

Future Trends of the Market

The future of the biomarker discovery outsourcing services market lies in deep biological insights, cross-platform data integration, and enhanced regulatory pathways. One major trend is the rise of multi-omics approaches, which combine data from genomics, proteomics, and metabolomics to create a holistic biomarker profile.

Additionally, there is a growing emphasis on liquid biopsies and non-invasive sample collection methods, especially in oncology and neurology. Outsourcing partners are expected to expand their capabilities in this area to support early detection and longitudinal disease tracking. Moreover, cloud-based bioinformatics and global collaborations between CROs (Contract Research Organizations) and pharma companies will become the norm. These trends point to a highly dynamic and opportunity-rich biomarker discovery outsourcing services market.

Rising Demand for Outsourced Biomarker Discovery

Several factors are fueling the rising demand in the biomarker discovery outsourcing services market. Pharmaceutical companies are under pressure to reduce R&D costs and accelerate time-to-market for new drugs. Outsourcing allows them to access specialized capabilities without investing heavily in in-house infrastructure.

In addition, the complexity of biomarker discovery—from sample preparation to data interpretation—requires multidisciplinary expertise, which CROs are well-equipped to provide. The need for biomarkers in oncology, immunology, and CNS (central nervous system) disorders is also growing rapidly. As clinical trials increasingly depend on biomarker stratification, the demand for reliable outsourcing partners continues to surge, driving the growth of the biomarker discovery outsourcing services market.

Key Market Highlights

One of the most notable highlights of the biomarker discovery outsourcing services market is its expanding client base. While large pharma companies remain key customers, small and mid-sized biotechs are increasingly outsourcing biomarker discovery to speed up development pipelines.

Another important highlight is the standardization of biomarker validation protocols across geographies. As regulatory agencies demand higher levels of evidence for biomarker-based claims, outsourcing companies are aligning with international standards like CLIA and GLP. Furthermore, there’s a growing interest in real-world data (RWD) and real-world evidence (RWE) to validate biomarkers in diverse patient populations. These developments highlight the maturity and sophistication of the biomarker discovery outsourcing services market.

Market Growth Drivers

Several strong growth drivers are propelling the biomarker discovery outsourcing services market forward:

-

Personalized Medicine: The shift toward personalized therapies demands precise biomarkers for patient stratification and treatment efficacy assessment.

-

Expanding Therapeutic Areas: Beyond oncology, biomarkers are now critical in cardiovascular, neurological, metabolic, and autoimmune diseases.

-

Technological Advancements: The emergence of AI, NGS, and mass spectrometry has made biomarker discovery more accessible and scalable.

-

Regulatory Support: Government initiatives supporting precision medicine and accelerated approvals for biomarker-based therapies have created favorable market conditions.

-

Cost-Effectiveness: Outsourcing reduces the financial burden of maintaining specialized research facilities and staff, making it a preferred option.

These drivers ensure a strong and sustained momentum in the biomarker discovery outsourcing services market globally.

Market Restraints

Despite its growth, the biomarker discovery outsourcing services market is not without challenges. One of the key restraints is the complexity of biomarker validation. Even after discovery, translating a biomarker into a clinically actionable test requires rigorous validation, which can be time-consuming and expensive.

Additionally, intellectual property (IP) concerns often arise when collaborating with outsourcing partners, especially in cross-border agreements. Data security and patient confidentiality are also significant concerns due to the sensitive nature of biological data. Another constraint is the variability in biomarker expression across populations, which complicates standardization. These issues may slow down the pace of growth in the biomarker discovery outsourcing services market if not adequately addressed.

Opportunities in the Market

The biomarker discovery outsourcing services market offers several lucrative opportunities. For one, the growing number of clinical trials using biomarkers as endpoints presents a vast potential for outsourcing partnerships. Companies that can offer integrated biomarker solutions—from discovery to clinical validation—stand to gain significant market share.

Another opportunity lies in rare diseases, where identifying novel biomarkers can open doors to niche therapeutic markets. In addition, the adoption of decentralized clinical trials and wearable biosensors is generating new types of real-time data that can be mined for biomarker discovery. Geographically, emerging markets in Asia-Pacific and Latin America offer untapped potential due to increasing investments in life sciences infrastructure. These opportunities reinforce the strong future outlook for the biomarker discovery outsourcing services market.

Regional Insights

North America

North America holds a leading position in the biomarker discovery outsourcing services market due to the presence of major pharmaceutical companies, advanced research institutions, and well-established CROs. The U.S., in particular, benefits from strong regulatory frameworks and substantial funding for precision medicine initiatives.

Europe

Europe is a significant contributor to the market, with countries like Germany, the UK, and France investing heavily in biomarker research. The region benefits from a collaborative research environment and a high focus on data transparency and clinical excellence.

Asia-Pacific

The Asia-Pacific region is emerging as a high-growth market, particularly in countries like China, India, and South Korea. Lower operational costs, skilled scientific talent, and expanding biopharma industries are attracting global outsourcing partnerships.

Latin America and Middle East & Africa

These regions are gradually gaining traction in the biomarker discovery outsourcing services market due to increasing healthcare investments, clinical research activity, and improving regulatory standards. Local CROs are also growing their capabilities to serve global clients.

Data Center Rack Market Companies

- Schneider Electric

- Eaton Corporation plc

- Vertiv Group Corp.

- Rittal GmbH & Co. KG

- Dell Technologies Inc.

- Hewlett Packard Enterprise (HPE)

- International Business Machines Corporation (IBM)

- Legrand S.A.

- Cisco Systems Inc.

- Fujitsu

Recent Developments

- In August 2025, Meta demonstrated an NVL36x2 rack configuration Catalina pod at Hot Chips, which is adapted from Nvidia’s NVL72 offering. This rack comes with GB200 GPUs equipment; the Catalina pods are utilized in 20kW air-cooled data centers. Each 120kW rack features 18 compute trays and nine switches.

- In July 2025, a digital transformation of energy management and automation, Schneider Electric announced the launch of new data center solutions engineered for meeting with growing demands of next-generation AI cluster architectures. The company has unveiled its prefabricated modular EcoStruxure pod data center solutions, elevating its EcoStructureTM Data Center Solutions for consolidation infrastructure for liquid cooling, high-density NetShelter Racks, and high-power busway.

Get Free sample Link @ https://www.precedenceresearch.com/sample/6754

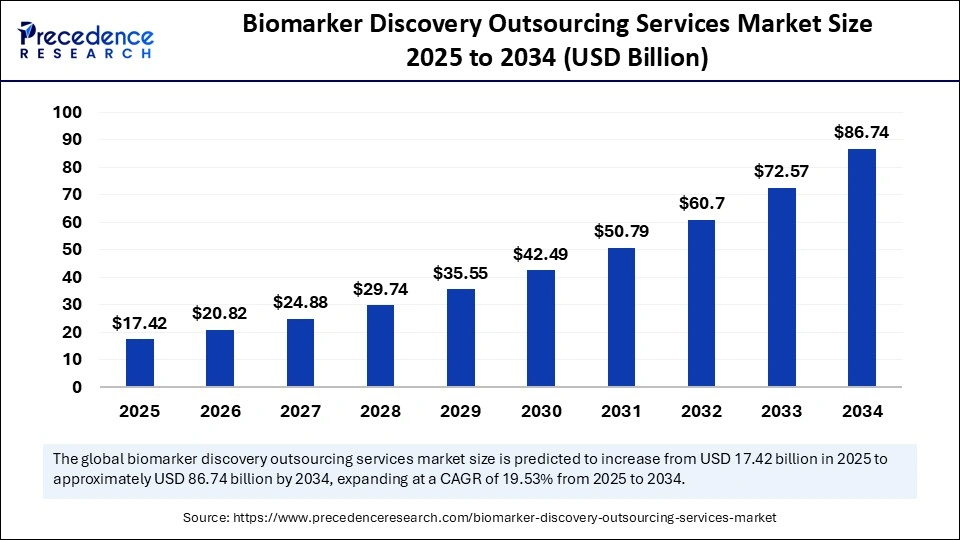

- Biomarker Discovery Outsourcing Services Market Size to Reach USD 86.74 Billion by 2034 - September 12, 2025

- Digestive Diamine Oxidase Enzyme for Supplements Market Size to Reach USD 43.87 Mn by 2034 - September 11, 2025

- Tocotrienol Market Size to Reach USD 701.88 Million by 2034 - September 11, 2025